Bubalus Resources Strikes Again: Strategic Gold Acquisition at the Perfect Time

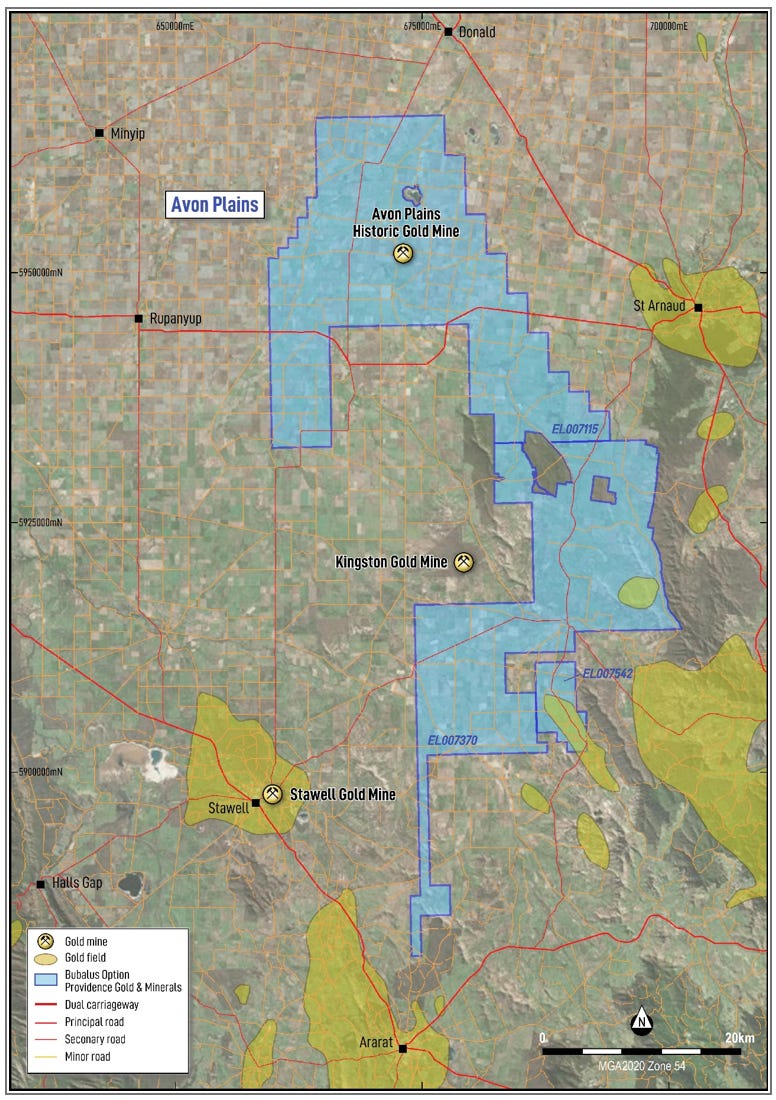

Avon Plains acquisition expands explorer's presence in fertile Victoria gold province as the price of the yellow metal soar

Gold's march past US$3,000/oz couldn't have come at a better time for Bubalus Resources (ASX: BUS) as it expands its Victorian footprint.

Today, the small-cap explorer secured an option over the historic Avon Plains Gold Mine, adding another high-potential target to its growing Victorian gold portfolio.

At just 19c per share and a market cap under $9 million, BUS remains one of the ASX's most tightly held gold plays with significant leverage to exploration success.

