Our Pick of the Year Gets Busy at Mt Egerton

BHL's drilling has nailed down where the old workings actually sit, with first assays due in weeks and gold at record highs

Black Horse Mining (ASX: BHL) listed in early December at 20 cents and now trades at 46 cents. The market’s clearly betting on what’s coming, with first drill results set to drop soon.

We called BHL our small-cap stock of the year back when it listed, and this morning’s update from their Victorian gold project Mt Egerton shows things are moving fast.

There’s already just under 500 metres of diamond drilling in the ground, channel samples sitting at the lab, soil sampling about to kick off east of the main mine, and geophysics helping refine the 3D model.

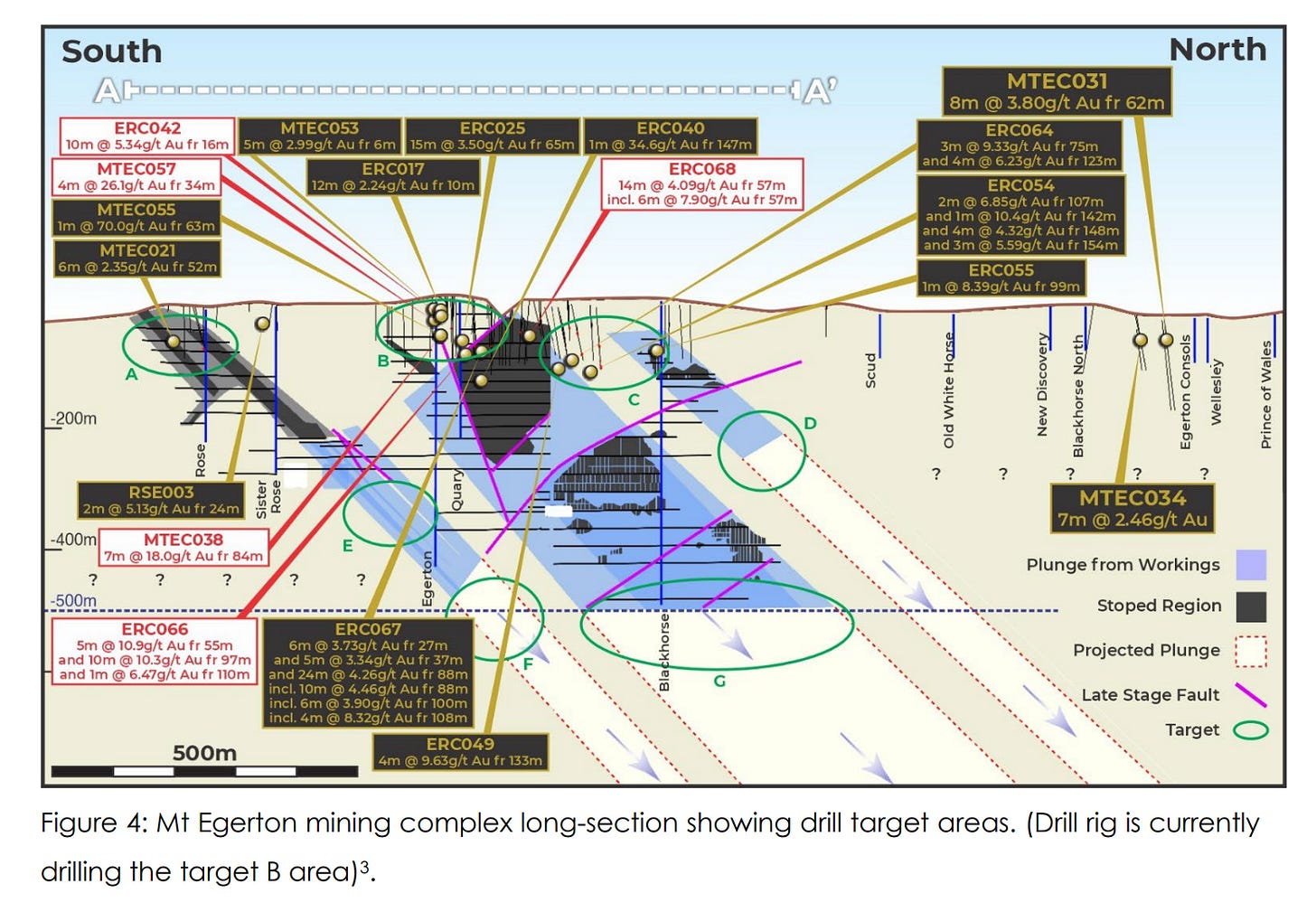

The early drilling has also given the team their first accurate picture of where the old underground workings actually sit. With that nailed down, they can start designing holes to test the deeper system that’s never been properly drilled.

