Weekly Wrap: Directors Dump, Rio Walks, and Lithium Signs of Life

A week of directors bailing, majors walking, and lithium showing signs of life after years in the wilderness. And if the drill gods smile, December could get interesting

It was one of those weeks where the market gave you plenty to think about.

Every morning brought something new. A drill hit in Chile. Rio walking away from Serbia. Directors dumping their own stock. Then the Liberal Party binned net zero just to keep things interesting.

The big end of town wasn’t much steadier either. The ASX 200 hit a four-month low on Friday, wiping out $37 billion in a single session after the Fed started talking tough on US rates and our jobs numbers killed any chance of an RBA cut.

If you live in small-cap world like us, you had your hands full keeping up.

FMR Resources edging toward its main copper target with all the right signals

Fortuna Metals locking in $3.5 million and gearing up for a busy run of results

DroneShield diving after directors unload stock into weakness

Rio pulling the pin on its Jadar lithium project after years of pushback

Early signs lithium might be starting to wake up

ASIC launching legal action against AVZ directors

Big investment banks tipping higher oil demand

Renewables, gas and coal all thrown into the discussion as Coalition shifts its climate stance

BHP found liable over its role in the 2015 Brazil dam disaster

FMR’s Drill Hitting All the Right Notes in Chile

FMR Resources (ASX: FMR) delivered another strong drilling update this week, with the hole at Southern Porphyry now down to 1,200 metres and pulling up just what you’d hope to see when a company edges closer to a major copper system.

They’re now sitting in what’s called an alteration halo - basically the zone where hot fluids have cooked the rock above a porphyry. The drill’s hitting copper veins and altered rock that match their models perfectly, and when drilling and modelling tell the same story, it usually means you are heading in the right direction.

Drilling paused briefly for mechanical issues, but replacement gear’s already on the way. They’ll push through to the main target at 1,600 metres over the coming weeks, where things should get properly interesting.

Cameron Peacock joined the board this week too. He helped build Nickel Industries into the world’s largest listed pure-play nickel producer, so he knows how to take a discovery story to international investors.

The appointment further builds the credibility of an already impressive board of directors.

