Weekly Wrap: Chaos, Commodities and Capital Raisings

A single post from Trump sends markets reeling while gold and silver hit all-time highs

What a good week to be backing commodities.

That was the lead we wrote Friday night, just hours before Trump hit send on a Truth Social post and sent markets into chaos.

In the 24 hours before that post, China expanded its rare earth export bans and gold and silver hit all-time highs. Then Trump reignited the trade war, crypto collapsed, equities sold off, and markets went haywire into the weekend.

Geopolitics appears to be the new reporting season.

It capped a week where copper broke through US$11,000, a uranium stock went flying, and rare earths dominated headlines. Capital started flowing back into small caps too, with a string of raisings showing risk appetite and enthusiasm is returning.

Here’s what caught our eye:

China’s rare earth restrictions increase ahead of (off again, on again) Trump-Xi talks.

Fortuna Metals confirms high-grade titanium mineralisation in Malawi.

Gold cracks $4,000 for the first time ever.

Silver hits an all-time high.

Copper trades through US$11,000 as supply tightens and demand strengthens.

Asian Battery Metals advances drilling across multiple targets in Mongolia.

Natural hydrogen gains market momentum.

Uranium catches attention as one stock finishes 250% up.

But first, WTF just happened…

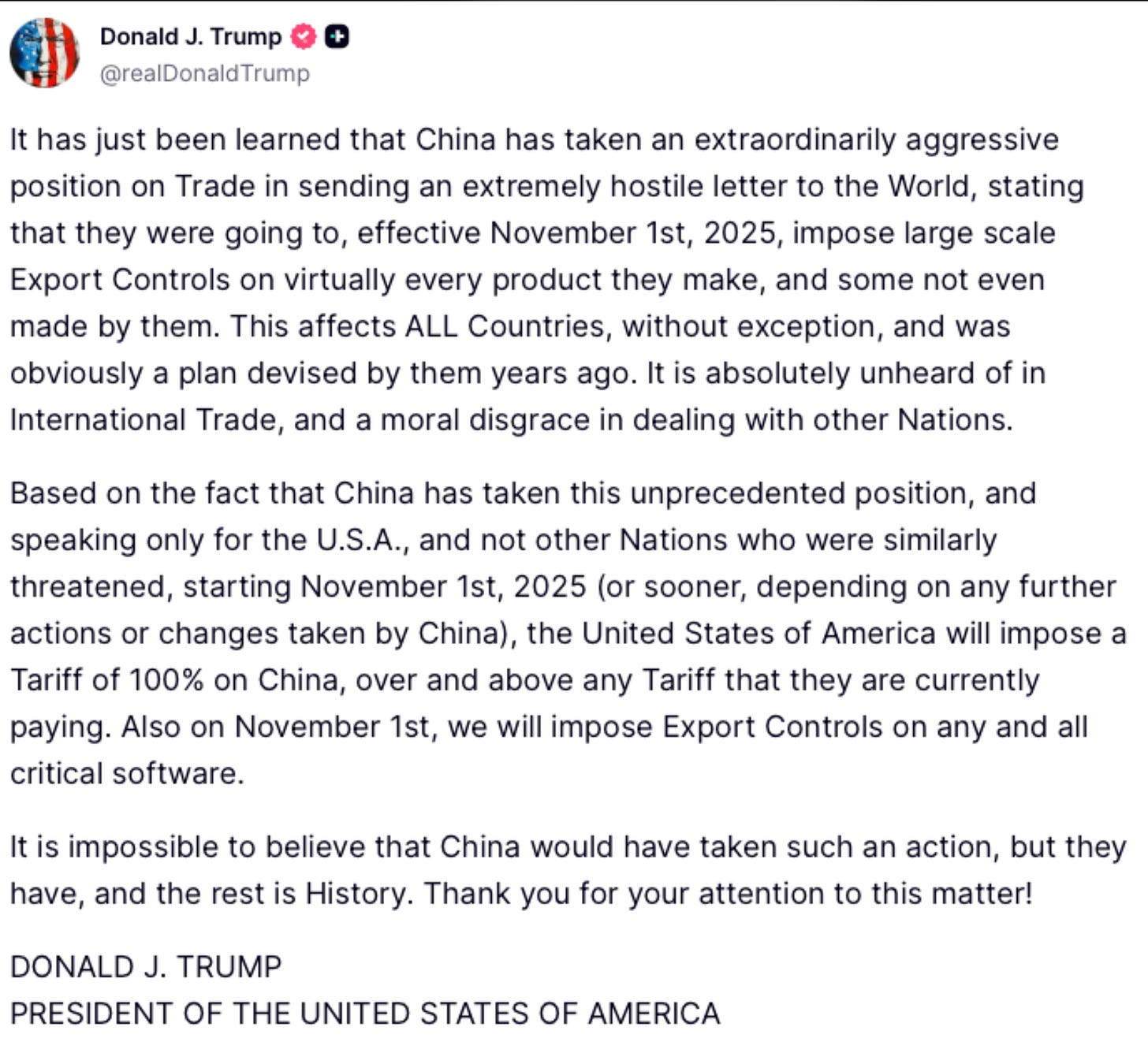

Trump Nukes Markets, China Doubles Down

Trump went nuclear on China early Saturday morning, threatening a 100% tariff hike on all Chinese imports from November (“or sooner”) and slapping export controls on critical software heading to Beijing.

The trigger was China’s expanded rare earth export restrictions, which Beijing justified as national security measures, but everyone else read as leverage ahead of trade talks.

