FUN Highlights World-Class Rutile Grades

Historical grades across two of Fortuna Metal's Malawi projects beat neighbour SVM's resource, with FUN trading at just 6% of its valuation.

World-class mineralisation has been confirmed for Fortuna Metals (ASX: FUN).

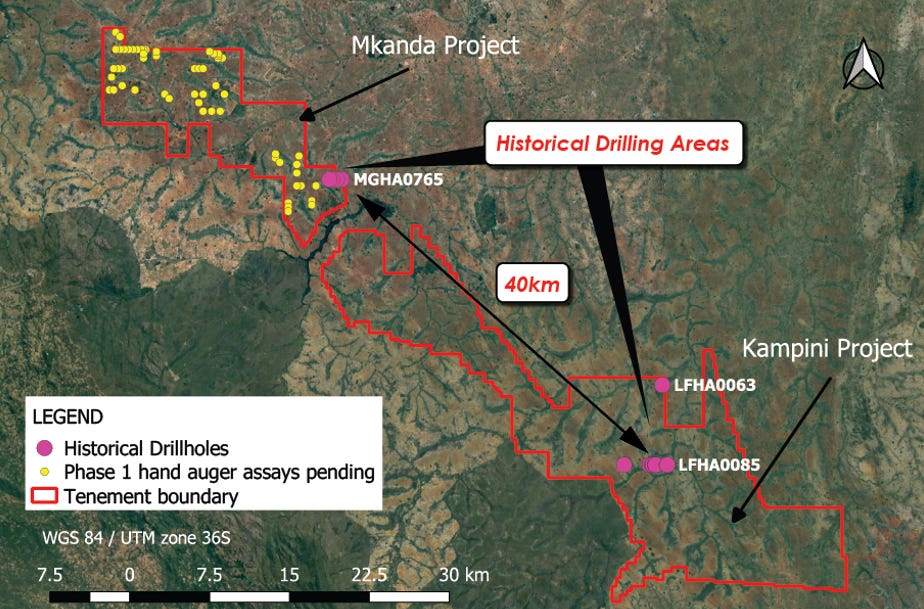

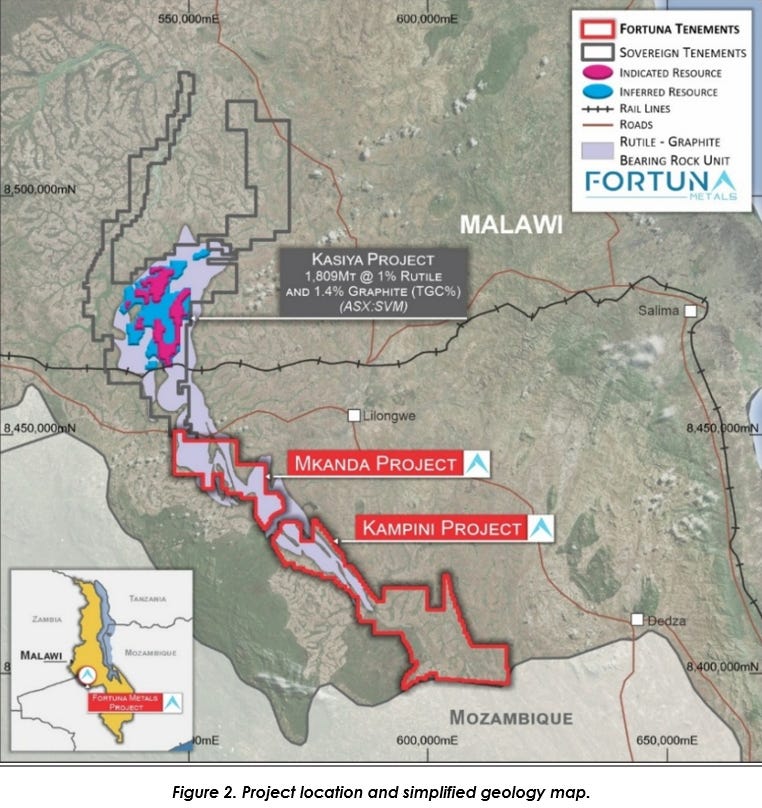

Rutile mineralisation has shown up across two of FUN’s projects in Malawi - Mkanda and Kampini, some 40km apart - with grades that beat their near half-a-billion-dollar neighbour’s resource.

