Weekly Wrap: Drill Bits Turning, Big Buyers Circling, and Gold Won't Stop

Finals footy, drilling campaigns everywhere, and big money dropped on BUS shares. Plus: India scrambles for rare earths and Milei's Argentina shows cracks

We’re writing this one from Melbourne, fresh from watching the Lions spank the Cats in front of 100k at the ‘G.1

For our readers on the other side of the Barassi Line, we’re tipping a GF rematch between the Storm and Panthers next weekend. But onto our area of expertise…

It was a big week for our portfolio. Announcement after announcement with the small-cap market still ripping. Drilling season is properly underway, and we’re watching our holdings turn drill bits like it’s Christmas morning.

With gold breaking records and copper fundamentals tightening by the day, if you’re not positioned in the right small-caps now, you might be watching from the sidelines when drilling results start landing.

What caught our eye:

FUN kicks off its exploration campaign next to a heavyweight

FMR starts drilling a giant copper target in Chile

AZ9 get some of the best metallurgy results we’ve seen

Investment banks cut copper supply forecast

BUS kicks off drilling at its Fosterville-like target, Crosbie North

Gold keeps running and hits record highs... again

India joins the critical minerals scramble

Argentina sits at the crossroads as Milei’s support wavers

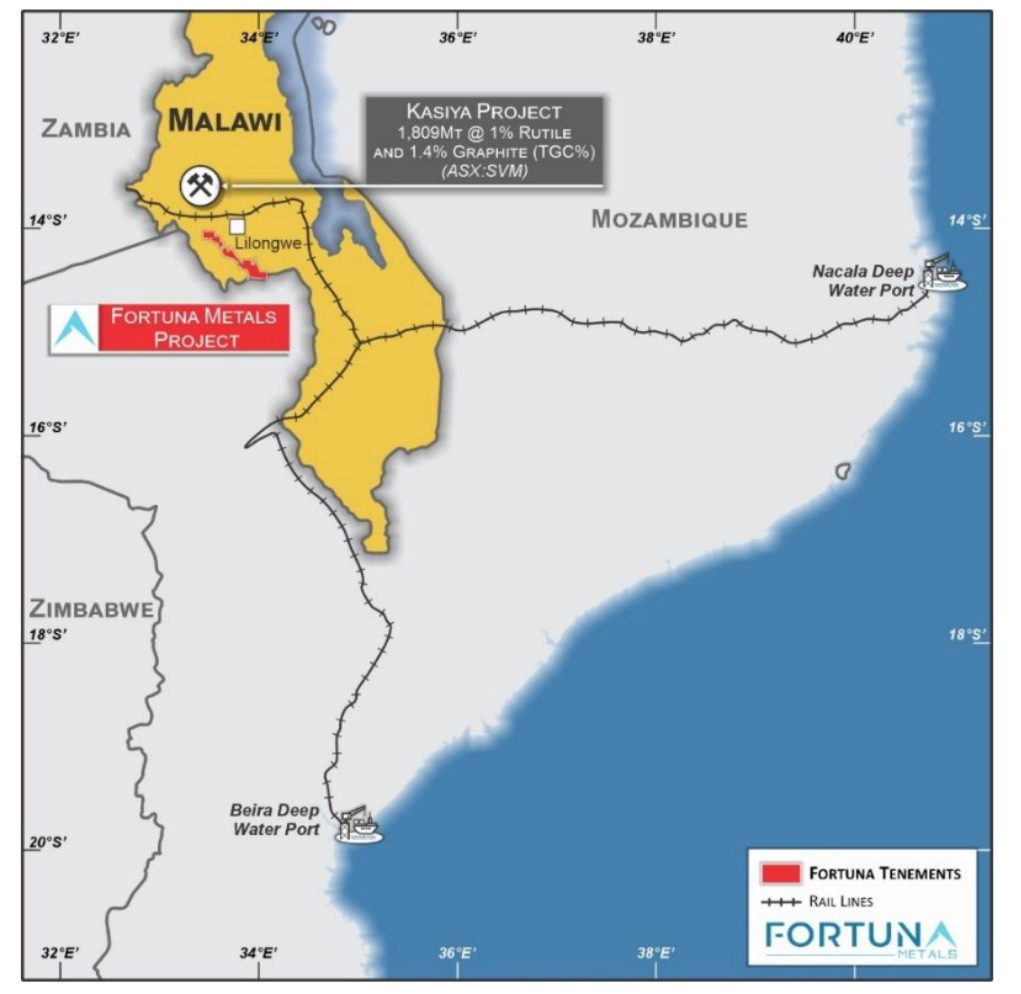

Fortuna Metals: Exploration Begins in Malawi

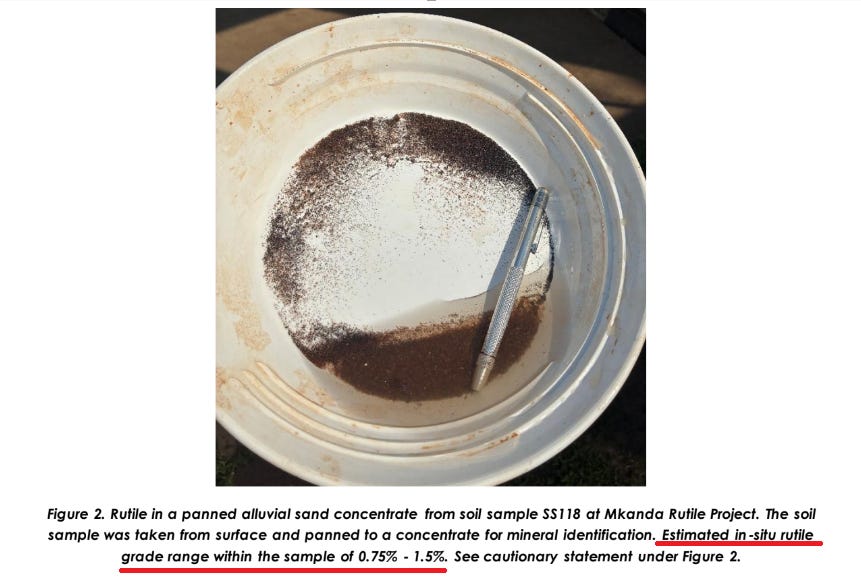

Fortuna Metals (ASX: FUN) has wasted no time pushing forward at its newly acquired ground in Malawi, with both sampling and drilling underway across the Mkanda and Kampini projects.

Early work has confirmed visible rutile, which is promising given Sovereign Metals’ (ASX: SVM) world-class Kasiya rutile deposit is right next door.

FUN now controls 658 square kilometres along strike from SVM. The market values SVM at nearly $600 million while FUN sits at $21 million, despite drilling what looks like the same geological trend in a region growing in status for rutile and graphite.

FUN’s moved quickly since the acquisition, getting boots on the ground and drills turning while rutile stock prices keep climbing.

Even modest hits could reset expectations and bring fresh attention from institutional money.