Trump took it personally and accused China of trying to hold the world “captive” over rare earths and said there was “no reason” to meet with Xi Jinping at next month’s APEC summit.

A few hours later, Trump half-walked it back - “I don’t know that we’re going to have it, but I’m going to be there regardless.”

Regardless, markets cratered and crypto imploded, while gold and silver held their ground.

China’s our biggest trading partner so the stakes are high, anything that rattles its trading relationships filters straight through the ASX.

Trump’s now either winding up for a bigger deal or doing what he does best - throwing a grenade, then following up with diplomacy talks in 280 characters or less.

Either way, every X or Truth Social post can shift the ground beneath us, so this could either be sorted by tomorrow or drag on for months.

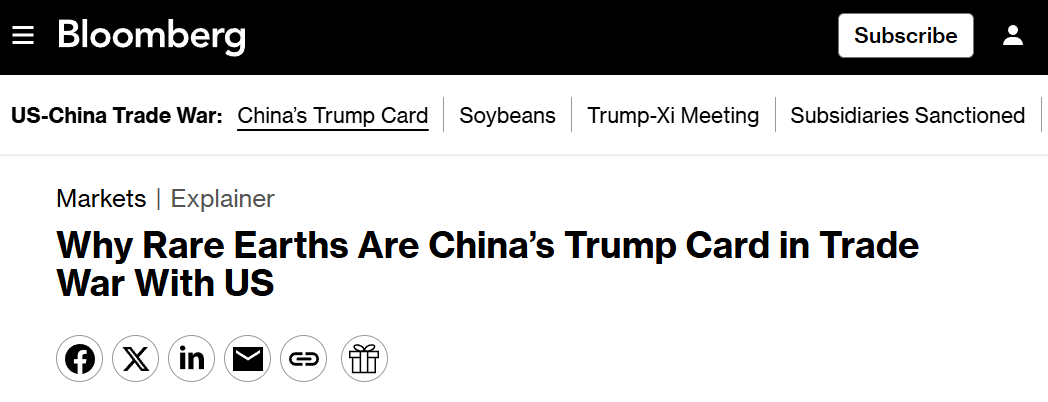

China tightens the rare earth tap

So what did China do to set Trump off?

While he may have orchestrated a historic deal in the Middle East, Trump is still at war with Beijing when it comes to rare earths, as China expanded its export restrictions on rare earths.

China added dozens of refining technologies to the restricted list and tightened the rules around who can buy what. With trade talks looming, Beijing basically reminded everyone who controls the tap.

Roughly 90% of the world’s rare earth refining sits in China, and the message to Washington was obvious: you want to talk about tariffs, fine - but let’s talk about magnets for your missiles and EVs.

Supply risk is rising, which means projects outside China are moving up the pecking order for capital, offtakes and policy support.

Short term, that means tighter availability and price volatility, while medium term, it means deposits that can feed magnet metals outside China (particularly those with a path to local processing) start getting re-rated.

