Weekly Wrap: BlackRock Goes Small, DroneShield Goes South, and Lithium Goes Up

BlackRock's buying Aussie small-caps, DroneShield holders cop more hits, and Gina's dumping lithium for rare earths

It was another rough week for equities, with the ASX 200 dropping a little over 2% and closing at its weakest level since early June as market fears started to bite.

Uncertainty around US interest rates, softer job numbers and a cooler market read on Nvidia’s earnings all combined, wiping more than $40 billion from the ASX.

While the big end of town bled red, a few stories emerged that suggest small-caps might be setting up for something interesting.

What caught our eye:

A US$13 trillion asset manager is backing ASX small-caps

Fortuna Metals releases world-class results

Bubalus provides an exploration update as a high-grade gold mine awaits

DroneShield’s fortnight from hell continues

Investment banks turn bullish on lithium (again)

Australia’s richest person dumps lithium for rare earths

Gold steadied above US$4,000/oz as many see it going higher in 2026

Race Oncology drops 17% on... good news?

Wood Mackenzie says copper demand’s about to get wild

EU ready to write cheques for Aussie critical minerals

Our portfolio pick of the year is getting close

BlackRock Backs ASX Small-Caps

BlackRock controls about US$13.5 trillion for pension funds, governments and institutions. When they adjust allocations, it usually means they’ve spotted something worth chasing.

This time they’re buying into our favourite corner of the market - Aussie small-caps. BlackRock has started loading up on the Small Ordinaries index fund, which is basically a basket of smaller ASX companies wrapped into one product.

Their logic is that large caps are expensive relative to earnings, while the big names on the index have stalled and people are finally getting optimistic about Aussie stocks again.

They’re onto something, too. The ASX 200 has barely moved this year, while the Small Ords are up more than 16%, which usually marks a period where money is rotating toward early-cycle growth.

BlackRock is adding small-caps across all their model portfolios, from conservative to growth, which suggests they’re positioning for a proper recovery.

It backs what we’ve been saying, that the next meaningful move is likely to come from outside the large-cap comfort zone, and it’s good to see the smart money is on-board.

