BUS Maps Gold-Antimony Sweet Spot at Crosbie North

Fresh soil sampling results strengthen the Victorian explorer's dual-track strategy as gold continues its strong run

Bubalus Resources (ASX: BUS) is quietly building one of the more impressive Victorian gold-antimony portfolios on the ASX - and this morning's announcement shows they're getting closer to pulling the trigger at their Crosbie North prospect.

A recently completed soil program has outlined a clear gold-antimony footprint, supported by earlier high-grade rock chips and now primed for follow-up geophysics and drilling.

With shares trading at 15c and a market cap around $8 million, BUS continues to fly under the radar despite assembling a strategic position in Victoria's goldfields through methodical exploration.

Most market attention has focused on their upcoming Crosbie South drilling program. But today's results suggest Crosbie North might be shaping up as an equally valuable target.

It’s fortuitous timing as the gold price hovers near record highs, fuelled by Donald Trump’s latest tariff push.

The rush into gold is picking up pace, and Bubalus is right where it needs to be.

With Crosbie South drilling kicking off this month and Crosbie North targets taking shape for Q3, BUS shareholders now have multiple shots on goal in one of Australia's richest gold provinces.

For a ~$8 million explorer with over $4 million in cash, it's a risk-reward ratio worth watching closely.

We've actually topped up our BUS holding just last week - such is our confidence in its trajectory.

What Today’s Announcement Tells Us

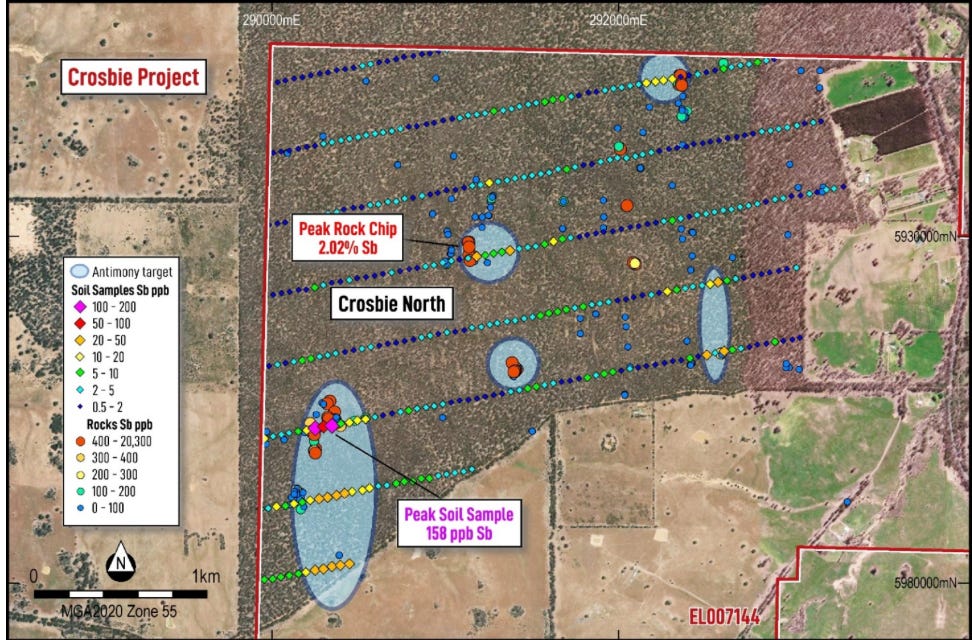

Rock chip grades up to 12.1 g/t gold and 2.02% antimony support the anomalies.

380 soil samples completed across Crosbie North confirming strong gold and antimony anomalies.

Peak values of 34 ppb gold (13 times background levels).

158 ppm antimony anomalies (30 times background levels).

Structural mapping and geophysics now underway to refine drilling targets.

Meanwhile, drilling at Crosbie South kicks off later this month.

This is textbook exploration work. Nothing flashy, just methodical science building a strong case for drilling.

