Yearly Wrap: 2025, How'd We Go?

How our 2025 ebook picks went, the year in review, and what's shaping up for 2026. Plus a few company updates (including a discovery) before we down tools

With the Aussies on the verge of wrapping up The Ashes (we're not jinxing anything), it feels like a good time to wrap up what's been a big year at Equities Club.

It's our final wrap for 2025, and rather than chasing the usual news cycle, we wanted to step back and take stock. How did the small-cap space actually perform? How did our ebook picks go? And what's shaping up for the year ahead?

We’ve also got a few company updates worth noting: a confirmed rutile discovery, gold drilling wrapped up and sent to the lab, and copper metallurgy results that should please anyone following the AZ9 story.

Oh, and we quietly launched the new Equities Club website this week. All our notes, videos, portfolio holdings, and the thinking behind our calls, now in one spot: www.equitiesclub.com

For the final time in 2025, let’s get to it:

2025 in review: a year that made you work for it.

Our ebook picked 10 stocks to watch at the start of the year. How’d we go?

Fortuna confirms world-class grades at depth despite a tough market.

Bubalus sends off drilling of historic high-grade gold mine for assaying.

What will the gold price be in 2026? We’ve got the investment banks’ predictions.

BHP bullish on copper 2026 and beyond, but steps aside on Ecuadorian deal.

Asian Battery Metals has two announcements in a tough week.

What a year 2025 was for small-cap investing

Small-caps made you work for it in 2025. The year kicked off sluggish, caught fire mid-year when the bull run began, then cooled off as profit-taking set in towards the end. If you stayed switched on, there were plenty of opportunities to make money.

Commodities did most of the heavy lifting, with gold and silver running hard while copper and rare earths reminded the market why supply matters. Lithium finally started showing signs of life too, after a long reset.

Biotech and defence stocks also had their moments throughout the year. Some rewarded patient holders with real results. Others grabbed attention for all the wrong reasons (DroneShield, we're looking at you).

Politics played a bigger role than usual, with Trump’s tariff talk setting the tone early before critical minerals became a national security talking point. At home we had a federal election campaign that briefly turned into a renewables-versus-nuclear cage match. We can’t remember a year where the capital moved as quickly as the headlines changed.

In markets like 2025, fortunes aren't made by owning everything. They're made by backing the right small-cap at the right point in the cycle, and having the patience to sit through the noise. Easier said than done.

The Equities Club 2025 ebook: pass or fail?

In the first few weeks of this year, we put together a free ebook covering 10 small-cap ASX stocks we thought had serious potential for the year ahead.

We sifted through hundreds of companies before landing on the final 10, looking at assets, balance sheets, management track records, and who was backing them.

The ebook ended up being one of our most-read pieces of the year.

We're happy, and somewhat relieved, to sit back now and say that collectively, the 10 stocks were up 53% in 2025.

That’s a solid result when you consider how many small-caps there are and how volatile the space can be.

Not all 10 went up. But seven finished flat or higher, and the wins more than covered the misses. That's the reality of backing early-stage companies, but finishing up 53% for the year highlights the power of small-caps when you back the right ones.

We'll be going through a large number of small-caps over the coming weeks as we put together the 2026 edition. If there's a stock you think we should be looking at, any sector, let us know. The new ebook drops early in the new year.

Fortuna confirms high-grade discovery, yet falls

Fortuna Metals (ASX: FUN) delivered what the market had been waiting for this week, confirming a rutile discovery at Mkanda in Malawi with high-grade, continuous mineralisation from surface across a wide area.

The first batch of hand auger drilling returned peak grades of 2.21% rutile. Multiple 10-metre intercepts came in above 1%, and every hole ended in mineralisation. That’s a strong early signal of both grade and scale.

This is only 10 holes from a program that already includes 544 completed. A steady flow of assays is due through Q1 2026.

We backed FUN because the geology looked right and the valuation looked wrong. The drilling is starting to prove that out.

Despite the results, FUN finished the week down around 20%, which says far more about the time of year and thin December liquidity than it does about the underlying story.

