The Copper Bullseye FMR’s Aiming For

Fresh survey results have lit up a single, unmissable target in Chile’s copper heartland, and FMR Resources is about to put the first holes into it

FMR Resources (ASX: FMR) has focused its crosshairs on a massive copper target in Chile, with new survey results pointing to the kind of large underground system that builds mining companies.

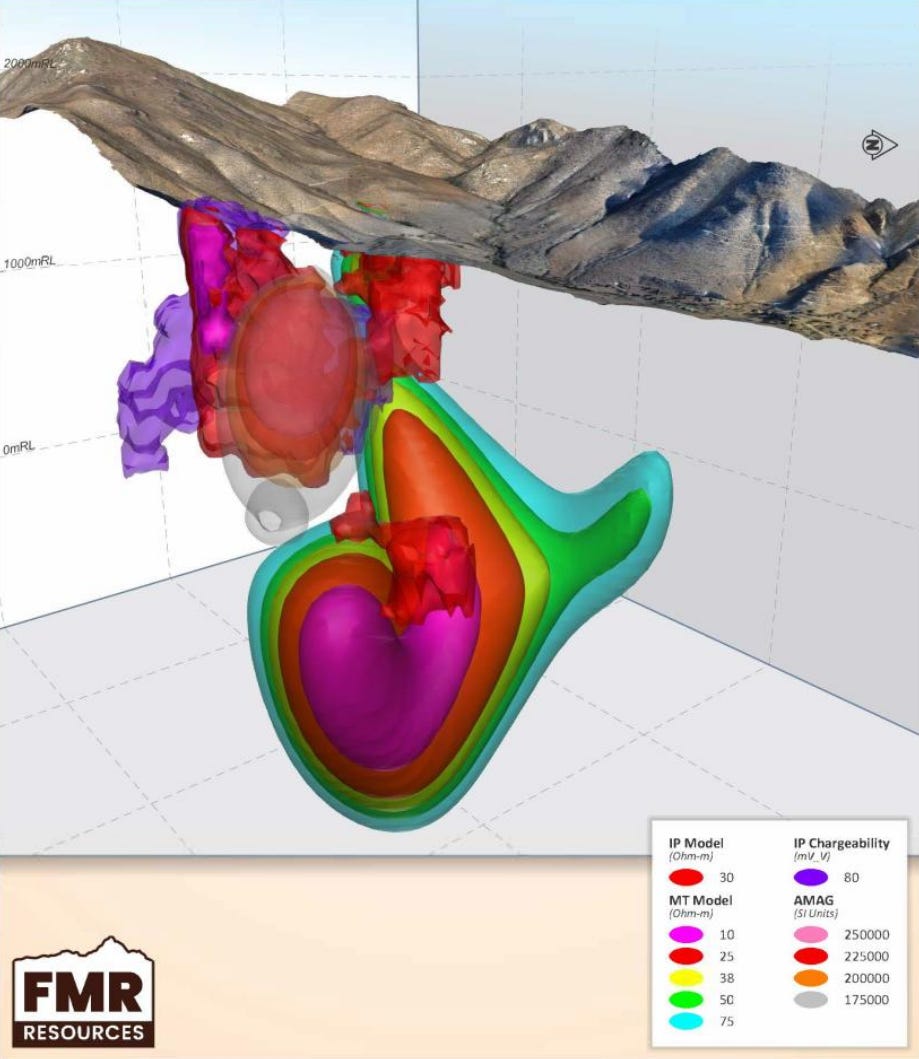

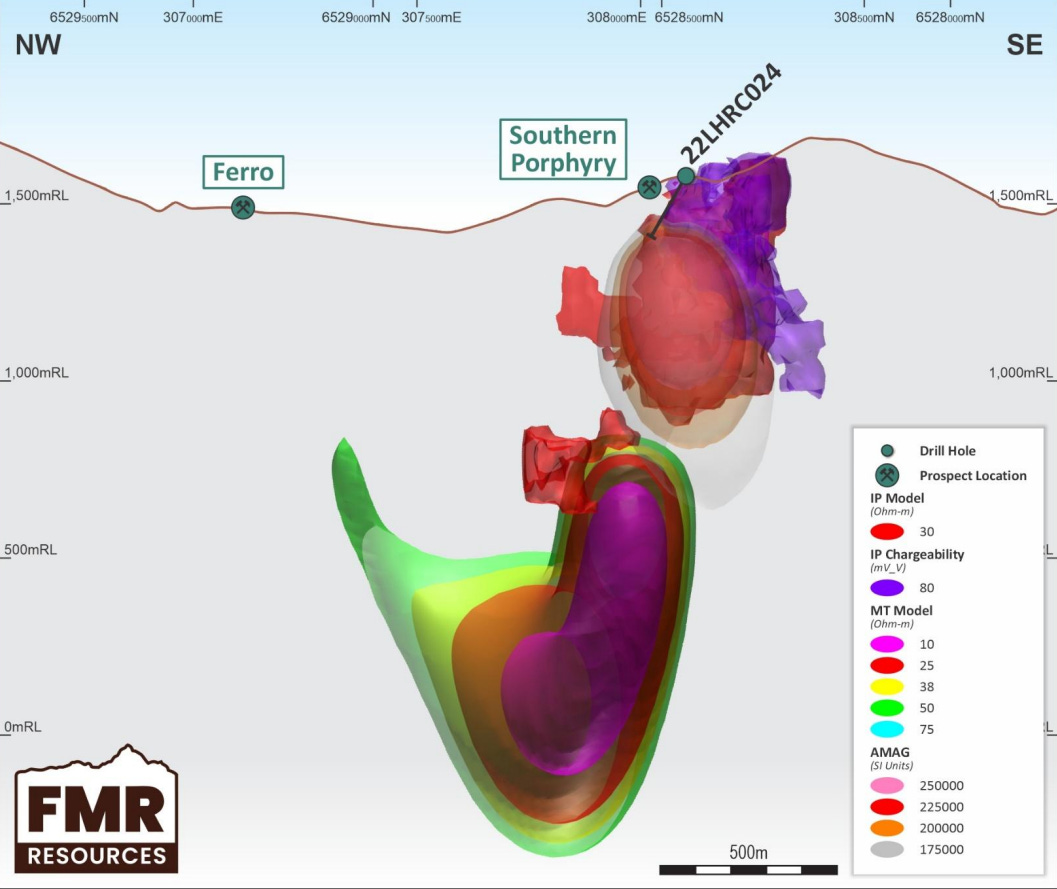

One look at the 3D model of its Southern Porphyry copper target below and you can see why FMR’s excited. Magnetic, resistivity and chargeability datasets don’t often sing in harmony. Here they’re all lighting up the same zone.

The reprocessed geophysics confirms a large, deep-seated system with every hallmark of a major porphyry.

At 40 cents and a $15 million market cap, FMR is drilling in early Q4 - just weeks away from testing a copper system that could change its trajectory overnight.

For those who’ve followed big Chilean copper discoveries, the early signs here will feel very familiar.

