Weekly Wrap: Markets Catch Breath as Pilbara Killer Wakes

The rally cooled, the Pilbara got competition, and our next Equities Club pick is almost here

Hopefully you backed a winner at Flemington on Tuesday, because this week on the market there were few to be found.

The small-cap party hit pause this week with a sell-off across the board at the lower end of the market.

Interest rates stayed flat, commodity prices didn’t seem to move, and yet the screen still bled red. In many ways, it was to be expected. The past couple of months have seen plenty of small-caps run hard, so a week off and a breather isn’t a bad thing at all.

A fair few things caught our eye this week.

A new portfolio addition, our PICK of 2025, is only weeks away.

Asian Battery Metals confirms copper, despite the sell-off.

Elon’s trillion-dollar pay deal gets the nod from shareholders. (What a sentence to write.)

Trump’s critical minerals list now includes copper, silver, uranium.

The gold price steadies as analysts stay bullish.

Lithium still grinding through the hangover.

Net zero politics back to the fore.

The iron ore mine dubbed “the Pilbara killer” starts production.

Equities Club Pick of the Year Drops Soon

A new addition is just weeks away from joining the Equities Club portfolio.

This will be only the third company we’ve backed for 2025, and for good reason. Our two picks this year are already up 200% and 100%, and we hope this next one can beat them both.

We’re highly selective about who we back, working only with companies that fit our investment vision, and we’ve turned away a lot this year that didn’t make the cut.

This company sits right in the sweet spot of what we look for: strong management, a clear catalyst on the horizon, and exposure to a theme that’s only getting stronger. Everything is lining up for what we see as a high-conviction play with serious upside potential.

If you’re not subscribed yet, now’s the time.

AZ9 Confirms Copper, Eyes Bigger Targets Ahead

Asian Battery Metals (ASX: AZ9) dropped fresh assays from its Oval copper-nickel-PGE project in Mongolia on Friday, with the drill hits showing consistent mineralisation across multiple step-out holes.

The best hits came in at 68.3 metres at 0.22% Cu and 0.24% Ni from near surface, and 19.1 metres at 0.66% Cu and 0.65% Ni, extending the system both north and south.

AZ9 will keep testing priority target areas along the trend and chasing extensions. The geological continuity they’re seeing backs up the decision to keep the rigs turning.

The results reinforce the view that Oval is part of a larger magmatic sulphide system, though the next phase of work will need to prove that scale and grade can align.

Maikhan Uul is where the focus will shift now. It’s their copper-gold VMS project where drills are turning right now, and we should see assays in the coming weeks.

Friday’s release saw shares dip 10 per cent, but that’s not unusual for early drill results. The market’s waiting to see what Maikhan Uul delivers, and the broader Mongolian portfolio has multiple shots on goal.

We caught up with MD Gan-Ochir Zunduisuren last month to talk through their projects - worth a look if you want the full picture.

Musk’s Trillion-Dollar Payday Gets the Nod

Elon Musk’s US$1 trillion Tesla pay package has now been locked in, capping the boldest compensation deal in corporate history.

Structured across twelve performance tranches, Musk only gets paid if he delivers. Each milestone requires Tesla to hit ambitious revenue and profit targets while driving the company’s market cap beyond US$8.5 trillion by decade’s end.

It’s peak Elon - absurdly ambitious and audacious, but you’d still be brave to bet against him. And after hinting he would shift his attention to AI and robotics if the package failed, shareholders had little choice but to back him.

Musk’s ambitions now stretch far beyond EVs as Tesla is fast becoming an AI-powered manufacturing platform, building humanoid robots, scaling autonomous systems and developing the infrastructure for mass electrification.

None of that happens without the right raw materials. The next wave needs a lot of titanium, rutile, copper and lithium - the metals that drive energy density, conductivity and weight reduction.

Which brings us to one of the companies we’ve backed in our portfolio, Fortuna Metals (ASX: FUN). They pulled back this week, but the world’s demand for rutile is only tightening.

At a $28 million market cap, the stock trades at a fraction of what peers are worth. If they prove up their targets (assays are due soon), that gap could close quickly as global supply chains reposition around the minerals Musk’s next revolution depends on.

Trump Adds Copper and Silver to US Shopping List

The United States has reshaped its critical minerals list under President Trump, adding copper, silver, uranium and metallurgical coal. Washington’s focus has clearly shifted towards resource independence and strategic stockpiling.

