Fortuna Metals Gets The All-Clear From Malawi

The Malawi panic cost FUN shareholders 50% in a single session. Today, the government confirmed it was all for nothing.

Remember when the company we invested in Fortuna Metals (ASX: FUN) got smashed in October on fears about Malawi’s raw mineral export ban? The stock dropped from 22c to 11c in a single session.

We called it a mountain made out of a molehill at the time. Now we have proof.

Today FUN has received official confirmation from the Malawi Government that its Mkanda rutile project is not affected by the ban…it never was.

The company has the letter in hand, and the uncertainty that's hung over the stock since October is gone.

Back then, FUN hadn't even drilled its Mkanda rutile project yet. Investors were selling a project that was still entirely speculative.

Fast forward a couple months and FUN has now returned two batches of world-class drill results showing high-grade rutile mineralisation that grades above the Sovereign Metals’ (ASX: SVM) Kasiya project 20km to the north. SVM is valued at just under $500 million.

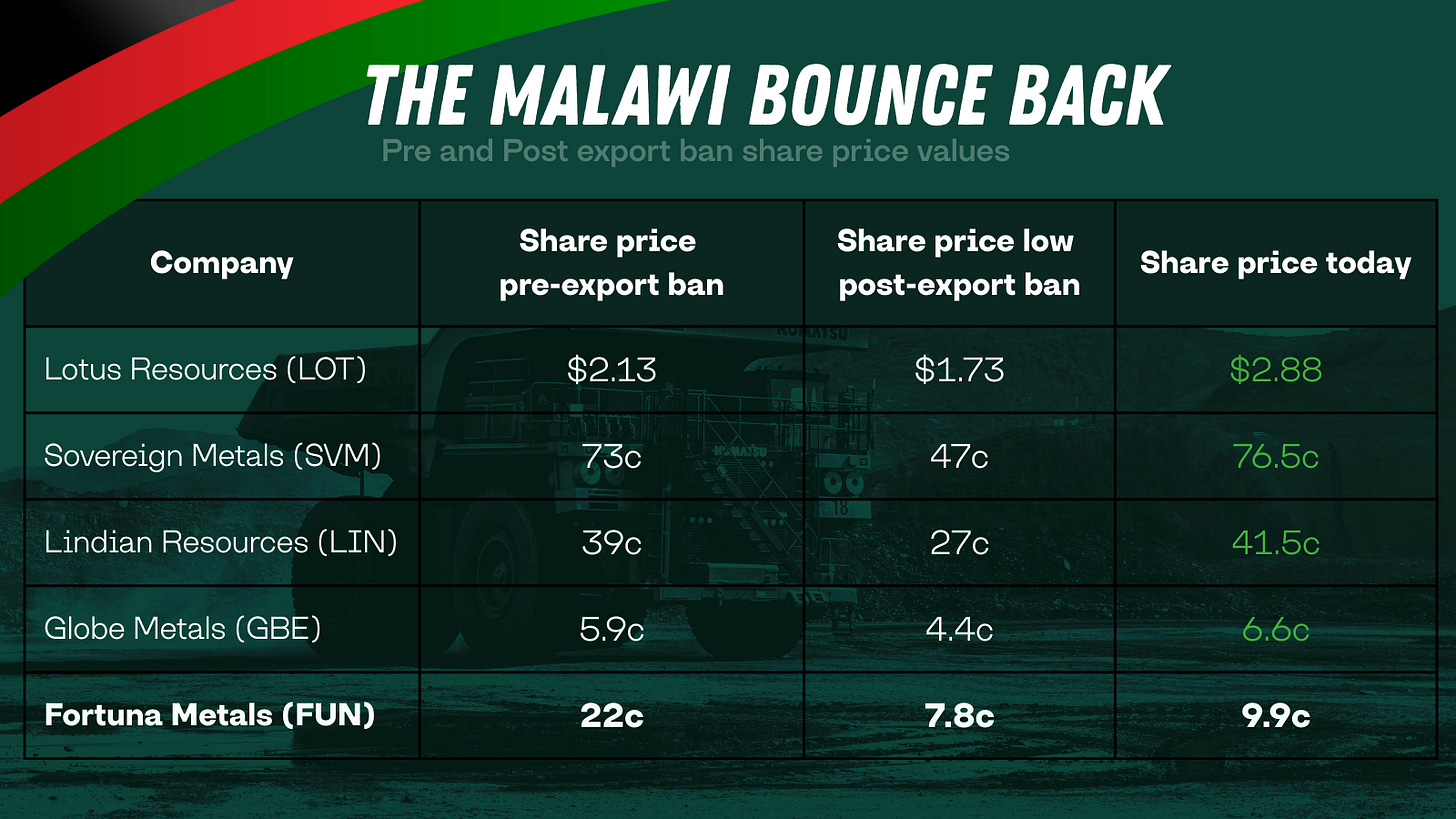

FUN trades at $28 million and 9.9c per share. The news from the government should release the shackles. The drilling proves the geology works, yet the stock sits at less than half what it was before the panic. If FUN follows its Malawian peers, that gap closes fast.