Fortuna Delivers World-Class Results

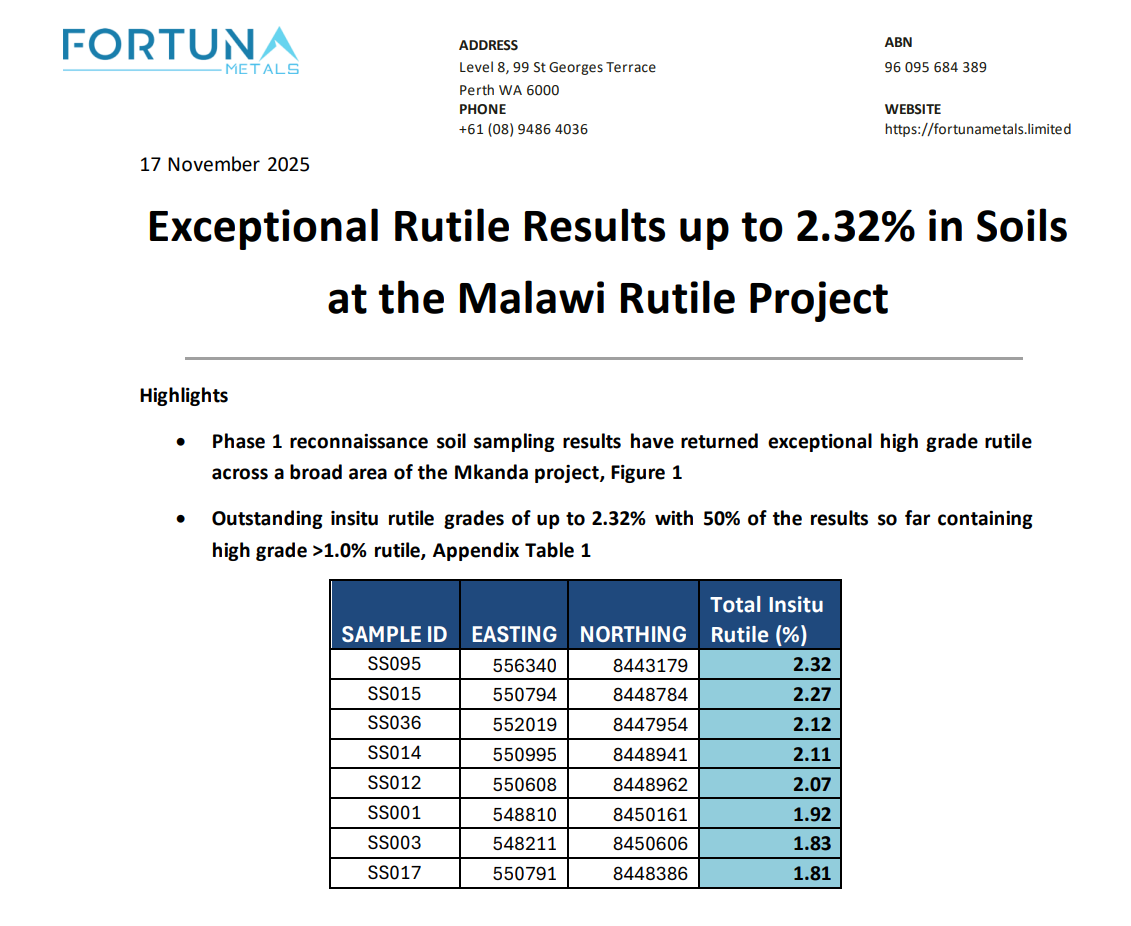

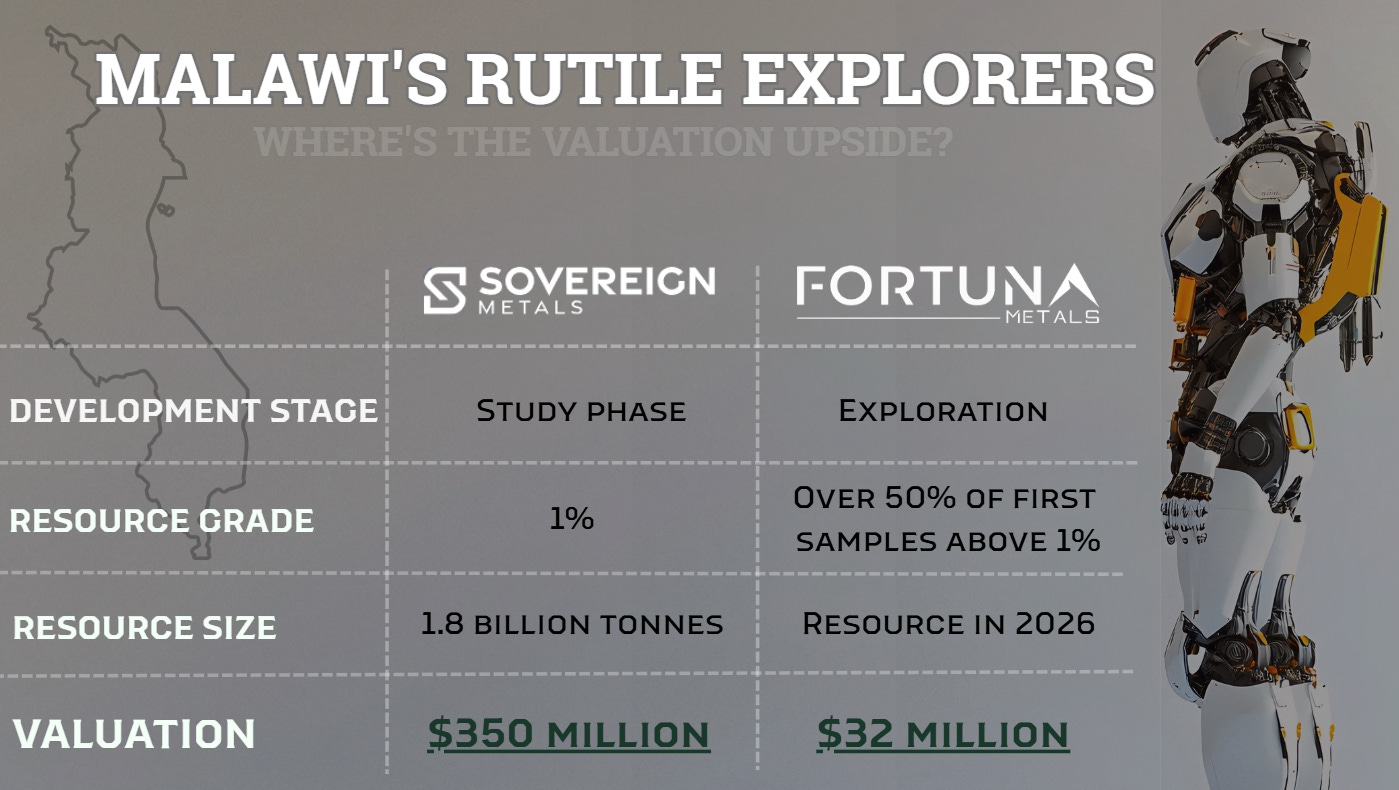

Fortuna Metals (ASX:FUN), the rutile explorer we’ve backed in our portfolio, delivered a set of results this week that put them in rare company.

The latest soils at their Mkanda target in Malawi returned insitu rutile up to 2.32%, with half of all samples above 1%, which is incredibly high for first-pass work.

FUN has already expanded the field team and kicked off hand-auger drilling on 400 x 800 metre grids. First assays are due mid-December and will run into early 2026.

Rutile is the main natural feedstock for titanium metal, which is quietly becoming the structural backbone of humanoid robots because it’s light, incredibly strong and doesn’t fatigue like steel. If Elon’s Optimus robot army and his many challengers scale humanoid production as expected, rutile demand goes through the roof.

FUN sits right next door to Sovereign Metals’ (ASX: SVM) Kasiya deposit, the world’s largest rutile resource. SVM has a resource at a 1% grading, and early indications show that FUN may be able to match this, or even beat it.

Yet FUN trades at just 10% of SVM’s valuation, despite controlling 658 square kilometres of ground on the same geological trend.

The grades are showing up across wide areas, not isolated pockets, which suggests real scale underneath. If auger and later aircore work confirm the trend, FUN may be setting the foundation for a globally significant rutile discovery in Malawi.

Bubalus Shifts Focus to Untouched Victorian Reef

Bubalus Resources (ASX: BUS) put out a strong update this week, and everyone’s eyes are now on Avon Plains, the historic high-grade reef that hasn’t seen a drill bit in more than 125 years.

The company has confirmed the drill rig and maiden 1,200 metre program is locked in for early December, to test whether this old Victorian gold system goes deeper than the pick-and-shovel boys ever reached.

