TEE Snaps Up More Prime Kansas Hydrogen Acres

Top End Energy aggressively expands its footprint in America's hottest hydrogen region by 25%. Landowners are fielding multiple offers as competition heats up in Kansas.

The land grab for Kansas’ hydrogen-rich territory is heating up, and Top End Energy (ASX: TEE) just made a major move by expanding its lease holding by 25% to 25,000 acres at its Serpentine natural hydrogen project.

The rush to secure prime acreage in Kansas is accelerating, with some of the biggest names in energy and private capital moving in fast.

Bill Gates, Jeff Bezos, Twiggy Forrest, Mitsubishi and Osaka Gas have all placed their bets here. TEE's expanded footprint places it at the centre of what will be a multi-billion-dollar market.

It's not just the land size that's increasing for TEE; the company is starting to attract market attention, and institutional funds are beginning to take notice.

The Best Part of Kansas

Discovering natural hydrogen follows the same playbook as conventional gas - you hunt where geology stacks the odds of making a discovery in your favour.

Kansas, known for its deep subsurface structures, sits at the heart of America's natural hydrogen potential.

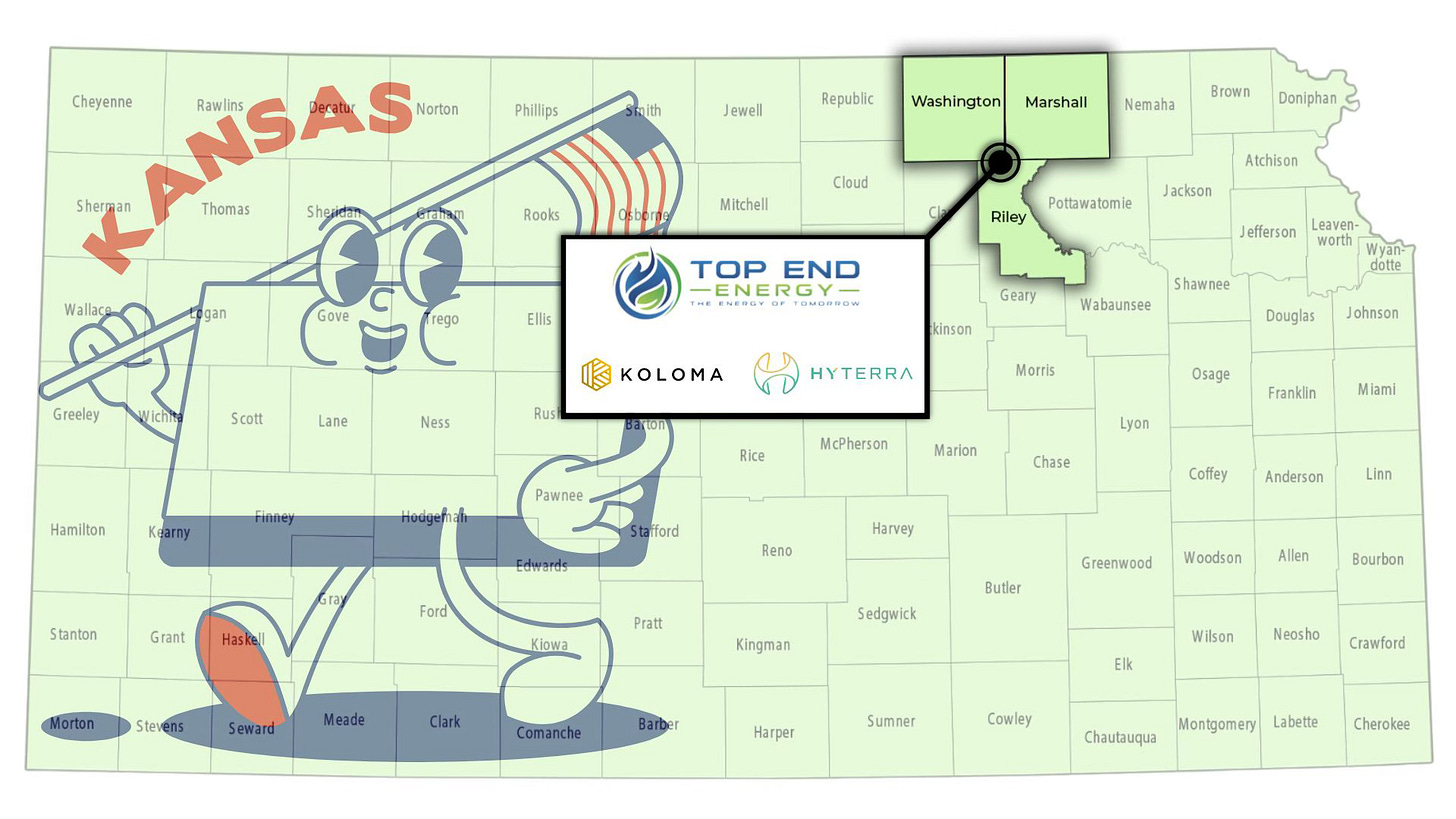

From today’s announcement and our discussions with management, we understand TEE's expansion strategy focuses on three key counties: Marshall, Riley, and Washington.