Every Clue Points to the Same Copper Bullseye

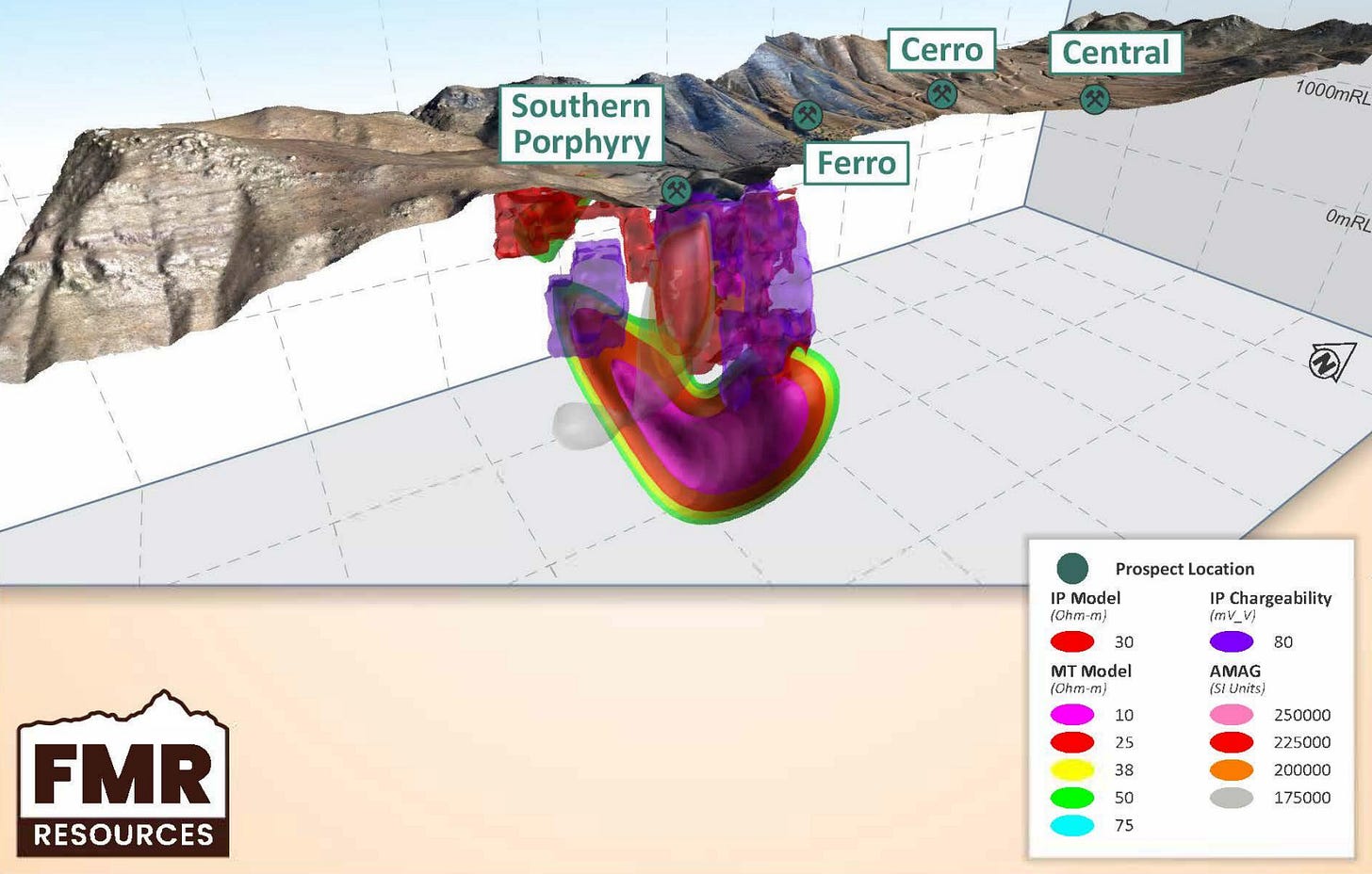

The Southern Porphyry target at FMR’s Llahuin Project has just had its exploration data reprocessed in detail, using modern survey techniques to get a clearer picture of what lies beneath the surface.

The result is a well-defined target that matches what you’d expect from a large copper deposit. It’s like using different tools to track the same suspect, and every one of them is pointing to the same spot.

The image below tells the story better than any description could.

What you’re looking at is a textbook porphyry: a magnetic core wrapped in sulphide-rich halos, surface mapping backing it up, and old drill holes above it already hitting copper. All the early geological ingredients you want are sitting in one neat package.

Southern Porphyry also sits in a six kilometre stretch that already hosts copper, gold and molybdenum. Fresh mapping’s even spotted the tell-tale alteration zones and copper stains that tend to sit right above the core of a porphyry deposit.

One dataset shows features often linked to the heart of a copper system. Another highlights zones that could be carrying copper-rich minerals.

On either side, sit signals consistent with the outer zones of a porphyry deposit. Around the world, major copper finds have shown this same pattern, and Southern Porphyry is now shaping up with that familiar, promising signature.

The latest survey results only reinforce our confidence in FMR.

Chile’s Giants all Began With a Target Like This

Chile has a long history of turning early-stage exploration targets into some of the world’s biggest copper mines.

Major operations such as Caserones and Collahuasi started the same way, with underground “signatures” that looked a lot like what FMR’s seeing now: the right mix of survey hits, surface signs and a favourable geological setting.

Both started as large geophysical targets before anyone put a drill in the ground.

While there’s no guarantee Southern Porphyry will match those giants, FMR’s on the same path those discoveries took in their first steps.

The surrounding district already hosts several known deposits, so the company is working in proven hunting ground. Southern Porphyry getting priority attention right now speaks volumes about the strength of the data and the conviction behind it.

