Weekly Wrap: $300B Merger Dead, Trump's $17B War Chest, and Our First Pick of 2026

The mining world nearly got its biggest merger ever. Then it didn't. Plus: US mineral reserve, Fortuna delivers, and our new pick drops midweek

After last week’s commodity chaos we figured things might calm down a bit. They didn’t.

An interest rate rise, the ASX 200 dropping over 1%, mining CEOs being wined and dined at the White House, mixed drill results from two of our portfolio companies, gold doing its usual dip-and-bounce, and a US$300 billion mega merger falling apart. That’s a lot for one week.

What caught our eye:

Our first investment of 2026 drops this week

Fortuna gets good news on two fronts

The US government backs copper in the DRC

Trump launches a US$17 billion critical minerals reserve

Bubalus hits gold at Avon Plains, but grades disappoint. MD buys on-market

Rio Tinto and Glencore merger collapses on valuation

Andina Copper hits big in Colombia

Argentina signs a critical minerals deal with the US

Our First Investment of 2026 is Coming This Week

For those who are new here, every year we put our own money into a handful of small-caps that meet our criteria. It’s been built over years of doing this, and the bar is high.

The small-cap space has been running hot, and we reckon this one has the setup to run with it or the year ahead. Without giving too much away:

A very low valuation

Multi-bag potential

Exploring for the right commodities in a tier-one location

Tight capital structure with a healthy bank balance

We’ll be announcing it around midweek, so keep your eyes on your inbox. This is one that could re-rate fast on good news.

Fortuna Metals Continues to Deliver

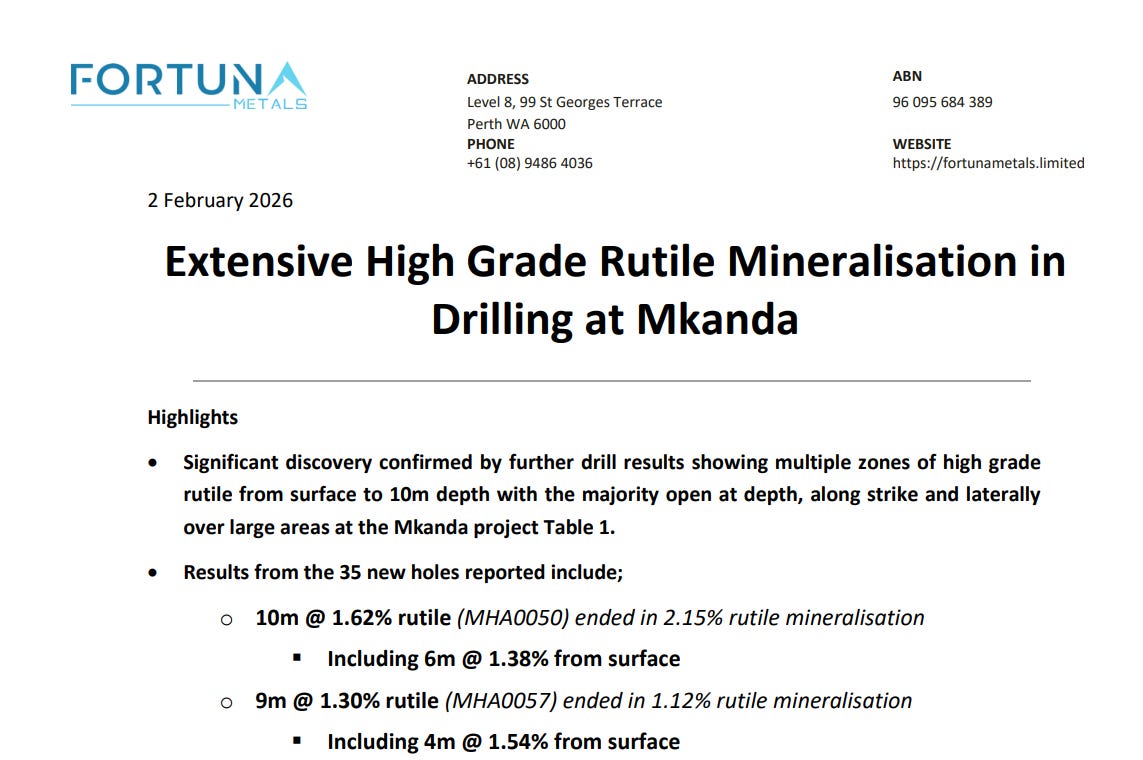

Two pieces of good news for rutile explorer Fortuna Metals (ASX: FUN) this week, and both matter.

