Weekly Wrap: Gold Fever and Copper Crunch Drive Markets

Gold and silver hit record highs, copper tightens, and US money eyes Aussie miners as momentum builds across the market this week

Markets went sideways this week while commodities absolutely ripped.

The ASX 200 barely moved, but underneath that calm surface, gold and silver smashed through record highs, copper inventories kept falling, and the world’s biggest miners crept toward a combined US$2 trillion valuation.

China kept tightening rare earth exports as the US kept signing cheques for them, and our portfolio companies kept the drills turning. One biotech even kicked off a first-in-human trial that could reshape how we treat eating disorders.

Plenty happened. Let’s get into it.

What caught our eye:

Gold and silver hit all-time highs as investors piled into safe havens.

HSBC calls US$5,000/oz gold by 2026

Fortuna Metals kept the drill turning in Malawi as it targets rutile and titanium

Asian Battery Metals hit a second thick zone of massive sulphides in Mongolia

Copper supply squeeze deepens, creating strong conditions for ASX explorers

The world’s top 50 miners close in on US$2 trillion combined valuation

The US is ramping up investment in critical minerals

Tryptamine Therapeutics enrolled its first patient in a world-first clinical trial

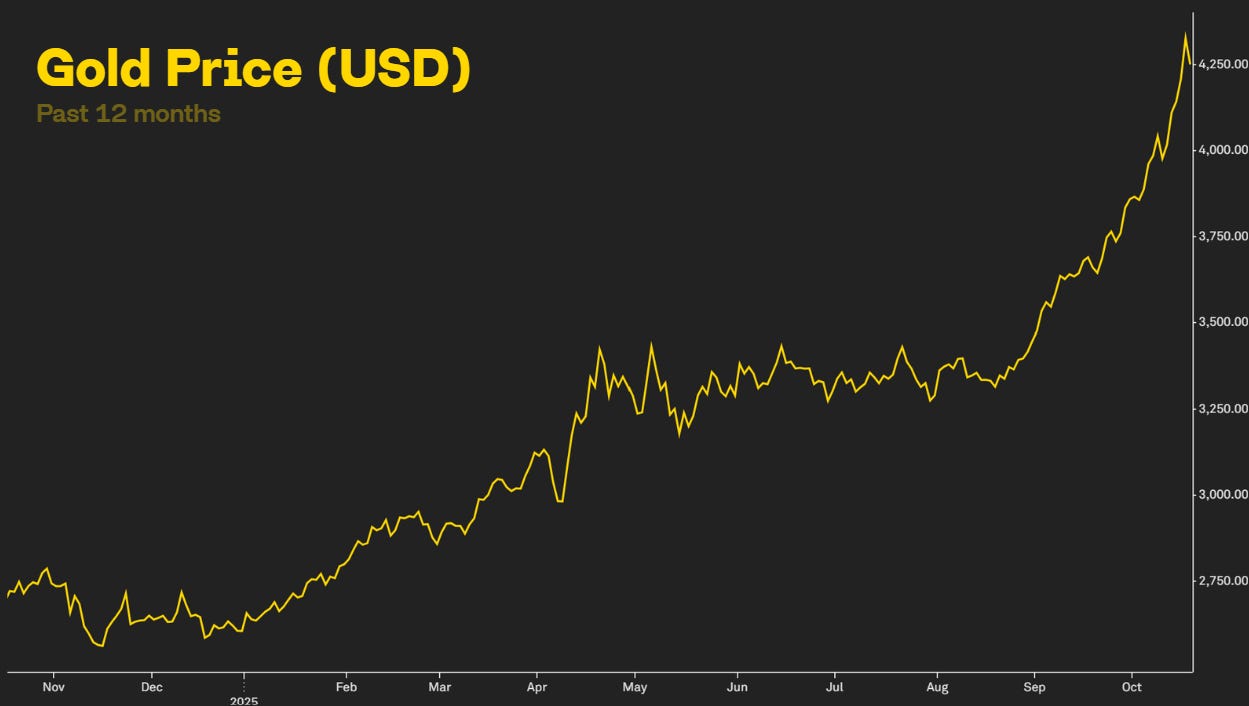

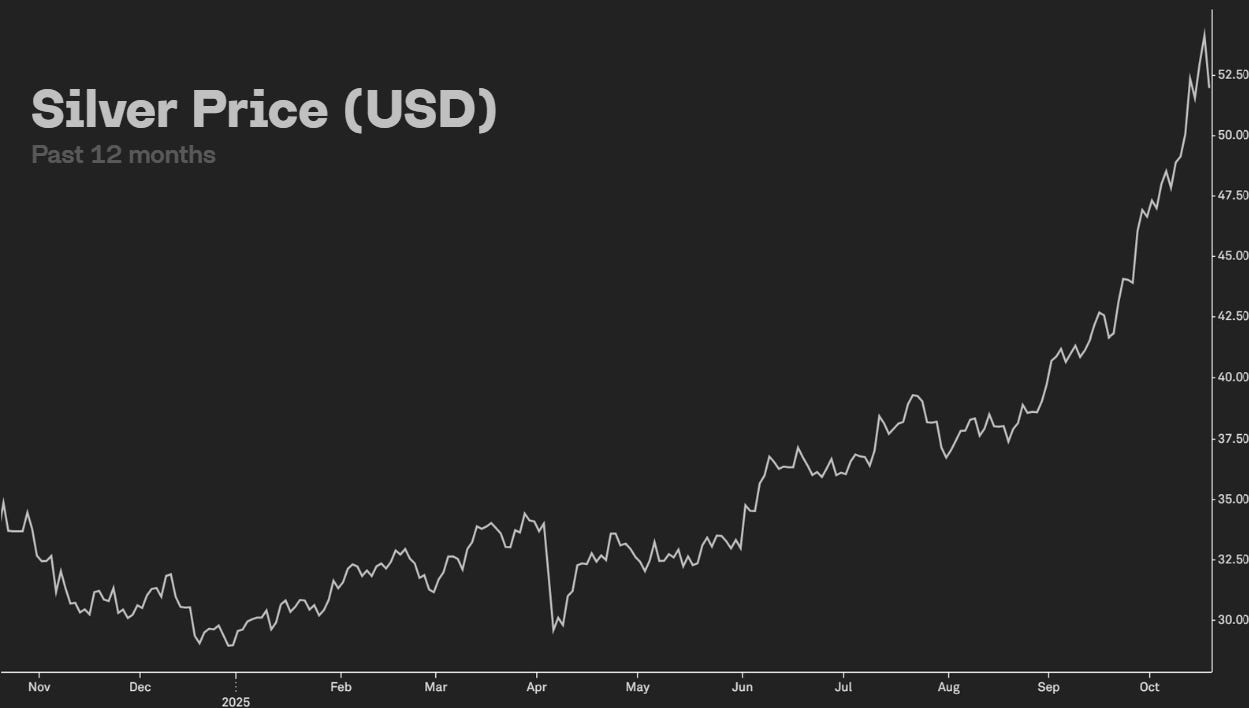

Gold and Silver Push Higher

What a week it was for gold and silver. Both precious metals smashed through record highs, with the bizarre scenes of queues of people lined up outside bullion retailers and mints in Australia trying to get their hands on physical metal.

The gold price started the week at just over US$4,000/oz, climbed as high as US$4,378/oz (tracking toward its biggest weekly gain since the GFC), before closing out at US$4,250/oz.

Silver kicked off at US$50/oz, touched US$54.40/oz mid-week, then settled just under US$52/oz by Friday.

We’ve said it before, but the ongoing worries about global growth and a weaker outlook in both the US and China have people worried. Inflation is still hanging around, and uncertainty is building, and if the US dollar keeps softening, plenty reckon there’s more upside to come.

It’s a reminder that while sentiment can swing, gold’s role as a store of value remains as strong as ever, and it’s now well and truly crossed over to the mainstream.

HSBC Sees Gold at US$5,000 by 2026

Where will the gold price go? It’s the question that everyone is asking, and investment banks are revising their targets weekly.

