How to Find Value in a Down Market

Our key criteria for uncovering value in a tough market, plus three ASX small-caps we believe are severely undervalued

Tough times don't last, tough people do. And let's be honest, this market's been testing our toughness lately. But here at Equities Club, we see a downturn as a chance to go bargain hunting.

At the moment it's easy to sit back and blame the market, but when it turns - and it will - will you be ready to pounce on potential winners?

Rest assured, we aren't sitting on our hands. We're dissecting small-cap companies, scrutinising their people, structure, and cash position to pinpoint where the real value lies.

In challenging markets, bargains often hide in plain sight. Share prices may dip below the last raise price or even the IPO price. But remember, markets like this offer a chance to build a position and hold your conviction.

Remember the COVID crash? The world felt like it was ending, and small-caps got hammered. But fast forward eighteen months, and the market was ripping. Rapid growth, sky-high returns - it was a wild ride. And that's the potential upside when this market finally turns.

Of course, hindsight is 20/20. The real question is: in a market like ours now, do you have the nerve to research, invest, and sit tight?

We've unearthed three companies with serious potential for when the market turns. We'll give you the names, tell you what we like about them, and let you decide if they're worth a spot in your portfolio.

These aren't guaranteed winners, but given our research, we like our chances.

What We’re Looking For

Bear markets represent opportunity.

It's rare to see company valuations plummet to the point where they're essentially backed by their cash reserves. But that's exactly what's happening in this market. And for the brave investor, this presents a chance for some potentially lucrative gains.

We're talking life-changing stuff here.

So, what should you be looking for in this market? We've boiled it down to three key factors:

Cash is King: The Cash Position and Enterprise Value (EV)

The cash position and enterprise value (EV) of a company are critical for any investor to know. When times are tough, you want to make sure the cash position of the company is strong.

Why? Because if a company needs to raise more funds now, it'll likely be at a steep discount. That means a flood of new shareholders getting in at a lower price than you. Not ideal.

Enterprise value is the company's value minus its cash position. Think of it like this: if a company is worth $10 million and has $5 million in the bank, its EV is $5 million.

This is an important metric to take note of.

If a company has a zero EV, it's essentially cash-backed (think a $4 million company with $4 million cash). The market is valuing its assets at zero. As soon as they start exploring or bring in an asset, watch that valuation climb.

Here's where it gets exciting. Invest in that $4 million company, and if it reaches a $10 million valuation, you've more than doubled your money. But it doesn't stop there. With the right asset and a market upswing, that $4 million company could become $40 million.

Suddenly, you're looking at a ten-bagger - a 1000% gain. Sounds like fantasy? When markets turn, these 'fantasies' can become reality.

Structure Matters

Now, imagine that same company has a tight share structure – meaning there aren't a ton of shares floating around. When good news hits and demand for those shares surges, the price can absolutely explode.

Take WA1 Resources, for instance. With a tight share structure, it rocketed from 20c to $20 on a world-class discovery.

Not every discovery will send shares to the moon, but it's simple supply and demand.

The key is finding companies with this tight structure. The fewer shares floating around, the better your chances of seeing that sustained upward trajectory we all dream about.

The People Behind the Curtain.

This can be the trickiest part of the equation. You're not just buying into a company, you're betting on people. Therefore, always look for the trifecta:

Management with a proven track record of making deals happen

Advisers who've been around the block (and then some)

A top 20 shareholder list that reads like a 'who's who' of deal-makers

It’s like backing a horse. You wouldn't bet on a nag running in its 11th maiden without a place. Same goes for investing. Look for management teams and advisors with a history of success.

What does success look like? It could be a recent asset sale, a major discovery, or someone like Brian Thomas at Lanthanein Resources, who orchestrated the sale of Azure for a cool $1 billion. That's the kind of experience you want.

When it comes to proven advisers, follow the money. Look to who put together the deal for the last round of 10-baggers. An easy way to do this is to analyse the top 20 shareholders of a company and see who owns a large number of shares.

You can take those names and search for what other deals they've been involved in.

It's not a guarantee, but just like in racing - winning form is good form.

Our top 3 under-the-radar picks

That's not a typo. It's incredible that FMR Resources has a negative EV. The company is worth less than its current cash position. No hidden debts, no smoke and mirrors - just a tough market doing its thing.

A few points to note:

FMR released an announcement this week about their copper project in Canada. With high-grade rock chip samples, you think the market would show this company some love, but crickets…for now.

They're sitting pretty with an asset in a tier-one location, a strong cash position, and a solid top-20 shareholder base.

Fresh off a re-listing on the ASX, the top 20 shareholders provide a look at some serious names in the industry, known deal makers in our eyes. With a cheap valuation no doubt those names will be looking to replicate their past success.

When the market turns, a company like FMR could quickly go from a small valuation to multiples overnight.

If FMR is to get a similar valuation to other companies searching for copper in the same region in Canada, it could easily 10-bag from current levels.

It's just a matter of being patient and understanding that life-changing gains could be three, six, or even 12 months away.