Early Q4 Drill Program Locked and Loaded

FMR is moving fast towards its first drill program at Southern Porphyry.

Contractors are about to be locked in, the program design is being fine-tuned, and final approvals are already in progress.

It’s a rapid move from target to testing in a sector where projects can often drag on.

Porphyry drilling is deep and can take a few weeks, but the rewards can be huge. These systems can deliver mineralised zones stretching for hundreds of metres.

Should the drilling confirm copper mineralisation at depth as strongly as the data suggests, it would likely trigger a rapid re-rating of FMR’s market value. Even a single high-quality intercept has the potential to transform FMR's outlook.

Value Gap and Upside Potential

At 40 cents and a $15 million market cap, the market is not fully reflecting the potential impact of a copper discovery in Chile.

A strong drill intercept can flip sentiment overnight, as Chile’s history of micro-cap re-rates shows.

Everything’s aligned - big target, strong geological signs, proven district and a team moving fast.

Copper demand’s rising, Chile knows how to build mines and FMR is now close to testing what could be a significant discovery.

Weeks Out From First Holes in the Ground

This is as close as you get to a loaded copper play without a hole in the ground.

Their project sits in Chile's copper heartland, minutes from grid power and major infrastructure, targeting a large system that's never been properly drilled. The capital structure is tight with just over 40 million shares on issue.

Any discovery here would be amplified fast.

Behind it all is a heavyweight lineup. Mark Creasy (the prospector behind Sirius Resources' $1.8 billion takeover and Azure Minerals' $1.7 billion sale) is a substantial shareholder. Justin Werner, who built Nickel Industries into a $3.25 billion powerhouse, recently joined the board.

Led by experienced managing director Oliver Kiddie, this is a discovery team, not a lifestyle crew.

Now, the focus is the big, coherent copper blob that every dataset agrees is worth hitting.

To say we’re excited would be an understatement.