ASX names in NdPr and heavy rare earths usually benefit because customers start diversifying supply and governments lean in with grants and tax credits.

The explorers and developers with real metallurgy, progress on permitting and partners in the wings are worth looking for, because every tonne produced outside China just got a whole lot more valuable.

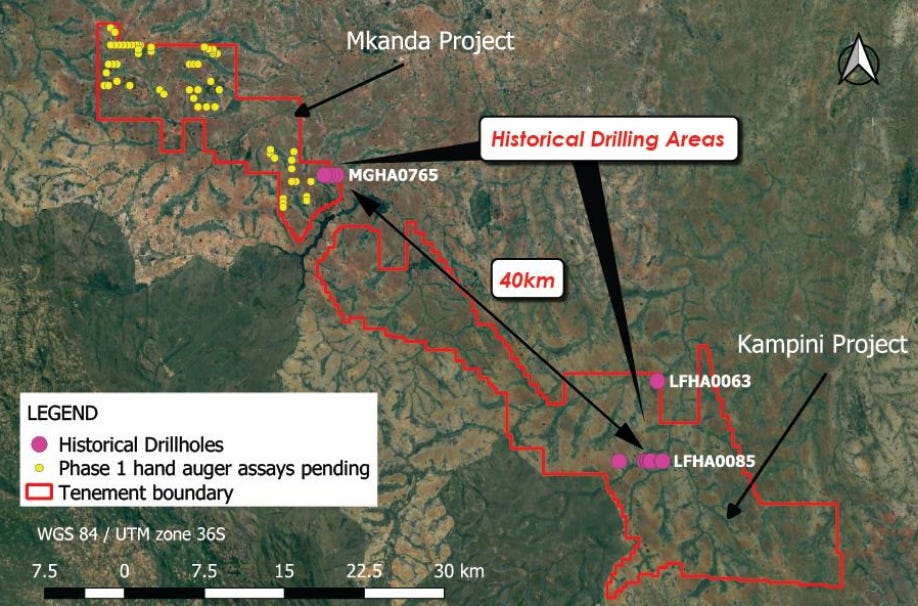

Fortuna Metals confirms mineralised system

This week, Fortuna Metals’ (ASX: FUN) desktop review unearthed 19 historical hand-auger holes at Mkanda and Kampini in Malawi that carry significant titanium.

Several holes reported above 2% TiO₂ from surface to end-of-hole, which is the right geometry at first pass and suggests scale to chase. Some of these holes were 40km apart, which means FUN could be sitting on something properly large.

The ground sits along strike in the same Lilongwe Plain weathered rocks that hosts Sovereign Metals (ASX: SVM), Rio-Tinto backed, Kasiya rutile resource at 1%, so the comparative results for FUN shown below are incredibly impressive:

10m @ 1.35% TiO₂ (MGHA0737)

7m @ 2.19% TiO₂ (LFHA0063)

8m @ 1.46% TiO₂ (LFHA0071)

7m @ 2.14% TiO₂ (LFHA0079)

8m @ 1.60% TiO₂ (LFHA0080)

7m @ 1.85% TiO₂ (LFHA0081)

7m @ 1.77% TiO₂ (LFHA0082)

8m @ 1.57% TiO₂ (LFHA0085)

Those results sit well above SVM’s 1% JORC resource to the north. SVM’s valued at $450 million, while FUN’s sitting at $30 million.

First assays from work on the ground are expected in November, and if they come in anywhere near these historical results, that valuation gap could close fast. We added FUN to our portfolio last month for exactly this reason.

Gold clears US$4,000 per ounce, why the set-up still reads bullish

This week was the first time in history that gold cracked the elusive US$4,000/oz.

When your sister-in-law asks you over dinner if she should buy gold, it’s a sharp reminder that the momentum gold’s had over the past two years brings retail investors back into the market. It also gets producers leaning into growth plans (look out, small-caps) and turns explorers with near-term news into momentum plays.

It’s been a straight climb built on central bank buying, geopolitical hedging and a stubborn inflation pulse, seeing the price double in 24 months.

Pullbacks will happen because they always do after records, but the follow-through tends to be higher lows as investment flows catch up.

For small-cap investors, keep your eyes peeled for any gold discovery in the market, even a sniff of something good at these prices will likely bring serious investment inflow.