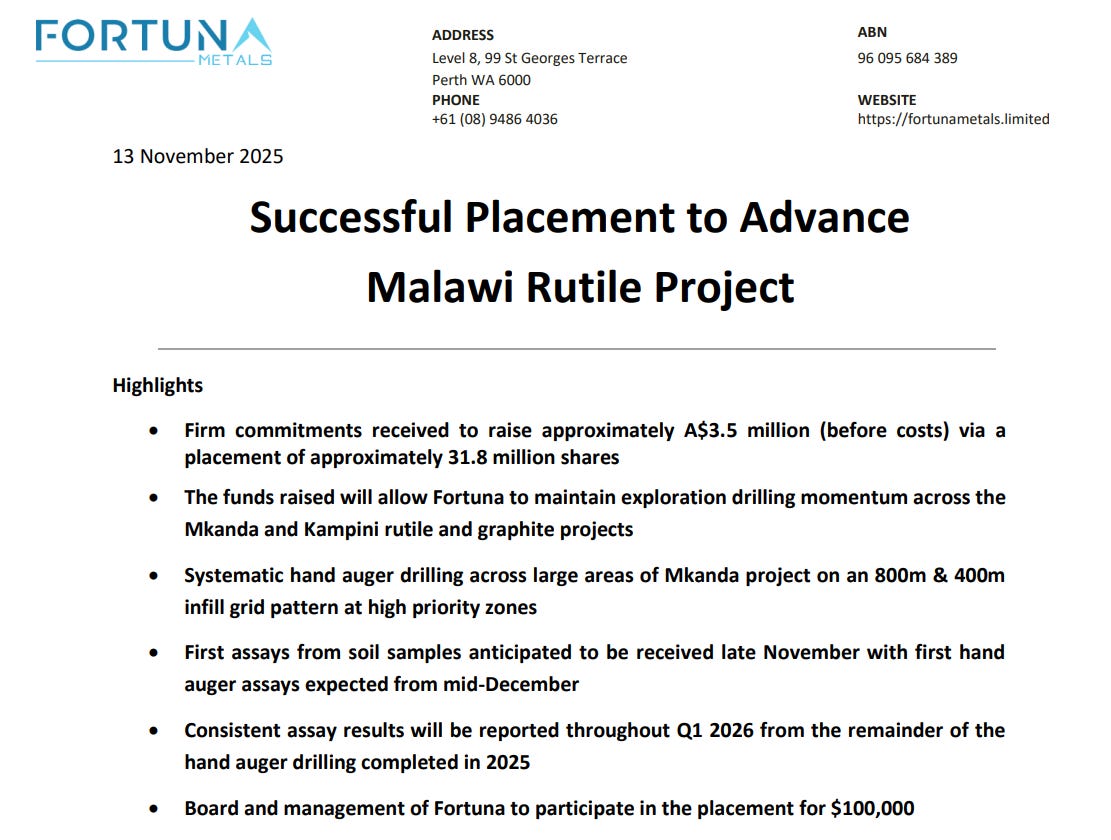

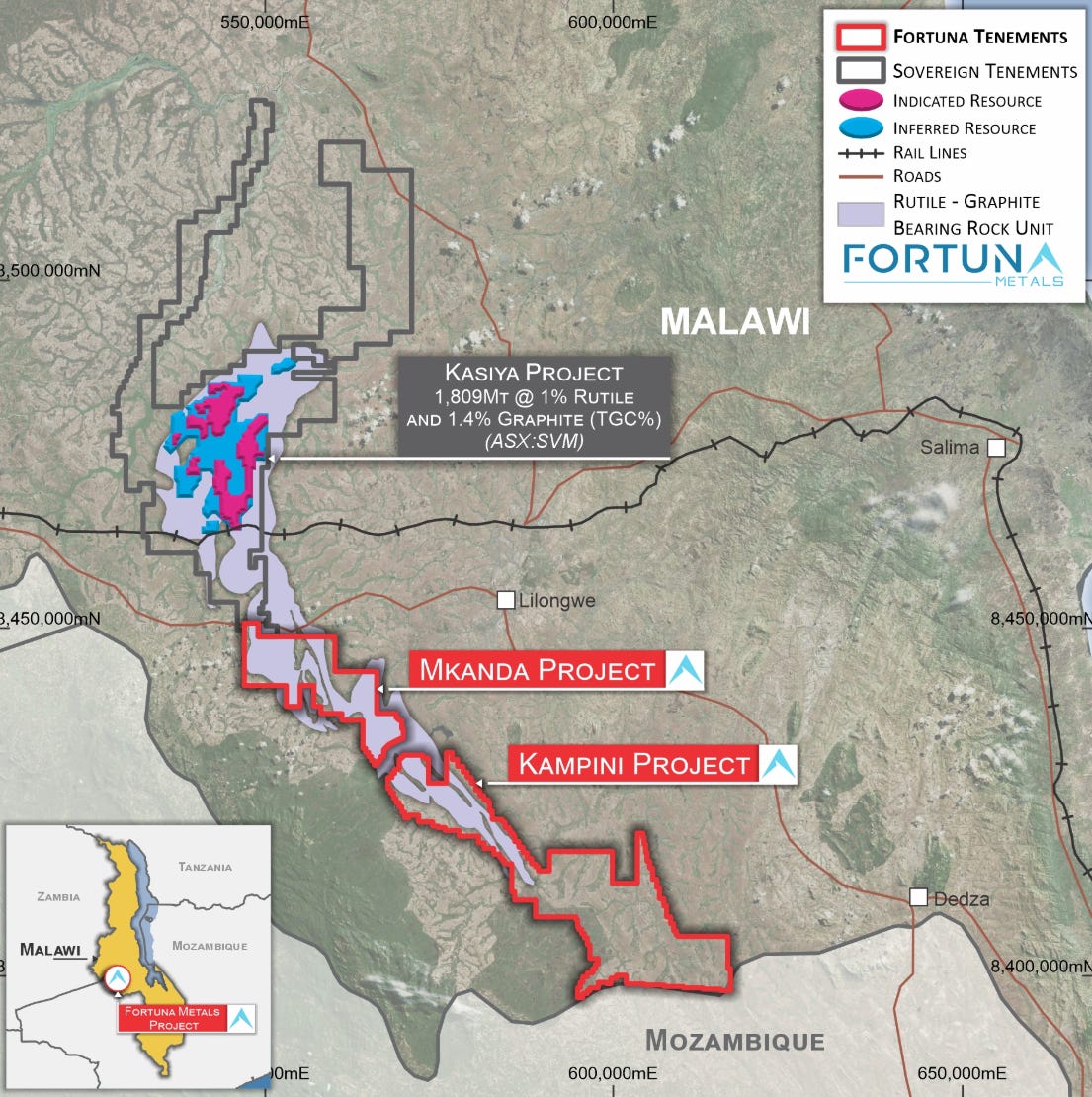

Fortuna Cashed up for the Foreseeable

Fortuna Metals (ASX: FUN) topped up the tank this week, raising $3.5 million to leave them with roughly $7.4 million in cash. It’s more than enough runway for a proper exploration program without coming back to market anytime soon.

The raise was oversubscribed, with directors also chipping in their own money, which usually tells you something. The board writing cheques ahead of a busy stretch of results tends to mean they like what they’re seeing.

Work’s already underway on the ground with hand auger drilling underway across broad grids at Mkanda and Kampini, zeroing in on the best targets while they build out scale and continuity.

Results should start flowing soon and keep coming through December into next year. Each set of results will help build the case for what FUN’s really sitting on.

FUN controls more than 650 square kilometres immediately south of Sovereign Metals’ (ASX: SVM) Kasiya deposit, the world’s largest rutile resource. FUN sits along the same geological trend but is trading at a fraction of Sovereign’s valuation.

With fresh cash, boots on the ground in-country and plenty of drilling ahead, FUN has what it needs to start closing that valuation gap. Now they just need the grades to cooperate.

DRO Board Sells Everything but Their Options

DroneShield (ASX: DRO) finished the week in damage control after directors unloaded almost all their ordinary shares on market, keeping only their options and leaving investors to wear the pain.

CEO Oleg Vornik set the tone by selling his entire shareholding, a cool $50 million worth, and the market’s response was understandably brutal - DRO dropped 31% for the week.

