Weekly Wrap: Small-Cap Chaos, Big-Cap Politics, Lithium Falls and More NST Rumours

From Kaili’s rare earth frenzy to Trump’s copper showdown, the ASX delivered one of its most unpredictable weeks of 2025 so far

The ASX broke through the 9,000-point mark for the first time ever this week, which should have been the headline. Except a micro-cap went up 8,700% in a day, Trump hauled our mining titans into the Oval Office, and lithium's hot start to 2025 might already be over.

Sometimes the index records are the sideshow.

Here's what caught our eye this week:

A small-cap surged an incredible 8,700% in a single day before crashing.

Rio Tinto and BHP bigwigs sat down with President Trump at the White House.

Trump ramps up his “Unleashing American Energy” order

Lithium’s rebound already looks wobbly.

And Northern Star can't shake the takeover talk.

An 8,700% Lesson in Market Mania

Kaili Resources (ASX: KLR) was the undisputed headline act this week, after one of the wildest trading rides we’ve seen on the ASX in years.

The rare earths junior went from obscurity to headlines to suspension in a matter of hours, all off the back of speculation around a newly approved drilling program in South Australia.

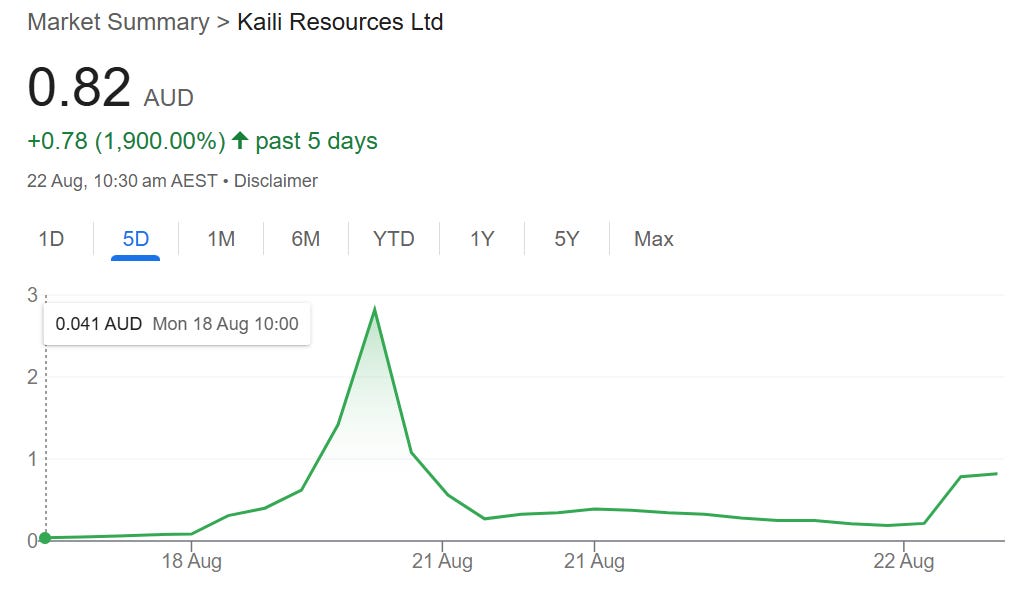

The chart tells the story - from 4c, to over $3, then back to 82c to close the week.

For those who missed it, here’s how it played out:

Friday, 15 August - KLR received approval to drill across three rare earth tenements in South Australia. The share price closed at 4c.

Monday, 18 August - Shares exploded 8,700% intraday, surging to $3.18. The ASX stepped in and suspended trading, querying the price movements.

Wednesday, 20 August - After market close, KLR told the ASX there was no new information to come and asked to be reinstated the next day.

Thursday, 21 August - Trading resumed. Volatility went off the charts: opened at 53c, fell to 18c, closed at 19c.

Friday, 22 August - KLR surged again, from 19c to 82c - a 331% rise on no fresh news. The ASX once more hit pause, with trading set to resume on Monday.

The frenzy was fuelled by punters speculating on rare earths upside, comparing KLR's ground to nearby successes like Australian Rare Earths (ASX: AR3). AR3 carries a valuation of $24M.

