FUN Just Drilled a Monster Rutile System

Fortuna Metals just confirmed a world-class rutile discovery at Mkanda. Every hole hit, every hole ended still in mineralisation, and there's 534 more assays coming.

It’s official. Fortuna Metals (ASX: FUN) has a world-class rutile discovery on its hands.

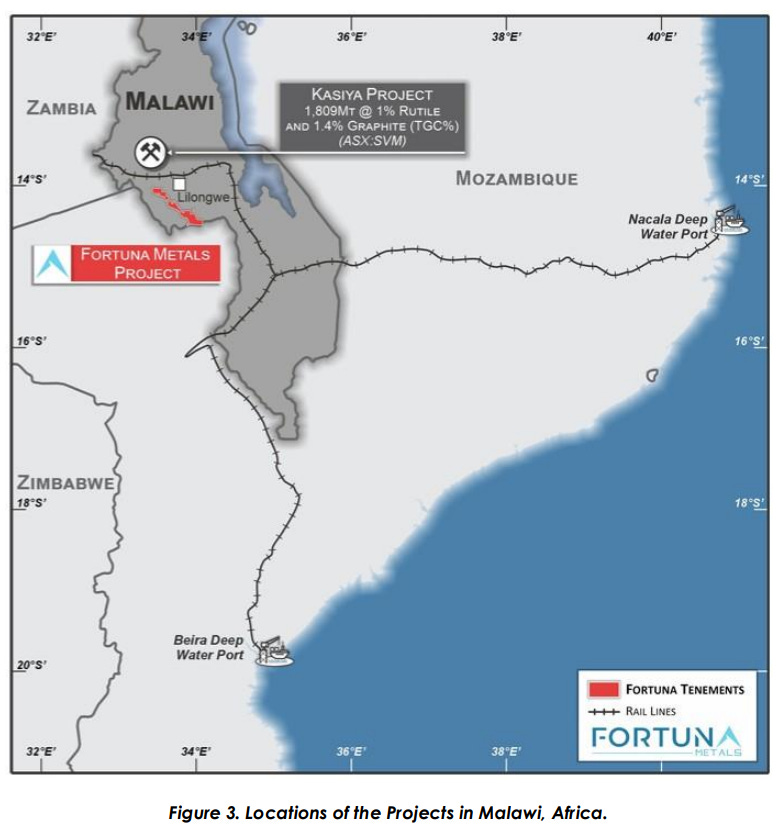

Their Mkanda project started as an interesting early-stage rutile idea in Malawi, one of those projects that looked promising but still needed the drill results to back it up.

That backing has now arrived, with drilling confirming rutile mineralisation running continuously across a large project area.

At 9.8 cents per share, FUN is trading with a market cap of roughly $28 million and over $7 million in cash. That valuation made sense when the story was still speculative. With this drilling in hand, it looks out of step with what’s now been shown.