First, drilling at Mkanda in Malawi keeps hitting shallow, high-grade rutile. Multiple intercepts ran from surface through to 10 metres, with grades up to 10 metres at 1.62% rutile.

Just over 10kg of rutile goes into each humanoid robot. If Musk's prediction lands and robots soon outnumber humans, rutile demand is going to explode.

A lot of the reported holes ended in mineralisation and remain open at depth, which tells you the system hasn’t been fully tested yet. The grades stack up well against, against Sovereign Metals (ASX: SVM) which is worth more than 17 times FUN’s valuation.

Second, the Malawian Government formally confirmed that its raw mineral export ban does not apply to Fortuna’s Mkanda project. That letter greatly reduces the sovereign risk overhang that triggered last year’s panic sell-off.

Fortuna always planned to beneficiate and upgrade material in-country, which was compliant with the regulations anyway, but having it confirmed in writing takes the uncertainty off the table.

With more than 600 drill holes still to be reported and aircore drilling planned to test depth, the story is progressing at a rapid pace. Management is at the 121 conference this week, which tends to put companies in front of the right eyes at the right time.

Glencore’s US-Backed Copper Deal in the DRC

Glencore is one of the world's biggest copper producers, and this week it signed a non-binding deal to sell a 40% stake in two of its DRC operations to the Orion Critical Minerals Consortium, a group backed by the US government.

The whole thing is about supply security. The US needs copper for everything from power grids to military hardware, and rather than hoping the market sorts itself out, Washington is backing a consortium to go and lock it in directly. Orion buying into Glencore's Mutanda and Kamoto assets, two of the largest copper-cobalt operations on the planet, is a bold move to to do so.

The implied enterprise value across both assets sits around US$9 billion, which gives you a sense of how seriously the US is taking this.

Glencore keeps operational control. Orion gets board seats and exposure to production that most countries would love access to.

For the DRC, landing US-backed capital at this scale is a big deal for a country that’s been working hard to clean up its mining sector.

And for anyone watching the copper space, it’s clear quality copper assets are scarce and governments are willing to pay up to secure them.

Trump’s US Critical Minerals Reserve

Trump launched "Project Vault" this week, basically a US$17 billion war chest to stockpile critical minerals and stop relying on China for them.

Funding comes from US$1.7 billion in private capital and a US$10 billion loan from the US Export-Import Bank - the biggest deal the bank has ever done.

The reserve will target copper, rare earths, gallium, germanium and cobalt, with buying starting this year and access rights stretching out over the next decade.

The US wants guaranteed access to the metals that underpin its defence and electrification ambitions. That requires actual metal sitting in reserve

For juniors, a government-backed buyer with deep pockets makes the funding picture a lot friendlier. It makes higher-risk exploration more attractive and can speed up development timelines, especially for projects in the US or friendly jurisdictions.

When governments start buying at this scale, capital tends to flow down to the smaller end of the market pretty quickly. We like it a lot.

Bubalus Hits Gold But it’s Not Enough

Our portfolio company Bubalus Resources (ASX: BUS) put the first drill holes into Avon Plains, a historic gold mine in the Victorian goldfields, and the grades came back light. The share price copped it. That’s the small-cap space in a nutshell when results come in below expectations.

The program confirmed a gold-bearing system tied to quartz reefs, but grades topped out at 1.26 g/t gold and were generally modest across the 15 RC holes, despite most of them intersecting quartz veining.

Enough to say the geology is there, but not enough to get investors excited about a near-term re-rate. The focus now shifts to Wilson’s Hill, where historical drilling has returned up to 8 metres at 23.83 g/t gold. A very different story to Avon Plains.

Managing Director Brendan Borg stepped in on-market late last week and bought 200,000 shares with his own money. Directors buying after disappointing results tends to tell you something about where they think the value sits.

