Weekly Wrap: Volume Returns, Apple Gets Magnetic and BUS Hits a Six

Speculative energy returns to small caps, Apple pours cash into rare earths and a familiar name from our stocks to watch eBook is back in play

Markets showed some energy this week, and small-caps had a bit more bite - enough to get people asking if things are finally turning.

Commodities mostly held their ground, macro noise softened, and speculative volume picked up across a few corners of the ASX. Small-caps felt more active than they have in months.

News was sold into, a new CEO for a major, Apple jumped into the mining game, and there’s a stock relisting Monday that deserves a spot on your watch list.

Here's what caught our attention:

Bubalus hits gold in every hole

KoBold's DRC move stirs fresh concern for AVZ holders

Simon Trott takes the reins at Rio Tinto

Apple drops US$500 million on rare earths at Mountain Pass

CBH returns as BHM, with serious Broken Hill assets

Bubalus: All Gold, No Glory (yet)

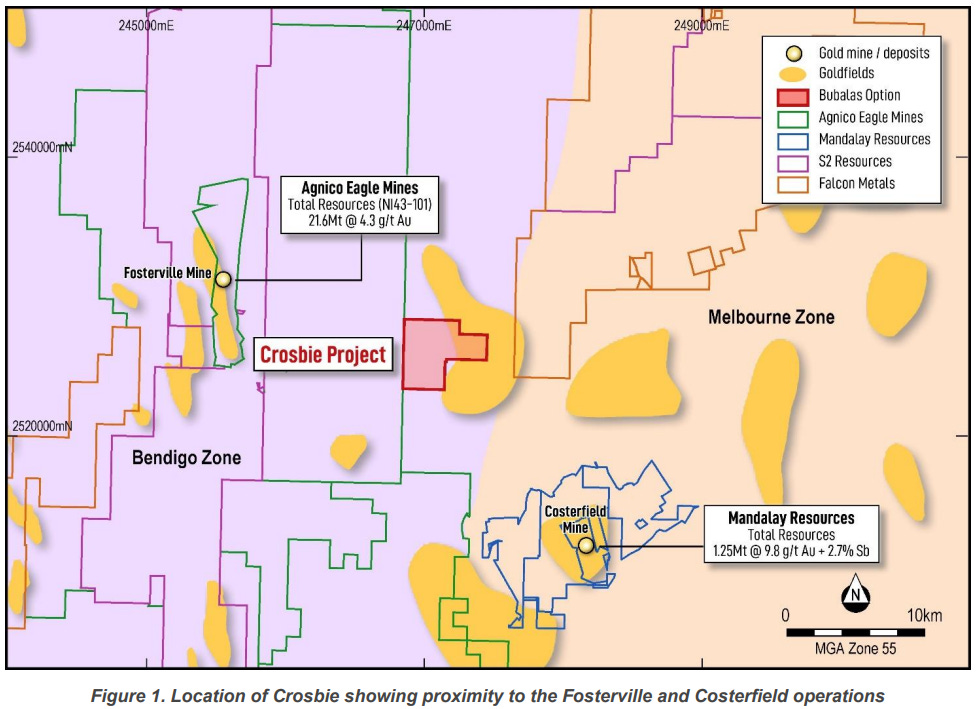

Bubalus Resources (ASX: BUS) dropped results from its maiden Victorian drill program this week and delivered gold intercepts in all six holes drilled at Crosbie South.

The mineral system looks live, with pathfinders backing up the narrow gold hits. The standout was 0.2m at 50g/t gold, while broader zones like 6m at 1.2g/t added structure and scale.

For a first pass over an untested target, hitting gold in every hole was encouraging.

Still, the market sold into the news. Volume was light, and gold’s soft finish didn’t help sentiment. Bubalus closed Friday at 9.6c, down 4% for the week.

That leaves BUS trading on a $6 million valuation, with $4 million still in the bank and two more high-impact drill programs due this year at Crosbie North and Avon Plains.

In our view, the downside looks limited. Victorian gold remains one of the highest-value per-ounce hunting grounds on the ASX, and BUS has plenty of ammunition left.