This week, HSBC joined the party calling for a big move in gold, forecasting prices could reach US$5,000 an ounce by 2026. That’s a near 20% jump from current levels.

The bank says central bank buying, a softer policy stance from major economies, and fiscal stimulus are creating the perfect setup for a structural re-rating.

The analysts behind the call think we’re still early in this bull run that began in late 2022. They see gold transitioning from a short-term rally to a broader repricing of what the metal represents.

If the forecast plays out, it would reshape the sector with producers enjoying bigger margins, explorers receiving renewed funding, and juniors would finally get the attention they’ve been missing.

US$5,000/oz was laughed at in 2015, but now it’s being called by some of the smartest analysts in the game as the market rediscovers its appetite for gold as a safe-haven.

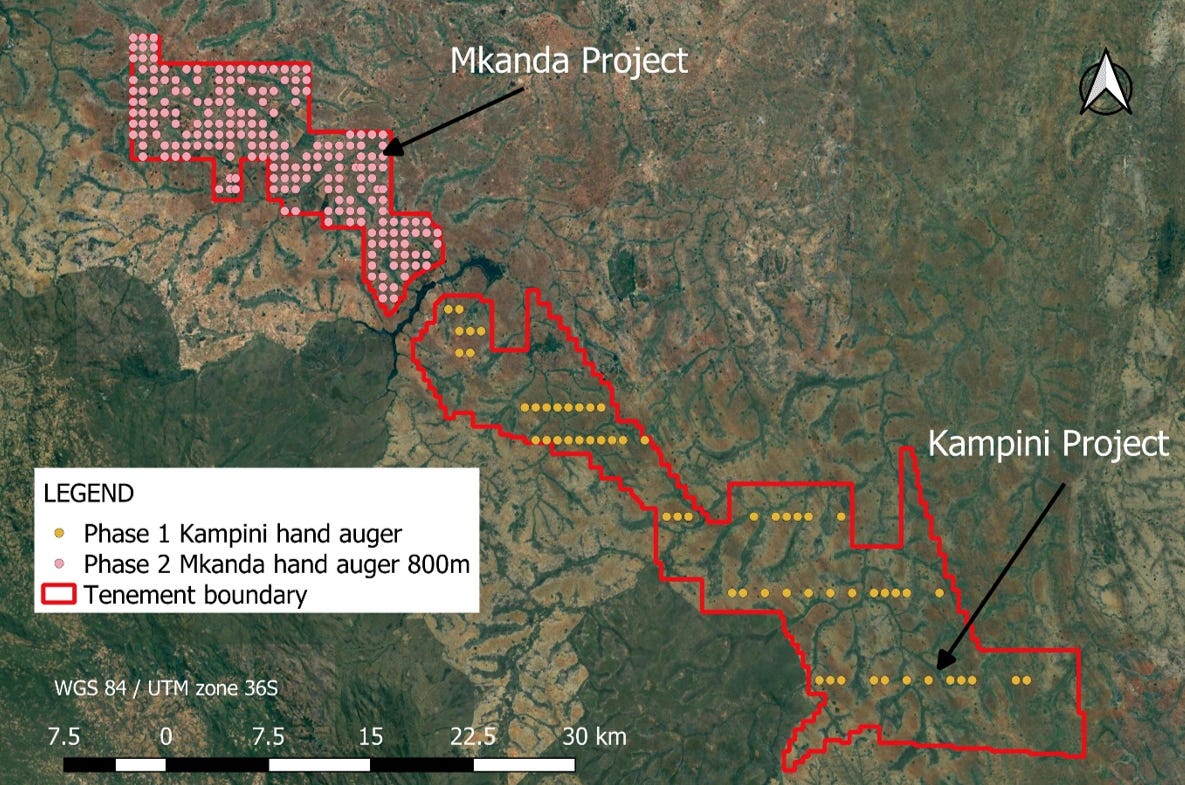

Fortuna Keeps the Drill Turning in Malawi

The news keeps flowing for our portfolio company Fortuna Metals (ASX: FUN), which this week announced boots were on the ground in Malawi as it ramps up drilling across two rutile targets, Mkanda and Kampini, in a world-class mineral province.