The selling wasn’t us either, we’re holding every BUS share and will wait for next steps. With a market cap around $7 million and roughly $3 million in cash, BUS is well-funded.

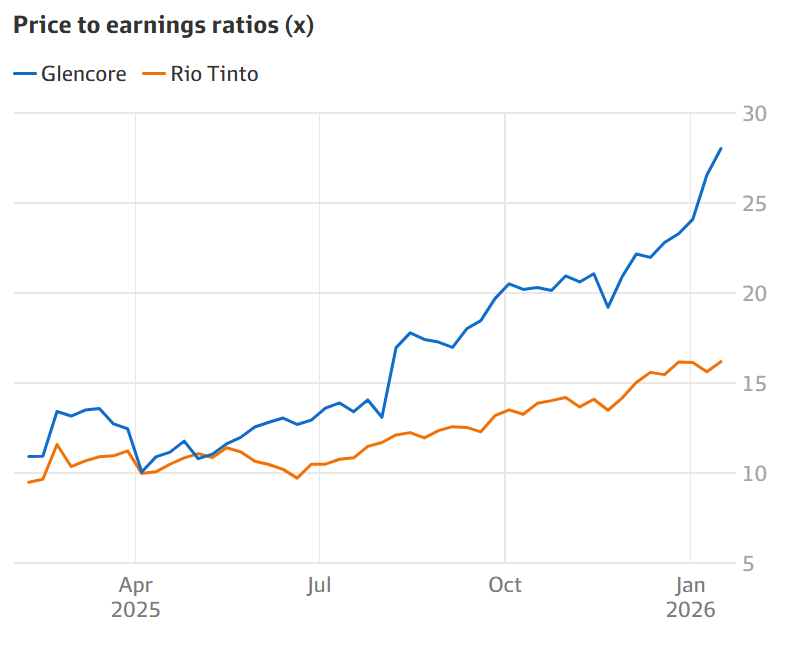

Rio Tinto and Glencore Merger Falls Apart

The big boys couldn’t get the deal done this week as the Rio-Glencore merger talks fell over, and it came down to valuation.

Rio Tinto is the world's biggest iron ore miner. Glencore is one of the largest copper producers and commodity traders on the planet.

At the time discussions peaked, the combined group was being framed as a US$300-350 billion mining giant, which would have made it the largest diversified miner in the world.

Rio came in with a market cap around US$180-190 billion, roughly double Glencore’s US$90-100 billion. Rio wanted any deal to reflect those relative values, pinning negotiations to a January valuation point before speculation drove Glencore’s share price higher.

Under that framework, Glencore shareholders would have ended up with around 32-33% of the merged entity. Glencore thought that undervalued its copper growth pipeline and trading business, and pushed for closer to 40%. That gap couldn’t be bridged.

Both companies were circling the same problem: future copper supply is tight and discovery rates are falling while the cost of building new mines keeps climbing.

Rio's cash cow is iron ore, but China is already buying less Aussie ore. Copper is where the growth is, and Rio wanted Glencore's Latin American pipeline badly enough to stomach its coal assets, debt and regulatory baggage.

For Rio, a deal would have fast-tracked its copper exposure while iron ore still dominates cash flow.

For Glencore, merging with Rio would have simplified a story that’s historically traded at a discount because of its complexity, coal exposure and jurisdictional risk.

In the end, Rio wasn’t willing to dilute shareholders or absorb assets it didn’t fully value at this point in the cycle. The fact the talks got as far as they did still tells you where the industry is heading, even if this particular deal couldn’t cross the line.