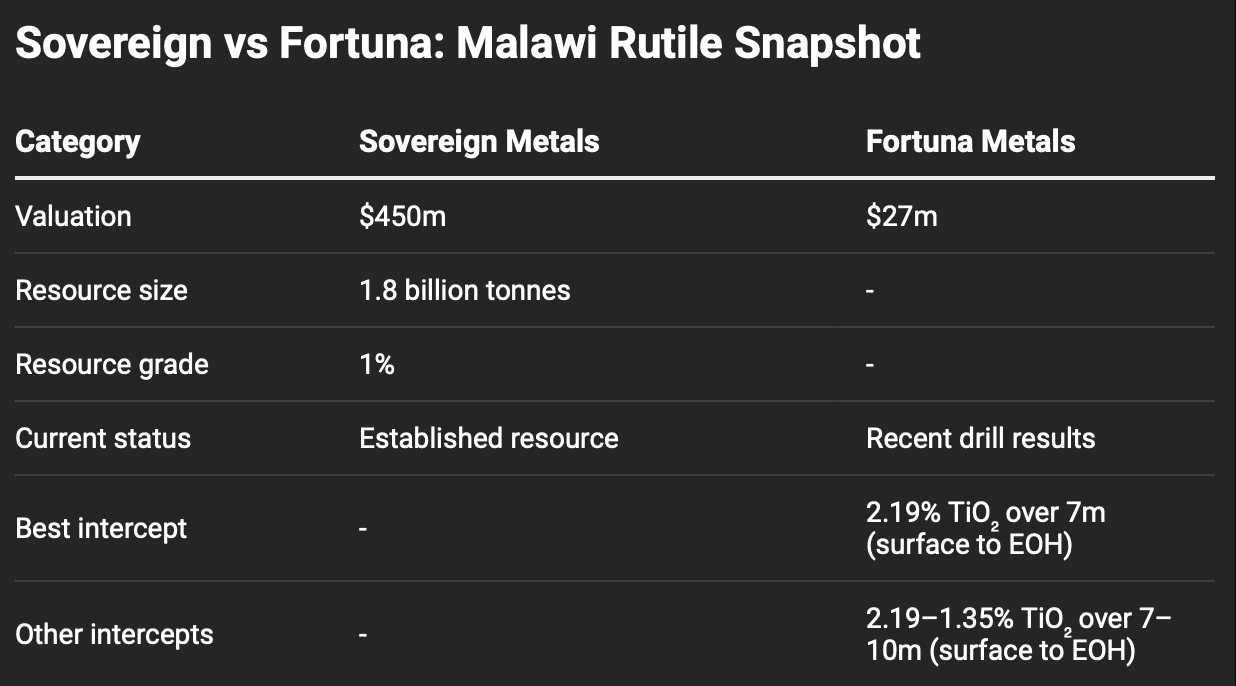

At 14.5c per share, with a company valuation of $27 million, FUN has turned from an exploration punt into a serious contender. The valuation gap between FUN and Sovereign Metals (ASX: SVM) - the $450 million company that owns the Rio Tinto-backed Kasiya deposit next door - will undoubtedly close.

The grades FUN reported today are higher than the SVM resource, and with multiple historical holes ending in mineralisation, there’s no knowing yet how deep this system runs.

We first backed Fortuna because it sat on the same rocks that host the world’s largest rutile deposit. Back then it was a promising punt with a big idea, but with today’s update, that idea is starting to take shape.

FUN now has the ground, standout numbers, and a blueprint from the neighbour that’s already proven this works. If upcoming results show the system runs as one belt across FUN’s ground, it won’t be trading like a junior for long.

