FUN Keeps Hitting. And They've Barely Started.

This $30 million explorer is drilling results that a $450 million neighbour took years to get. And they've barely scratched the surface

Fortuna Metals (ASX: FUN) has dropped its second batch of Mkanda results, and they look a lot like the first. High-grade rutile over wide areas, and the system’s still open at depth.

It comes after FUN's first ten holes in December confirmed high-grade rutile across the board, with every hole ending in mineralisation.

In exploration, one good batch gets attention. Two in a row starts building conviction. FUN’s now returned 45 holes out of 675 drilled at Mkanda, its primary rutile project in Malawi, and the grades keep sitting above their neighbour, Sovereign Metals (ASX: SVM).

The attractive bit is that FUN trades at less than 10% of SVM's valuation. We got in at 4c. At 11.5c, we think there's still a long way to run.

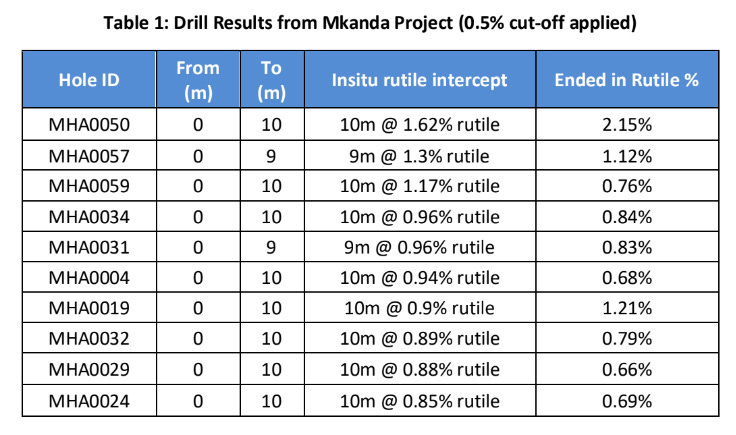

The standout result from today’s announcement was hole MHA0050, which recorded 10 metres at 1.62% rutile, with the bottom 2 metres grading 2.15%. Peak grade across the batch hit 2.26%.

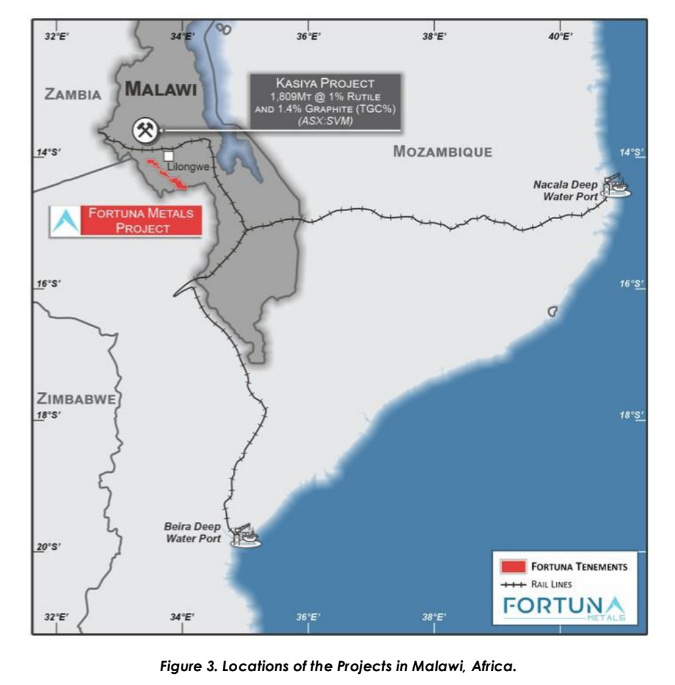

For context, SVM’s Kasiya resource - the world’s largest rutile deposit, 20km to the north - averages about 1% TiO₂.

FUN will release the rest over the coming months, and if they keep landing like this, it’s shaping up to be a large high-grade rutile resource.

Rutile is a feedstock for titanium, which is used in humanoid robots, and with Tesla last week stating they will discontinue some of their car models to focus on robots, rutile demand could be about to explode.

Holes keep ending in rutile

More than half of the holes reported today ended in mineralisation.

Hand-auger holes only reach about 8 to 10 metres before they hit the water table which can sometimes muddy the sample quality. The best grade in this batch (2.15% in hole MHA0050) was sitting right at the bottom. Meaning the drill stopped before the rutile did.

Aircore drilling, planned from around May this year, will punch through that water table and keep any water out of the samples, giving a reliable result and letting us know how deep the rutile mineralisation goes.

At Mkanda, the saprock boundary sits around 20 to 30 metres below surface, marking the transition from weathered material into fresh, harder rock where mineralisation can behave very differently.

To date, FUN has not drilled anywhere close to this level, meaning the company has so far only tested the shallow, weathered portion of the system, with a large amount of geological potential still sitting completely untested at depth.

If grades hold or improve below 10 metres, the tonnage picture changes completely. That's the step that took Sovereign Metals from interesting to the world's biggest.

