AZ9 Strikes Again: New High-Grade Sulphide Hit at North Oval

AZ9's Mongolia success continues with high-grade second massive sulphide hit 500m from Oval discovery hole.

Christmas has come early for Asian Battery Metals (ASX:AZ9) shareholders. The company has just confirmed another exceptional high-grade copper-nickel intersection at its Oval project in Mongolia, hitting massive sulphides 500m northwest of their discovery hole.

At just 5.3 cents per share, this could be one of 2025’s most watched ASX small-cap stocks.

Drilling massive sulphides once is fortunate, but hitting them twice 500m apart starts to paint a picture of something substantial.

The Oval project is rapidly emerging as a highly fertile copper-nickel system with scale potential that the market is yet to fully appreciate.

The confirmation of today’s high-grade results has again confirmed why we invested in AZ9.

Breaking Down Today’s Results

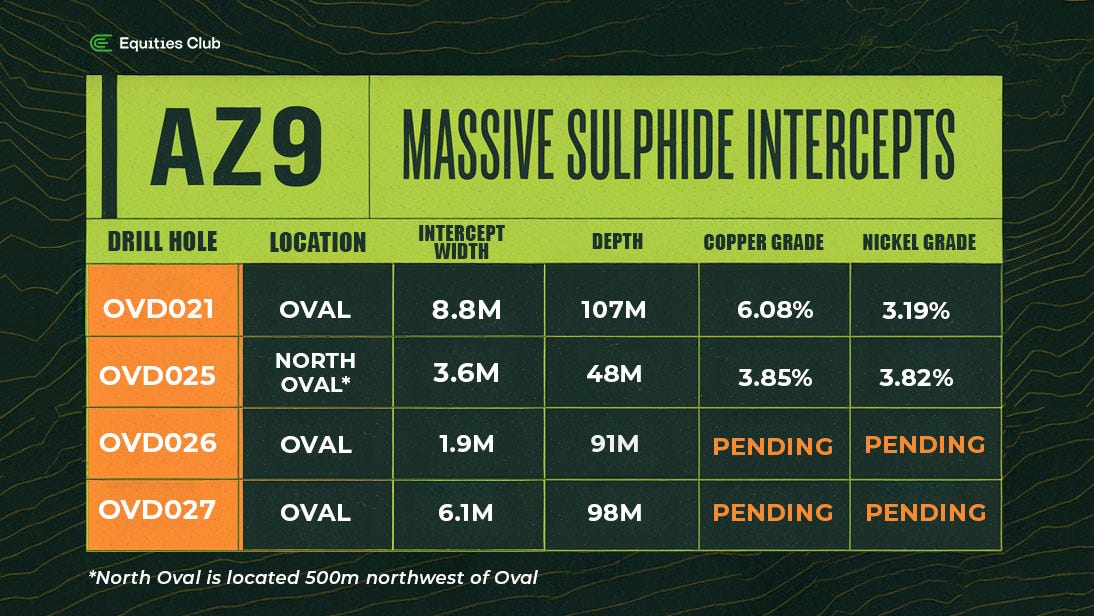

The highlight from Phase 2 drilling at North Oval is hole OVD025, which delivered:

3.6 metres of massive sulphides grading 3.85% copper and 3.82% nickel

Additional credits of 1.55g/t precious metals and 0.15% cobalt

All within a broader 11.4-metre zone running 1.85% copper and 1.70% nickel

“The exceptional high-grade intercept at North Oval is very encouraging for our future exploration in Oval Cu-Ni mineral system.”

- AZ9 Managing Director, Gan-Ochir Zunduisuren

These results follow up on the original discovery hole, which returned an impressive 8.8m massive sulphide hit grading 6.08% copper and 3.19% nickel.

For perspective on just how significant this is - drilling a massive sulphide is every small-cap explorer’s dream.

Drilling two 500m apart, both carrying high grades, is nearly unheard of.

Turning Data into Discovery at Oval

The results validate the methodical approach taken by Managing Director Gan-Ochir Zunduisuren and his team. Their use of downhole electromagnetic surveys to identify targets is proving highly effective, with today’s hit coming from exactly where their technical work suggested it would be.

With more assay results expected in the coming weeks and another drill program to start in early 2025 targeting already defined targets, AZ9 has a lot of opportunity for significant price catalysts ahead.

What’s particularly intriguing is the variability they’re seeing in the system.

The Oval and North Oval high-grade intercepts, though 500 metres apart, may represent separate high-grade feeder systems.

The potential for two-grade systems is good news for investors; think of it as hedging your investment with the potential of two outcomes, not one.

Massive Sulphide at North Oval: A Significant Find

Asian Battery Minerals has once again hit a high-grade massive sulphide at their Oval project, which is now shaping up to be something really substantial for the company and shareholders.

You’d remember AZ9 did downhole electromagnetic surveys to help identify targets previously; this targeting helped identify today’s high-grade massive sulphide announcement.

The geometry of these intersections also tells an important story:

The massive sulphide in OVD025 lies nearly flat

This orientation differs from the surrounding mineralised rock

These characteristics often indicate a feeder system of mineralising fluids at depth

The 2025 drilling program will now test this possibility

With today’s results, the company has been able to re-analyse data and has identified several untested targets, which will be the basis for the drill program in early 2025.

This systematic approach AZ9 has taken exploring is credited to an experienced team that understands geology well. Not only is it a targeted approach, but it is also the most cost-effective, meaning the company is saving money, which we like to see.

Lessons from Sirius Resources: The Nova Parallel

For those seeking a historical comparison, Sirius Resources’ Nova-Bollinger discovery in Western Australia offers a compelling parallel.

Like Oval, Nova began with high-grade nickel and copper intersections. Nova captured the market’s attention with these high-grade results, leading to Sirius Resources being taken over by Independence Group for $1.8 billion.

What we like about AZ9 is the similar hallmarks of expertise management is using. Geophysics has identified targets, followed by systematic drilling, leading to the discovery of high-grade intercepts.

Nova intersected a massive sulphide that was relatively shallow; it wasn’t until further drilling at depth that the main ore body was hit; this is similar to AZ9, which has hit at shallow depths and, in 2025, will test deeper targets.

We understand it’s still early days, but the quality of results from AZ9 suggests it could be on the same trajectory as Sirius Resources if drilling proves up well.

If AZ9 can realise anything near the valuation of what Sirius did, it would be an excellent outcome for shareholders. The foundations are laid, and further drilling is needed to tell the rest of the story in Mongolia.

What’s Next for Asian Battery Metals?

As we wait for further assays, this current round of drilling has been a huge success for AZ9; eight holes have been completed, with four confirming high-grade potential.

Additional assays are expected in early 2025, alongside preparation for the next drilling campaign targeting:

New zones identified through geophysical analysis

Deeper drilling in search of the bigger feeder system

Extension of the known high-grade zones

To use a footy parlance, AZ9 is kicking with the wind and has all the momentum at the moment, with every drill hole providing another piece of the puzzle of an incredibly mineral-rich region.

If drilling is successful, this could solidify the transition from small-cap explorer to a serious contender in the copper-nickel space.

The Bottom Line

AZ9 has all the hallmarks of a significant discovery in the making. At 5.3 cents per share, we believe the market is yet to fully grasp what’s developing here - the story at Oval is just getting started.