We took a position in FUN after its recent rutile acquisition. Since then, the share price is up 300% (from 4c to 16c), with a current market cap of $30 million.

To the north, Sovereign Metals (ASX: SVM) sits at over $500 million on the back of its world-class Kasiya deposit. Fortuna to the south, valued at a fraction of that, sits along the same geological corridor and has confirmed rutile at its two targets, some 40km apart.

Early fieldwork’s already turned up rutile from surface, and the historical results shown below give a sense of what might be there:

10m @ 1.35% TiO₂ (Mkanda Project)

7m @ 2.19% TiO₂ (Kampini Project)

8m @ 1.46% TiO₂ (Kampini Project)

7m @ 2.14% TiO₂ (Kampini Project)

8m @ 1.60% TiO₂ (Kampini Project)

7m @ 1.85% TiO₂ (Kampini Project)

7m @ 1.77% TiO₂ (Kampini Project)

8m @ 1.57% TiO₂ (Kampini Project)

Follow-up drilling is now focused on testing both scale and grade potential.

This week, J.P. Morgan announced a US$1.5 trillion Security and Resiliency Initiative, with titanium on the list. Titanium is critical for defence, manufacturing, and robotics.

The combination of near-surface rutile, solid geological context, and a bullish titanium market puts FUN in a strong position as the global race for critical minerals accelerates.

Asian Battery Metals Extends Massive Sulphide System at Maikhan Uul

It was a busy week for Asian Battery Metals (ASX: AZ9), which confirmed two thick hits of massive sulphides at its recently acquired Maikhan Uul copper-gold project in Mongolia (backing up the idea they might be onto something properly large here), then went into a trading halt to raise funds.

The first hole, MU2501, delivered a standout 20 metres of massive sulphides, kicking off what looks to be the start of a broader discovery.

The follow-up hole, MU2502, drilled 73 metres to the east, intersected 34 metres of massive sulphides, mostly pyrite with visible copper. The consistency across both holes suggests strong continuity along strike and solid geological structure.

Assays will tell the real story once they land, and the company’s planning deeper holes to test what’s sitting below. Maikhan Uul’s only eight kilometres from AZ9’s Oval copper-nickel-PGE discovery, so they’ve now got two targets worth chasing in the same district.

AZ9’s in a trading halt as we type and should resume tomorrow.

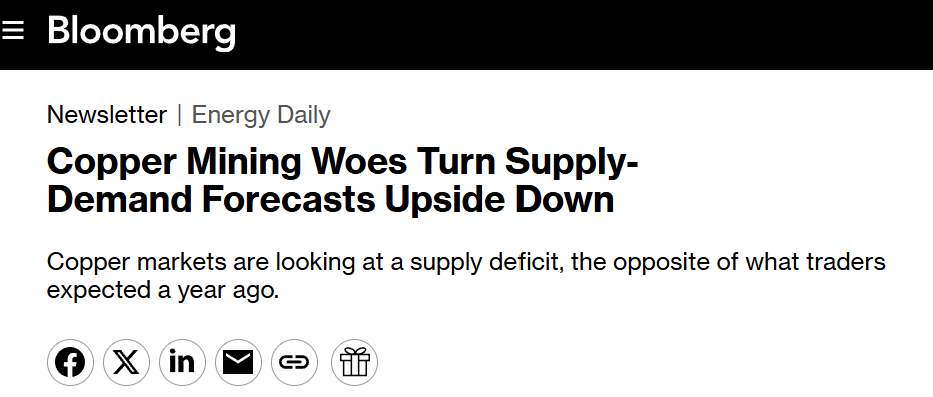

Copper Deficit Turns the Market on its Head

The copper market is starting to get tighter and tighter, with the supply story changing fast. Global production problems and slower-than-expected ramp-ups have flipped the balance from surplus to deficit quicker than many expected.

Bloomberg is now reporting that inventories could fall to multi-year lows before the end of the year. Low inventories coupled with higher demand equals higher prices.