Early miners at Avon Plains were pulling out serious grades with hand tools back in the day, including 12-15 grams per tonne across multiple working areas and pockets reported up to 90 grams per tonne.

Groundwater at roughly twenty metres forced them to pack up in the 1890s, long before anyone could drill beneath the reef. So the geology never failed, only the technology did.

That is what makes the upcoming program so important, nobody has ever drilled below those workings. The first few holes will tell the market very quickly whether the system continues at depth.

A discovery here would completely change the scale of BUS at its current valuation, and is why it’s one of the companies we added to our portfolio.

Meanwhile, Crosbie North and South samples are at the lab, and Wilson’s Hill is lined up for next year with historical hits like eight metres at 23.8 g/t from the old Western Mining work.

For now, Avon Plains is the one to watch. It’s rare to see a high-grade reef untouched for more than a century finally get tested. We’ll know soon enough if the grades continue at depth.

DroneShield’s Horror Show

DroneShield (ASX: DRO) just lived through the kind of week that tests even the most loyal holders, finishing 27% lower after a cascade of bad headlines fed straight into investor fear.

It started with The AFR revealing the company’s core jamming tech is struggling to keep up with rapidly evolving battlefield tactics, particularly as Russian and Ukrainian forces shift to lower-tech solutions that bypass jamming altogether.

The AFR’s source said some soldiers in Ukraine now prefer shotguns to DRO’s signature weapon, which didn’t paint a great picture for the tech.

That would’ve been bad enough, given DRO’s entire value rests on staying ahead of the curve. Then the governance troubles hit.