The Numbers That Matter

You can’t fudge the numbers when it comes to exploration, and the figures reported today by FUN are world-class and still leave much to the imagination.

Many of the drill holes reported ended with mineralisation, a sign that the system continues below what’s been tested so far. The key intercepts, all ending in mineralisation, show grades well above SVM’s 1% TiO₂ average at Kasiya.

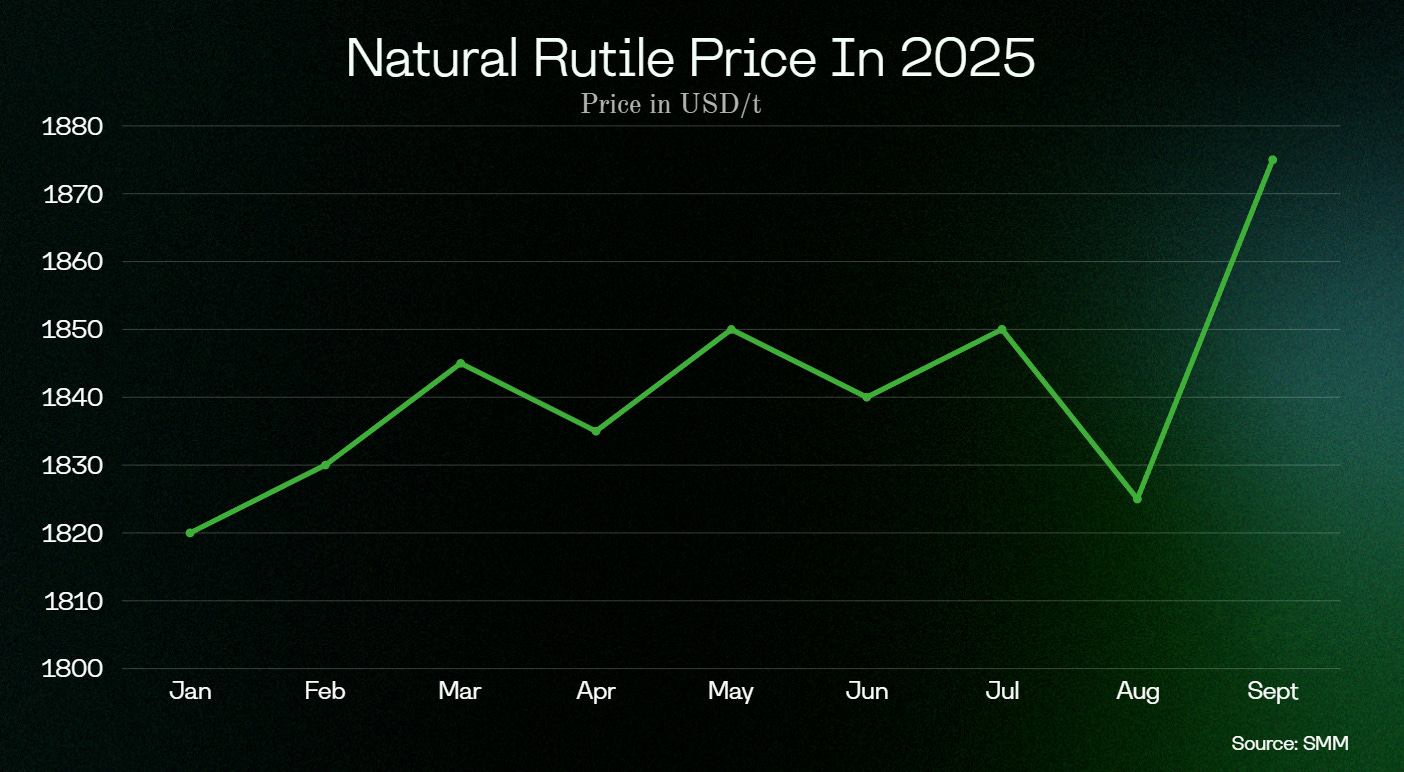

The titanium market is forecast to expand from US$30 billion in 2025 to US$54 billion by 2034. A high-grade, near-surface deposit like this commands a premium, and FUN’s current valuation doesn’t reflect that yet.

