Weekly Wrap: IMARC Buzz, Copper Hits, and Super Deals in Washington

We were on the floor at IMARC this week, where 20,000 people packed the halls, funds were back hunting deals, and the tone across mining had clearly turned

IMARC wrapped up in Sydney this week, and the mood was different to what we’ve seen in years past.

The conference floor of Australia’s largest mining conference was properly buzzing with tens of thousands of people through the doors over the three days.

Our portfolio companies had plenty of news too, with copper hits, oversubscribed raisings, and investor presentations all landing as gold and silver price mayhem stole headlines.

Meanwhile, Albo was in Washington signing deals that’ll irk China and see our super funds pump more money into US markets.

There was plenty to unpack, here’s a taster:

IMARC: Mining’s back in favour as funds and governments chase deals.

FMR Resources: Copper hit sends shares flying.

Asian Battery Metals: $6 million raised (oversubscribed) while team works the room at IMARC.

Fortuna Metals: Share price hits all-time high during investor roadshow.

Gold has its biggest daily drop in over a decade.

Australia–US rare earths deal: $13 billion partnership lifts ASX explorers.

Superannuation shuffle: Our retirement funds set to flow into US markets.

Let’s get into it.

From the Floor at Australia’s Largest Mining Conference

We headed to the International Mining and Resources Conference (IMARC) in Sydney this week - three days of pure mining madness that brings out everyone who matters in the sector.

From junior explorers, government bodies and mining services companies to brokers, funds and media outlets are there.

A few takeaways from the floor:

1. The Crowd was Massive

More than 20,000 people showed up, with 500+ companies setting up shop and over 200 speakers taking the stage, while every state government in Australia sent delegations.

The international crowd was huge too, with Canada, Saudi Arabia, Germany, France, Morocco, New Zealand, Chile, Mongolia, and the US all with strong representation and underlining the standing the conference has established in the mining industry.

The big shift was in who we were meeting. In previous years, we’d spent most of our time with explorers and government officials, but this time around, we met with investment banks and private equity funds who were actively looking to deploy capital.

The overriding sentiment from them was they wanted to back mining projects or finance them through construction.

When the money starts showing up like that, you know the sector’s turned for the better.

2. Asian Battery Metals Draws a Crowd

One of the companies in our portfolio, Asian Battery Metals (ASX: AZ9), had a strong showing at the conference. We caught up with managing director Gan-Ochir Zunduisuren, fresh off announcing their $6 million oversubscribed raise to fund further exploration.

Gan-Ochir presented to a packed room on Wednesday afternoon, walking through AZ9’s work plans for the coming months. The reception was warm, and the people we spoke to afterwards were impressed with their strategy on how to advance their copper-gold targets in Mongolia.

The current drilling program has reported strong results, and you could feel the momentum building around the story.

Mongolia also had a big presence at the conference again this year, and it was clear watching AZ9 work the room that they’ve built solid relationships with government officials.

With more drill results coming in the next few months and the cash to keep the rigs turning, AZ9’s in a good spot.

3. The Hot Commodities are Critical Minerals, Gold, Silver and Copper

Money’s clearly flowing into specific commodities right now, and you only needed eyes to see the buzz around them on the conference floor.

Critical minerals were everywhere, especially after the US-Australia deal dropped this week.

Arafura Resources (ASX: ARU) suddenly found themselves in the spotlight, with their Northern Territory rare earths project looking like it might get built now that government funding’s on the table.

ARU’s market cap is now well over $1 billion, and they were riding high at the conference, along with plenty of other explorers now jockeying for a piece of that government money.

Gold had a wild week, but with prices holding strong above US$4,000/oz, the gold explorers were peppered with questions about upcoming drill programs.

We ran into Brendan Borg from Bubalus Resources (ASX: BUS), a company we invested in late last year. He was excited about their Victorian drilling program and the gold price holding strong.

Silver was also at the fore with the number of silver companies at IMARC (and the silver price), underlining how bullish many are on the long-term fundamentals.

Copper isn’t going anywhere either, with a large number of copper juniors touting projects across the globe. Beyond AZ9’s packed presentation, we spoke with a heap of copper juniors with projects around the world. The electrification story isn’t slowing down, and everyone knows we need a lot more copper than we’re currently finding.

4. Governments Want Mining Investment

The shift in how governments treat mining has been remarkable. Not too long ago, mining was an industry that politicians were keeping at arm’s length. Now, they’re falling over themselves to attract investment.

Gone are the small booths of yesteryear, we now see full-blown marquees, maps, coffee machines, merch and big giveaways. One Australian state had a setup that looked more like a tech company activation than a government stand.

We sat through presentations and conversations with officials who were practically begging miners to come explore their jurisdictions.

Mining is no longer a dirty word, and governments appear to be actively courting the sector, aware of the value and jobs it creates.

IMARC 2025 delivered on every front, with energy up and the industry feeling properly back.

We’ll be there again next year, and based on what we saw this week, 2026 might be bigger again.

FMR Confirms Copper At Depth and the Share Price Heads North

FMR Resources (ASX: FMR) delivered the goods this week, hitting copper exactly where they said they would at Southern Porphyry in Chile.