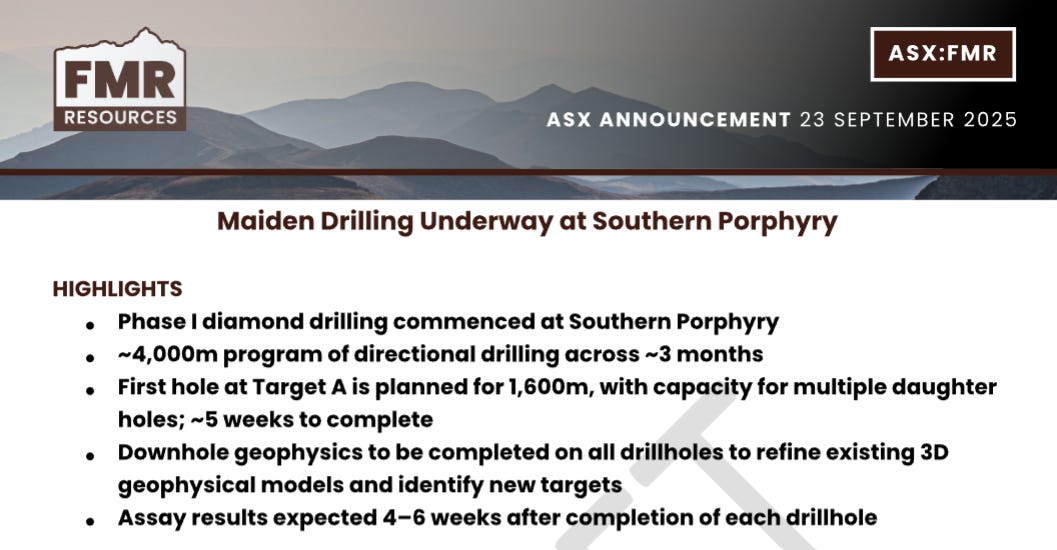

FMR: Drilling Campaign Kicks off in Chile

FMR Resources (ASX: FMR) has begun a 4,000-metre drilling program in Chile, testing a large copper anomaly at depth for the first time.

Previous work identified the porphyry signatures through geophysics and surface mapping, but nobody’s actually drilled deep enough to see what’s down there.

The majors have picked the country clean of the easy finds, leaving juniors to chase new exploration success in the world’s copper powerhouse.

FMR’s drilling ground that’s already shown copper porphyry indicators at surface, which is about as good a starting point as you get.

Success here would transform FMR’s valuation overnight and give a shot in the arm to the junior copper space, which continues to attract attention amid the global push for electrification.

Copper’s sitting at historically strong levels, and the world needs new supply yesterday. It’s hard to imagine a better backdrop for drilling results.

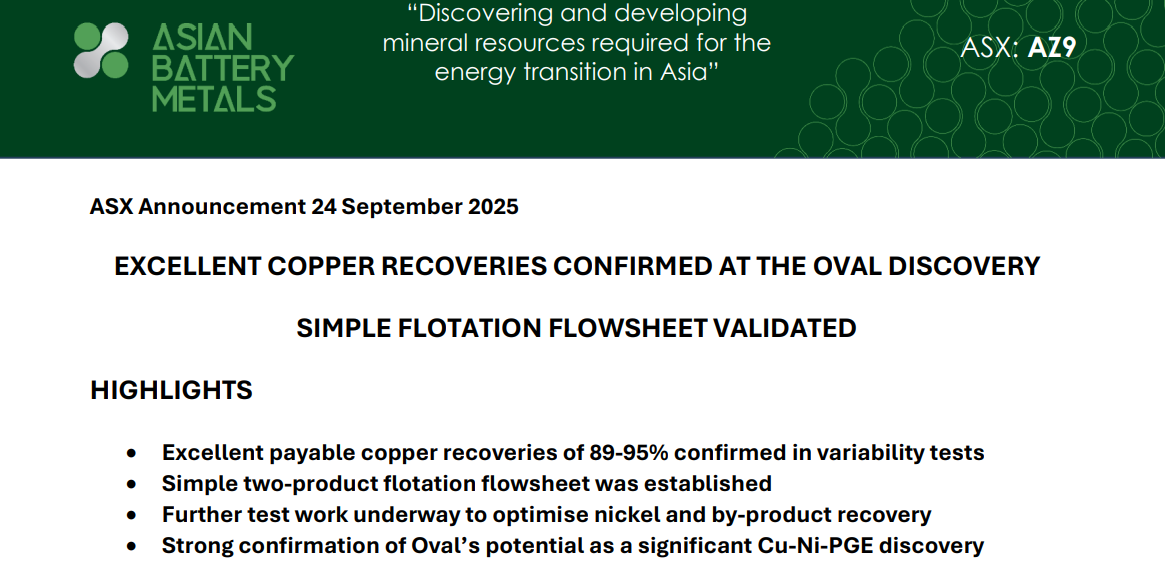

Asian Battery Metals: Strong Metallurgy Backs Discovery

Asian Battery Metals (ASX: AZ9) reported first-pass metallurgical results from its Oval discovery in Mongolia on Thursday, with recoveries exceeding 90% for both copper and nickel.