The AFR reported that CEO Oleg Vornik, chairman Peter James and director Jethro Marks offloaded nearly $70 million worth of stock as the company was dealing with a retracted ASX announcement, a trading halt, and a corrected release soon after. Vornik reportedly sold $1.8 million worth during the two hours when the market wrongly thought they’d landed a new US contract.

The timing poured petrol on a raging fire, wiping about $1 billion from the market cap.

Vornik then cancelled speaking events, leaving the market to fill the vacuum with its own assumptions. Bell Potter also abruptly cancelled an investor call that had been scheduled to shore up confidence.

The AFR’s deep-dive into the saga also painted the company in a poor light. There was questions over whether the tech still matches modern combat conditions, details on hedge funds building short positions, and a growing list of governance and accounting red flags.

US CEO Matt McCrann also abruptly quit after three years during the week, sending shares down another 20% on Wednesday.

A flagship CEO going missing, tech under fire, insiders selling during a messy announcement sequence, and battlefield realities shifting fast is a lot to process in a couple of weeks for holders.

Of course, the chaos began last week, when the three directors dumped the shares they’d just been issued after hitting revenue targets, while shareholders bore the pain.

DRO holders will be hoping the company fronts up quickly, because right now, uncertainty is doing all the talking, and the share price is paying the price.

Lithium Shows Signs of Life

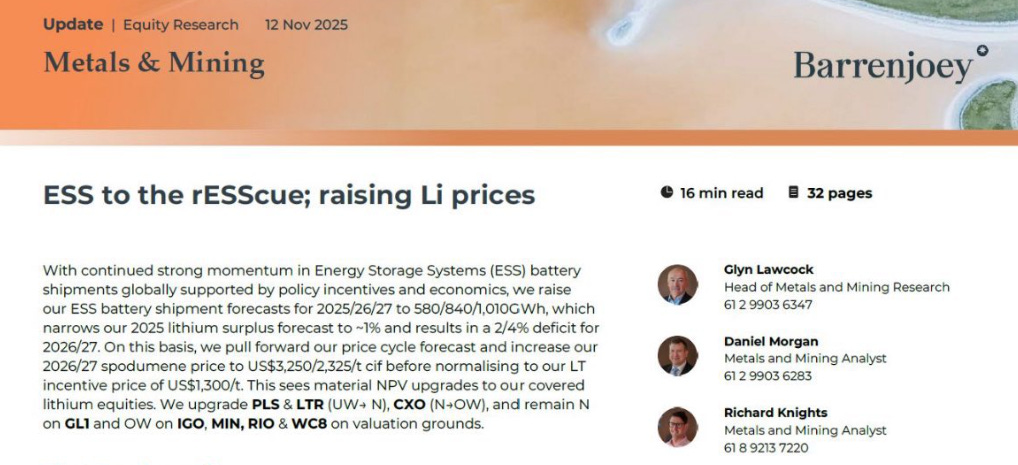

We flagged last week that there were whiffs of a turnaround in lithium sentiment.

Pilbara Minerals (ASX: PLS) climbed to its highest level in eighteen months this week, tripling its share price since early June, and the pace of the move has forced the market to rethink what is really happening in the lithium market.

Some of the early lift came from short covering, which is when funds that have bet against a stock are forced to buy it back as the price rises.

But a rally of this size rarely comes from short covering alone.

This week, the focus turned to fresh commentary out of China. Ganfeng, one of the largest lithium producers globally and a major supplier to battery makers, set the tone when chairman Li Liangbin suggested lithium carbonate prices could rocket in 2026.

The AFR floated a figure of AUD$43,000 a tonne for lithium carbonate this week, though that’s more currency conversion theatre than actual pricing since carbonate trades in US dollars. But it still got everyone’s attention.

The real action came from the banks, with Barrenjoey lifting its 2026 spodumene forecast to US$3,250/t, about triple today’s prices. Bullish indeed.

Citi, JPMorgan and Morgan Stanley all followed suit as China’s EV sales hit new highs, adding more fuel to the recovery story.

Gina Goes Against the Grain on Lithium

While everyone else is warming back up to lithium, Australia’s richest person Gina Rinehart is heading for the exits.

Recent US filings show Rinehart has cut her holding in lithium major SQM by roughly a third and either trimmed or exited positions in Albemarle, Lithium Americas and Lithium Argentina during a period when prices were close to doubling.