Our first investment of 2025, FMR intersected a nine-metre mineralised zone between 171 and 180 metres downhole, grading up to 1.7% copper, confirming the system remains open and strongly mineralised as it extends downward.

The announcement got attention with the stock closing nearly 50% higher from its lows earlier in the week. It’s a reminder that sometimes low-volume selling and nervous hands can mask the underlying story, and we’re happy holders here.

The hole has now passed 800 metres and continues toward the main porphyry target, where key indicators suggest a much larger copper system may sit below.

Managing director Oliver Kiddie has been consistent since day one: build the evidence, phase by phase, that there’s a large-scale copper system sitting under Southern Porphyry. The early signs say he’s onto something.

We cut together a short video from footage he sent through from site if you want to see the drill turning.

We’re now watching closely as drilling steps into the heart of the target zone. If the deeper sections return further mineralisation, this could become one of the most significant discoveries in Chile’s emerging copper belt.

In short, management’s thesis is alive and well, and gaining momentum.

Asian Battery Metals Oversubscribed Capital Raise

Our other copper play, Asian Battery Metals (ASX: AZ9), raised $6 million this week, oversubscribed after initially seeking $5 million.

It shows clear investor belief in the company’s copper-gold story and the capability of the team to deliver on it.

The funds will keep drilling going across their portfolio, particularly at Maikhan Uul in Mongolia, which is starting to look very interesting.

Recent drilling confirmed multiple zones of massive sulphide mineralisation, alongside copper and gold values that suggest a strong hydrothermal system.

It’s the kind of mineralogy that geologists look for when defining a genuine copper-gold discovery. What makes Maikhan Uul turn heads is how coherent the results have been so far. The mineralisation sits within a broader structural corridor, showing continuity and scale, two ingredients that point to a potentially large system.

From what we’ve seen so far, Maikhan Uul could become the company’s flagship and a key growth driver as the market continues to tighten around quality copper-gold assets.

Fortuna Metals Roadshow Delivers

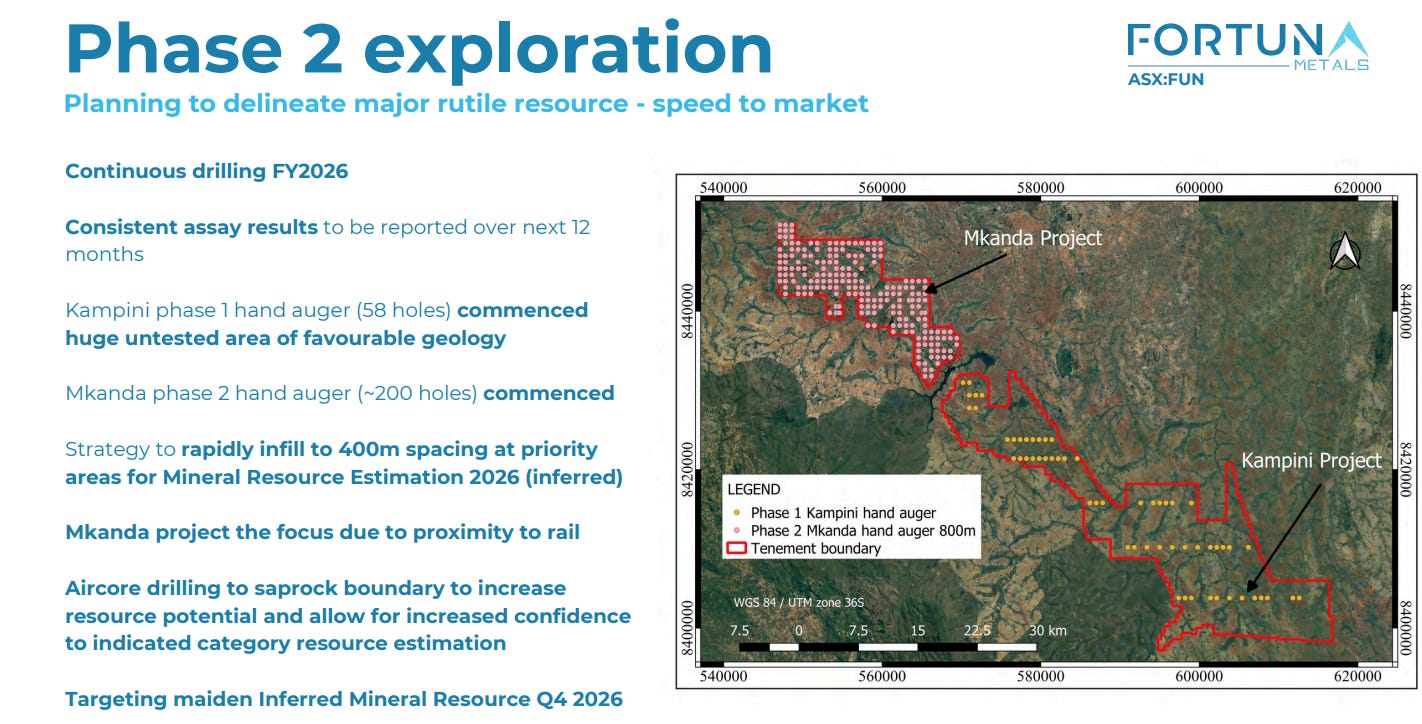

For those following our rutile investment, Fortuna Metals (ASX: FUN) hit an all-time high of 22c this week, up over 400% from where we entered at 4c.