To make matters worse, directors sold right after the company had to clarify revenue timing on a major defence contract, which already had investors nervous about the near-term outlook.

Moves like this hit harder in small caps because alignment matters more than anything. When directors dump their real equity and keep only the upside, the market naturally asks whether the board has short-term confidence in the company.

The board trotted out the usual lines about planned trades and strong fundamentals, but not many were buying it. The stock’s more than halved since early October, and director selling only threw petrol on the fire.

Sentiment in the small-cap world lives and dies on trust, and whatever trust DRO’s board had with shareholders took a heavy blow this week.

Now the company has to deliver, and deliver quickly. Investors will want to see a clear reversal in momentum, otherwise it wouldn’t be surprising to see more investors follow the directors out the door.

Rio Kills $3.7 Billion Serbian Project After Years of Drama

Rio Tinto quietly pulled the pin on its US$3.7 billion Jadar lithium project in Serbia this week, officially blaming cost cuts, but most know the real story.

The project’s been a headache for Rio for years. Community protests, environmental campaigns, permit cancellations - even Novak Djokovic joined the pile-on at one point. Serbia couldn’t decide if it wanted to be a battery materials hub or keep its farmland pristine.

Rio’s decision sends a clear message to other mining jurisdictions: you may have all the commodities in the world, but if the locals, regulators and government aren’t on board, even the biggest miners will walk away.

Many in Serbia were hoping Jadar could put the country on the global lithium map. Instead, Rio has decided to take its money elsewhere.