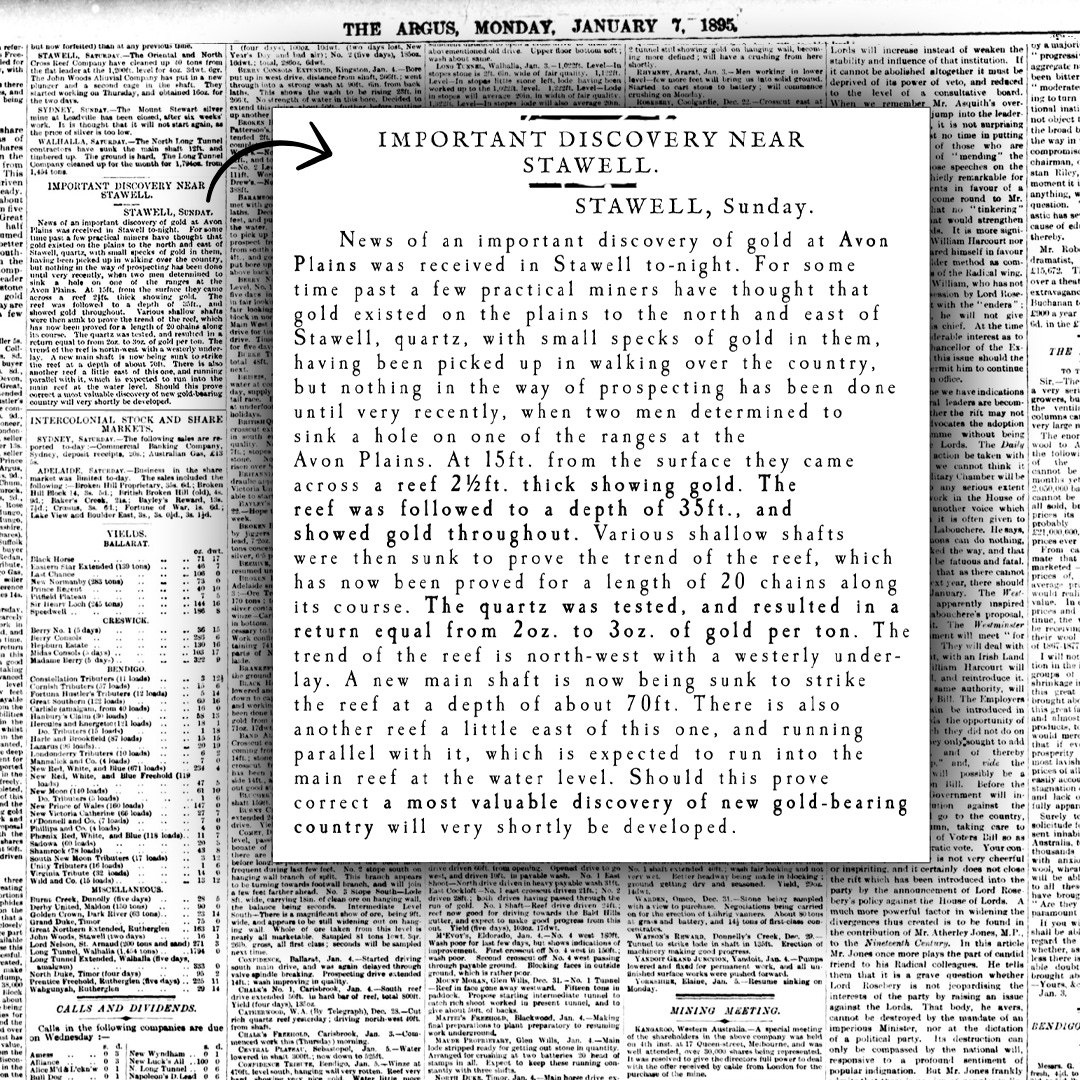

This historical mine comes with a remarkable pedigree - 1890s newspaper reports include standout assays of up to 3 ounces per tonne (around 90 g/t gold) from early shaft work at Avon Plains. The original miners abandoned operations in the early 1900s due to water management challenges rather than geology.

With $3 million in the bank and drilling locked in for April at its flagship Victorian assets, BUS now commands multiple shots at a high-grade discovery in one of Australia's most fertile gold jurisdictions.

Here's why this deal matters:

Historic Avon Plains Gold Mine optioned - with multiple 1890s–1900s reports citing standout assays of 2–3 oz/t (60–90 g/t) from shallow shafts and trial crushings.

Original miners abandoned the site due to water issues, not lack of gold.

No modern drilling has ever tested these high-grade reefs.

Low-cost option structure protects BUS shareholders.

A Quick Look at Bubalus Resources

Bubalus Resources is a junior gold explorer with an established portfolio of exploration tenements targeting high-grade gold in a proven region.

Its flagship assets sit in the prolific Bendigo Zone – the Crosbie Gold Project wedged perfectly between two gold powerhouses, a mere 18 km from Fosterville and 20 km from Costerfield. These neighbouring operations are among Victoria's most profitable and highest-grade gold mines.

Surface sampling at Crosbie has already delivered eye-catching grades, including:

19.1 g/t gold

7.53 g/t, 4.26 g/t, and 3.89 g/t gold

In recent months, Bubalus has been ramping up efforts to advance these projects with a well-structured drilling campaign that is due to begin in April.

This latest acquisition adds serious weight to the BUS portfolio - a savvy move that could shift the dial dramatically on this small but nimble player.

Here’s managing director Brendan Borg talking through the acquisition:

Avon Plains Historic Gold Mine Added to the Bubalus Portfolio

Today's tenement option includes the historic Avon Plains Gold Mine, where 19th-century reports detailed extraordinary gold grades - including a remarkable interval assaying 2–3 ounces per tonne (60–90 g/t) from a narrow quartz reef accessed by two shallow shafts, with high-grade ore encountered just 34 feet below surface.

No reverse circulation or diamond drilling has ever tested the reef — only shallow aircore holes, which struggled with hard ground and water inflow.

The miners of the 1890s pulled ounces from near-surface quartz veins using little more than picks, shovels and basic shaft mining. Since then, the area has largely flown under the radar.

The original miners abandoned operations in the early 1900s purely because of water flooding from 60 feet depth - not because they ran out of gold.

Modern pumping technology easily overcomes these century-old challenges, giving BUS clear access to potentially untouched gold zones that early miners simply couldn't reach.