Our gold investment is Bubalus Resources (ASX: BUS), which is drilling right now in the Victorian Goldfields. BUS released an investor presentation this week, it can be found here.

Silver breaks US$50/oz for the first time since 1980

Gold wasn’t the only metal hitting records this week, with silver cracking through US$51/oz.

Silver’s up 125% in the past two years, outpacing gold’s 100% run, yet it still flies under the radar for many investors.

The industrial demand from the energy transition positions silver as more than just a precious metal, helping support any dips in pricing that may come its way.

The leverage for small-cap investors lies in quality silver producers that can leverage the price gain, and explorers currently drilling who can quickly spike in value.

Quality silver producers can leverage this price move hard, and explorers with drills turning right now can see their valuations spike on any decent result.

Copper breaks through US$11,000 per tonne, eyes turn to discoveries

Copper pushed back above US$11,000 a tonne this week on the back of supply hiccups and a softer dollar, but the move says more about tight availability in the short-term than roaring demand.

Expect things to settle somewhere in the mid to high US$10,000s in the short term. Longer term though, the deficit story keeps building and should increase the price significantly in the coming years.

Given there are very few large new copper discoveries being made, grades at existing producers are slipping, and mine disruptions keep rolling through from strikes to permitting delays, the balance of power tends to tilt toward producers already delivering reliable tonnes and explorers going after big discoveries.