KLR, by contrast, is still an early-stage company. Drilling hasn’t even started. Yet for a moment, it wore a $100M valuation. At 82c (where it’s currently suspended), the market cap is $28M. There’s no logical reason KLR should be worth more than AR3.

Given the wild swings, the ASX is right to question it. Either way, Monday’s re-open will be fascinating to watch.

Trump Goes to War Over Copper

Our two biggest miners got summoned to the Oval Office this week. Rio Tinto and BHP chiefs sat down with Trump to talk about the Resolution Copper Project, a massive Arizona deposit that could supply a quarter of America's future copper needs.

The project's been stuck in regulatory purgatory for years, caught between environmental and Native American groups’ opposition and America's desperate need for domestic copper.

Just a day earlier, a US appeals court had blocked a key land transfer, effectively stalling the mine yet again.

Trump called it "critical for America's energy independence" and seemed ready to bulldoze through the red tape. The Oval Office photo op was his way of showing support for Rio and BHP straight after the setback.

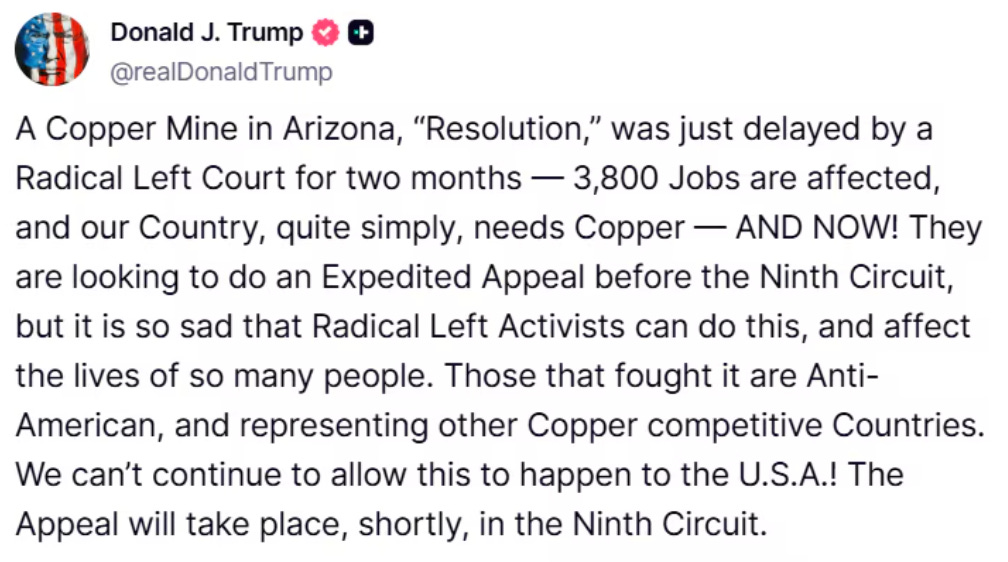

Then he went predictably volcanic, taking to Truth Social to argue America can't compete globally when projects like this get tangled in bureaucracy.

The subtext was as subtle as a sledgehammer: he'll be back for another crack at this.

For Rio and BHP, it's a reminder that even presidential backing doesn't guarantee a smooth ride in American mining. But with copper heading toward structural deficits and prices likely to follow, they'll keep pushing. A project this size is worth the political theatre.

Trump Loads the Energy Cannons

If Trump’s been loud on copper, he’s been even louder on energy. His “Unleashing American Energy” order is a green light for faster permitting and bigger cheques for domestic supply.

This week there were reports the administration is looking at redirecting US$2 billion from the CHIPS Act into critical minerals. The plan would shift funds meant for semiconductors into mining, dodging the need for new approval from Congress.

And in Nevada, plans are moving ahead for the first strategic minerals reserve at the Hawthorne Army Depot. A public-private venture will stockpile, refine and recycle the metals Washington doesn’t want to rely on China for.

The message is that if it’s critical, the US wants it dug and stored on home soil.

America throwing money and politics at its own supply chains puts more value on safe supply elsewhere, and Australia sits right in that slipstream.

For Australian miners with US projects, or those looking to supply American refiners, this is the friendliest policy environment in decades.