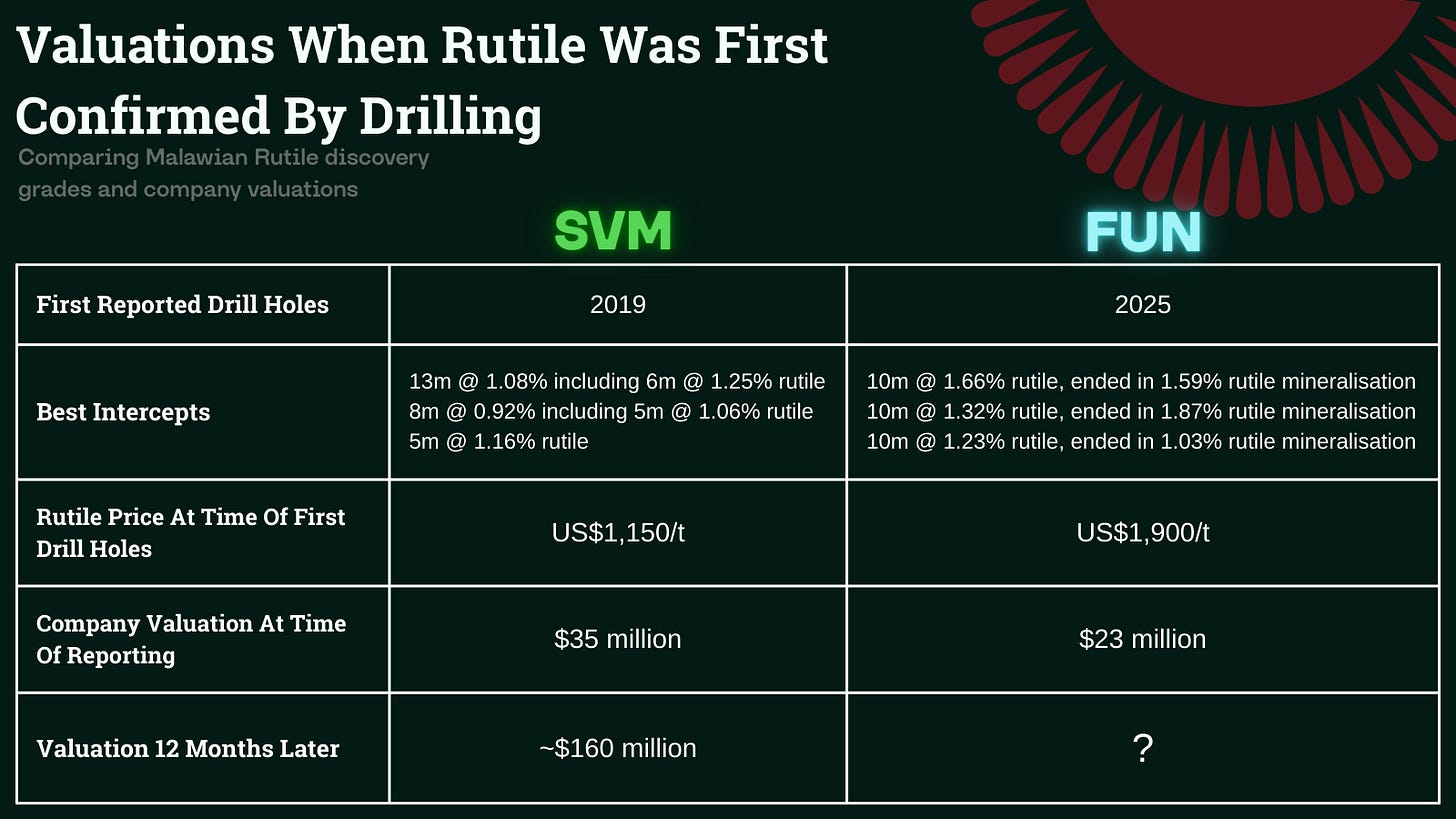

In contrast, neighbour Sovereign Metals (ASX: SVM) finished the week up roughly 20%. Both companies sit in the same geological system and share the same mineralogy.

SVM is now valued at $400 million, while FUN is valued at $23 million.

When you line up early-stage results like-for-like, FUN’s initial grades and thicknesses actually stack up better than SVM’s did at a comparable point.