The footprint keeps spreading

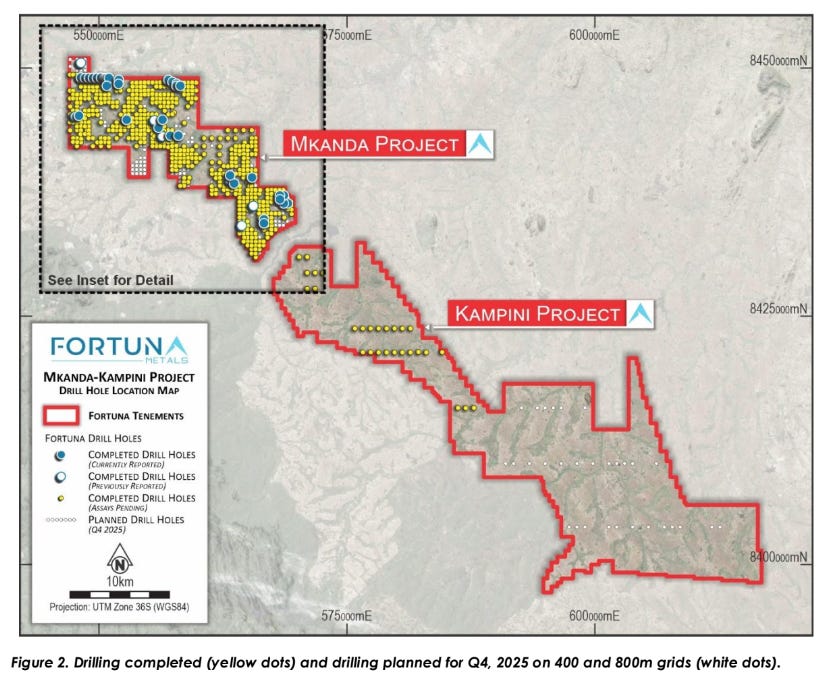

Results from this batch span from the northwest to the south of Mkanda, hitting mineralisation across multiple prospects over more than 17 kilometres of strike.

This isn’t the only project Fortuna has either, the company holds a second project at Kampini, 40 kilometres south on the same geological belt.

FUN now sits on over 50km of potential mineralised ground. Not bad for a $30 million company that just happens to share the same geology as its neighbour to the north that's worth $450 million.

The 400 by 400 metre drill spacing FUN used is the same density SVM needed for its inferred resource at Kasiya, so when these results are done flowing in, FUN won’t be far off having what it needs to pull a resource together this year.

Every step-out hole that hits makes this harder to explain away as one lucky cluster. This looks to be a large continuation of SVM’s system, that happens to be growing with each reported drill hole.

And for anyone still uneasy about Malawi as a mining jurisdiction, it’s worth watching what’s happening around FUN. Lindian kicked off construction at its Kangankunde rare earths mine in January. Globe Metals started building at the fully permitted Kanyika niobium project the same month. And in December, the World Bank Group’s IFC signed on with SVM to support development at Kasiya.

Three projects moving toward production within spitting distance of Mkanda is about as much country-level de-risking as a small-cap explorer can ask for.

Tesla parks cars to build robots

While FUN was in its trading halt, the titanium demand story took a big step forward.

Tesla announced on its Q4 earnings call last week that it’s ending production of the Model S and Model X and retooling the Fremont factory for one million Optimus humanoid robots per year. Elon’s words: “an honourable discharge” for the two cars that made Tesla famous.

In the same week, Figure AI unveiled Helix 02, a humanoid that ran a four-minute fully autonomous kitchen routine that’s worth watching below. It loaded and unloaded a dishwasher, all without human input. Figure called it the longest continuous autonomous task by a humanoid yet.

FUN’s own announcement cites roughly 10.4 kilograms of rutile per humanoid unit, based on titanium’s role in the frame and joints. Titanium doesn’t fatigue the way steel does, which is why anything built to move under its own power for years needs it.

The US market's already starting to take notice. The Themes Humanoid Robotics ETF (NASDAQ: BOTT) has roughly tripled from its 52-week lows. Rutile, as the cleanest natural feedstock for titanium, might soon be a material the world doesn't have enough of.

Let’s be straight about what’s ahead

There are 630 holes still to come. Results will flow through Q1, and FUN is setting up a lab down the road from their projects to speed up assay turnaround.

Management is in Malawi this week, helping sort out all the particulars before heading to and presenting at the 121 Mining Investment conference in Cape Town.

Graphite analysis is also underway and rare earth work is planned, after SVM found heavy rare earths at Kasiya in the same geological setting. Neither changes the story right now. But if either turns into something, they’re a bonus on top of the main rutile story.

SVM’s Kasiya gets uplifted from 1% to 2.00% rutile equivalent once graphite credits are included, so if FUN starts off at a higher grading before any credits, the gap only gets bigger.

The next few months of results are going to look a lot like this one. Batch after batch at grades above the neighbour. That’s what working through 675 drill holes looks like, and it won’t be a new discovery every fortnight.

But every batch that lands with numbers like these brings FUN closer to a resource. A resource is what separates an explorer from a developer. And this resource is expected to be announced in 2026.

We announced FUN was added to our portfolio at 4c. At 11.5c we’re close to a 3x and we’re holding every share. The discount to SVM is still massive, and FUN doesn’t need to match its neighbour to deliver a serious re-rate from here.

The grades keep confirming and the footprint keeps growing. And the market for what’s in the ground just got a lot more interesting.