The new inclusions on the list go beyond the usual battery metals. Now, old-school commodities are back in fashion and sit at the centre of US industrial strategy.

Copper’s addition makes sense given its growing importance to electrification, data infrastructure and AI energy demand. Silver’s back thanks to its role in solar panels, electronics and high-end manufacturing, while uranium is enjoying a nuclear revival.

Metallurgical coal, once sidelined in green policy debates, is now recognised as indispensable for defence-grade steelmaking and industrial resilience.

For investors, Trump’s list matters because federal funding, fast-tracked approvals, and policy protection come with being on it. These commodities just got a tailwind few other sectors enjoy.

For ASX-listed producers and explorers, it opens doors to US government partnerships, which is a valuable tick of approval on any project.

Gold Stays Above $4k Despite the Wobbles

Gold’s had a topsy-turvy week, finishing just above USD$4000/oz.

The metal’s up more than 25 per cent over the past six months, driven by slowing global growth, investors rotating into defensive assets and central banks hoovering it up.

Even with the erratic price the past couple of weeks, the banks are still calling much higher prices from here.

Here’s where the big banks see it:

UBS: US$4,700/oz within a year, led by central-bank demand.

Citi: Up to US$5,000/oz within the next 12 months if the US dollar weakens and ETF inflows lift

ING: Averaging around US$4,200/oz in 2026, citing structural supply deficits and strong Asian demand.

Goldman Sachs & JPMorgan: Sitting near US$4,300/oz range through 2026 as real yields ease and rate cuts kick in.

ANZ: Gold will reach $4,600/oz by June 2026

For ASX gold explorers and producers, these prices are a gift. With margins strong even in the mid-US$3,000s, producers are printing money and renewed investor interest is following.