SVM ran from $35 million to $160 million in the twelve months after its first proper drill results. FUN's sitting at $23 million with better early grades. You can draw your own conclusions, but we think the market’s sleeping on FUN, particularly with more data still to come.

Bubalus wraps up gold drilling at Avon Plains

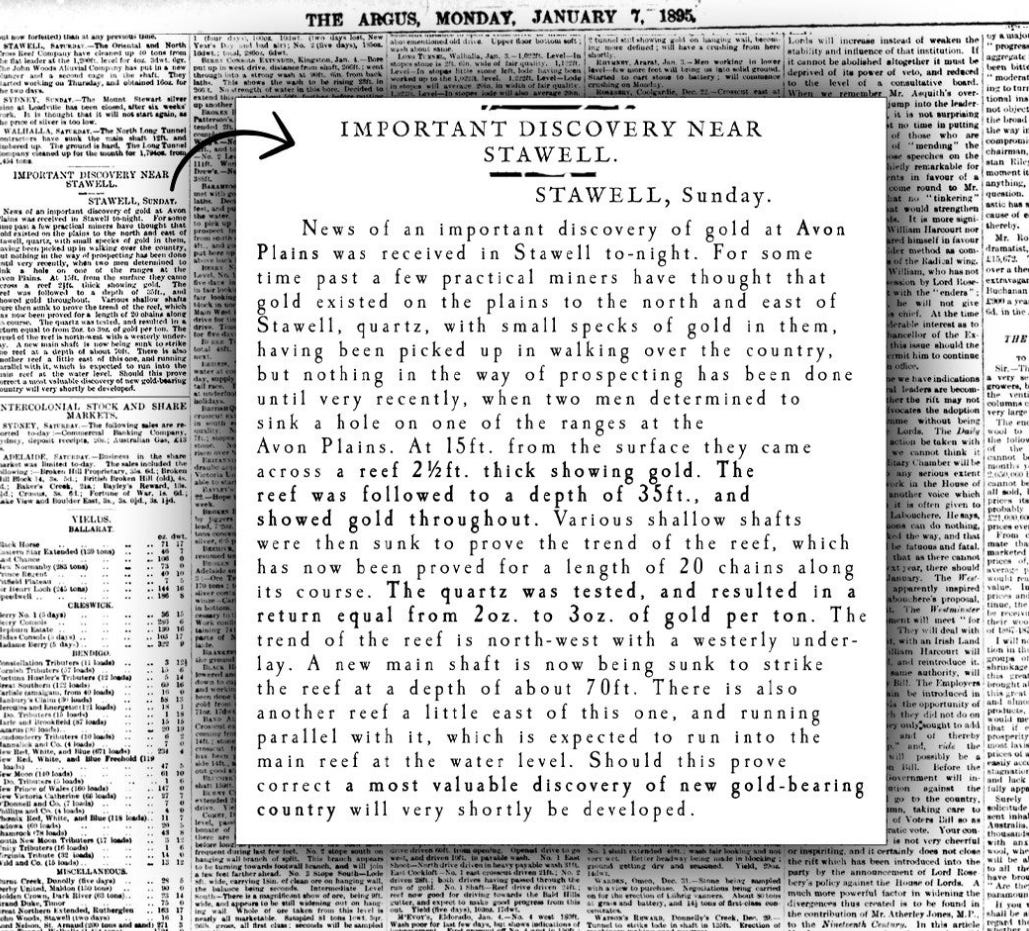

Drilling is now complete for Bubalus Resources (ASX: BUS) at Avon Plains, a historic high-grade gold mine in Victoria. This marks the first time a modern rig has tested beneath one of the state's more intriguing historic gold systems.

BUS jetted through its maiden drill program, completing 15 holes for a total of 1,234 metres. All samples have been dispatched to the lab and assays are expected in early February.

This program was always about answering a simple but important question: Do the historic grades reported from shallow 19th-century workings carry into fresh rock at depth?

Those old workings recorded 2-3 ounces per tonne (roughly 60-90 grams per tonne), along with repeated reports of 12–15 gram reefs, before water ingress forced mining to stop. Nobody has drilled beneath those shafts since. Until now.