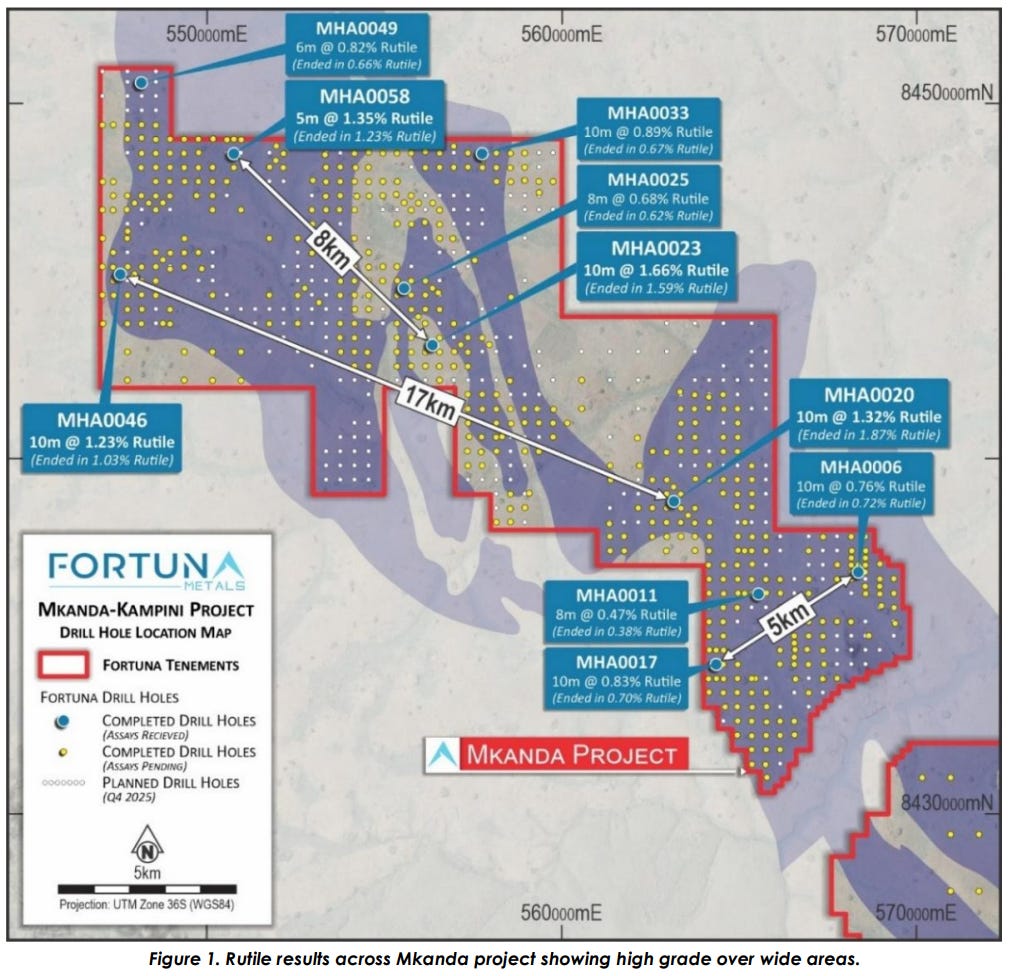

Today’s results show widespread near-surface mineralisation, with multiple holes still ending in rutile, suggesting the system remains open at depth.

