Mining's New Energy: What We Saw at IMARC

From major copper discoveries to packed presentation halls, IMARC was buzzing. Our latest investment AZ9 perfectly captured the changing mood - here's what we saw on the ground

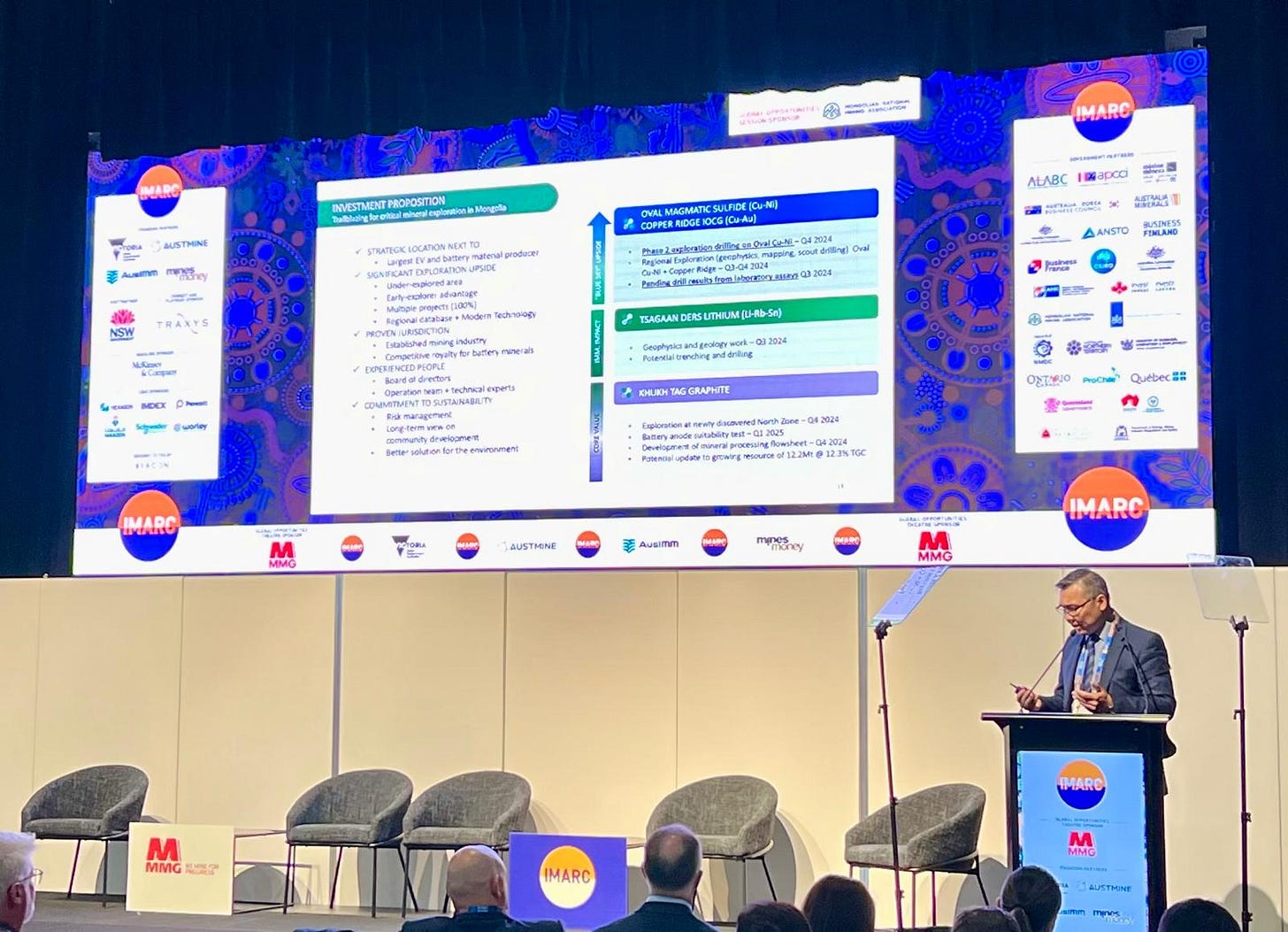

Talk about perfect timing. Our new portfolio addition, Asian Battery Metals (ASX: AZ9), announced a major copper discovery on Monday, sending the stock up 79%. Two days later, Managing Director Gan-Ochir presented to a packed room at the International Mining and Resources Conference (IMARC), Australia's premier mining conference.

