AZ9's Big Drill: Phase 3 Goes Deep at Oval

Fresh off a $4M capital raise, AZ9 launches a 1,500m drilling campaign targeting the source of their world-class copper-nickel hits, with results due in May

The hunt for Mongolia's next copper monster is back on. Asian Battery Metals (ASX: AZ9) has fired up the drill rigs at their Oval project, kicking off a crucial Phase 3 drilling campaign that could reveal just how big this discovery might be.

After pulling some of the highest-grade copper-nickel hits seen globally in 2024, AZ9 isn't wasting time. Fresh from banking $4 million in new capital, they're drilling deeper to chase the source of those massive sulphides that got the market's attention last year.

This round of drilling is designed to test deeper high-grade copper-nickel massive sulphide anomalies to find the source of previous world-class results in late 2024. AZ9 anticipates a speedy turnaround with results due in May.

AZ9 is a small-cap stock at 4.1c, and if this drilling proves successful in confirming deeper mineralisation, we suspect this copper-nickel play won't stay small for long.

Building on Exceptional Discoveries

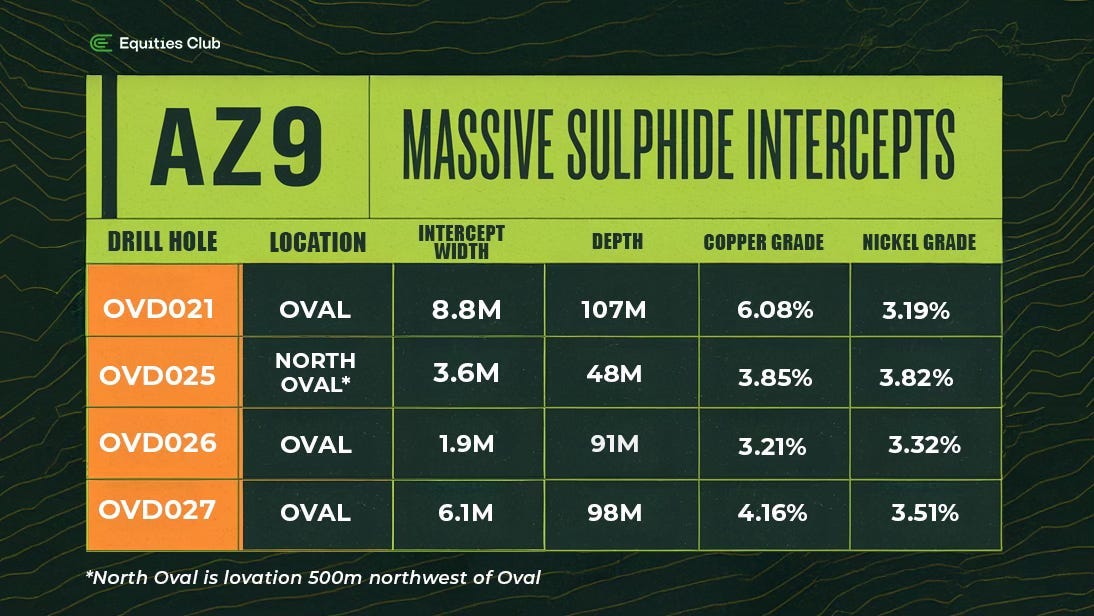

AZ9's 2024 drilling campaigns at Oval knocked it out of the park, delivering multiple high-grade copper-nickel intercepts crowned by a world-class discovery hole intersecting 8.8m @ 6.08% Copper and 3.19% Nickel from just 107m.

Further drilling expanded the mineralised footprint 500m northwest of the discovery hole, confirming the continuity of these high-grade zones across the Oval gabbroic intrusion to the aptly named North Oval.

What makes these discoveries particularly impressive is their consistency. Every massive sulphide intersection to date has returned grades above 3% for both copper and nickel - the kind of numbers that typically get major mining companies paying attention.

AZ9's methodical approach is paying dividends - they've now proven the Oval Project hosts multiple massive sulphide zones, with mineralisation remaining open at depth and along strike. That's explorer-speak for "we haven't found the edges yet."

Phase 3 Drilling: Expanding the High-Grade System

The Phase 3 campaign ramps things up with 1,500 metres of precision diamond drilling, backed by Downhole Electromagnetic (DHEM) surveys on all new drill holes - essentially giving AZ9 an underground radar system to track those rich sulphide zones.

The program will focus on:

Step-out drilling targeting potential extensions of the mineralised system.

Deep drilling (~550m) beneath the southern Oval gabbroic intrusion to investigate a gravity inversion anomaly that may indicate a larger source of mineralisation.

More drilling in high-priority zones to further understand known mineralisation.

Assessing potential feeder zones that may be controlling the distribution of high-grade sulphide mineralisation.

Testing unexamined and modified DHEM conductive plates in the Oval and North Oval areas.

Comparing geophysical anomalies with previous drilling results to refine future exploration targets.

Drilling operations are expected to run through late April 2025, with the first of the assay results anticipated by May 2025.

Beyond the drilling, AZ9 is beefing up their exploration toolkit with high-resolution gravity and ground-based EM surveys. It's a smart play as these advanced geophysical techniques can spot mineral-rich zones that might otherwise be missed by drilling alone.

The company is upgrading their gravity survey from a 100m x 100m grid to a much more detailed 25m x 25m grid, dramatically improving their ability to pinpoint exactly where those high-grade deposits might be hiding.

“We are excited to launch the Phase 3 drilling program at Oval, following the exceptional results achieved last year. With a fully funded program and a clear strategy to test deeper extensions and new targets”

- Asian Battery Metals’ Managing Director, Gan-Ochir Zunduisuren

Technical Insights: Why This Drilling Matters

AZ9's Phase 3 drilling aims straight at the heart of what controls these exceptional grades. Understanding the structural framework could unlock the full potential of the Oval system.

Copper-nickel deposits of this calibre typically form when molten rock cools and traps metal-rich fluids in pockets, where they solidify into valuable mineral deposits. AZ9 is targeting these potential traps where the richest mineralisation might accumulate.

The exciting part is that the presence of multiple high-conductivity DHEM plates suggests that Oval may contain additional mineralised zones beyond what has been drilled so far.

The Phase 3 program will also target a high-gravity anomaly at depth, which could represent a deeper accumulation of sulphide-rich material. This is what every company hopes to find, the ‘motherlode’ at depth.

A significant hit in this deeper drilling could send AZ9's valuation north in a hurry. Connecting these near-surface high-grade zones to a larger system at depth would turn Oval from an exciting prospect into a potentially company-making asset.

Early shareholders would likely find their patience well rewarded.

Metallurgical Test Work Underway

While the drills turn in Mongolia, AZ9 has samples being tested at ALS Metallurgy in Perth to assess recovery rates for copper, nickel, and PGE metals.

Many investors overlook metallurgical test work, but it's a crucial step that determines how efficiently metals can be extracted from the ore. It directly impacts the project's economic viability and future development potential.

One thing investors must know is that good Mets can help a project significantly, bad Mets can kill one quickly. We look forward to results in the coming months.

A Catalyst-Rich 2025 for AZ9

Ongoing drilling through to May 2025

Initial assay results expected in May 2025

Metallurgical test results anticipated in Q3 2025

Each new phase of drilling brings AZ9 closer to defining what could be a significant copper-nickel resource at Oval. The systematic approach they've taken so far has consistently delivered results worth watching.

As with any exploration story, there are no guarantees. But the quality and consistency of results from Oval so far provide solid reasons for optimism. Let’s hope this continues and the company can find the source of its world-class results to date.