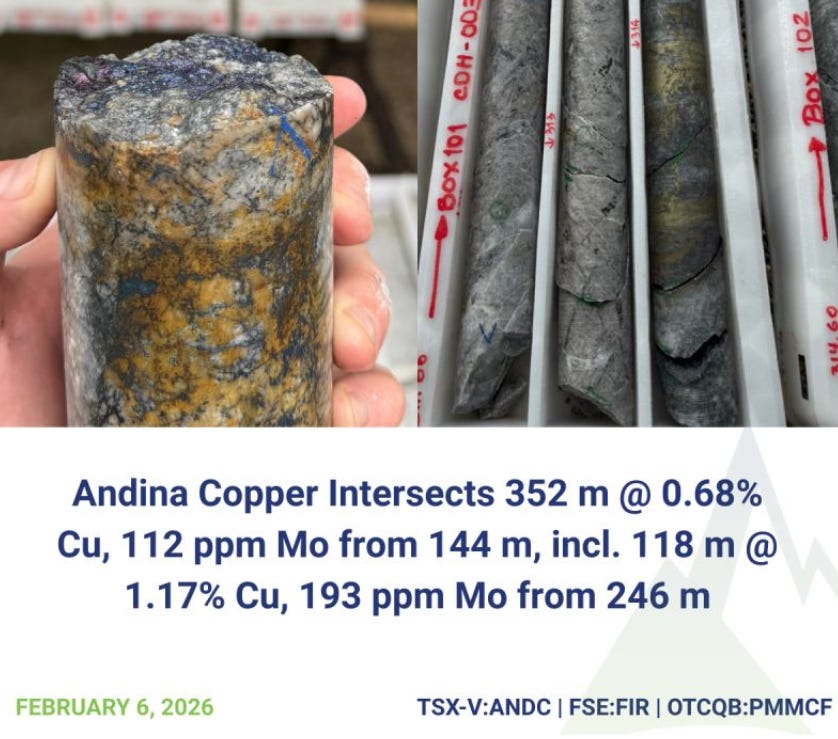

Andina Copper Hits Big at Cobrasco

Canadian listed Andina Copper (TSX-V: ANDC) reported one of the best globally reported copper interecepts in recent months at their Cobrasco asset in Colombia this week.

352 metres at 0.68% copper, including 118 metres at 1.17% copper. For an early-stage porphyry, those numbers are rare, and they build on historical wide intercepts that show continuity from surface to depth.

Those are the widths and grades that get big miners picking up the phone. Rio Tinto is next door, and we'd be surprised if they weren't paying attention.

We first covered Andina Copper with Geólogo Trader 🇦🇺 Jordan Webster (link below) when it was Pampa Metals just over a year ago. Back then the stock was trading around 15 cents. Today it sits at 94 cents , which shows how far the story has come since.

Drilling continues at Cobrasco with assays pending from step-out holes designed to push the mineralised footprint wider and deeper.

Multiple rigs are turning and there’s a clear plan in front of them, which is all you can really ask for at this stage. Quality copper discoveries are getting harder to find, and Andina has one that keeps delivering.

We'll be checking in with Jordan in the coming weeks. Give his Substack a follow a follow if you want to track Cobrasco as it develops.

Argentina and the US Sign a Critical Minerals Deal

Argentina and the US signed a trade and investment agreement covering copper, lithium and silver this week. It keeps building on the momentum we’ve been watching since Milei threw open the doors to mining investment.

We've covered Argentina's mining story in detail before, and this deal adds another layer to it. US-backed capital can now flow into Argentine mining projects across the full chain, from exploration through to processing and export, and the US gets a more reliable supply of metals it's scrambling to lock in.

Argentina has spent the last couple of years trying to convince the world it's serious about mining. The pitch seems to be landing. Access to US development finance and export credit support lowers funding risk and should help projects move through development faster.

Exploration in Argentina is ramping up with urgency as prospective geology is now becoming unlocked to small-cap players.

As capital gets more comfortable with Argentina, interest tends to flow into the broader region too. For early-stage companies trying to fund drilling in a tightening metals market, clearer policy alignment between major economies is a tailwind.

The Wrap

Big week. Rate rise, merger collapse, drill results, policy shifts, and half the mining industry meeting at the White House.

The portfolio saw both sides of the ledger. Fortuna cleared a major risk and kept delivering on the drill front. Bubalus didn’t get the grades investors wanted, but the MD put his own money in. We’re sticking with both.

On the macro side, the US is putting real dollars behind critical minerals, copper assets are being fought over at billion-dollar valuations, and Argentina just opened the door wider for mining investment. The backdrop for small-cap explorers with the right commodities in the right places keeps getting stronger.

Our first new pick of 2026 drops midweek. We’ve spent serious time looking over this one and we reckon it fits the current market well. Keep an eye on your inbox.

Till next week.