Her position in Aussie producer Liontown (ASX: LTR) also got diluted after she passed on their recent capital raise.

Where the money has gone is just as telling. Rinehart has been building her stake in US-listed MP Materials, where she’s now a substantial shareholder, plus she already owns a chunk of Australia’s Arafura (ASX: ARU).

The shift says Rinehart believes rare earths offer better odds, especially with the United States throwing money and support at anyone who can break China’s stranglehold.

It creates a neat contrast for us all to follow over the coming 12 months. Lithium is finding its feet again and sentiment is finally improving, yet one of Australia’s most influential resource investors is steering her capital into a very different future.

The bets are placed. Let’s see who’s right.

Gold Holding Firm, Banks See Higher

The gold price held firm this week above US$4,000 an ounce, and the mood across the major banks suggests the next leg higher is still ahead of us.

UBS just pushed their 2026 mid-year target to US$4,500/oz, lifting its previous view on the back of continued central-bank buying and a softer outlook for US monetary policy.

Goldman Sachs went even bigger with US$4,900/oz by the end of 2026, banking on reserve banks staying hungry and investors piling in once the US Federal Reserve likely cuts rates.

Despite the bull run, gold hasn’t given much back, usually a sign buyers are treating every dip as an opportunity to buy more.

If these forecasts land anywhere close and miners keep their costs under control, the next eighteen months could be properly profitable. And for explorers, any sniff of gold will likely see their share price rocket.