Management hit the road with a new investor presentation, meeting brokers and funds in the back half of the week. The share price followed them higher as managing director Tom Langley laid out the opportunity in FUN trading at such a massive discount to its peers.

Fortuna Metals is valued at $38 million while sitting on the same geological belt as Sovereign Metals (ASX: SVM), which trades at nearly $500 million. Both have confirmed rutile, but one’s trading at a fraction of the other.

FUN is pushing ahead with Phase 2 drilling across high-confidence rutile and titanium targets in Malawi, with management believing these areas will feed directly into the resource planned for 2026.

The roadshow continues next week, and based on this week’s reception, we’re excited to see how much more FUN can close that valuation gap.

Gold and Silver: Wild Week in the Metals

Gold and silver put on quite a show this week, to say the least.

Gold opened around US$4,200/oz, shot up to nearly US$4,400 for a new all-time high, then copped its biggest single-day hammering in 12 years, dropping just over 6% in one day. By Friday it had bounced back above US$4,100/oz.

Silver did much the same, starting above $50/oz before closing just under $49.

You’d expect the rollercoaster ride would have thinned the herd of buyers lined up outside gold dealers the past few weeks. Quite the opposite, as queues formed outside ABC Bullion in Sydney’s Martin Place from early morning through to late afternoon to buy the dip.

Even after this week’s volatility, both metals are sitting near record highs. Six months ago, these prices would have been fantasy land. We are still bullish both gold and silver.

The USA and Australia: Deal-Making Week

Albo finally got his White House moment with Trump, and amid the car crash comedy of watching Trump take shots at our sheepish ambassador and ex-PM he’d never heard of, a couple of big deals got done.

Let’s break them down.

The Critical Minerals Deal

Australia and the United States signed a US$8.5 billion critical minerals deal, one of the largest industrial agreements ever struck between the two nations.

The deal, formalised in the White House, is designed to secure long-term access to minerals while reducing dependency on China as a supplier.

The package includes US$5 billion in US government loan guarantees and defence procurement, alongside roughly A$5 billion from Australia’s Critical Minerals Facility and Export Finance programs.

That money’s meant to accelerate mine development, refining capacity and recycling infrastructure across both countries. It’s a massive tick for the mining sector.

What piqued our interest is Australian miners now count as “domestic suppliers” under US law, giving them direct access to America’s $800 billion clean-energy and industrial policy pipeline. That opens doors to new offtake partners, financing arrangements and technology partnerships that weren’t available before.

This moves Australia from just digging stuff up and exporting it to being central to the West’s clean-energy build-out.

It’s a huge step forward and the market loved it, and rightly so.

Australia–US Superannuation Deal

The other headline was about our super funds getting easier access to US markets.

The landmark financial deal unlocks more than US$1.5 trillion in potential investment flow. Yes, trillion.

The agreement gives Australia’s $3.7 trillion superannuation sector streamlined access to US infrastructure, clean-energy, and tech projects that qualify for American industrial-policy incentives.

Australian superannuation funds already have substantial US exposure, and the government is not directing where they must invest, rather it’s creating conditions for them to invest more easily in the US if they choose.

Albo described it as a way to diversify Australia’s savings engine while deepening economic alignment with the US. For Washington, it’s another step in bringing us Aussies into America’s re-shoring and decarbonisation build-out.

It effectively turns the super industry into a global investor in next-generation energy, digital, and manufacturing infrastructure. Something we really like.

For the ASX, it might mean some rebalancing as capital heads overseas in the short term. But longer term, it sets up reciprocal flows back into Australian resources and infrastructure.

Even a tiny percentage of that money coming back equals billions chasing ASX-listed companies.

The Wrap

IMARC was buzzing this year, and not just from the free coffee at the stands. Investment banks and funds were there to write cheques, which is a proper shift from some of the tyre-kicking we’ve seen in previous years.

The US critical minerals deal also dropped at the perfect time, our explorers can now tap into American money while our super funds get to chase returns in US infrastructure.

Everyone wins (except maybe China).

Getting self-indulgent for a moment, our portfolio had a cracker of a week with FMR hitting copper at depth and the share price rocketing, and AZ9 raising $6 million without breaking a sweat. FUN also kept climbing toward a valuation that makes sense compared to its neighbours.

Even with gold and silver throwing a tantrum mid-week, the underlying story for commodities keeps getting stronger, and we haven’t put our cue in the rack for 2025 just yet, still looking closely at new opportunities worth investing in.

The narrative at play right now is exactly the kind of setup we like to see heading into the final couple of months of the year - bullish commodities, bullish explorers, and an investment climate rewarding success.

Till next week.