The market liked it too, up 16% after the results landed.

Metallurgy is often where early-stage projects falter, but these results put AZ9 in rare company and remove a key technical risk.

The company is now running its latest exploration campaign in parallel, following up on high-grade intersections that have already confirmed massive sulphides at depth.

Importantly, the metallurgy aligns AZ9 with some of the world’s top copper-nickel projects in terms of potential recoverability.

The market’s valuing AZ9 at $16 million, which feels light given these recovery rates and the drilling momentum. Good metallurgy this early changes the investment case.

The company’s ticking both boxes now - proving the grades through drilling while showing they can actually get the metal out economically. That de-risks the whole project.

Copper Supply Shock a Positive for Juniors

Goldman Sachs has cut its global copper supply forecast, flagging a widening deficit expected to bite as early as 2025.

Central to the forecast is Indonesia’s Grasberg mine, one of the world’s largest copper operations, which faces declining grades and lower output. Grasberg has long been a pillar of global supply, so any shortfall there magnifies pressure on already tight inventories.

Demand from electrification, AI data centres, and renewable infrastructure keeps intensifying while supply struggles to keep pace.

For juniors like FMR and AZ9, who are both drilling now, any discovery in this market gets amplified.

Exploration success in a tightening market is rewarded disproportionately, and projects showing scale or high grades should be re-rated quickly.

Bubalus Resources: Crosbie North drilling begins

Bubalus Resources (ASX: BUS) has kicked off its maiden drill program at Crosbie North, a gold-antimony project located just 15 kilometres from Agnico Eagle’s world-class Fosterville gold mine.

The 1,000-metre program is designed to test whether Crosbie North shares the same geological hallmarks that made Fosterville one of the most profitable gold operations in the world.

We saw a buyer enter BUS’ top 20 shareholders with a single large buy on Friday afternoon. That’s confidence in this small-cap gold explorer.

With rigs now turning, the focus is on identifying high-grade zones at shallow levels that could quickly establish Crosbie North as a serious Victorian gold prospect.

The location alone makes this an exciting campaign, but what matters is whether assays confirm structural similarities to Fosterville’s orebody.

BUS has more shots lined up across its portfolio after this, but Crosbie North is the immediate catalyst. Any strong hit would be a major coup at a time when gold stocks are already benefiting from record prices.

Gold: Record Highs with Momentum Building

Speaking of gold, the price of gold has surged to fresh record highs above US$3,750 an ounce, with market consensus pointing to further gains.

A combination of factors is driving the rally: expectations of rate cuts in major economies, central bank buying, and persistent geopolitical uncertainty.

China’s stimulus efforts and ongoing demand for safe-haven assets have added fuel to the move, with gold now trading at levels unthinkable just a year ago.

The investment banks have suggested that the momentum remains firmly intact, and many are lifting their forecasts for 2025.

For ASX gold producers and explorers, this environment provides some breathing space in a commodity that for years was sidelined while battery metals took centre stage.

Juniors with active drill programs (like BUS) are well-positioned, as even moderate discoveries become more valuable at these price levels.

The record high underscores why capital continues to flow back into the sector, and why investor appetite for gold equities looks set to remain strong in the months ahead. Now we just hope the drill results play ball.

India Stockpiles While Aussie Miners Head Stateside

India is another now considering setting up a strategic reserve of critical minerals for emergency defence manufacturing, a top defence ministry official said this week.