Race Drops Despite Strong Update

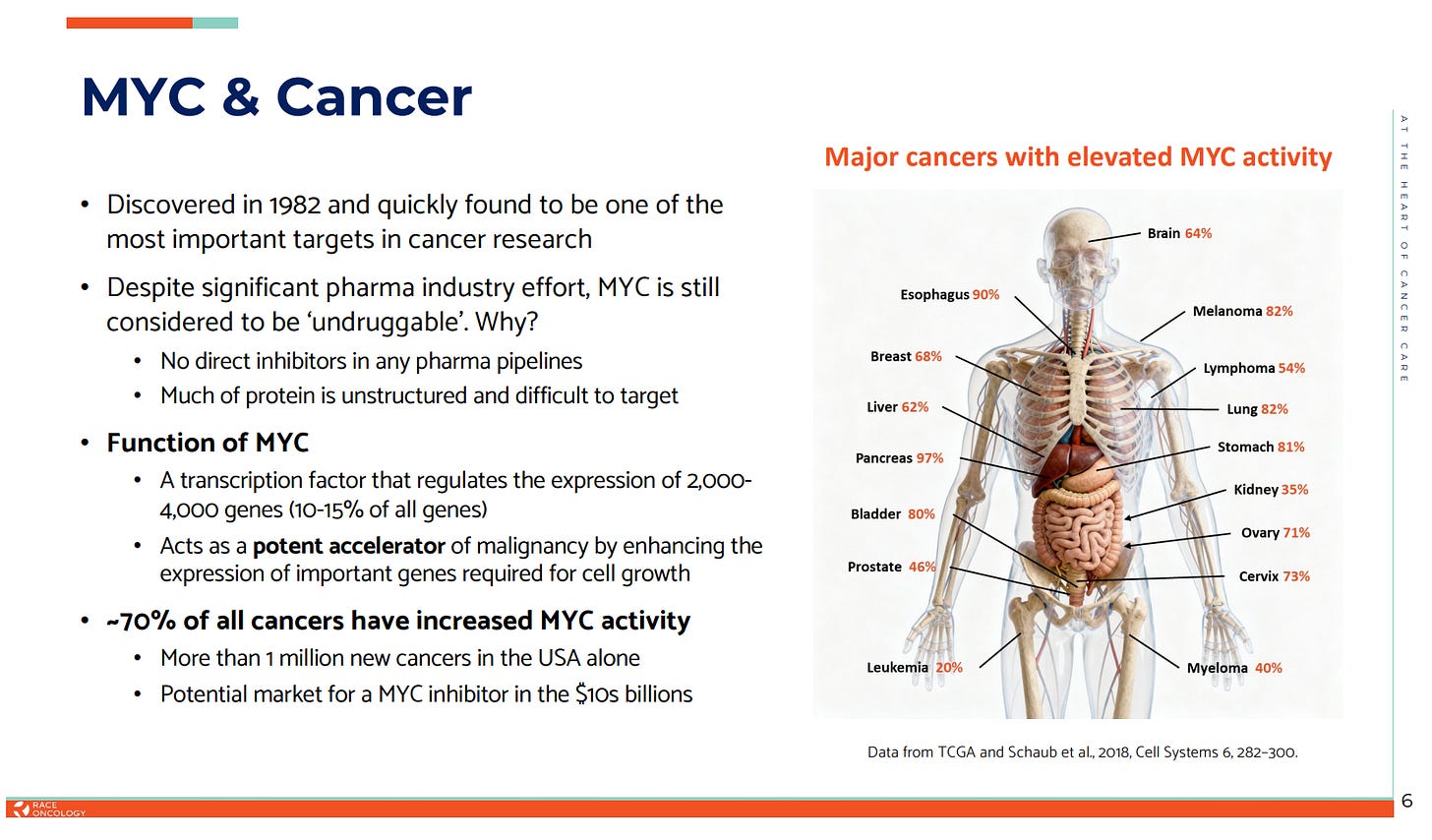

Race Oncology (ASX: RAC) finished the week down 17%, which didn’t make much sense given what they actually announced, and looked more like traders spooked by timelines than anything wrong with the fundamentals.

Race laid out a clearer path for RC220, its bisantrene-based cancer drug, and the program looks stronger than the share price suggests.

RC220 started life as an older chemotherapy, but the newer work around its ability to switch off MYC, a major driver of cancer growth and treatment resistance, puts it in a far more interesting category than most early-stage assets.

The standout move in the update was the launch of a new clinical program in EGFR-mutant non-small-cell lung cancer, a large cancer segment that needs better treatment options.

Trial design is now done, the ethics submission has been lodged and clinical sites across the country are ready, with principal investigators already locked in.

The market wobbled on the bigger picture, though. Two major programs mean more to fund, timelines stretch into 2026 and the company needs option conversions to help keep the lights on.

Short-term traders hate that stuff, even when the underlying story is improving.

For holders, the update pushes Race firmly into its next phase of growth.

Despite the sell-off, they’re well positioned for what comes next, and if they hit their milestones, the next twelve months could look very different from today’s share price.