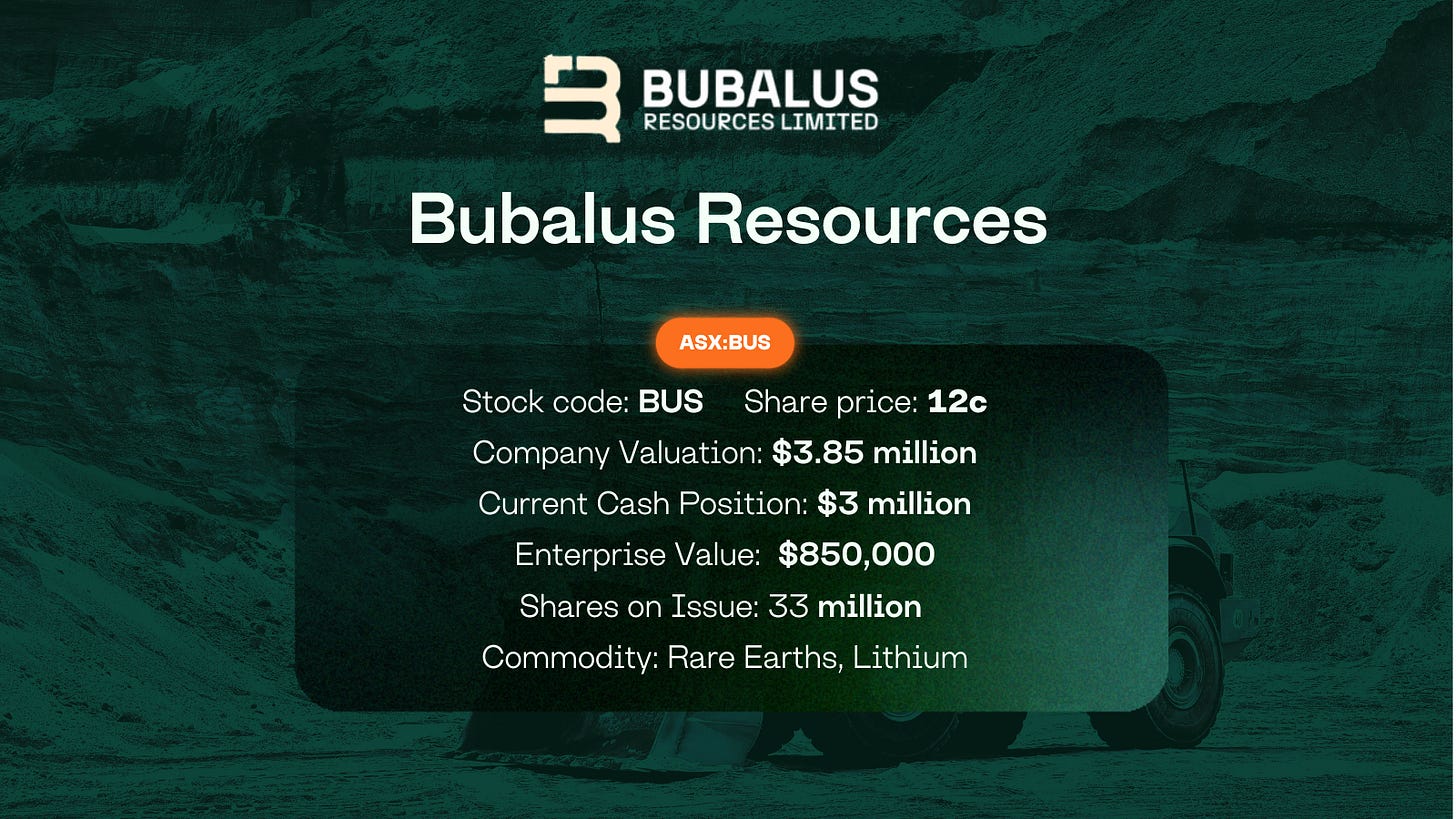

Another prime example of a tiny valuation with a strong cash position is Bubalus Resources, BUS represents an entry into an Australian-based explorer with a large potential upside.

Here's why BUS is on our radar:

It's an Aussie explorer with a tiny market cap compared to its potential.

With only 33 million shares on issue, any good news could potentially send this stock substantially higher.

With a current share price of only 12c and with two assets based in Australia next door to billion-dollar companies, the potential for significant gains when the market turns certainly applies here.

BUS isn't just asset-rich and cash-strong, they also have a top 20 shareholder list that includes numerous deal-making brokers from around Australia.

We won't name names, but we like the look of the top 20 shareholders of BUS. They have proven experience and are more than likely to replicate it.

Laybyrinth Resources shows precisely what a company can do coming off a low base when the right project goes into a company.

Here's the LRL story in a nutshell:

In the past month, LRL has been up some 400% in an incredibly tough market.

Their recent acquisition of the Vivien Gold project in Western Australia. This move mean LRL is well and truly on its way to a ten-bagger for shareholders who got in at the lows.

A prime example of backing the management involved is LRL, which has proven management with gold experience from Northern Star Resources (NST), and buying on the lows could represent a life-changing opportunity for investors.

While LRL's share register is a bit more crowded than FMR and BUS, the market's certainly not complaining. It now has a project that is valued by the market. LRL went from a $5 million valuation to over $20 million in a matter of weeks.

LRL shows us exactly what can happen when the right project lands in the lap of the right company at the right time. It's a reminder that even in tough markets, opportunities are out there - if you know where to look.

Research, Patience, and Potential

We know it's not easy. Sifting through countless companies takes time and effort. But remember, the rewards can be immense. Building a position in these undervalued companies now could pay off handsomely when the market turns.

Building a material position in these companies at low valuations can take weeks, if not months, as many will refuse to sell. However, if you are able to build such a position, it then becomes a game of patience in waiting for the market to turn.

During the boom time after COVID, we saw companies go on those booming life-changing gains, the ten-bagger. During these periods, turning a $10,000 investment into $100,000 is possible.

Not every company will have that ten-bagger run, so as always, we encourage our readers to do the research. Don't just take our word for it. Dive deep into your own research, scrutinise those financials, and get to know the teams behind these companies. Back the teams you believe in, and then hold steady.

In this market, we're all being forced to sharpen our tools and get back to basics. But remember, this hard work isn't just about surviving the downturn - it's about positioning yourself for the inevitable upturn.

Best of luck.