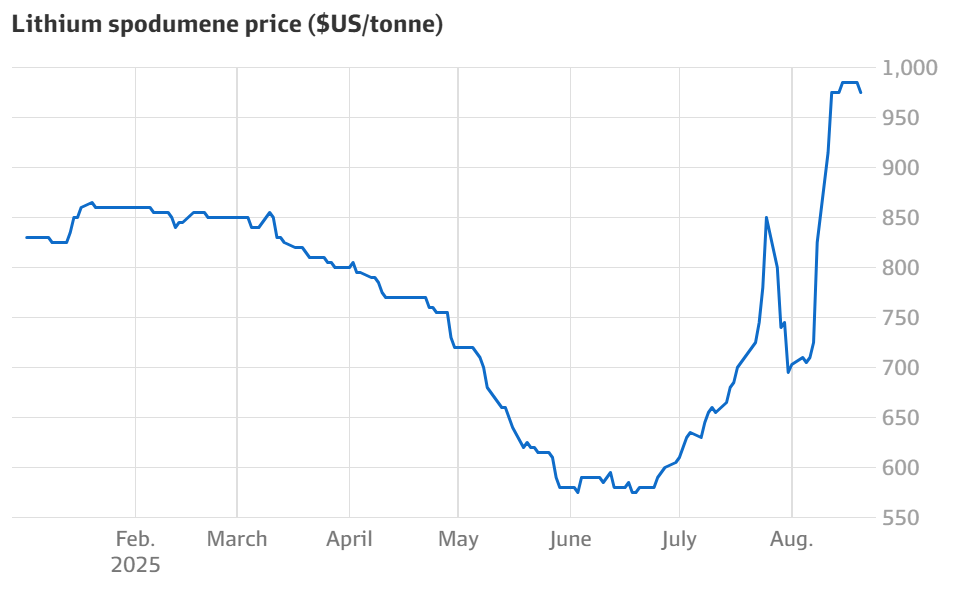

Lithium Prices May Have Peaked for 2025

Following a rapid rebound in early 2025, analysts are now warning that the lithium price surge may have already peaked. Sorry, lithium bulls.

Spot spodumene prices have climbed nearly 30% since January - a big bounce driven by some Chinese supply hiccups and a brief EV demand spike. But that might be as good as it gets for 2025.

The bears have solid reasoning, with multiple forecasts now expecting a softening into Q4:

Chinese operations that shut when prices tanked are firing back up, adding downward pressure.

Global EV demand growth is slowing from early-2025 highs, particularly in the US and Europe.

Inventory levels across major refiners are building, suggesting recent price support may not hold through year-end.

If you're still holding lithium positions, buckle up. This sector might not be done with its wild rides yet.

NST Takeover Rumours That Won't Go Away

Northern Star Resources (ASX: NST) can't shake the takeover tag. This week reports surfaced that Agnico Eagle Mines, the Canadian gold heavyweight, is sniffing around a potential acquisition.

We first mentioned the rumour in our Diggers & Dealers wrap two weeks ago. Now they're getting louder.

Market chatter suggests preliminary discussions may have taken place, though neither company has confirmed anything. Standard stuff - nobody usually admits to talking until there's ink on paper.

The logic is easy enough to see. NST runs high-grade, long-life operations with exploration upside. A deal would instantly strengthen Agnico's presence in Australia at a time when gold's printing money.

NST just posted a more than doubling of net profit year-on-year, thanks to higher realised gold prices, bumping its dividend up 40% for those that hold.

Analysts note that this strong performance may drive management to hold firm on valuation, which could then price Agnico out of any takeover.

If Agnico does make a play on the ASX’s largest gold producer, keep an eye on other gold producers. Nothing gets M&A moving like the first big domino falling.

The Wrap

If nothing else, the week proved the ASX can still outdo itself for drama. 9,000 points looks remarkable on the chart, but it’s the chaos underneath that can make this market worth watching.

It also showed how politics, policy and speculation can swing prices as much as drill results or quarterly numbers. Small-caps live in that space, where stories hit first and fundamentals can take their time to catch up.

And it’s not slowing down. Plenty of eyes will be on the theatre of KLR re-opening on Monday, while the broader market should rally in the wake of the US Fed’s hint at interest rate cuts.

Local fireworks meeting global currents is a mix that can turn sentiment quickly. After a week of copper theatre, lithium wobbles and gold whispers, the noise isn’t easing.

The job is picking what matters.