Bubalus will deploy targeted RC drilling at Avon Plains to map the orientation, grade and extent of the gold-bearing quartz reef. Angled holes will be drilled along SE–NW lines to intercept the east-dipping structure - a proven approach that has unveiled major discoveries across Victoria's goldfields.

The Victorian Government's comprehensive Gold Undercover program identified this region as prime territory for hidden deposits beneath shallow cover. Avon Plains sits squarely within this prospective corridor, potentially hosting substantial gold resources just beneath the surface.

A High-Grade Past That Was Barely Touched

Historical records from Avon Plains show a consistent pattern of high-grade returns from shallow shafts and early test work between 1890 and 1907. Newspaper clippings from the time describe assays of 2–3 oz/t (around 60–90 g/t), as well as multiple reports of grades in the 12–15 g/t range, and quartz visibly showing gold throughout.

This bears repeating – 90 grams per tonne. Three ounces of gold from each tonne of rock pulled from the ground.

These reports span over a decade and multiple publications, offering a remarkably consistent picture of gold mineralisation across shallow workings.

Equities Club has reviewed more than a dozen historical sources covering Avon Plains, including articles from The Argus, The Age, Punch, The Riverine Herald and George Walker’s 1924 historical account - all pointing to a long-overlooked, high-grade gold occurrence.

For a project with this kind of high-grade production history, it’s staggering that no modern drilling has properly tested the system. A few shallow aircore holes were attempted, but they barely scratched the surface.

Modern drilling could reveal something substantial beneath these historical workings.

The Stawell Zone, where Avon Plains is located, is known for these stacked, high-grade lode systems that can continue at depth.

In fact, most major gold discoveries in the region have been made by modern explorers targeting below the old workings. BUS now has the opportunity to apply this proven approach at Avon Plains.

This Deal Favours Bubalus in Every Way

The option agreement is not a complete acquisition, which gives Bubalus flexibility to explore before fully committing. A bit like a ‘try before you buy’ arrangement.

Bubalus can enter into a binding agreement to acquire 100% of three granted Victorian exploration licences covering the historic high-grade Avon Plains gold project. The key terms include:

Option period: 48 months

Initial exclusivity fee: $50,000 in cash + 700,000 shares (subject to shareholder approval)

Bubalus can walk away if early results don't justify further spending, a valuable safeguard for shareholders. For a junior explorer, this is a capital-efficient structure that limits upfront cost while retaining full upside potential.

At a market cap under $9 million and with a tightly held register, successful drilling could deliver outsized share price appreciation. The minimal upfront payment creates asymmetric risk-reward. Limited downside with substantial upside potential.

With gold trading near all-time highs, leverage to a Victorian gold discovery is well-timed, and the option to walk away without any large upfront payment is a genius move from management.

Could This Be Like Fosterville?

Fosterville stands as Victoria's greatest modern mining success story. Once a modest, low-grade operation heading toward closure, everything changed in 2016 when Kirkland Lake Gold drilled beneath old workings and uncovered an ultra-high-grade zone - spectacular intercepts of 90–300 g/t over multiple metres.

This discovery transformed Fosterville into one of the world's most profitable gold mines, now owned by the world’s largest gold producer by market capitalisation, Agnico Eagle Mines (US$53 billion market cap).

Does Avon Plains mirror Fosterville? Not quite as their geological settings differ - but three exploration parallels stand out:

Stawell Zone setting: Bubalus’ project sits in the Stawell Zone - an under-explored part of Victoria highlighted by the government as having strong potential for gold hidden in deep rock structures.

Unexplored depth: Like Fosterville pre-2016, the ground has seen high-grade historic production but no RC or diamond drilling to depth.

Structural upside: Quartz veins linked to steep cracks in the ground have been found, hinting there could be more gold in deeper layers - but detailed mapping of the area hasn’t been done yet.

This isn't a claim that Bubalus has found "the next Fosterville." But the exploration fundamentals align remarkably well: documented high grades at surface, untouched depth, and location within a recognised gold corridor.

At just a $9 million market cap, the optionality is hard to ignore.

Upcoming Catalysts

The next 12 months could be pivotal for Bubalus. With drilling at the promising Crosbie targets locked in for April, the Avon Plains acquisition adds another potential catalyst to the timeline. Here's what shareholders should monitor:

Initial field work at Avon Plains will help determine whether BUS commits further capital to the option structure.

RC drilling preparations will accelerate once target definition is complete.

Results from the April Crosbie drilling program could deliver market-moving news within months.

Gold stands at record levels precisely as BUS assembles this portfolio of high-potential Victorian assets.

The company now controls multiple shots on goal with $3 million in the bank to fund exploration activities.

The methodical approach taken by management - securing high-grade targets while maintaining financial flexibility - creates the ideal setup for a junior explorer. Rarely do you see untested historical gold mines with documented 90 g/t production still available for systematic modern exploration.

Both Crosbie and now Avon Plains offer genuine discovery potential in Australia's most productive high-grade gold province.

If Bubalus hits at Crosbie or Avon Plains, shareholders will likely be glad they were in early.