Weekly Wrap: Creasy Backs FMR, BUS Surges, Gold Hits High

Record gold, BUS bonanza, Creasy backing copper - momentum’s back in ASX small-caps

Gold smashed through fresh record highs this week and suddenly the small-cap market feels different. There's an energy that's been missing all year.

Money is moving. Mark Creasy's writing cheques, institutions are back at the table, and the combination of record commodity prices and actual capital flowing means the next few months should get interesting.

This week:

FMR Resources locks in $3.4m with Creasy cornerstoning as Chilean copper drilling nears.

Bubalus Resources brings bonanza-grade historical hits at Wilson's Hill back into the spotlight as stock price surges.

Gold surges past $3,600 as investment banks start throwing around $5,000 targets.

MAGA - Make Argentina Great Again as mining resurgence continues

FMR Resources Raises $3.4m for Chile copper drilling

$3.4 million in three hours.

FMR Resources (ASX: FMR) closed their placement this week with Mark Creasy, major shareholders and institutions piling in. When a legendary prospector like Creasy backs your copper story ahead of the drill bit, it turns heads.

The share price hit fresh highs at 49.5c this week, up nearly 300% since we first flagged it to readers, with drilling kicking off within weeks on their 4,000m program at Southern Porphyry in Chile.

For those in need of a quick refresher, the target sits in tier-one copper territory - 1.5 square kilometres that has lit up every geophysical survey and is sitting next to some of the world's biggest copper mines.

Management now has more than $7 million in the bank and a clear run at what could be a significant porphyry system.

FMR's tight turnaround from raise to rigs means newsflow is about to accelerate. With heavyweights like Creasy behind the story, anticipation is building for good reason.