The early data is pointing toward a tightly folded gold-antimony system - the same style of geology that underpins Mandalay Resources’ nearby Costerfield Mine.

For context, Costerfield is a beast of a deposit, regularly pulling out some of the highest-grade gold-antimony ore you'll find anywhere in the world.

What’s Next for Bubalus Resources

Managing Director Brendan Borg says BUS will now crank up a ground-based IP survey at Crosbie North, followed by detailed structural mapping. These techniques should help pinpoint sulphide zones and structural traps where high-grade gold and antimony might concentrate.

With both projects advancing, BUS shareholders face an action-packed few months: Crosbie South drilling results by mid-year, followed by Crosbie North target finalisation and potential drilling in Q3.

For a small explorer sitting in the shadow of billion-dollar mines like Fosterville and Costerfield, the upside potential is substantial. The systematic approach they're taking dramatically increases the odds of hitting meaningful mineralisation when the drills finally turn at Crosbie North.

Not Just Surface Smoke

What sets Crosbie apart is that the surface anomalies have teeth.

The soil grid confirmed a multi-element signature, perfectly aligned along structural trends and folding patterns typical of Castlemaine Group geology. This is the exact same rocks that host Fosterville and Costerfield.

The rock chip data shows standout grades like 12.1 g/t gold and 2.02% antimony taken from folded meta-sediments near the hinge zone. That kind of high-grade sniff at surface is exactly what launched mines like Costerfield into the big leagues.

Now, BUS is layering on geophysics and structural interpretation to define the best drill targets.

Drilling Is Coming

Bubalus says drilling at Crosbie North is targeted for next quarter (Q3). Before then, the team will spend the next few weeks finalising structural mapping and running a high-resolution IP survey, which should help identify sulphide-rich zones beneath the soil anomalies.

In the meantime, the real excitement kicks off at Crosbie South in late April, chasing IRGS-style mineralisation that also sits near historic high-grade rock chips. That's the program that could really move the needle for BUS shareholders.

Why This Matters

BUS now has a clear twin-track exploration strategy:

Crosbie South — drilling imminent

Crosbie North — targets finalised, drill-ready by Q3

Both sit within the prolific Bendigo Zone, literally surrounded by billion-dollar gold mines, and both are delivering promising early-stage data.

For investors, the implications are straightforward:

Tiny market cap with substantial leverage to exploration success

Multiple distinct targets providing opportunities for discovery

Strategic location between two proven, high-grade operations

Strong management with a track record of creating shareholder value

More than $4 million in cash to fund planned exploration after recent $1.5 million placement.

At a small market cap, and with drilling now locked in, Bubalus has multiple shots at a Victorian gold discovery - just as gold prices remain perched near all-time highs.

With cash in the bank and a methodical approach to unlocking value, the next few months could reshape BUS entirely.

How We Got Here

It's worth remembering that we've been tracking BUS closely since February, when they first announced their gold-antimony hunt in Victoria.

Back then, freshly appointed managing director Brendan Borg (the same bloke who helped deliver 875% returns at Celsius Resources) was just kicking off the geochemical sampling program at Crosbie North.

That initial work has now paid off with today's results, and just last month we saw BUS expand its Victorian footprint with the strategic acquisition of the historic Avon Plains Gold Mine - a cracking project with historical records of up to 3 ounces per tonne (90 g/t gold).

The original miners abandoned operations in the early 1900s purely because of water flooding from 60 feet depth - not because they ran out of gold. Talk about a situation ripe for modern techniques.

It’s also worth noting that BUS recently completed a $1.5 million placement at 16.5c, with MD Brendan Borg himself participating. At the current 15c share price, you're actually buying in at a discount to what sophisticated investors just paid.

Crosbie sits smack-bang between two of Victoria's most profitable mines (Fosterville and Costerfield), and with today's results strengthening the case for Crosbie North, BUS continues to advance two distinct targets within their Victorian exploration portfolio.

Cheap entry, multiple targets, proven address.