The completed holes cut across the quartz reef beneath the old workings, targeting ground that’s sat untouched for more than a century. With drilling done, Avon Plains moves into the waiting phase.

If the results early next year confirm continuity beneath the historic workings, this could change things for BUS shareholders very quickly. At a $10 million valuation with gold near record highs, any positive result could be very big for holders.

Will the gold bull run continue in 2026?

The gold price started 2025 at US$2,650 an ounce and now sits at US$4,340, a 63% gain in under 12 months. It's not down to any single factor:

Geopolitical noise and the constant threat of war

Economic uncertainty and money printing keeping safe-haven demand elevated

Central banks consistently buying, particularly across emerging markets

Investors coming back through ETFs

Throw in growing expectations of interest rate cuts while inflation stays elevated, which takes the shine off cash and bonds, and gold continues to look attractive.

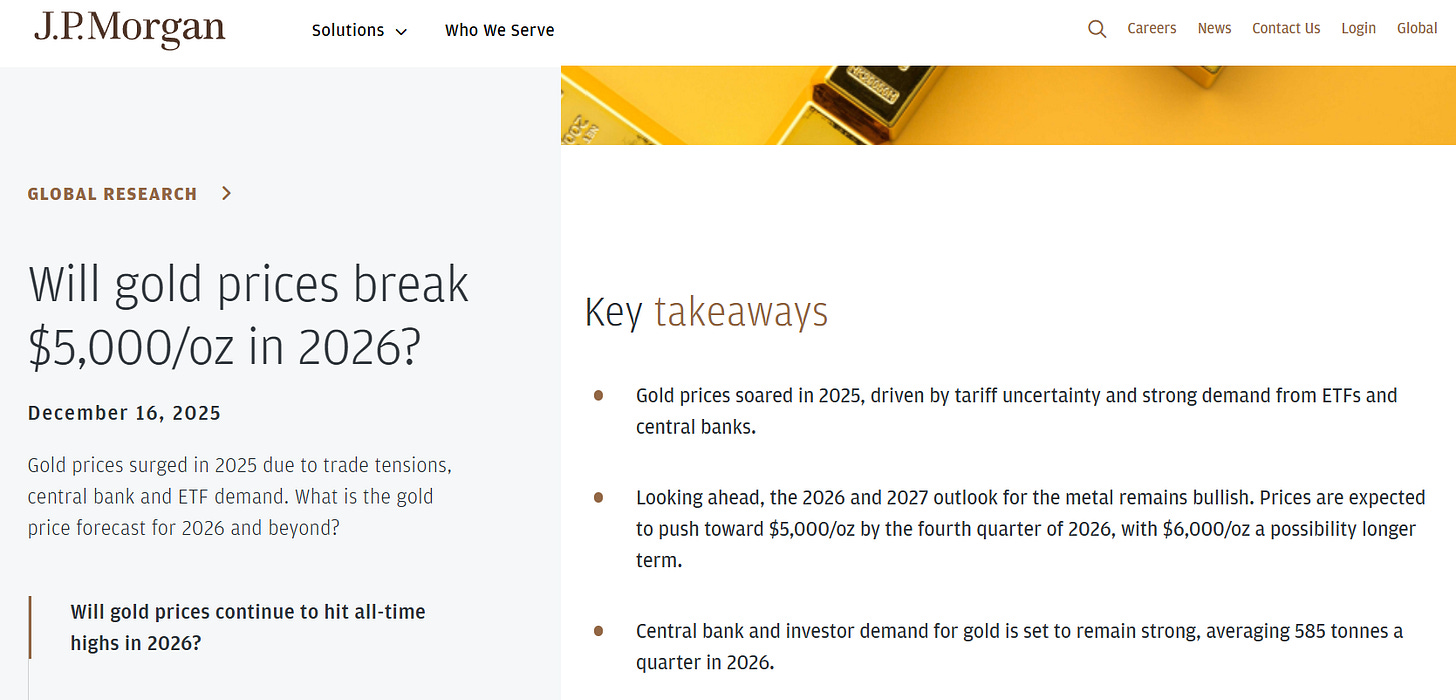

We've pulled together the big investment banks' gold price predictions for 2026, and what this could mean for small-caps.