We tipped FUN at 4c. It’s 14.5c today. That call was about backing the right rocks and the right neighbours and with today’s update, we’re hanging on to every share.

The world class results from Mkanda and Kampini show Rutile from surface with several holes ending in mineralisation.

The results below detail how prospective the land holding is and with some 40km between the two deposits this could be a continuous corridor.

10m @ 1.35% TiO₂ (MGHA0737)

7m @ 2.19% TiO₂ (LFHA0063)

8m @ 1.46% TiO₂ (LFHA0071)

7m @ 2.14% TiO₂ (LFHA0079)

8m @ 1.60% TiO₂ (LFHA0080)

7m @ 1.85% TiO₂ (LFHA0081)

7m @ 1.77% TiO₂ (LFHA0082)

8m @ 1.57% TiO₂ (LFHA0085)

These results are well above the 1% grade of the JORC resource of the $450 million Sovereign Metals to the north

“The titanium results in historical drilling validate the prospectivity for widespread rutile potential across our projects in Malawi.”

Fortuna CEO, Tom Langley

Two Confirmed Mineralised Zones, 40km Apart

Mkanda and Kampini sit a hefty distance apart, yet both have confirmed high-grade rutile mineralisation. The next question is whether they’re connected.

Both projects appear to be part of the same geological system, sitting within the weathered rock sequence that hosts SVM’s Kasiya deposit to the north.

If recently completed drilling confirms the mineralisation connects between the two deposits, FUN could be sitting on a rutile-rich belt stretching over 40km.

This means the company may control the southern half of one of the world’s largest rutile provinces, a province that has mining majors invested and foreign governments investing in infrastructure.

Why Investors Should Care

Rutile is the purest and most valuable type of titanium ore, containing around 93 to 97% titanium dioxide, which sells for around US$1,850 per tonne at the moment.

That purity matters because rutile is used in high-end applications with growing demand, such as robotics, defence, advanced manufacturing.

Meanwhile, supply is tightening as legacy operations decline. Iluka’s Cataby mine is transitioning into care and maintenance, while its new Balranald project in NSW starts 60 metres below surface and requires a huge investment in underground mining technology.

By contrast, FUN’s mineralisation sits at the surface - ideal for low-cost mining and simple processing.

SVM’s test work at Kasiya has already proven rutile can be recovered using standard mineral-sands flowsheets with clean, liberated grains. FUN’s ground mirrors that geology and could follow the same development path without spending years proving the concept.

FUN has the blueprint of what SVM did, and can now shortcut the time taken to advance the project and bridge the valuation gap. FUN trades at only 6% the value of SVM, offering serious leverage into a confirmed world-class region.

Exploration Already Underway

FUN has completed its first-phase soil and hand-auger program, drilling 63 holes for 581 metres and collecting 232 soil samples.

Those samples are being analysed in South Africa, with further analysis in Perth to pin down what’s in the rock.

The analysis will confirm whether the mineralisation has the same high-grade rutile content as SVM next door. First pass visuals look very promising.

Next steps include re-processing government data to refine drill targets and then launching a much larger exploration program across FUN’s landholding.

FUN is also setting up a small lab in Malawi to do early-stage testing locally, which will save time and money as they scale up exploration.

The Takeaway

Fortuna Metals has confirmed rutile mineralisation across two projects 40 kilometres apart, with multiple holes finishing in mineralisation and the system still open at depth.

Those zones could connect into a single belt running the full distance between Mkanda and Kampini.

This feels like the fun part when an early hunch starts showing its teeth and you get that buzz that maybe it’s bigger than you first thought.

With A$4.5 million in cash, assays only weeks away, and a market value at just 6% of its neighbour’s, FUN offers some of the best leverage on the ASX to this world-class rutile province.

Here’s hoping for a little more Malawi magic in the months ahead.