Demand remains solid thanks to EVs, renewable infrastructure, and AI data centres, but the real squeeze is coming from the supply side. Existing mines have falling grades, new projects are slow to get moving, and energy costs are hurting output.

Copper’s trading in the US$10,500-11,000 range right now, and if these supply constraints stick around, US$12,000 a tonne starts looking reasonable.

This is a strong environment for ASX explorers with credible targets, as the market begins hunting for the next source of fresh tonnes.

We’re invested in FMR Resources (ASX: FMR) and Asian Battery Metals (ASX: AZ9) as they drill their respective copper targets in Chile and Mongolia.

Miners Near the US$2 Trillion Mark

This week, we saw that the combined value of the world’s top 50 miners is now closing in on US$2 trillion.

BHP’s still the heavyweight with a market cap at just under US$150 billion, Rio Tinto sits at US$114 billion, and Chinese miner Zijin rounds out the top three at US$113 billion.

The ASX has six names in the top 50. FMG comes in at 17th, gold plays NST and EVN are at 30th and 46th respectively, with rare earth behemoth LYC 48th.

Gold and rare earths are clawing back capital that spent years flowing into other sectors, helped along by stronger pricing and balance sheets that can actually support growth plans.

Six companies in the top 50 isn’t bad, but it shows how concentrated value sits at the big end. If juniors consolidate or scale up operations, there’s room for more names to crack that list.

The irony is that even with a combined value approaching US$2 trillion, the entire top 50 mining companies together are still worth less than a single tech giant like Nvidia, Microsoft, Apple, Alphabet, or Amazon.