KoBold in the Congo: More Confusion Near Manono

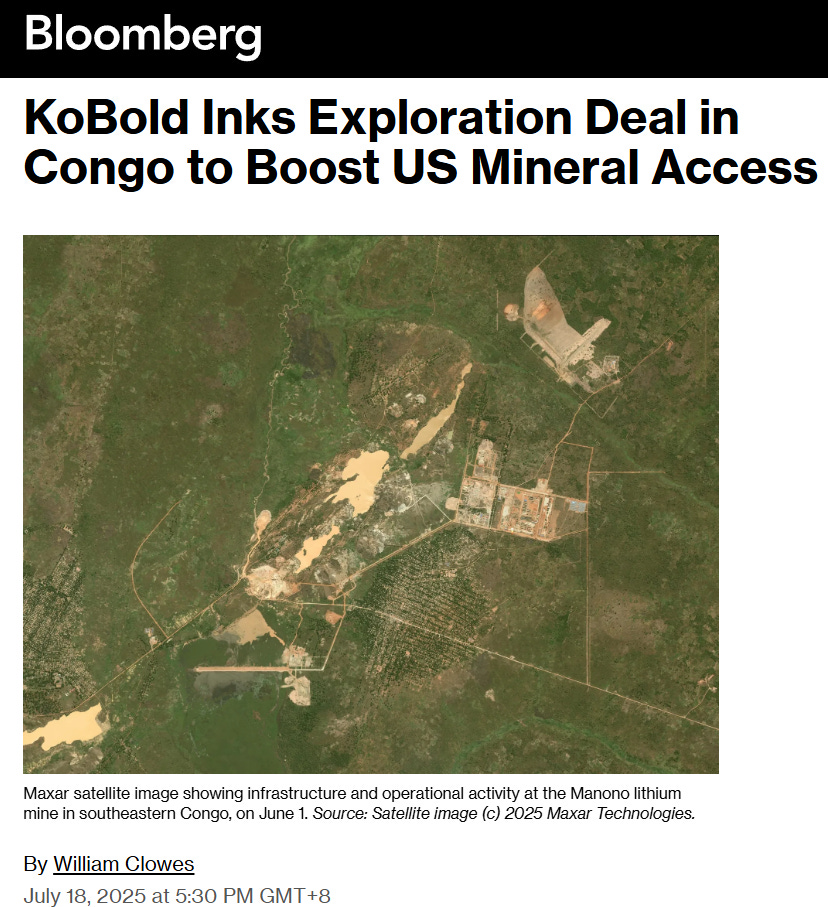

KoBold Metals dropped a bombshell this week that might have raised the blood pressure of some AVZ shareholders.

The billion-dollar US startup (backed by big names like Breakthrough Energy Ventures) announced a $150 million exploration deal in the DRC. The problem is it's with Cominière, the same state-run entity that's at the centre of AVZ’s legal dispute over Manono.

For context, AVZ shareholders have endured years of uncertainty since trading was suspended in May 2022. The company is pursuing international arbitration against the DRC through the World Bank-backed ICSID framework, claiming unlawful seizure of its 75% stake in what's considered one of the world's largest hard rock lithium deposits.

While KoBold hasn't confirmed precise tenement boundaries, the market's treating this as a serious escalation in the contest for Manono control. The deal may include areas adjacent to, or overlapping with, the disputed lithium project.

AVZ shareholders are all too familiar with the deals and alleged influence Cominière has within the DRC.

For AVZ holders, this is a surprising development given previous talks between AVZ and KoBold. It highlights just how complex and fragile this situation is.

It's another twist in what's already been a gruelling few years for shareholders.

KoBold’s move adds another layer to an already tangled picture. If KoBold does move forward with exploration, it could reshape how Manono’s future unfolds.

And only time will tell where AVZ sits within it all.

Meet the New Boss: Simon Trott Takes the Helm at Rio

Rio Tinto ended weeks of speculation this week by naming Simon Trott as its new Chief Executive, replacing Jakob Stausholm.

Trott's been with Rio for more than two decades, most recently running the iron ore division that keeps the Rio engine humming.

Trott’s resumé reads like a Rio greatest hits album with key roles across aluminium, bauxite and now, the top job.

He's widely regarded as measured and respected, with the operational chops to navigate challenges without unnecessary drama.

His appointment signals a likely continuation of Rio’s current strategy: optimise what it already owns, avoid unnecessary headline risk, and keep optionality open on tier-1 growth.

For shareholders, we see it as a net positive. Trott’s appointment is likely aimed at cementing Rio’s position as a cash generator, rather than a dealmaker chasing headlines.

Apple Drops Half a Billion on Rare Earths

Apple dropped US$500 million on rare earths this week, which tells you everything about how seriously they're taking supply chain security these days.

The money’s going to MP Materials, which runs the Mountain Pass rare earths mine in California.

Apple is keen on control of its entire supply chain from digging up ore to manufacturing the magnets that go in everything from iPhones to AirPods to the Vision Pros we’ve never seen anyone wear.

Apple is now helping fund both ends of the pipeline, from ore to processing, with the goal of building a fully domestic magnet supply chain.

It’s a smart move considering China dominates over 80% of global rare earth processing, and geopolitical tensions have a habit of flaring up at inconvenient times.

The sector now has a massive vote of confidence from the world's most valuable company. Expect renewed attention on ASX-listed rare earth plays, especially those with proven metallurgy and realistic paths to production.

Our eBook Pick: Back to Broken Hill: CBH becomes BHM

We featured Coolabah Metals (ASX:CBH) in our 2025 stocks to watch eBook, and this Monday it returns to trading with fresh assets and a new name: Broken Hill Mines (ASX: BHM).

The company's picked up the Rasp and Pinnacles mines, raised $20 million and positioned itself as a near-term producer in one of Australia's most historically rich silver-lead-zinc provinces.

Post-relisting, BHM will have a $94 million market cap. More importantly, it inherits a modern 750,000tpa processing facility, high-grade underground resources, and a skilled workforce that actually lives in town (which matters more than you'd think).

With silver prices ripping, this is one worth keeping on the radar from day one.

The Wrap

This was the week momentum started returning to small-caps.

Volume improved, announcement quality lifted, and several companies put meaningful news in front of the market. Not every result got the reception it deserved, but there’s a sense the market is warming up again.

Cash on the sidelines is starting to peek out. It's a reminder of how fast things can move when the pieces align. The back half of 2025 might just start early.

Here’s to a big week ahead.