Here's what sets these counties apart from the rest:

What's in the ground

The region houses extensive paleo-reservoirs underground - ancient rock formations that have locked in fluids and gases since their formation. These structures suggest that hydrogen could be similarly trapped and accumulated.

Natural traps and sealing formations

Unlike other areas where gas escapes, these counties have a natural advantage, thick caprock layers that trap hydrogen underground. Think of it as a sealed environment, increasing the likelihood of significant hydrogen deposits.

Decades of data

Marshall, Riley, and Washington counties have been drilling for oil and gas since the early 1900s.

Decades of drilling have mapped out the underground structures in detail. All that historical data now proves invaluable - showing exactly where gas gets trapped and which formations hold it best.

Past drilling teams kept finding unexpected gas pockets they couldn't explain. Those mystery gases might well have been hydrogen all along.

Proximity to energy infrastructure

Unlike most hydrogen projects in remote locations, these counties already have everything needed to get moving - pipelines, power, and processing facilities all in place. The region sits right next to major industrial hubs too. When production starts, TEE won't have to ship hydrogen across the country to find buyers.

Active hydrogen exploration and industry interest

Koloma's serious exploration work has turned heads in the region. When backers like Bill Gates start moving in, you know the potential is real. The natural hydrogen sector is just warming up, and TEE has locked down prime real estate right in the middle of the action.

With HyTerra (ASX:HYT) set to drill nearby and Koloma's exploration program already underway, the region's potential is drawing serious attention.

These counties tick every box: the right rocks making hydrogen, proven seals keeping it trapped, decades of exploration data, and all the infrastructure ready to go. The big names clearly see what TEE saw early - this region has everything needed for a major hydrogen hub.

Community engagement, local hiring, and equity investment in the company by landowners has built strong local support - a smart move by TEE as they position themselves in the region.

TEE’s 25,000-acre position now puts them at the heart of America's most promising hydrogen play. The company is aggressively expanding its footprint, targeting 30,000 acres by mid-2025.

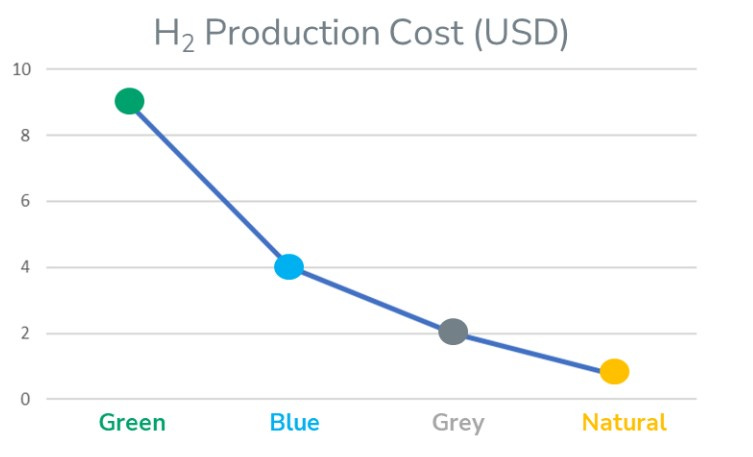

The Cost Advantage

Natural hydrogen stands apart in production costs. While green hydrogen producers spend $6-$8 per kilogram, natural hydrogen could be extracted for as little as $1.

Green hydrogen needs massive amounts of renewable energy and expensive electrolysis plants. Natural hydrogen just needs a well, as nature's already done the hard work underground.

TEE sits on prime real estate in America's hydrogen heartland, aiming to tap into one of the world's lowest-cost clean energy sources. The potential here should grab any investor's attention, and is why we nearly doubled our TEE holding buying on market earlier this month.

A Spot on the NaTH2 Index

TEE's recognition as a rising player in the natural hydrogen space was further solidified this week with its inclusion in the NaTH2 Index.

This index tracks the leading companies in the natural hydrogen sector, identifying key players shaping the future of hydrogen exploration and production.

For TEE, this puts them alongside the sector's established names. With growing institutional awareness, it will be firmly on the radar of major funds that are looking for clean energy investments.

Final Takeaways

Top End Energy's lease expansion has strengthened its position right alongside the biggest names in the industry.

The region has drawn serious capital - Bill Gates, Bezos, and Twiggy Forrest don't often end up in the same postcode by accident.

TEE's inclusion in the NaTH2 Index confirms its position as an emerging player, setting the stage for institutional interest.

Landowners in the region are fielding multiple lease offers, highlighting just how competitive the area has become.

With a target of 30,000 acres by mid-2025, TEE is building critical mass for its exploration plans.

Drilling and exploration are set for 2025, right when natural hydrogen looks set to hit its stride.

The land grab in Kansas is heating up, and TEE has carved out a serious chunk of the action.