JP Morgan says by the end of 2026, gold will be US$5,000 an ounce,

Goldman Sachs is predicting US$4,900 an ounce in 2026,

Morgan Stanley forecasts gold at $4,500 per ounce by mid-2026,

Bank of America says gold to $5,000, on U.S. deficit spending to fuel demand, and

Metals Focus forecasts gold at $5,000 an ounce by the end of 2026

For small-cap gold explorers, a price above $4k with the banks tipping even higher means any decent drill hit tends to get rewarded quickly.

We’ve backed Bubalus Resources throughout 2025, and recently added our pick of the year, Black Horse Mining (ASX: BHL), to our portfolio. Both are drilling historic Victorian gold mines at low valuations.

Copper is tightening, and BHP is playing the long game

We’ve banged on about copper all year and nothing’s changed heading into 2026.

What started as a nice thematic trade has turned into a genuine supply crunch, and nobody's figured out how to fix it yet.

Demand keeps rising as electrification rolls on, grids get upgraded, EV sales climb, and data centres chew through metal. Supply just isn't keeping up.

Meanwhile, grade are falling and new discoveries are rare while the timeline from finding copper to actually mining it keeps blowing out. The market can't sustain itself at current pricing for much longer.

Amid all the talk of rare earths this year, BHP CEO Mike Henry was quick to remind everyone that copper is a US$300-400 billion annual market. Rare earths sit around US$10-20 billion. There's a reason the majors keep circling back to copper.

It sits at the centre of BHP’s long-term strategy, with capital going into Escondida, Olympic Dam, and a broader pipeline of brownfield growth rather than chasing marginal tonnes.

But in a strange twist, they stepped aside from bidding for SolGold, where they'd been a long-time shareholder with more than 10%. SolGold owns Cascabel in Ecuador, a large and well-known undeveloped copper-gold system.

The asset is now set to be acquired by China’s Jiangxi Copper, in a deal valuing SolGold at around US$1.69 billion. Even with copper fundamentals tightening, capital discipline still comes first for the world’s biggest miner.

Asian Battery Metals double-drops announcements

Asian Battery Metals (ASX: AZ9) dropped two announcements this week, covering both ends of the portfolio from development work at Oval through to growing optionality at Maikhan Uul.

Key takeaways from the announcements:

Metallurgical test work at Oval confirmed excellent payable copper recoveries of 89–95%, using a simple, conventional flotation flowsheet.

The copper is sitting in chalcopyrite, which is the kind of copper mineral you want to see. It breaks free easily during processing, which makes life much simpler if this ever turns into a mine.

At Maikhan Uul, surface sampling extended gold mineralisation well beyond the existing drillholes, defining a 600 by 100 metre anomalous zone, including a standout 22.9 g/t gold rock chip.

Follow-up drilling showed sulphide mineralisation continues, although the hole intersected a part of the system that lies further from the main centre.

Despite all that, AZ9 finished the week down around 8%. That looks more like the broader year-end sell-off than any judgment on the announcements themselves.

AZ9 continues to push hard in Mongolia across its projects. The news has added depth to the story, even if the market chose to look past it this week.

That’s a wrap for 2025

It’s been a big year for small-cap investors. Plenty of opportunity, and a market that occasionally favoured the brave when perhaps it shouldn’t have.

We're heading into 2026 bullish on nearly every commodity we cover. Biotech and defence too. If next year delivers even half the action we saw in 2025, it'll be one worth showing up for.

For the Equities Club team, 2025 was a year of firsts. Our inaugural stock-picking competition (congrats again, Geoffrey). More articles, deeper analysis, and a shiny new website that finally puts everything in one place.

We're downing tools for a couple of weeks. After the year that was, we reckon we've earned a beer or two. But plans for 2026 are already taking shape, and we’ll be back early in the new year.

To everyone who followed along, sent us stocks to look at, agreed or disagreed with us in the comments or on emails, or just read our stuff quietly from the sidelines, a sincere thank you.

Have a good break. Till next year.