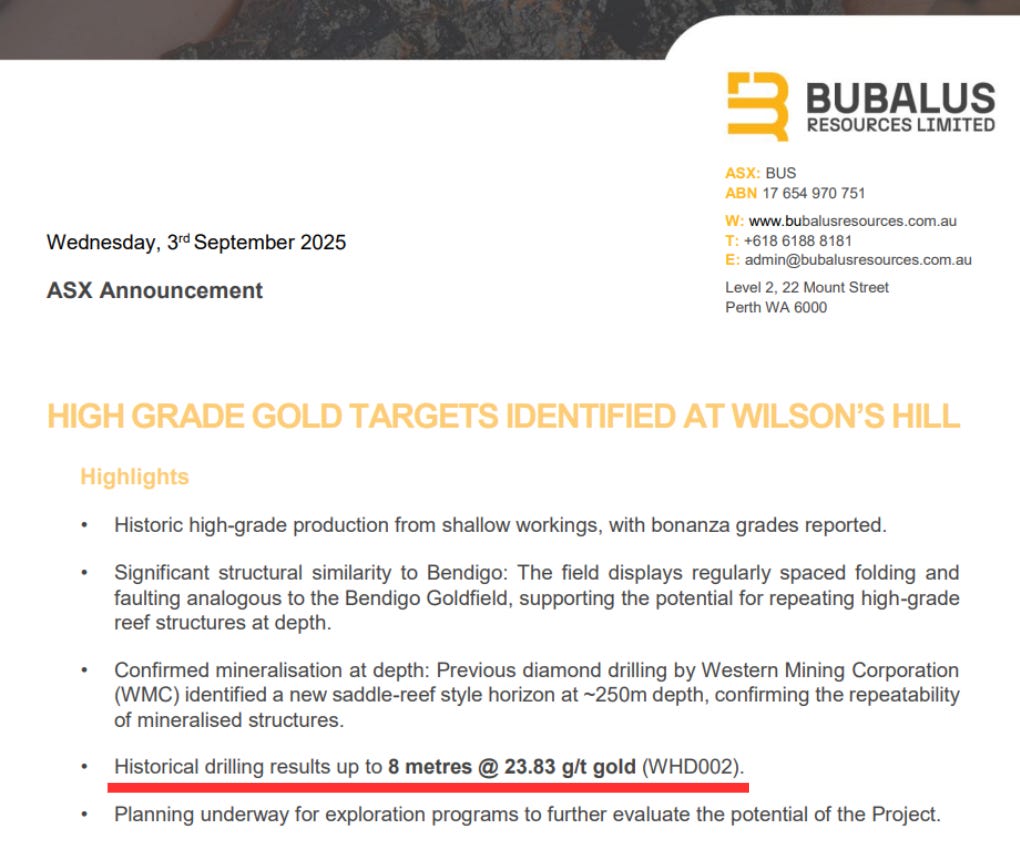

Bubalus Resources Targets Wilson's Hill Bonanza

Bubalus Resources (ASX: BUS) has dragged its Wilson's Hill Gold Project out of 40 years of dormancy and straight into the spotlight.

Historical drill results returned 8m at over 23g/t gold, in the middle of one of Victoria's richest gold belts, surrounded by multi-million-ounce deposits.

The announce sent BUS shares flying - the highest volume day in almost two years, with the stock surging from 11c to 17c intraday before settling at 13.5c.

Digging further back, Wilson's Hill produced 10,450 ounces at 14.8 g/t gold in the 1870s–80s. If it were today, that grade would make it the highest-grade producer in the country.

And Wilson's Hill is only the start. Drilling at Crosbie North kicks off shortly - the same rock package that hosts Fosterville just 20km away. Q4 brings Avon Plains, a mine that hasn’t heard a drill since the early 1900s.

BUS sits on a $7M market cap with cash in the bank and three chances to land something meaningful in the coming months.

Victorian geology + bonanza-grade historicals + gold pushing record highs = A setup as clean as it gets for a junior explorer.

Gold Breaks Records as $5,000 Calls Grow Louder

Gold pushed through $3,600 an ounce this week, setting fresh all-time highs and pouring fuel on junior exploration.

Central banks are hoarding it. Supply’s tightening. And conviction’s building that the next leg of the cycle could run hard.

When Daan Struyven, the co-head of global commodities research at investment bank Goldman Sachs, says gold “could hit US$5,000”, people listen.

Juniors with drill-ready projects are suddenly fielding calls again. Valuations are starting to move across Victoria, WA and Queensland.

Investors are chasing ounces, and any sniff of a high-grade discovery is commanding attention. If gold's heading to $5,000, today's $3,600 discoveries will look cheap in hindsight.

Majors are sitting on depleting reserves with replacement costs going through the roof. They need ounces, and they'll pay for them. Explorers with promising ground and imminent catalysts are looking attractive.

MAGA: Make Argentina Great Again

President Javier Milei's taken a chainsaw to the red tape that's strangled Argentine mining for decades, and the mood’s flipped fast.

This is a country that holds some of the world’s richest copper and lithium systems, yet most of it’s sat idle thanks to flaky policy and decades of underinvestment.

That's over. BHP, Rio Tinto, and Glencore have already committed tens of billions across copper, gold, and lithium projects. And juniors are suddenly in a position to leverage institutional momentum.

The centrepiece is RIGI (Regime of Incentive for Large Investments) - a guarantee of 30 years of tax, customs, and currency stability for projects investing over US$200m. After decades of Argentine governments changing the rules mid-game, this is the stability miners have been waiting for.

If you want the full Argentina playbook, we’ve covered it here.

And if you want it from the ground, follow Jordan Webster - Aussie geologist, head of IR at Andina Copper (CSE: ANDC), based in South America, and writing sharp takes on his Substack here.

The Wrap

Money’s moving again, and it’s more than just gold driving it.

$3,600 an ounce certainly helps, but what's really shifted is sentiment. The same investors who've been sitting on their hands for months are suddenly making moves, while placements are closing quickly.

Sometimes markets just turn. No grand catalyst, no single narrative. One day everyone's scared, next day they're not. We're in one of those windows now where optimism outweighs caution and drill results actually matter again.

The next few months will separate the real from the rhetoric. FMR's drilling copper. BUS has three shots at Victorian gold. Argentina's doors are open.

For those who've been waiting for the market to show signs of life - this is it. These windows where sentiment shifts and capital flows tend to create the best opportunities in small-caps.

As the old line goes: he who hesitates is lost.