When we say large, we mean it. More than 9,000 delegates packed into 20,000 square metres of exhibition space in Sydney. Fund managers, mining executives, and government officials from around the world, all gathering as copper shortages dominate industry discussions.

Against this backdrop, AZ9 couldn't have picked a better time to drop world-class copper grades.

The timing feels significant. The mood at IMARC was different this year. After months of quiet capital markets and cautious investors, the buzz is back. Meeting rooms were full, presentation halls packed, and for the first time in a while, junior miners had a spring in their step.

Inside IMARC 2024

IMARC is where governments from resource-rich nations come to showcase their mining potential and attract investment. Officials from France, Chile, Canada, Mongolia, Finland, Slovakia, Peru, and more graced the conference.

The conference program features nine concurrent conferences covering the entire mining value chain, with more than 370 technical talks, panel discussions, and strategic keynote presentations throughout the three days.

The Mongolian delegation, in particular, was making a strong impression. With their Mining Minister leading the charge, they were promoting the country's stable investment environment and vast mineral wealth. This focus on government support and resource nationalism caught our attention, especially given AZ9's promising discovery in Mongolia.

Asian Battery Metals: Three Reasons Our Confidence Grew

Fund managers, mining executives and investors were lining up to speak with Gan-Ochir about the Oval discovery.

After watching his presentation and spending time with the team, three things stood out to us that investors would be excited to hear.:

1. AZ9 will keep the momentum going

AZ9 are full steam ahead at their Oval discovery. EM survey results are due in the coming weeks, followed by more drilling as soon as possible.

Instead of splitting focus, management is redirecting funds from other projects to Oval - a strong sign of confidence in what they've found.

With a result like AZ9's, Gan was quick to point out the importance of the EM survey and how it will guide the upcoming drill program. We appreciate this measured approach and realise, as shareholders, that it helps manage cash flow while continuing.

We're expecting a steady flow of news over the coming months. With the Oval discovery open in nearly all directions and an estimated 800m of strike length, the potential upside here is enormous. Every new drill hole could deliver another share price catalyst.

2. Management that Matters

Gan-Ochir is a seasoned mining veteran with an intimate knowledge of Mongolia's mining sector.

Before joining AZ9, Gan-Ochir sat on the board of Rio Tinto's US $12 billion Oyu Tolgoi copper mine, representing Mongolia's government. But it's not just his connections that impressed us. In our chat, he broke down everything from drill core angles to government policies with the kind of depth that only comes from years in-country. The guy knows his stuff.

Gan-Ochir effortlessly fielded our questions about the Oval discovery's geology, the current mining framework in Mongolia, and the broader copper shortage. His deep understanding of both the technical and commercial aspects of the project instilled further confidence in AZ9's leadership.

We walked away from our discussions more confident than we anticipated. Hearing Gan-Ochir present, seeing him speak with government officials at length, and answering all our questions was more than we expected.