AZ9 and its big exploration campaign

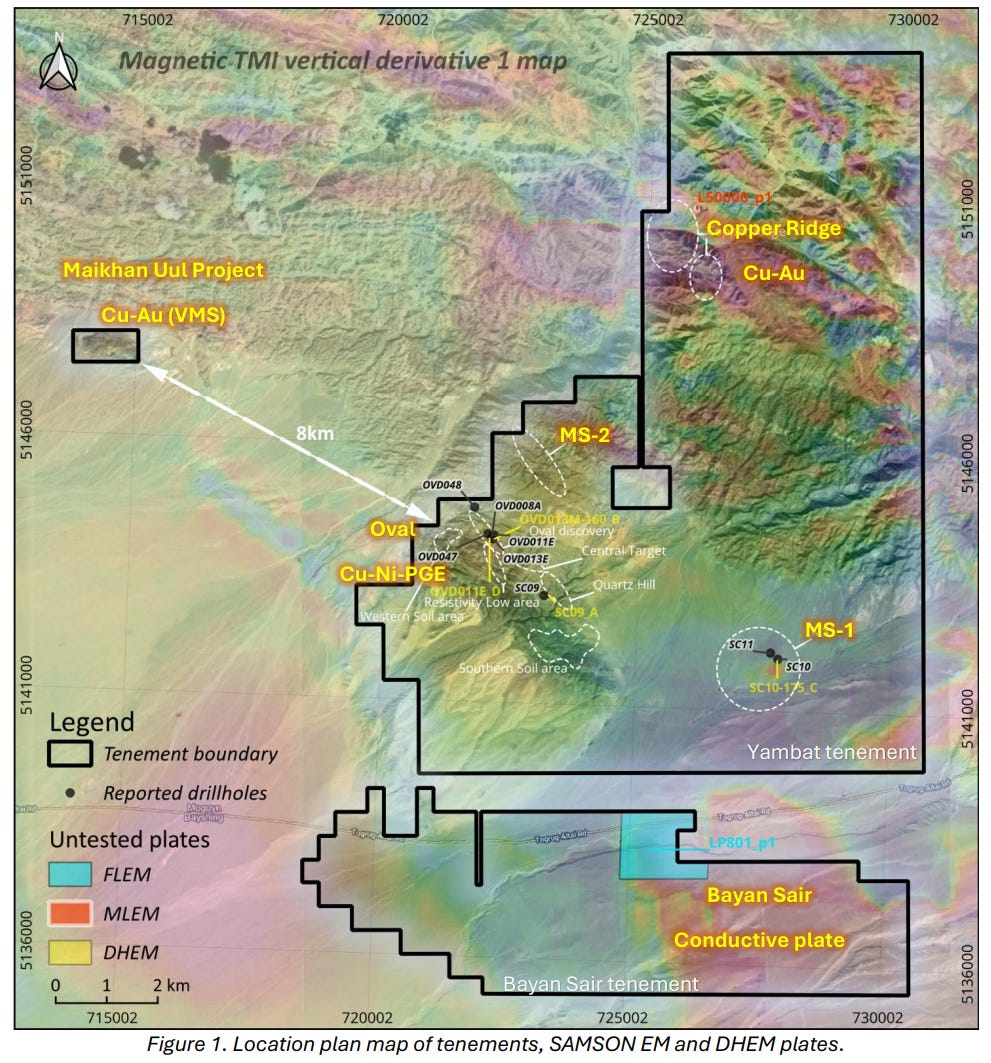

Which brings us to our copper play, Asian Battery Metals (ASX: AZ9).

The company dropped a meaty update this week covering the multiple projects they have on the go in Mongolia at the moment.

The announcement can be found here, but for those wanting a summary of all the work that management is currently undertaking (it’s rather impressive), here’s where things sit:

Oval: Drilling is ongoing and they have hit the mineralised zone. A strong electrical conductor sits below. Next up is testing that target and stepping out along the trend. Assays are pending.

North Oval: Recent drilling brought the zone closer to surface and showed it continues. Next up is more step-outs and assays.

Bayan Sair: A new geophysical plate has been mapped. First-pass drilling is the next step.

Copper Ridge: Another strong conductor has been defined. First-pass drilling to test it comes next.

MS1 (Yambat): Two deeper holes are in. Assays will guide the follow-up plan.

Quartz Hill: One hole completed. Assays will decide what comes next.

Maikhan Uul (VMS): Due-diligence drilling continues alongside the Oval work. Results will shape the forward program, drilling expected.

That’s seven targets being worked at once, which gives them plenty of shots on goal. The team’s been busy, to say the least, and we expect to see them push through to the end of the year.

Natural hydrogen’s getting serious

Momentum in natural hydrogen is building, with the sector index jumping 13% last week to 15,356, now within 435 points of its record.

The news flow is no doubt helping the price action with:

The Bill Gates-backed Koloma picking up the Philippines’ first upstream natural hydrogen exploration licences.

HyTerra (ASX: HYT) reporting flowing hydrogen and helium in Kansas with a production test pencilled for 2026.

Max Power lining up Canada’s first natural hydrogen well in Saskatchewan.

Put it all together and you have a story that is spreading across three continents, moving from concept into execution, and building the project pipeline that institutions like to see.

If sector indices and hydrogen ETFs keep firm, the next phase is simple because capital tends to follow activity, better names can fund next wells, and genuine discoveries will start to command valuations.

Our investment, Top End Energy (ASX: TEE), sits next door to HyTerra in Kansas and has its data room open as they look for a drilling partner. Maiden wells are pencilled for early 2026, and with HyTerra proving up flowing gas right next door, TEE’s technical case keeps getting stronger.

TEE also holds a major Beetaloo Basin gas position, which we covered in detail last week after Tamboran’s US$172 million Falcon acquisition set a valuation benchmark across the basin.

Uranium lights up with 250% mover

Uranium stole the show this week as Infini Resources (ASX: I88) delivered an eye-catching exploration update at Portland Creek, and the share price finished the week about 250% up.

The drill core shows obvious uranium, and the on-site handheld readings were strong, with full lab assays due this quarter to put hard numbers around it.

The broader uranium sector’s been picking up steam too, renowned investor Sprott put out a write-up this week calling out policy tailwinds and improving fundamentals, saying the market looks like it has its stride back.

Stronger pricing and a tighter physical market are drawing capital back into uranium, while a visible pipeline of drilling and development is giving the sector clear catalysts to trade against, which is why good news is travelling fast and being rewarded.

Drills turning, Trump posting

All eyes have now turned to Trump and Xi, and we’ll be keen observers on how that plays out over the coming days and months (and the rest of Trump’s whole term, to be honest).

The noise around trade wars and tariffs will dominate headlines for a while, but underneath all that chaos, the commodity story keeps building.

The increased flow of capital into markets has shown that when markets turn, they really do rip higher, and we are clearly seeing this at the moment.

The geopolitical backdrop might stay messy for months, but that can be when the best opportunities show up. While everyone’s watching Trump’s next Truth Social post, the drills keep turning and the results keep coming.

We’re watching closely.

Till next week.