Lithium Showing Signs of Life

There’s a faint pulse in the lithium sector after years on life support. Pilbara Minerals (ASX: PLS) jumped 27% this week, leading a rally that saw lithium stocks become the best performers on the ASX 200.

Early signs of a recovery popped up late last month when investment banks quietly lifted their long-term price forecasts. Then the AFR pointed out this week that battery storage is tipped to explode - energy storage systems expected to jump 45% in 2026, while EVs grow 26%.

There’s a few other shifts in lithium worth watching:

Banks are lifting forecasts with JP Morgan taking 2026/27 spodumene back towards US$1,300 a tonne. Big banks tend to only move long-term assumptions when the tone is shifting.

Energy-storage demand is exploding and expected to make up 30% of lithium demand by 2030. This alone pushes investment bank models into deficit.

A US House committee called out China for price manipulation, claiming Beijing pushes prices down every time they start recovering.

Western producers are sitting on their hands and refusing to restart mines until prices improve. So supply discipline is now back (but it likely won’t last forever).

None of the above guarantees a new boom, but it does feel like there are some green shoots starting to appear. Lithium has been struggling for a couple of years, and these are the kind of early signals you tend to see when a cycle starts to turn.

ASIC Turns up the Heat on AVZ Directors

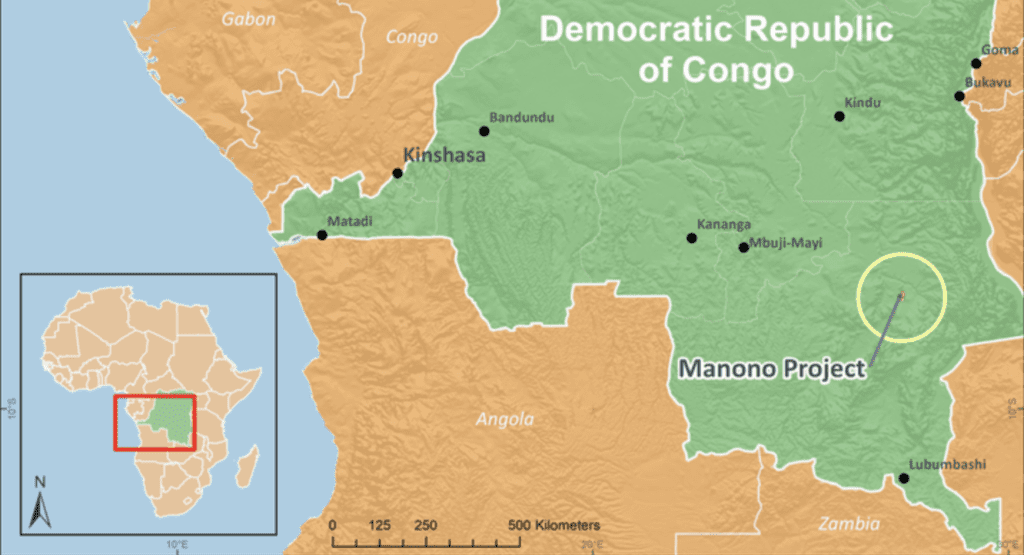

AVZ Minerals was once the lithium market’s golden child, the go-to play for a massive African hard-rock deposit. At its peak the company was worth $4.6 billion.

Manono looked like the project that could reshape the global lithium supply picture.

That feels like ancient history now. AVZ went into a trading halt in 2022, never came back, and was eventually delisted in 2024. Shareholders haven’t been able to trade a single share since.

And this week ASIC launched civil proceedings against directors over alleged continuous-disclosure failures.

The case centres on whether the company kept the market properly informed about ownership disputes and permitting dramas around Manono. Both issues have been at the heart of a messy legal fight in the DRC that’s dragged on for years.

Years of competing claims, shifting licences and political tension have already pushed development well beyond any realistic timeline. Now regulators are stepping in to pick apart the decision-making that happened during those critical periods.

For the 20,000-plus shareholders frozen since the 2022 halt, this is just another kick in the teeth. No clarity, no resolution, just more lawyers and more waiting.