For those new to the story, Mt Egerton is one of only eight Victorian gold mines to produce more than a million ounces from underground workings, and one that most investors have never heard of. Water flooded the workings in 1906, leaving the deeper system barely touched. Most historical drilling stopped above 150 metres.

First assays are due by the end of February, and the gold price is absolutely ripping right now with most major banks tipping it higher through 2026. If results land while the price keeps climbing, this could get interesting.

Black Horse is All Systems Go

BHL listed on the ASX at the start of December and from day one it was obvious this was not a lifestyle company. Drilling started straight away and the team has been pushing hard to understand the geology ever since.

Since we last heard from management it's been systems go at the Mt Egerton project:

Roadside sampling now completed - This program covered historical gold-bearing outcrops exposed in road cuttings. The samples were designed to verify historical surface level data, with assay results expected mid-to-late February.

Geophysics and modelling refined - Management combined modern surveys with historical underground data to build an updated 3D model. Early drilling found the old workings sitting up to 40 metres off from where historical records placed them. With that sorted, they can design deeper holes with more confidence.

Diamond drilling underway - Just under 500 metres of diamond drilling has been completed to date, with drilling intersecting heavily altered zones and historical workings. These conditions have required a more measured approach, but adjustments to hole angles and drilling techniques are now paying off, with penetration rates improving as the program progresses.

No Slowing Down for Black Horse

BHL expects to finish its maiden 2,000-metre diamond drilling program within three months. Drilling has picked up pace now that the team has a better handle on where the old workings sit and how the geology behaves at depth.

Each new hole feeds data back into the 3D model, which sharpens the targeting for the next round. That's how modern exploration works when it's done well, and BHL seems to be following the playbook.

Soil sampling is also about to kick off along the eastern trends that run parallel to the main Mt Egerton structure. The historic miners focused on the main lode, leaving these parallel structures barely touched. If they carry mineralisation along strike, the exploration footprint expands considerably.

“The vital structural information and accurate location of historical workings gained from this early drilling will be critical for designing holes to test deeper targets where the main potential of this project lies.”

- Black Horse Managing Director David Frances

Investors need to remember that mining at Mt Egerton stopped in 1906 because water flooded the workings, not because they ran out of gold. The deeper parts of the system remain largely untested. As do the structures running alongside it. BHL is chasing ground that the old-timers couldn't reach and didn't know existed.

First assays from drilling and channel sampling are due in the coming weeks. For a company that listed last month, that's a fast turnaround. Gold is sitting near record highs and the banks keep lifting their forecasts. It’s the perfect time to be releasing results.

Gold Price Goes From Strength to Strength

While BHL has been getting after it on the ground, gold’s generational run has continued.

Since BHL listed in December, gold has risen around 15%, going from US$4,200 an ounce to now sitting near US$4,860oz, and within striking distance of US$5,000/oz.

The major global banks keep lifting their forecasts. Here’s where they are forecasting for 2026 (per ounce in):

UBS US$5,400

JPMorgan Chase US$5,055

Bank of America US$5,000

ANZ Bank US$5,000

Commonwealth Bank US$5,000

Goldman Sachs US$4,900

Macquarie US$4,900

A well-funded small-cap drilling a historic million-ounce gold mine while the price sits at record highs is about as good a setup as you’ll find in this market.

If BHL confirms what the geology is hinting at, shareholders are holding leverage to a gold price that most banks expect to keep climbing.

Why BHL is Worth Following Very Closely

BHL is early in the story. There are no assays yet and plenty of work ahead, but the company has cash in the bank and a geological picture that’s sharpening at a historic Victorian gold system.

We’ve seen this play out before in Victoria. Southern Cross Gold (ASX: SX2) listed at 20c with their Sunday Creek historic gold mine just 100km from Mt Egerton. SX2 now trades around $11.

Mt Egerton sat in private hands for years before BHL brought it to market and they'll be hoping to repeat the success of others in the region.

With gold prices strengthening and forecasts continuing to move higher, the leverage on offer for BHL is only increasing.

We called BHL our small-cap pick of 2025. So far, it’s tracking the way we hoped it would.