In April, China squeezed rare earth flows with its export controls. They control 90% of the rare earth magnet market, and the restrictions disrupted everything from EVs to wind turbines.

Beijing’s eased up recently, but the knock-on effects are still being felt with everyone scrambling for alternative supply. The West buys 40,000 tons of rare earth magnets annually while producing less than 2,000 tons - China pumps out over 200,000 tons a year.

Meanwhile, in the wake of the US’ $5 billion critical minerals fund we mentioned last week, our ASX juniors have upped camp to America.

A delegation of Australian critical minerals companies hit Washington and New York this week to meet officials and investors. Australian Strategic Materials (ASX: ASM) is doing due diligence in Oklahoma and South Carolina. Ionic Rare Earths (ASX: IXR) is in advanced talks for Tennessee. International Graphite is looking at both US and European options.

The US has a massive customer base, cheap energy and fat subsidies. Defence contractors need their suppliers close for national security reasons, and the funding on offer makes our government support look like pocket change.

PwC estimated Australia could make $170 billion from critical minerals by 2040, but it’s harder to see that being reached if all our processors set up shop in Alabama instead of Adelaide.

Argentina Gets a Lifeline, but the Drama Continues

Scott Bessent dropped a bombshell on X this week, declaring Argentina “a systemically important US ally” with “all options for stabilisation on the table.” Donald Trump followed up saying they’ll help Argentina get “good debt” to “make Argentina great again.”

The US is talking about a $20 billion swap line and even buying Argentine bonds through the Treasury’s Exchange Stabilisation Fund.

President Milei may need it, his party got crushed in September’s provincial elections, and the October 26 midterms are looming. The peso’s under pressure, some investors are spooked, and he’s burning through reserves trying to keep things stable.

We wrote about Argentina’s mining renaissance back in March when Milei’s reforms had everyone excited. BHP, Rio Tinto, and Glencore poured billions in, and the RIGI investment regime has been a massive success, attracting multi-billion dollar commitments that would’ve been unthinkable two years ago.

Man on the ground, Jordan 🇦🇺 (Geologo Trader), just dropped his latest thoughts from Buenos Aires. Jordan’s an Aussie geologist who’s been living and working in Argentina, giving us the real story beyond the headlines.

His take is that Argentina feels cheap again in dollar terms, and bills aren’t stinging like they did earlier this year. But Milei’s under real pressure. If he holds ground in the midterms, reform keeps rolling. If he stumbles, the old protectionist guard creeps back and who knows where the peso ends up.

Jordan’s still backing his Argentina plays - he’s invested in companies there and thinks it’s still one of the best places for shareholder returns despite the volatility. Check out his full piece here for the unvarnished view from the streets of Buenos Aires.

We’re still bullish on Argentina’s mining potential long-term. The geology doesn’t change, and neither does the world’s need for copper, lithium, and gold.

As Jordan puts it, you can’t ignore the opportunities, but you also can’t forget how quickly the ground shifts under your feet.

The US bailout might buy Milei time, but Argentina’s got a century-long habit of snatching defeat from the jaws of victory. For ASX juniors with Argentine exposure, October 26 is the date to watch.

The Wrap

Finals footy, drilling announcements, gold at record highs, India scrambling for rare earths, and Milei’s Argentine experiment showing cracks. Plenty happening.

Our portfolio companies are turning drill bits right when copper’s tight and gold’s breaking records. FUN’s working in Malawi, FMR’s drilling in Chile, AZ9’s metallurgy just proved the project works, and BUS has someone dropping big money ahead of results.

Drilling (and hopefully, discovery) season is properly underway, and the market is now hot. The next few weeks will separate the hits from the misses.

Till next week.

Good to bump into fellow writer Nick Rynne at the ‘G too. Recommend his Jumper Punches page to all fellow footy nuffies, he’ll no doubt have a good summary of the weekend out Monday.

Cheers team!