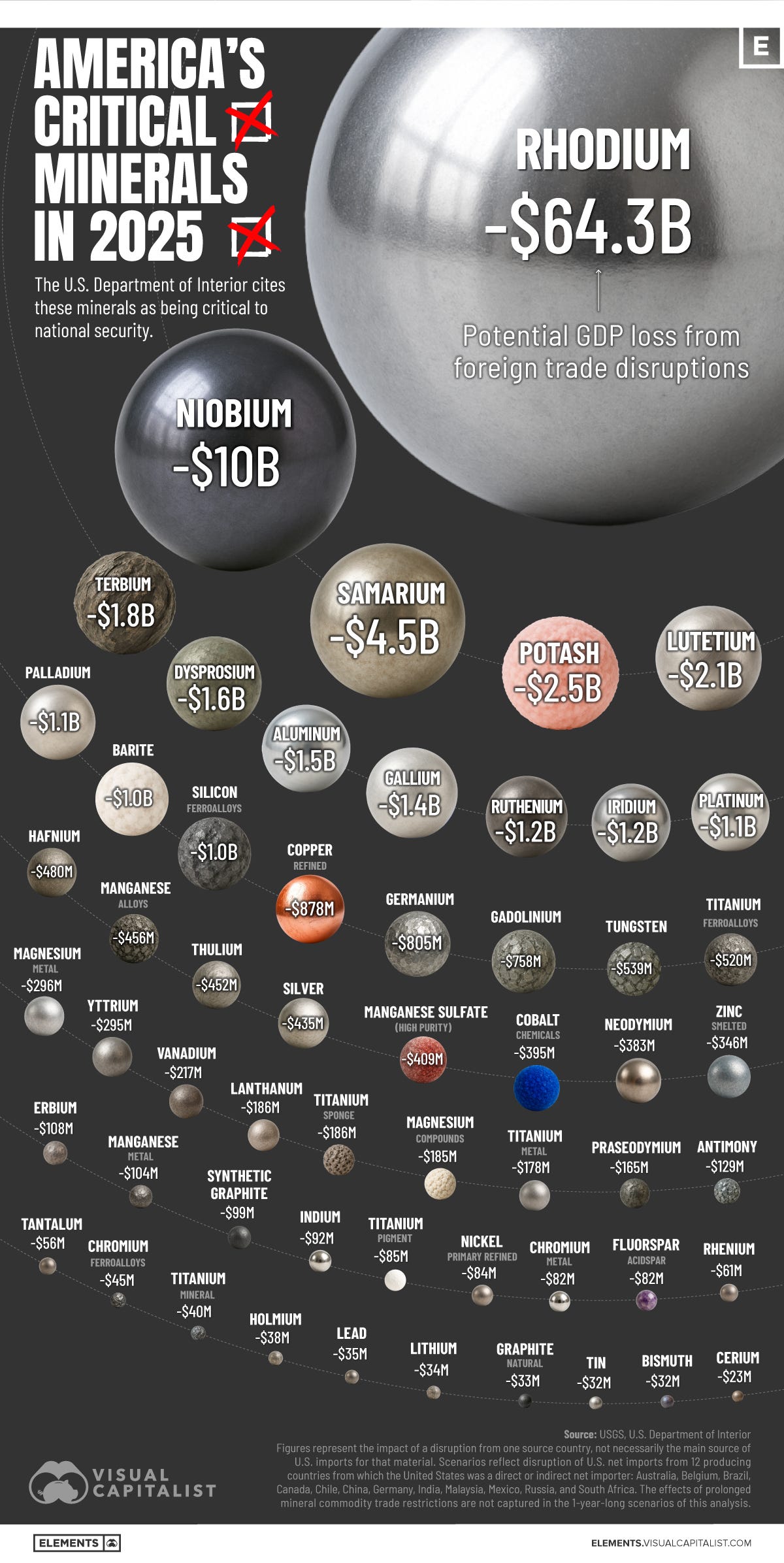

US Critical Minerals Push Could Be a Major Tailwind for Australia

The US has intensified efforts to lock in supplies of key materials like copper, rare earths, and gallium, pouring billions into funding and partnerships to cut its dependence on China.

Nearly every global supply chain runs through Beijing, and Washington’s finally woken up to what happens when China decides to tighten the tap on rare earth exports.

That urgency is putting Australia and many ASX-listed companies in the spotlight. Big American funds are already circling ASX-listed explorers, setting the stage for more joint ventures, project funding, and long-term offtake deals.

It’s obvious the US wants a secure supply and is ready to invest, and Australia has the rare earths and critical minerals they desire.

If capital keeps flowing this way through 2026, it could reshape the critical minerals landscape in Australia, helping many ASX juniors get off the ground.

Tryptamine Therapeutics Enrols First Patient in BED Trial

Bit of a detour from copper and gold, but it’s caught our eye: Tryptamine Therapeutics (ASX: TYP) has started a critical stage in its research, enrolling the first person in a new medical trial.

The trial is testing a treatment called TRP-8803, which delivers a controlled dose of psilocin (a compound related to psilocybin, the active ingredient in “magic mushrooms”) directly into the bloodstream.

The goal is to see if this therapy can safely and effectively help people who suffer from Binge Eating Disorder (BED), a condition where individuals regularly eat large amounts of food in a short time and feel unable to stop.

The Swinburne University trial will test TRP-8803’s safety and effectiveness through two closely monitored doses. Unlike oral psilocybin, the IV acts faster and can be precisely controlled.

Strong interest has already led to more enrolments, marking an early but essential milestone as TYP builds momentum in the psychedelic treatments industry, which is growing at over 11% per year with an estimated value of US$5 billion.

Not our usual territory, but we’re closely watching how it develops.

A Big Week, With a Bigger Week Ahead

Gold continues to steal headlines, and copper’s tightening supply story is pushing valuations higher, all while capital is pouring back into the sector as the US makes its biggest critical minerals push ever.

ASX Investors are once again backing discovery stories, with companies like AZ9, FUN, and our gold investment Bubalus (ASX: BUS) highlighting that drill programs attract attention in this market.

We’ve got a big week ahead as we’ll be heading to Australia’s largest mining conference in Sydney next week, IMARC, meeting with management teams, analysts, and fund managers to get a clearer sense of where capital is flowing next.

Expect plenty of insights from the floor.

Thanks for writng this, it clarifies a lot. Makes me wonder about critical minerals for green tech.