Lithium Still in the Doghouse

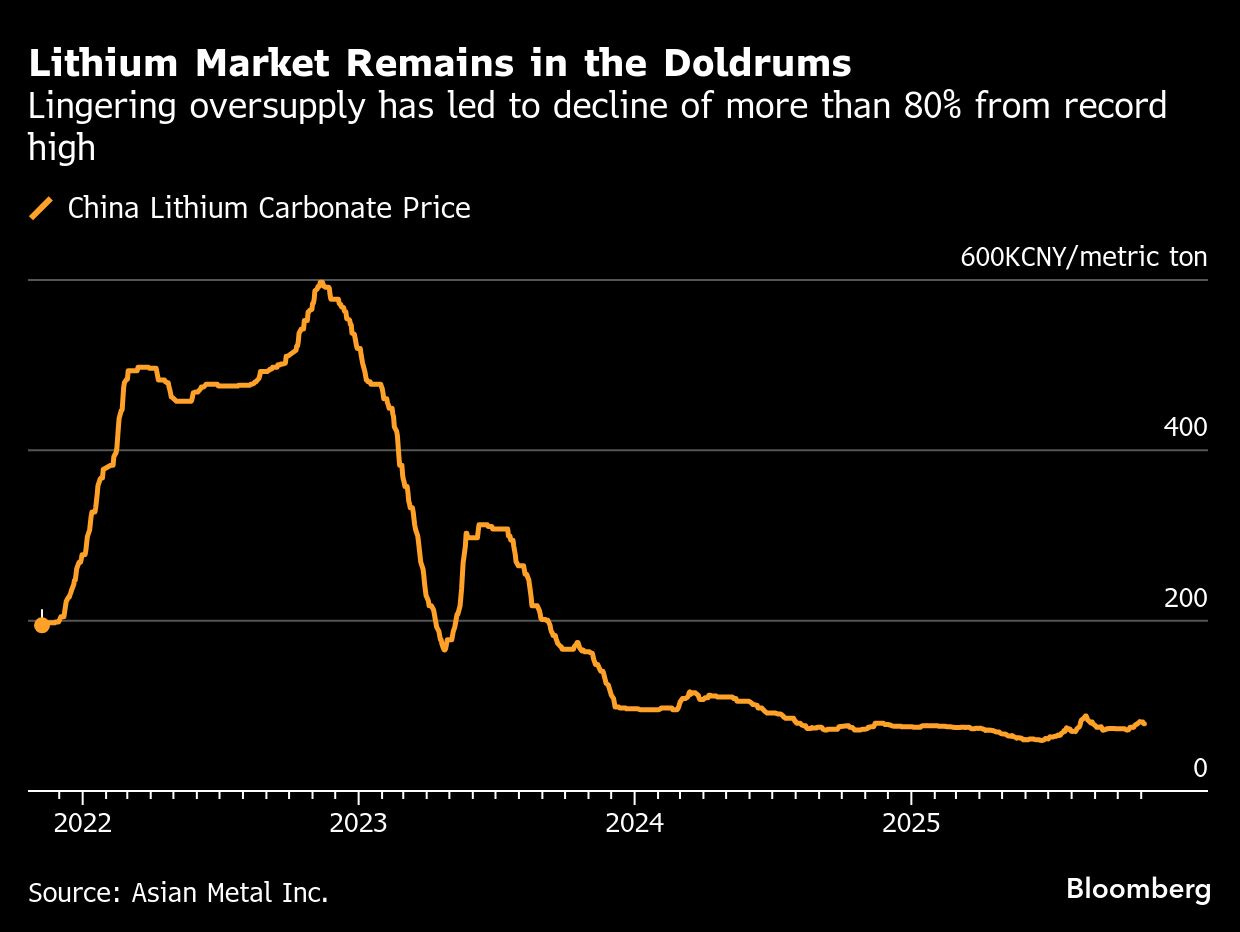

Lithium has slumped hard from its 2022 highs, with China’s carbonate price down more than 80% and now sitting near 100,000 CNY/t (around US $13,700/t).

Oversupply from new Chinese and South American projects has collided with weaker electric vehicle sales and drained all the momentum from what was once the hottest commodity in the market. Even the strongest producers are feeling the squeeze as margins narrow and everyone’s redoing their spreadsheets.

This week, Pilbara Minerals’ Managing Director Dale Henderson said the market has “reset expectations” and warned Australia’s competitive edge will slip to lower-cost regions like Brazil and Africa if production costs and approvals don’t come down.

Henderson’s point was that rivals in these regions are moving quickly with government backing and lower energy costs, which puts pressure on Australia’s dominance in spodumene supply.

For explorers, this is a brutal phase as equity markets have dried up and offtake deals are harder to land. But history shows lithium corrections often set the base for the next cycle. With decarbonisation demand still intact and inventories slowly clearing, today’s prices may look cheap in hindsight when the next uptrend arrives.

Questions Mount Over Net Zero Plan

Australia’s political tide is turning as the Nationals bin the 2050 net zero target, arguing it’s punishing the very regions that keep the country’s lights on.

It’s put the heat on the Liberals, with leader Sussan Ley and others signalling the policy is past its use-by date in resource-heavy seats.

If the Opposition shifts its stance and maintains it into the next election, it’d mark a swing back to reliability and affordability over ideology. That likely means renewed focus on coal and gas to stabilise supply, while renewable projects could face slower approvals and a cooler investment climate.

For commodities, fossil fuel producers might catch a bid if energy pragmatism takes hold. Meanwhile, policy uncertainty could spook investors in critical minerals like lithium, which is already copping it from all sides.

In the broader context, Australia looks ready to pivot from transition leadership to a more grounded, resource-first approach that aligns with the country’s strengths.

Labor is still miles ahead in polling, so net zero remains the law of the land for now. While the energy transition is alive, it’s far from settled.

The Pilbara Killer?