The geology at Manono was never the problem, it’s a world-class deposit that could have been a company-maker. Instead, it’s become the poster child for why jurisdiction matters more than grade. When ownership, governance and politics collide, even the best resource in the world can’t save you.

Oil’s Not Dead: Banks and IEA Change Their Tune

The tone around oil shifted this week. After years of hearing about so-called peak oil, that narrative has faded and the investment banks are now leaning bullish.

Goldman Sachs is telling clients it remains one of the most attractive corners of the market, pushing producers as the smartest way to play what they reckon is a tighter market ahead.

Demand’s holding up better than expected, while OPEC remains disciplined with production cuts, and US shale isn’t growing fast enough to flood the market like it once did.

The IEA also dropped its latest World Energy Outlook this week with a message that would’ve been unthinkable not long ago. Oil and gas consumption could keep rising until 2050, hitting 113 million barrels a day under their ‘business-as-usual’ scenario.

LNG is expected to surge 50 per cent by 2030, driven by power demand from data centres and AI. Not exactly a backdrop where oil prices quietly trend lower.

Put it all together and the picture’s clear that the banks see value, the IEA sees structural demand, and supply growth isn’t the given it once was.

For investors, it suggests oil’s got a sturdier floor than most want to admit. While plenty are trying to distance themselves from fossil fuels, the upside is getting harder to ignore.

Libs Torch Net Zero

The Liberal Party has binned its net zero by 2050 commitment, a position first locked in under Scott Morrison and kept in place for a while under Peter Dutton.

After a marathon party room meeting that reportedly got heated, new leader Sussan Ley confirmed the Coalition would scrap Labor’s 43% emissions target and pivot its messaging towards gas, coal and whatever keeps energy costs down.

They’re staying in the Paris Agreement (for now), but the shift in tone is clear. This came about due to a mix of internal politics and a need to win back regional seats and reconnect with the base, not some grand rethink on climate economics.

Labor’s obviously still in charge and well ahead in the polls, so nothing changes immediately and the legislated emissions targets and renewable build-out continue. But the next Coalition government would almost certainly lean into fossil fuels, nuclear and a much slower energy transition.

That narrative shift alone could lift coal, gas and uranium plays on the small-cap end of the ASX, though the Libs are a fair way from power at the moment.

At the same time, global capital is still rewarding decarbonisation. Copper, nickel, lithium and rare earth developers will still attract money as long as the economics stack up.

For small-cap investors, it’s not about picking sides in the climate policy wars. Both energy systems need massive volumes of raw materials. The smart money backs whichever commodities have the strongest tailwind over the next cycle.

BHP Liable for 2015 Dam Collapse That Killed 19

The week ended with a bit of a jolt after a UK court ruled BHP liable for its role in the 2015 Fundão dam collapse in Brazil, the disaster that killed 19 people and destroyed entire communities along the Doce River.

It’s taken nearly a decade to get here, and now comes the part many have been waiting for - the fight over damages. More than 600,000 Brazilians have joined the claim, and the numbers being thrown around are eye-watering.

The damages trials will drag on into the late 2020s, with BHP saying it’ll appeal and pointing to compensation already paid through Brazilian channels, but that’s not going to make this go away.

Expect this to be a slow, grinding legal process that’ll hang over them for years. Courts are getting bolder about holding resource companies accountable when things go catastrophically wrong, and BHP just became the test case for that shift.

The Wrap

The market gave us plenty to chew on this week, but the common thread was momentum shifting back toward companies with real catalysts in front of them.

FMR is drilling into the section of the hole where things get very interesting, Fortuna is cashed up with results about to flow. Even lithium’s showing a pulse.

Not everything was roses though as DroneShield’s board torched investor trust with their stock dump, BHP got handed a ruling that’ll shadow them for years. Meanwhile, Rio walked away from Jadar after burning through patience and cash and AVZ is tied up in courts, again.

For small-cap investors, the next few weeks come down to one thing - delivery. We’re heading into silly season with drill results, assays and milestones stacking up across the portfolio. If even one of them hits properly, the market could hand out an early Christmas present.

Till next week.