Our first pick: Five reasons we're backing this lithium explorer

Out of hundreds of ASX contenders, this is the one lithium explorer that made us pull the trigger. Here's why.

Today marks a milestone for Equities Club: our inaugural investment.

After countless hours kicking the tyres of hundreds of small-cap companies – scrutinising valuations, projects, pipelines, and the current market for all commodities – we’re thrilled to unveil our first investment: Lanthanein Resources (LNR).

We’ve had LNR on the watch list since March, pegging it here as a potential 10-bagger (1000% investment return).

“There's a lot to like about LNR. With lithium-bearing pegmatites that look to be running into LNR's tenements ... and with lithium sentiment turning, it could be a perfect storm.”

- Equities Club, March 5

A month later, they announced a massive lithium anomaly dubbed GODZILLA, sending the share price soaring 43% that day.

We reached out to the LNR team to learn more about their vision and were impressed by their ambitious plans and commitment to having drills turning soon.

We’ve put our money where our mouth is: the Equities Club team has been buying LNR stock on-market for the past week.

Beyond our investment, Lanthanein Resources has engaged us to provide regular updates as they embark on their maiden lithium drilling campaign. We'll be meeting with management regularly to ensure our readers stay up to date.

The top 5 reasons we chose LNR

1. Could history repeat?

We look at LNR and think this could be KDR 2.0. For those unfamiliar with KDR (Kidman Resources), they once owned the land next door to LNR’s tenement.

They, too, were a small exploration company valued at approximately $27 million when they drilled for lithium back in 2016, a fruitful decision that changed the course of history for them.

KDR went from a $27 mil company in April 2016 to $250 mil by October 2016 on the back of successful drilling, a near tenfold increase. Three years later, they were bought out for more than $880 million.

LNR is starting at a very similar position to KDR in 2016, only cheaper, at a $10 million valuation. If they can replicate the drilling success KDR had, the share price is only going one way.

Now imagine being able to turn back the clock and buying stock at the start of the graphic above. This is what LNR now represents.

2. Lithium, it’s only going one way: UP

We'll say it straight: we think lithium prices have bottomed out. We’re firm believers in investing in a commodity when its price has taken a hit; it indicates to us that blue skies could be on the horizon.

This couldn't be truer than in the lithium space. We've seen the price belted the past 12 months, but from all the reading we do, we believe the only way is up.

Don’t believe us? That’s fine. Global Lithium Joe Lowry presented earlier this year in Singapore, and he gave some compelling reasons for optimism.

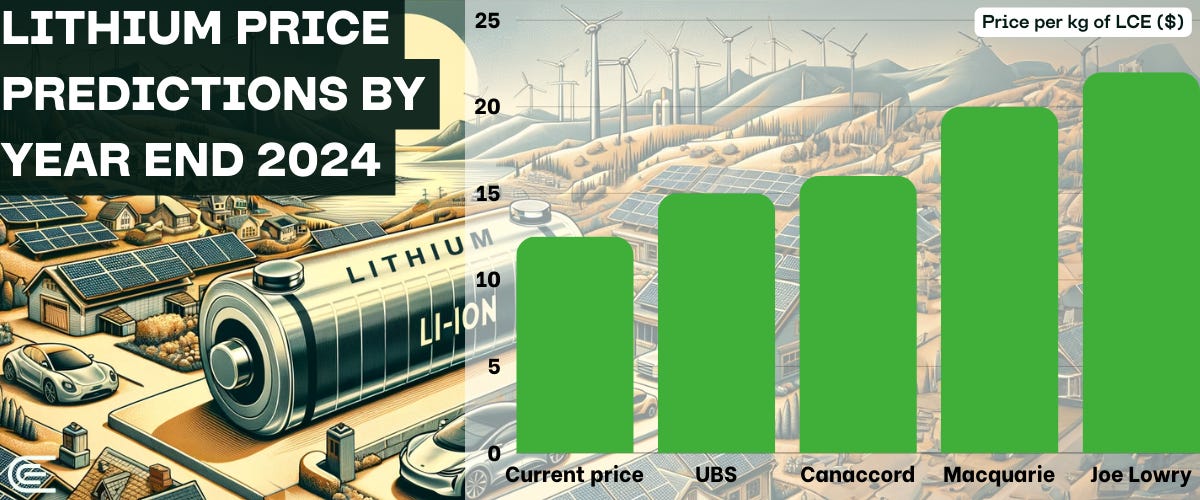

Heavyweights like Macquarie, UBS, and Canaccord are forecasting major gains-think 15% to 50% by year’s end. Joe’s even predicting lithium prices to hit $20/kg by December-a whopping 50% jump from today’s $13/kg.

If Lanthanein Resources strikes lithium paydirt while prices are surging, expect some serious fireworks in the share price.

3. The Godzilla Target

We’ve been keeping tabs on Lanthanein Resources since the RIU Explorers Conference back in February, but it was the Godzilla lithium target, announced in late April, that really turned our heads.

We believe Godzilla has the potential to catapult LNR to multiples of its current valuation upon a successful drilling campaign in the coming months.

A soil anomaly is an important exploration tool for helping to locate potential deposits beneath the surface. The Godzilla soil anomaly discovered by LNR measures a massive 4km in length and could be the start of something much bigger. Does a monster really lie underneath?

The best part is we won't have to wait long, as LNR is laser-focused on drilling this target ASAP. This aligns perfectly with our investment strategy: find a company with a potential game-changing target that's committed to drilling as soon as possible.

4. Huge world-class mine next door

Imagine LNR unearths a lithium behemoth when drilling shortly. The next logical questions are: Who’s going to develop it? And will someone take it out?

This is where LNR’s location couldn’t be better, it’s a stone’s throw away from the multi-billion dollar operating Mt Holland lithium mine.

This world-class asset was snapped up by SQM and Wesfarmers for more than $880 million three years after it was discovered, with another $2 billion poured in to get it up and running.

Why is this such a big deal for Lanthanein Resources?

Well, having an established mine next door means all the infrastructure – roads, power, water – is already in place. Increasing the likelihood of a takeover from the operating mine next door significantly.

5. The billion-dollar man: Brian Thomas

When we’re considering an investment, we don’t just look at the rocks – we look at the people behind the company. And LNR’s Technical Director, Brian Thomas, is a big reason we're confident in their potential.

If you’re not familiar with Brian, he was the Chairman of Azure Minerals, the Pilbara lithium explorer that recently sold for a staggering $1.7 billion. Straight from closing the Azure deal to cracking on with LNR.

Now, here’s where things get interesting. Azure was acquired by a joint venture that included none other than... SQM. The same SQM that co-owns the Mt Holland mine next door to LNR.

With Brian’s recent billion-dollar deal-making experience with SQM and LNR’s proximity to an SQM-owned mine, we reckon he’s the perfect person to get a deal done if LNR's drilling hits the mark.

This is true exploration - high-risk, high-reward territory. LNR’s ground has never been drilled before, so we strongly encourage all our readers to do their own research and carefully consider the risks involved in an exploration story like this.

For us, the combination of a massive target, a management team with a proven track record of closing billion-dollar lithium deals, and a rebounding lithium market was too good to ignore. That’s why we’ve been scooping up LNR shares over the past week and now hold just over 4.5 million.

Of course, if we see significant price appreciation in the lead-up to drilling, we’ll be de-risking some of our position and encourage all investors to assess their own situation.

We’re excited to bring you along on Lanthanein’s journey over the coming months. We’ll be meeting with management regularly to keep you in the loop with all the latest developments. And if Godzilla does turn out to be lurking beneath the surface, we’ll be celebrating right alongside you.

—