Why This Billion-Dollar CEO Just Joined a $13m ASX Junior

FMR Resources brings in the CEO of $3B Nickel Industries as a director - just as it prepares to drill in Chile’s copper heartland

A $13 million copper junior just brought one of the ASX’s top mining operators onto its board.

Justin Werner, CEO of $3.25 billion Nickel Industries (ASX: NIC), has joined FMR Resources (ASX: FMR) as a non-executive director.

Werner has spent more than 25 years building serious mining operations, taking Nickel Industries from a small operation to the world’s largest listed pure-play nickel producer. He’s deliberate about where he spends his time.

Whether it’s the target, the team, or the timing, something about FMR has drawn him in.

At 36 cents a share and a market cap of just $13 million, this is a company still early in the story. Werner’s appointment signals he thinks the next chapter could be a big one.

The beauty is Werner only cashes in if the share price moves up. No copper discovery, no share price appreciation, no payday. It means his interests align with anyone buying FMR shares today.

Who is Justin Werner? And Why it Matters

Justin Werner has spent over two decades delivering on complex mining projects across multiple commodities and jurisdictions.

He’s operated in challenging regions, scaled vertically integrated operations, and raised hundreds of millions in capital. Most importantly, he knows how to spot early-stage opportunities and turn them into commercial successes.

As managing director of Nickel Industries, he transformed a little-known operator into a multi-billion-dollar powerhouse now dominating the global pure-play nickel market, churning out over 130,000 tonnes of nickel annually.

Now he’s bringing that experience to FMR.

And this isn’t a free ride. Werner’s appointment includes performance rights tied to meaningful milestones - share price hurdles and a copper intercept of at least 100m at 1% copper equivalent.

In other words, he only benefits if the company delivers. That’s the kind of alignment we want to see as investors in FMR, and it’s rare at this stage of the curve.

Why Does FMR’s Copper Play have Werner’s Attention?

FMR’s Llahuin Project sits in central Chile, one of the most copper-rich regions on earth. It’s in the same neighbourhood as tier-one porphyry systems like Los Pelambres and El Espino.

Los Pelambres, run by Antofagasta, is one of Chile’s biggest copper mines, with reserves topping 5.8 billion tonnes at 0.53% copper. Just 8km from FMR’s ground is El Espino, a copper-gold project backed by Resource Capital Funds, with 230 million tonnes at 0.59% copper equivalent.

But it’s not just postcode appeal that makes Llahuin interesting.

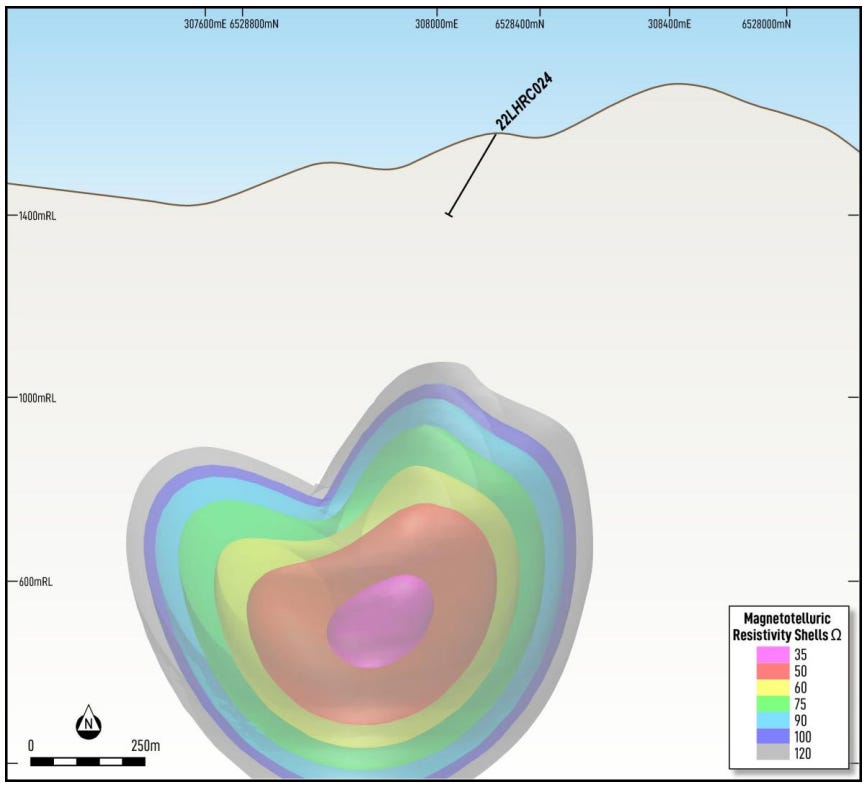

FMR’s southern porphyry target - the focus of its upcoming drill campaign - spans a 1.5km by 1.5km footprint and lights up across multiple datasets. The main target has never been drilled at depth.

Previous drill holes intercepted copper but didn’t get anywhere near the main porphyry target. FMR is set to drill this target shortly in October 2025.

The historic holes hit shallow copper, including 164m at 0.16% copper equivalent and 2m at 1.45% near the bottom of earlier holes. All strong indicators that something larger sits below.

Werner’s backed plenty of discoveries in his time. His decision to get involved here suggests he sees the same early ingredients - prime location, potential for scale, and a system that’s barely been scratched.

The Team Behind the Drill Bit

FMR has assembled a board that punches well above its weight class. The technical depth, corporate experience, and combined track record across this team is impressive for a company this size.

Managing director Oliver Kiddie, formerly of Legend Mining, brings serious exploration experience with a clear focus: drill smart, hit the right system, and deliver shareholder value. His incentives are tied to both technical milestones and share price performance.