3. Mongolia is Open for Business

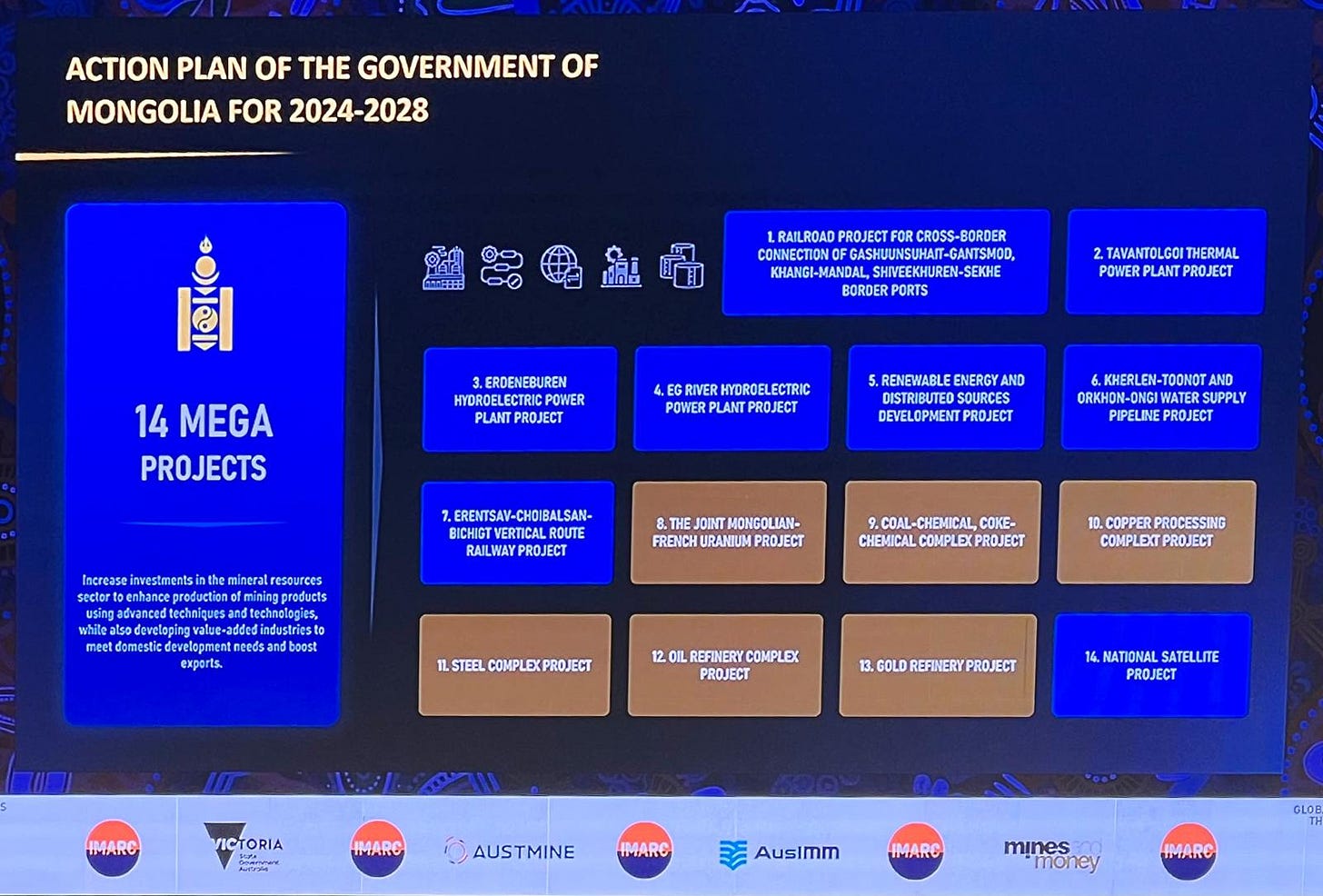

When Mongolia's Minister of Industry and Mineral Resources, Tuvaan Ts, addressed IMARC, the room was packed. For good reason - this is a roughly $31 billion economy where mining drives nearly a third of GDP. The sector also accounts for 94% of the country's export revenue and 82% of direct foreign investment.

These are incredible numbers, and they give confidence that the Government understands the crucial role mining plays in its economy. It's courting international partners to develop its vast mineral wealth.

This supportive environment, coupled with Mongolia's strategic location bordering China (the world's largest copper consumer), creates a compelling case for investment in the country's mining sector.

We were also encouraged to learn that Mongolia has its sights on 14 mega-projects in the country, from increasing the power grid to maximising the beneficiation of raw materials. This is all music to an investor's ears.

For AZ9 shareholders, this matters. Major infrastructure development reduces future capital costs and accelerates project timelines. When your host country is this committed to mining success, it’s a big leg-up. Mongolia is laying the groundwork for its next mining boom.

The energy at IMARC told us something's changing. Governments are realising the need to cut red tape and attract investment, investors are hunting opportunities, and after a long quiet spell, the sector's waking up.

Our discussions with the AZ9 team were fantastic and reinforced our belief that we've backed a winner. Strong management, government support, and a looming copper shortage — AZ9 has it all. Sometimes, you need to be in the room to feel the energy, and this week, AZ9 certainly had it.

We also used the conference to speak with many government officials, helping us formulate a plan for our next investment, whenever that may be.

We'll keep readers up to date with all our investments. We expect a busy time ahead with drilling on all fronts. Feel free to share this with anyone who might find our articles interesting. We want to take everyone on the mining journey.

It’s an exciting time to be an investor, and we look forward to a big 2024 year-end.