A Trip Down Malawi Memory Lane

In late October, the Malawian Government announced restrictions on exporting unprocessed minerals. Investors panicked. Anything with exposure to Malawi got sold off in a hurry.

FUN dropped from 22c to 11c in a single session before recovering to around 15c by the end of that week. Fear gripped the stock.

But few people had read the fine print. The ban only applies to raw, unprocessed minerals leaving the country. Companies that process their material in Malawi were never affected.

FUN plans to follow the same path as Sovereign Metals at Kasiya, 20km north. All material would be extracted and beneficiated in-country to produce a premium rutile product (+95% TiO₂), not shipped out as run-of-mine bulk. That was always the plan.

The government letter confirms FUN is in the clear. Shareholders no longer need to wonder whether the ban applies. It doesn't.

FUN can get back to what matters: drilling out Mkanda.

What’s Happened Since

FUN still trades at a fraction of where it was before the panic. The stock sits at 9.9c today, less than half the 22c it touched before the news hit.

A return to those pre-panic levels means over 120% upside from here. And the company has done a lot of work since then.

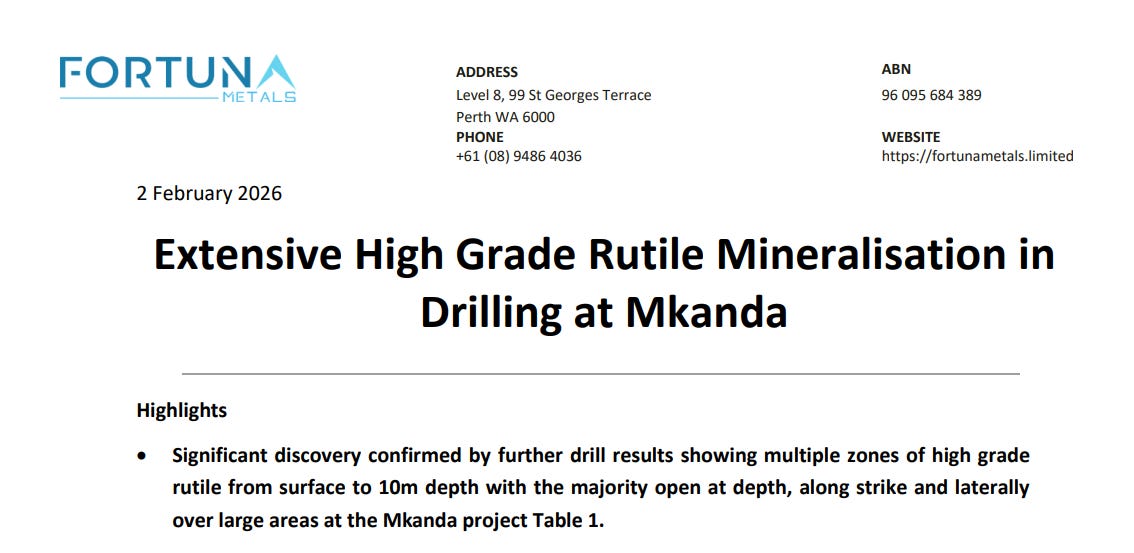

Back when the panic hit, Mkanda was still early-stage exploration. FUN has now reported two batches of high-grade rutile drill results that sit above SVM’s Kasiya grades.

The most recent standout we covered this week was 10 metres at 1.62% rutile. For context, Kasiya averages about 1% TiO₂.

So the share price is lower than it was before the scare, yet the project has moved forward on two fronts: the geology is proving up, and the sovereign risk just got a line through it.

The Valuation Gap is Getting Harder to Ignore

FUN trades at a $28 million market cap. Sovereign Metals, sitting on the same geological corridor 20km to the north, is worth just under $500 million.

Since the October sell-off, SVM has bounced roughly 40%, adding around $170 million to its market cap. Lindian Resources, (ASX: LIN) also operating in Malawi, has added over 50%, or over $200 million in dollar terms.

FUN has the same all-clear, plus high-grade rutile results that grade above Kasiya, yet the stock has barely moved.

The geology doesn’t care about market caps. If Mkanda keeps delivering results like the first two batches, a valuation 15 times smaller than its neighbour becomes impossible to justify.

Malawi Keeps Building Momentum

The past few months have seen major movement in Malawi:

Lindian kicked off construction at Kangankunde rare earths in January.

Globe Metals (ASX: GBE) started building at the fully permitted Kanyika niobium project the same month.

The World Bank’s IFC signed on with SVM in December to support development at Kasiya.

Lotus Resources is set to ramp up production at their uranium mine.

One project in production and three progressing toward production is about as much country-level de-risking as a small-cap explorer can ask for.

What We’re Watching Next

FUN still has over 600 drill holes to report from its Mkanda program. If the results keep landing like the first two batches, a maiden resource estimate should come together later this year.

Aircore drilling is planned from around May, which will punch through the water table and see how far the mineralisation extends at depth.

More than half the holes in the latest batch ended in rutile, meaning the drill stopped before the mineralisation did. Deeper drilling changes the tonnage picture entirely.

We got into FUN at 4c. At 9.9c with confirmed high-grade rutile and the Malawi scare officially behind them, the re-rate could just be getting started.