Joining Kiddie is Bill Oliver, the non-executive technical director who helped develop the current Llahuin model and brings decades of hands-on exploration experience.

Chairman Patrick Burke adds depth across legal and capital markets, with a track record of taking juniors from drill holes to buyouts.

In the background are the major backers: legendary prospector Mark Creasy and Inyati Capital, who together anchor the register and provide strategic firepower that few juniors can match.

Now with Werner in the mix, FMR has a team that knows how to spot opportunity and act on it.

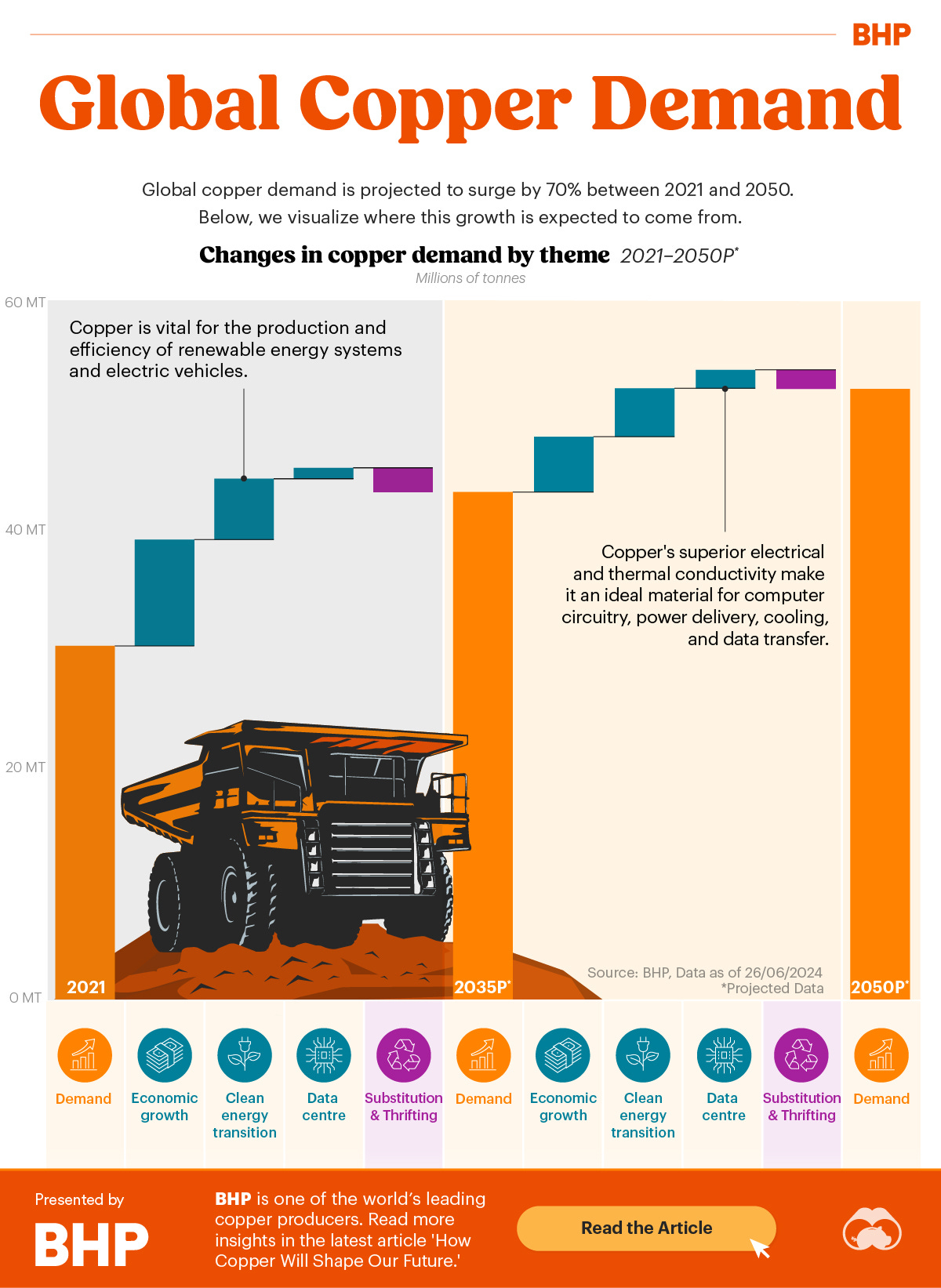

Why Copper’s Having a Moment

The world needs more copper. A lot more. Electric cars need it, data centres need it, wind farms need it. The problem is, copper discoveries have basically stopped.

The easy deposits are gone. What’s left is harder to find, harder to mine, and costs more to develop. All while demand keeps climbing.

Chile produces about a quarter of the world’s copper. FMR sits right in the middle of that, with all the infrastructure and mining expertise that comes with it.

Werner’s background in building billion-dollar operations will be invaluable, not just in recognising scale but in navigating capital markets and strategic partnerships.

His skillset complements the rest of the board. It gives FMR a level of operational maturity and investor credibility well beyond its current market capitalisation.

The Stars are Aligning for FMR

FMR sits in an unusual and enviable position for a small-cap ASX copper company. They have a serious target in Chile’s copper heartland with experienced management to execute on it. The funding is in place, and now Werner brings operational expertise that most small caps can only dream of.

Werner’s appointment caps a solid positioning phase. FMR secured the Llahuin project and has built the right team for what comes next in a tier-one jurisdiction..

Exploration always carries risk, but FMR has stacked the deck in its favour. If they hit something meaningful in October, this 36c story could get very interesting very quickly.