BUS Fires up the Drill as Gold Smashes $3,600

$7m market cap explorer Bubalus Resources kicks off triple gold program in Fosterville's backyard.

Bubalus Resources (ASX: BUS) is about to drill its Crosbie North gold-antimony prospect, just as gold smashes through US$3,600 and Goldman Sachs starts talking about US$5,000 per ounce.

The company has been quietly building a portfolio of drill targets across Victoria's proven goldfields, and Crosbie North is first cab off the rank.

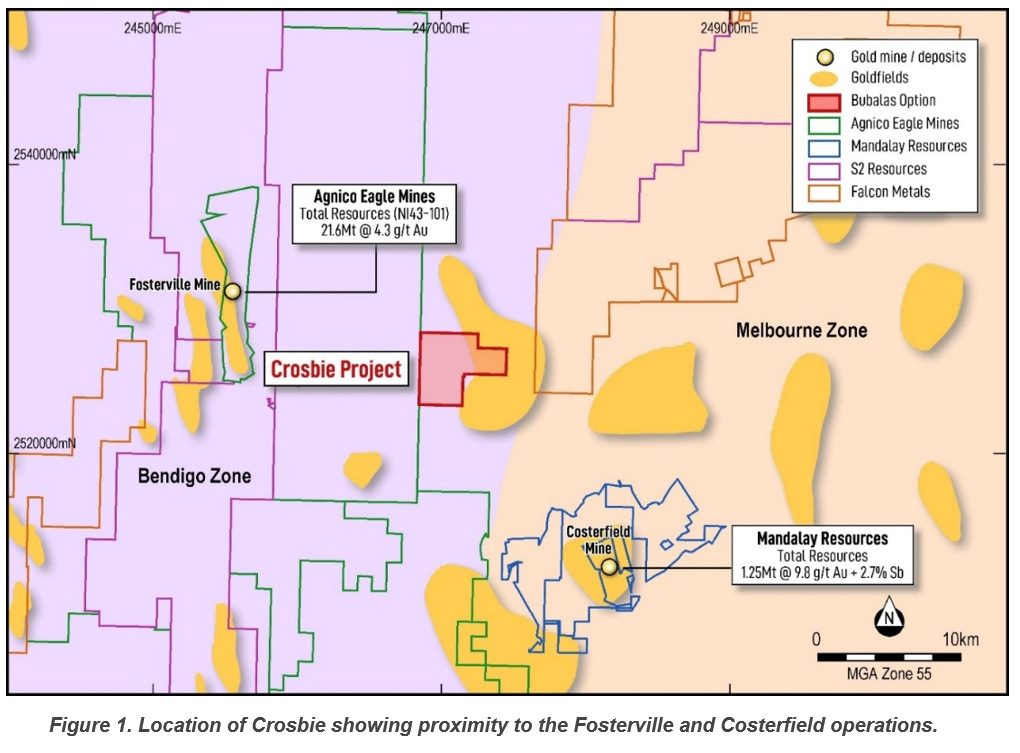

Crosbie North sits just 15 kilometres from Fosterville, one of Australia’s most successful, high-grade, low-cost gold mines.