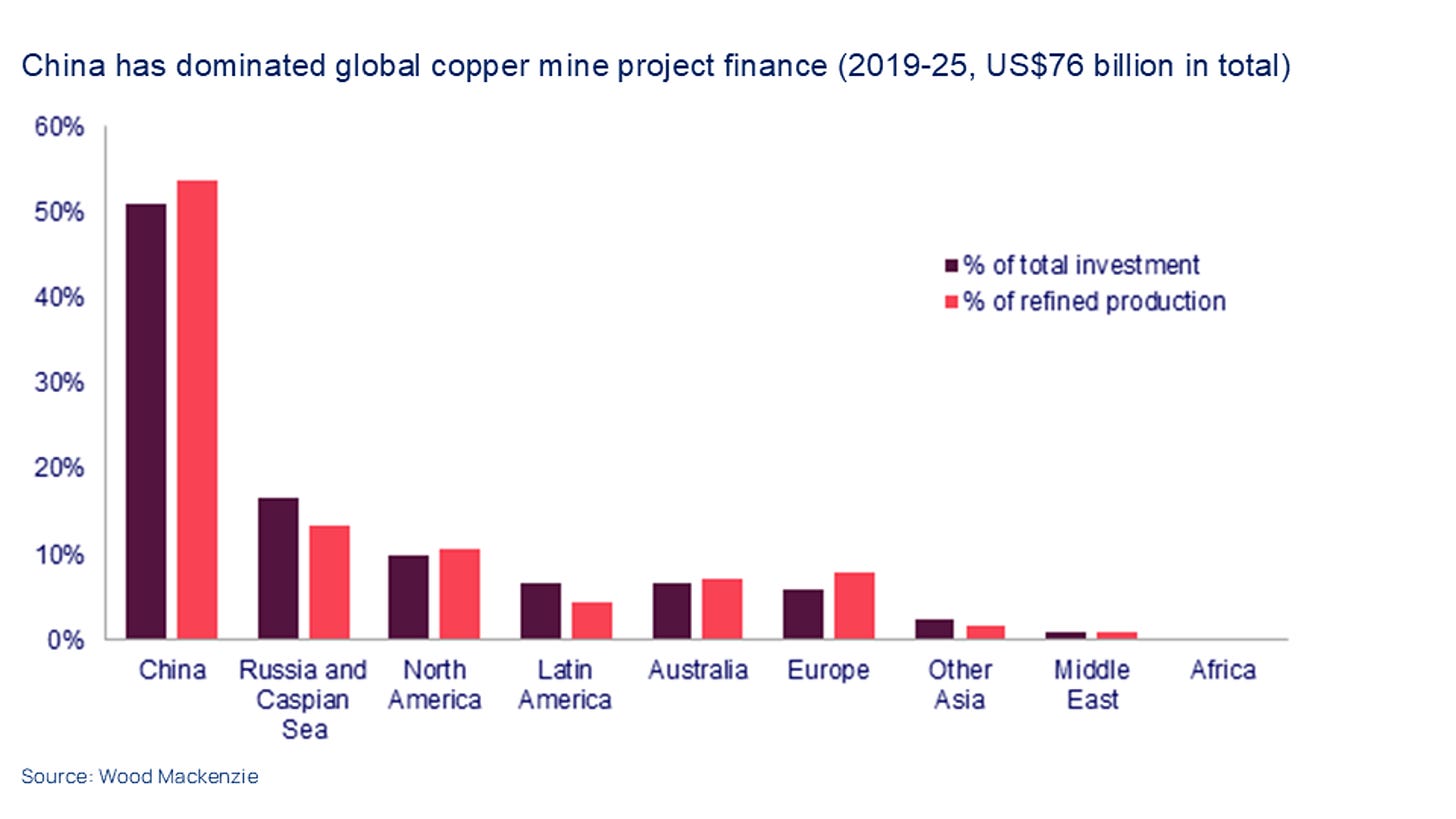

Copper Demand Steps up Again

Copper demand got another boost this week with new research that’s hard to ignore.

Wood Mackenzie, one of the world’s most respected commodity and energy research firms and a long-time adviser to governments, major miners and institutional investors, laid out why demand is showing no signs of easing.

Their latest outlook points to four major drivers all accelerating at once:

Data centres needing copper like there’s no tomorrow

Power grids getting the biggest upgrade in decades

Defence spending going through the roof

EVs and solar still ramping hard

WoodMac believes global copper demand will jump almost a quarter by 2035, led primarily by Asia and emerging markets, while new supply continues to lag.

Production constraints remain and seem to only be getting worse, exploration pipelines are jammed, discoveries are rare, and global demand keeps climbing. The longer that gap stays open, the stronger the upward pressure on prices.

Our portfolio company FMR Resources (ASX:FMR), should be drilling through the target zone of their Chilean copper play any day now. If they hit something big, FMR’s share price could take off.

EU Ready to Back Aussie Critical Minerals Projects

The European Union made a pretty big call this week, signalling it’s ready to put money into Australian lithium and rare earths projects.

EU Trade Commissioner Maroš Šefčovič told reporters in Melbourne that Europe needs long-term security for the minerals that power everything from EVs to defence and semiconductors, and relying on a single dominant supplier (China) is no longer an option.

This could be the kick The Australian sector has been waiting for. The EU wants transparent, well-run projects with strong ESG credentials, which is right in Australia’s wheelhouse.

European capital landing here could speed things up for rare earths developers and give junior explorers a funding partner that thinks long-term.

It’s risk reduction across the board and puts Australian critical minerals in a stronger position than they’ve been in years. With funding from the US and now the EU, there’s never been more money chasing Aussie critical minerals.

Our Pick Of The Year is Getting Close

We’re not ready to pull the curtain back just yet, but the next addition to the Equities Club portfolio is getting very close.

Our portfolio companies are our own investments. We only back a small number of names each year that we believe have genuine multi-bag potential.

This is our third pick, and our pick of the year. Our two picks this year are already up 200% and 100%, and we believe this company has the potential to beat them both.

More next week.