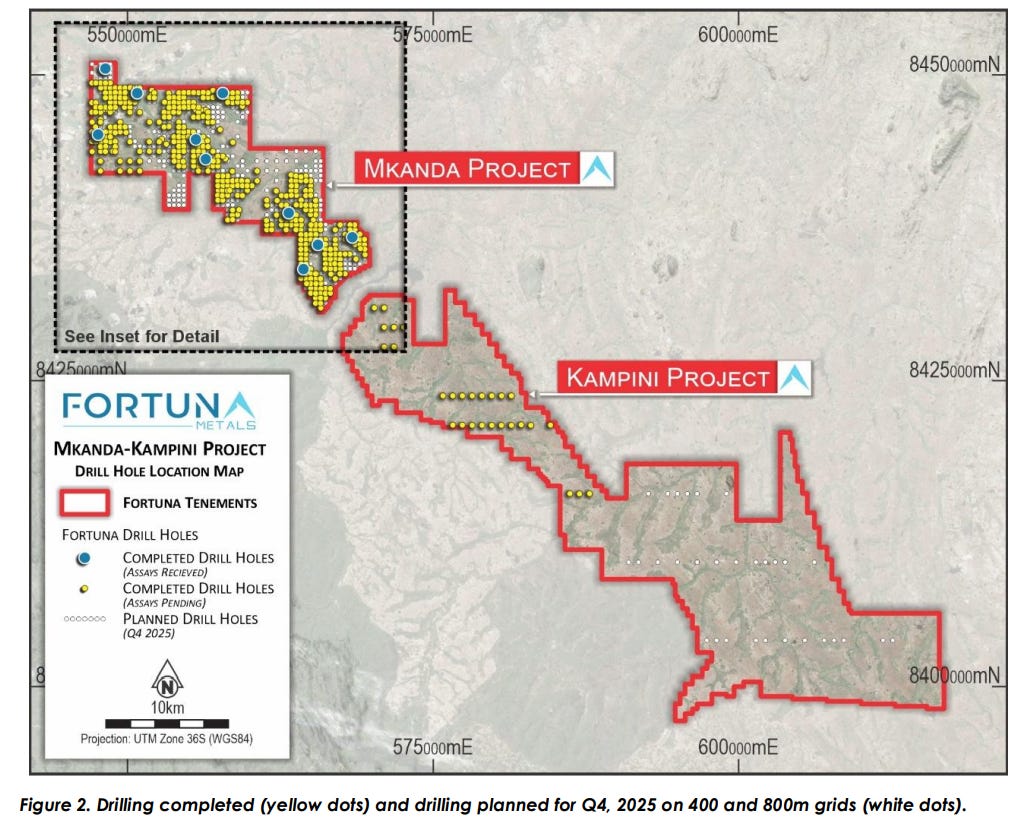

These are just 10 results from 544 holes already drilled at Mkanda. The rest will flow through over Q1 2026, which means FUN’s got a steady drumbeat of news coming for months.

FUN has widened its drilling across Mkanda, and the rutile hasn’t dropped away. It’s now moved well past the “is there rutile here” stage, and into figuring out just how big this thing can get.

The Results are in, and They Are Good

FUN’s first batch of Mkanda results delivered rutile grades up to 2.21%, with multiple 10-metre intercepts above 1% rutile, including:

10 metres at 1.66%,

10 metres at 1.32%, and

10 metres at 1.23%

These are full-length intersections from surface through shallow drilling, not narrow hits.

The standout is that all ten holes ended in mineralisation, with bottom-of-hole grades still running as high as 1.87% rutile between 8 and 10 metres.

In other words, the drilling stopped before the mineralisation did. A great result at this stage of exploration.

These are early results from wide-spaced holes across a large area. With 544 holes already completed and a lot of assays still to flow through Q1, this feels less like a one-off release and more like the opening chapter of a much bigger dataset.

How Big Can Mkanda Get?

The telling part of this announcement is that FUN deliberately drilled wide and kept hitting.

When you test the edges of a system and rutile keeps showing up near surface, it starts to say something about scale. Rutile projects that only show coherence on tight spacing often lose shape once drilling spreads out. Mkanda’s doing the opposite.

As FUN moves further from its initial work, the mineralisation keeps holding together. That’s a strong hint this is part of a much broader system. Mkanda already stretches more than 20 kilometres across the project area, and that’s just the starting point.

Wide-spaced drilling that hits consistently goes straight to the question of scale. Grade matters, but scale is what moves valuations. FUN’s effectively stress-testing Mkanda early, and the system’s responding better than we’d hoped.

Each step-out hole makes it harder to argue that this is anything other than a large, laterally extensive deposit in the making.

The style of mineralisation helps too. Results are coming from surface and holes are ending in rutile, which means there could be plenty more at depth than what’s already confirmed.

Mkanda’s now behaving like a system that wants to be large, and there’s a whole lot of assays still to look forward to.

What Does This Discovery Mean For Shareholders?