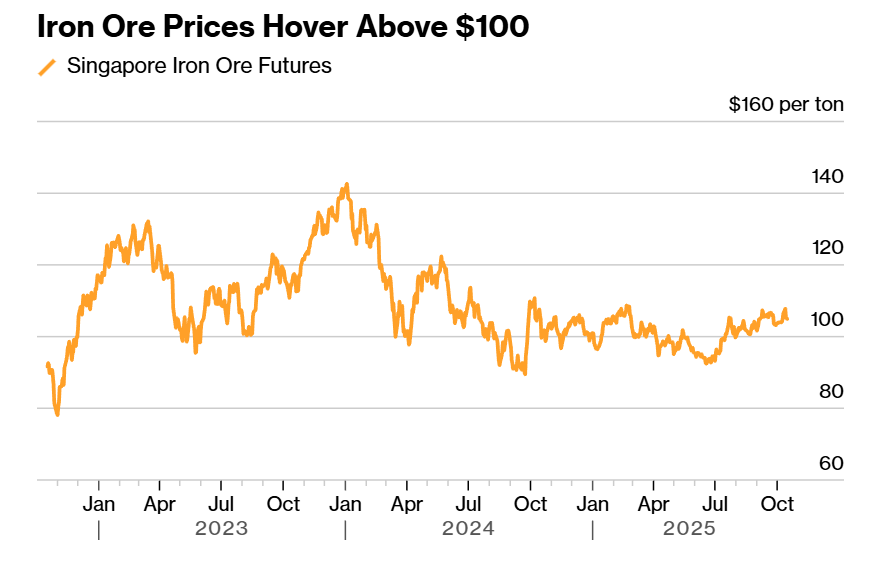

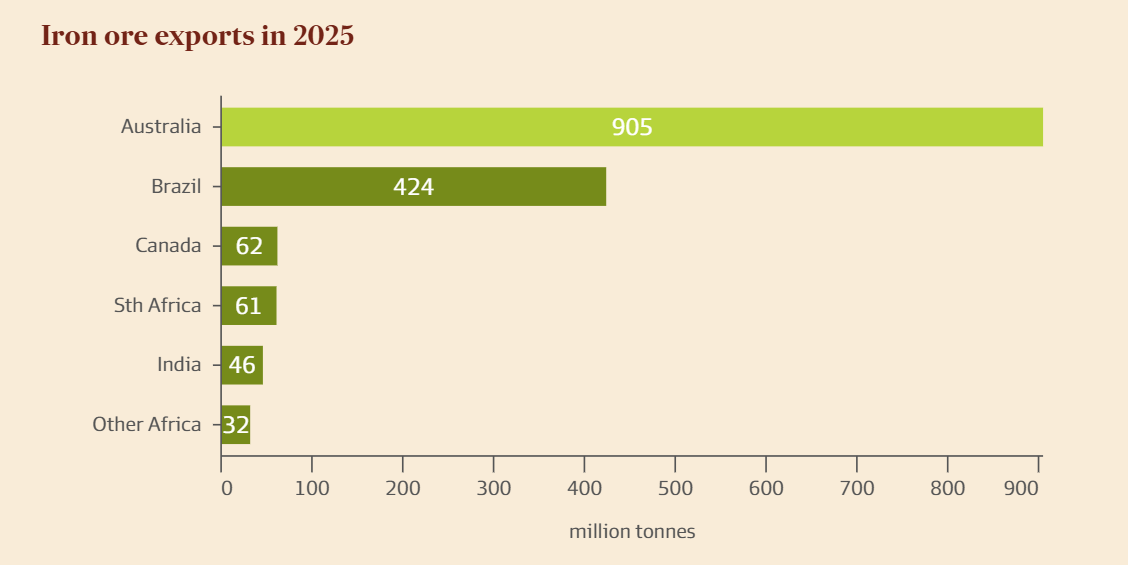

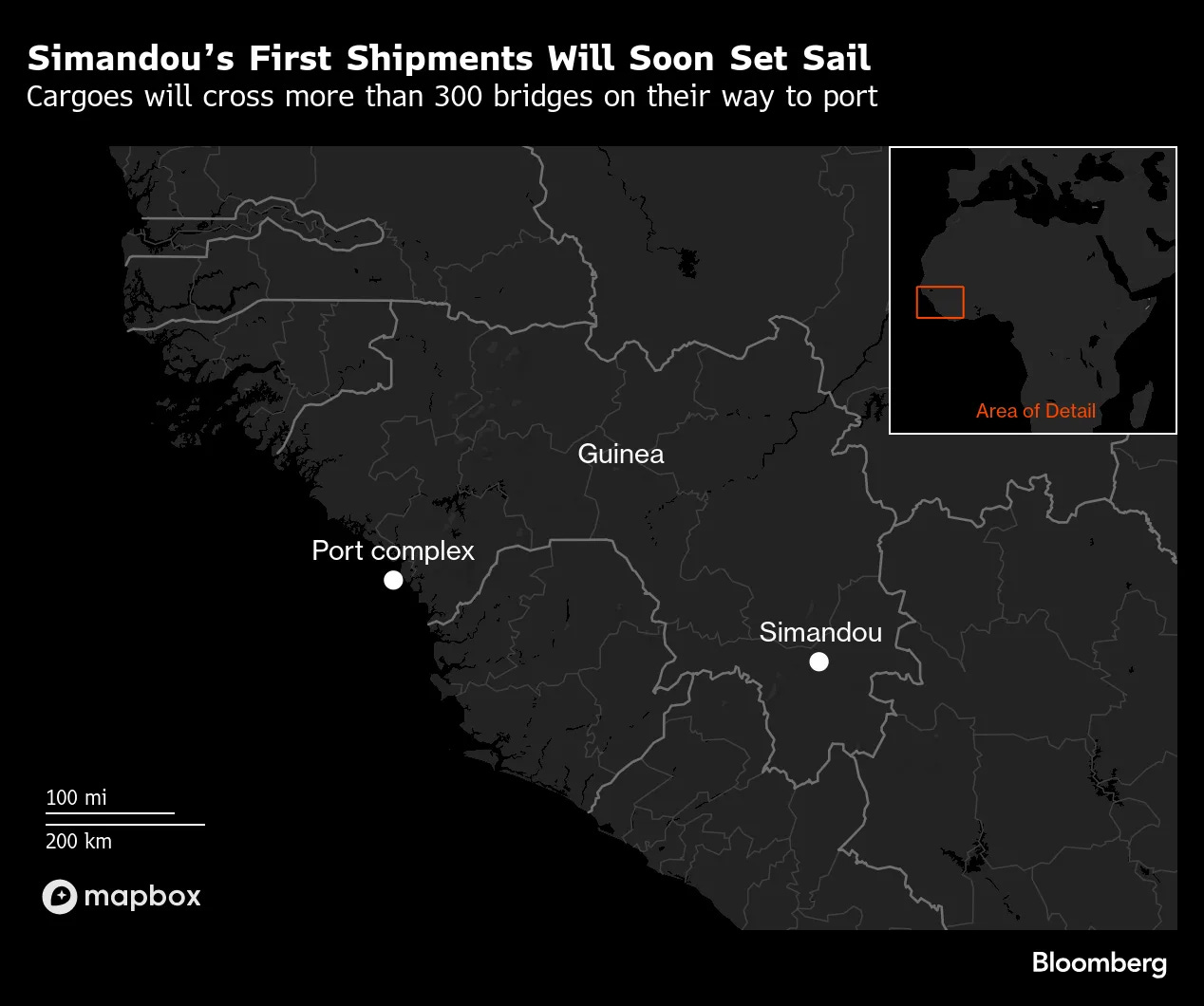

Production has begun at Guinea’s Simandou iron ore project, marking a major shift in the balance of global supply. Once Simandou hits full capacity, it’ll pump out around 60 million tonnes of ultra-high-grade ore each year. Add the neighbouring Winning consortium’s 60 million tonnes, and it’s enough to rattle Australia’s dominance.

Australia currently supplies about 55 per cent of the world’s seaborne iron ore, but that could drop to 45 per cent as Simandou ramps up and Chinese steel mills get more options.

The benchmark price for iron ore is around US$105/t, but the banks are getting nervous. UBS and S&P Global expect prices to ease toward US$90/t. RBC Capital Markets goes further, forecasting a drop to around US$75/t by 2028 as new supply hits the market and demand from China slows.

For Rio Tinto, which co-owns the southern half of Simandou through its Simfer joint venture with Chinalco and the Guinean government, the project is both a hedge and a growth play. BHP and Fortescue, however, face tighter margins as the global price floor declines.

For the Australian economy, the ripple effects will be hard to ignore. Iron ore contributes more than $120 billion in export income each year, and any sustained fall in prices would cut into tax receipts, trade surpluses and business investment.

Treasury modelling shows every US$10/t drop in the iron ore price cuts roughly $3.5 billion in tax receipts over four years. A US$30/t fall, right in line with some analysts’ forecasts, could carve around $10 billion from future budgets.

For smaller producers, higher costs and shrinking margins could be terminal, leaving the majors to consolidate what remains of Australia’s iron ore dominance.

Taking Stock After a Rough Week

This week’s pullback across the small-cap space was overdue. After several months of strong gains, the market needed to catch its breath.

The fundamentals that drove this rally haven’t gone anywhere. Commodity prices are stable, gold is still trading above US$4,000/oz, and the long-term story for copper and rutile remains intact.

Markets never run in straight lines, and one red week doesn’t kill the narrative around electrification, critical minerals and renewed global investment in resources.

For investors, the lesson is simple: Momentum pauses, but the story has not changed. The opportunity in small-caps remains, and while corrections test conviction, they also set up the next move.

Till next week

Excellent analisys, building on your previous notes regarding small-cap valuations and the expected market breather. Given the ongoing pressure on lithium and the renewed focus on net zero politics, how do you see these factors influencing broader market sentiment moving into the next quarter?