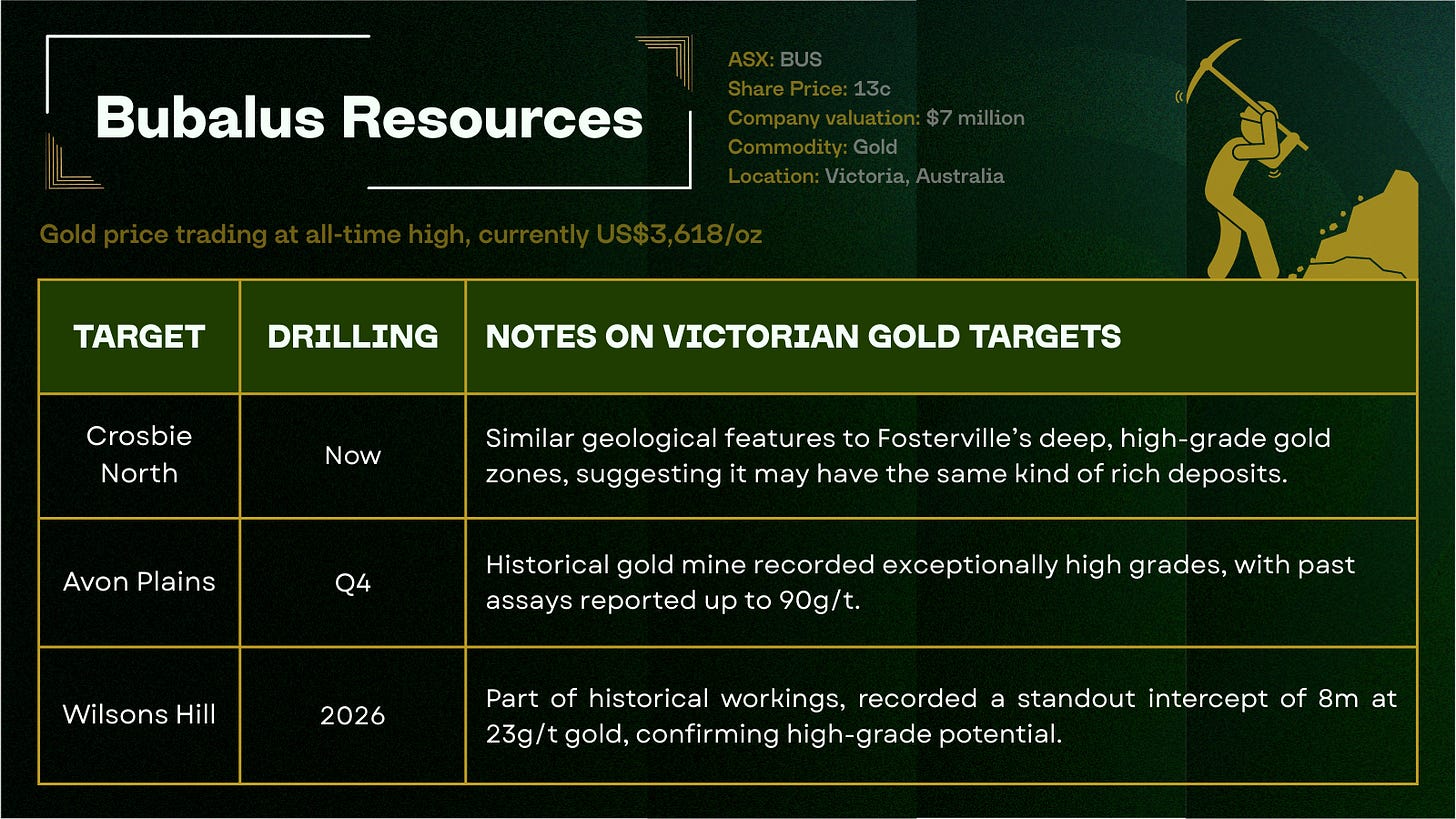

BUS is trading at 13c with a market cap of $7 million and nearly $4 million in cash. That cash will fund this program and leaves room to roll into Avon Plains and Wilson’s Hill.

BUS has multiple targets lined up across Victoria, and if any one of them delivers the goods, the share price could look rather silly in hindsight.

First up is Crosbie North, where the geophysics has lit up some interesting targets.

Crosbie North: Why We Like It

BUS kicks off about 1,000 metres of diamond drilling across seven holes at Crosbie North next week.

They’ll be testing high-priority targets defined by a recent Induced Polarisation (IP) survey, which helped BUS zero in on the spots most likely to hold gold.

The IP work revealed strong electrical anomalies in folded and faulted sedimentary rocks - the same geological structures that host Fosterville's Eagle and Swan zones, which are renowned for their ultra-high-grade gold.

Surface sampling has also delivered, with rock chips returning up to 12.1 g/t gold and 2.02% antimony sitting directly above these underground targets(always a promising sign when the surface hints match what's happening below).

Fosterville became one of Australia’s most successful gold mines by tapping into deep, high-grade zones formed when gold-rich fluids moved through cracks in the rock.

Bubalus is now testing that same geological set-up at Crosbie North.

Next Up: Avon Plains and Wilson’s Hill

BUS has been quietly lining up a pipeline of projects that would make most gold small-caps jealous.

In Q4, BUS plans to drill the historic Avon Plains, where miners in the 1890s pulled grades above 30 g/t from shallow workings, until water management became too much to handle.

The old-timers eventually threw in the towel when flooding kept drowning their shafts, which is a problem that modern drilling easily solves.

BUS also intends to advance Wilson’s Hill, another historical high-grade gold mine that hasn’t had modern techniques applied to it for more than 40 years.

Previous drilling at Wilson’s delivered a standout hit of 8 metres at over 23 g/t gold, and those numbers have a way of demanding more follow-up work.

BUS is one of the most aggressive gold juniors on the ASX right now with three drill-ready catalysts in quick succession and a steady run of news to come.

The Market Backdrop: Gold Goes Vertical

Gold has been on an absolute tear lately, driven by everything from central banks loading up their vaults to investors getting nervous about pretty much everything (insert your preferred global crisis here).

Global investors are losing confidence in the US dollar, while central banks are diversifying away from US treasuries, and private vault operators are reporting unprecedented demand.

It’s fortuitous timing for a gold-focused small-cap about to drill in a market that pays attention to anything that looks like it might host high-grade mineralisation in a proven district.

Exploration success in the small-cap space is seeing companies go from tiny valuations into the hundreds of millions very quickly. Capital is flowing back into gold juniors capable of defining new ounces in proven areas.

This is where the opportunity lies for BUS, a small company valuation of only $7 million, drilling high-grade gold targets, and getting to work with multiple drill programs.

Shareholders won't have to wait long for results either, with first assays from Crosbie North expected back in November.

In Short

BUS has assembled multiple drill-ready targets in Victoria's proven goldfields, all while gold hits record highs and the market is on high alert for gold exploration success.

Crosbie North (next week), Avon Plains (Q4) and Wilson’s Hill all have high-grade history and modern technical work pointing to where the drills should go.

And BUS only needs one of the three to land meaningful intercepts.

At a $7 million market cap, BUS trades like most early-stage explorers, but most don't get to drill next door to Fosterville with this level of geological work already guiding the program.

Victoria's goldfields have a habit of rewarding companies that can actually deliver competent exploration programs, and the current gold price means even modest discoveries can get noticed quickly.

When a low market cap tightly-held explorer makes a high-impact discovery, small-cap investors who recognised the potential are often rewarded big time.

Bubalus is about to test that thesis, and the next few months will be critical.