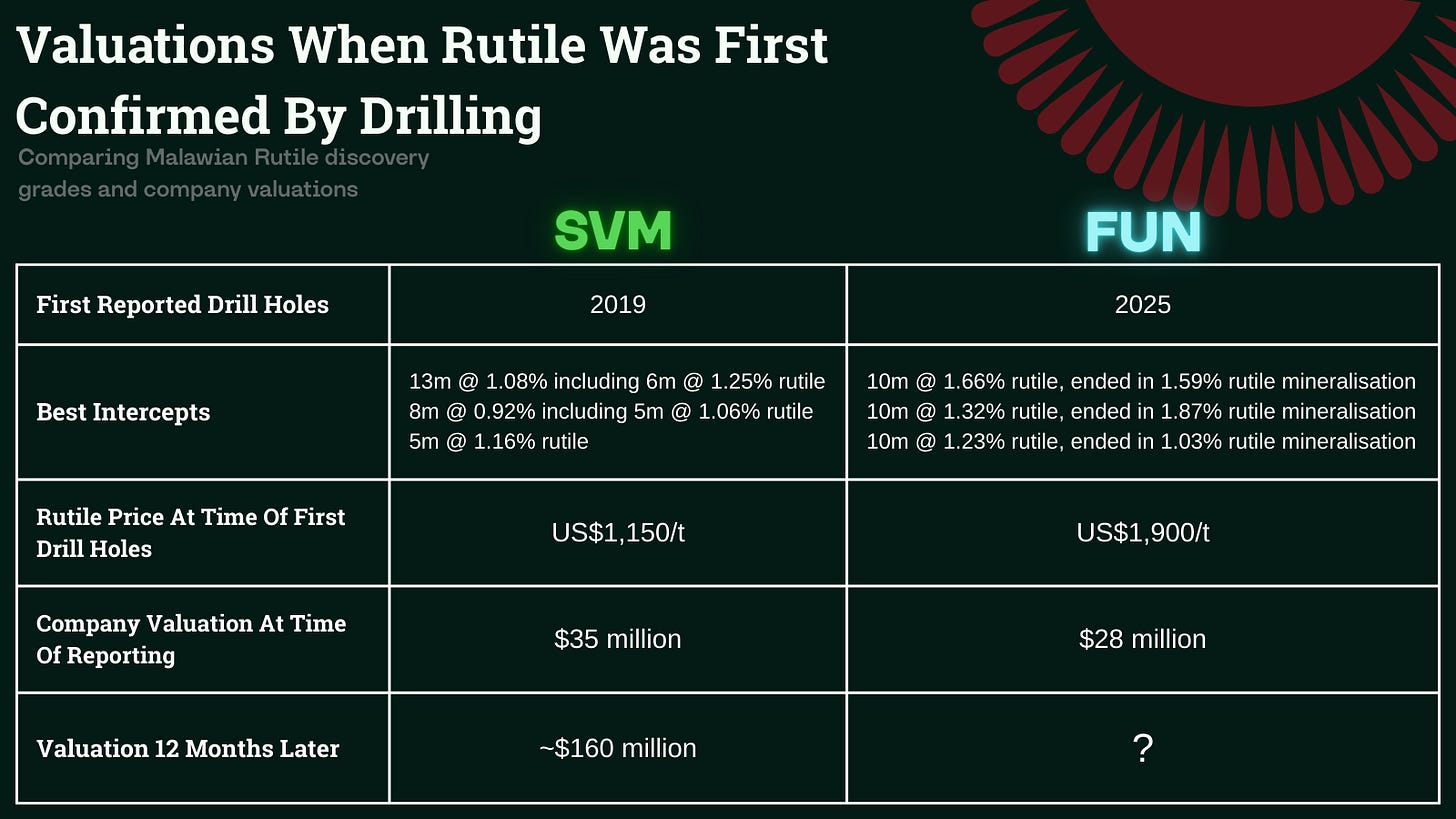

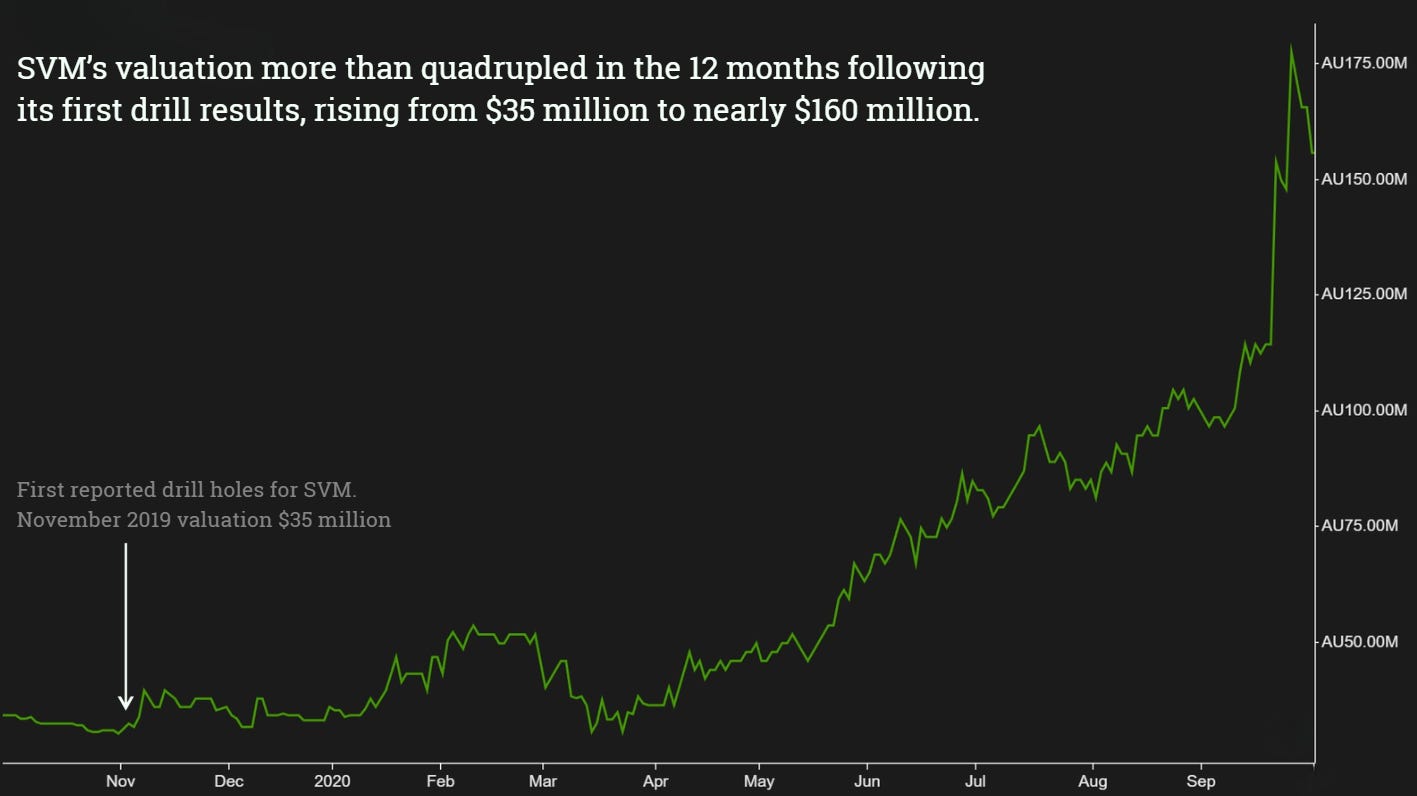

The obvious comparison is Sovereign Metals (ASX: SVM), but it only holds weight if you look at the story at the same point in time.

Comparing today’s SVM to today’s FUN tells you where FUN could end up. The useful comparison is where each company sat when the market was first asked to believe in a rutile system.

On that basis, FUN shareholders have good reason to pay attention.

FUN is working within the same geological sequence as SVM, which today carries a market capitalisation north of $300 million. FUN, by contrast, is valued at around $28 million, with shares trading at roughly 9.8 cents.

SVM now has a 1.8 billion tonne resource grading about 1% rutile, but that is not the relevant benchmark. The right comparison point is 2019, when SVM first released drill results from holes it had completed itself. At that stage, SVM was valued at around $35 million and was only just beginning to demonstrate continuity.

Line up those early SVM results against FUN’s first results at Mkanda, and FUN comes out ahead.

Higher grades, thicker intersections, and mineralisation that remains open at depth. And this is coming from wide-spaced holes across a large area, rather than tight infill designed to manufacture confidence.

What followed for SVM was a strong re-pricing. Twelve months after those first drill results, SVM was valued at roughly $160 million, a fourfold increase from its early discovery valuation. Continued drilling and resource growth carried it much further from there.

There are two points worth sitting with when placing FUN alongside that trajectory.

FUN is currently valued below where SVM was when it first demonstrated continuity, despite delivering stronger early indicators on grade and scale.

The rutile price has moved. It was trading around US$1,150 per tonne when SVM released its first results in 2019. The rutile price today is closer to US$1,900, which lifts the value of any large, scalable system.

FUN has delivered better early drill results, demonstrated across a broad area, in a stronger rutile price environment. At a $28 million valuation, this feels like the beginning of a reassessment that could go much higher.

There are no guarantees in exploration, but the pathway is one that we can measure against. We’ve seen this movie before, and FUN is only at the opening scenes.

Fortune Awaits Fortuna?

FUN has moved quickly from proving rutile exists to showing it holds together over distance, at grade, and from surface.

More than 500 holes are already in the ground with assays flowing through the next few months. If the rest of the results look anything like the first batch, the market’s going to have to pay attention.

FUN’s still trading at a valuation that reflects the old speculative story rather than what’s now been drilled. That gap probably won’t last.

If Mkanda continues to behave the way it has so far, the next few months could be defining for FUN and for shareholders who got in early.