Weekly Wrap: Forgotten Goldfields, On-Market Backing, and Albo's Election Call

Forgotten Victorian gold asset finds new owner, chairman puts $50k where his mouth is, and election battle lines are drawn in a week that sets the stage for a dynamic Q2

A big week across the junior explorer space. Commodity prices surged to fresh highs, a forgotten Victorian gold mine with remarkable historical grades found a new owner, and the federal election was called amid a flurry of budget promises that could reshape the sector.

April's always been good to us small-cap followers - something about this time of year just gets deals moving. Acquisitions are happening, fresh leadership is being backed with cold hard cash, and record metal prices create the perfect backdrop for exploration momentum.

Here's what we're unpacking this week:

Bubalus Resources (ASX:BUS) picked up a highly strategic asset in Victoria (Avon Plains).

Century-old newspaper reports suggest Avon Plains has serious untapped potential.

Top End Energy (ASX:TEE) named new CEO & its chair backed him with a $50k on-market purchase

Gold broke another record; copper continues to defy expectations

The federal election was called - what it means for miners, both now and next

Bubalus Resources Strikes Again - Avon Plains Acquisition

Bubalus Resources (ASX: BUS) added another piece to its Victorian gold puzzle this week. The $9 million market cap explorer secured an option over the historic Avon Plains Gold Mine right as gold prices pushed to fresh records.

The Avon Plains Gold project is a smart, low-cost acquisition that can redefine the valuation of a company. You can find our article on the acquisition here.

Avon Plains sits on the southern tip of the Bendigo Zone, 40km north of Stawell and 17km from the St Arnaud gold plant. Postcodes matter in Victorian gold exploration, and this one puts BUS in prime hunting ground.

The miners of the 1890s didn't leave because they ran out of gold - water flooding forced them to abandon operations. Modern pumps and drilling technology solve that century-old problem, potentially giving BUS access to deeper extensions of the gold-bearing quartz veins.

This part of Victoria has produced over 60 million ounces historically, and it's still highly prospective. We had a chat with MD Brendan Borg about what has him excited about the location.

The project comes with all the advantages of an established mining region - roads, processing options, and skilled workers nearby. Yet Avon Plains has somehow dodged modern exploration. We read more than a dozen historical reports documenting gold-rich quartz veins that have never been properly drill-tested at depth.

For a ~$9 million company to acquire a brownfields project with proven mineralisation that hasn't had a proper go in the modern era - that's exactly the kind of move that makes small-cap mining investing so interesting.

Avon Plains: What The History Books Tell Us

Equities Club reviewed more than a dozen historical reports on the Avon Plains Gold Mine. We dug deep into the archives and got VERY excited. Fair to say there was a lot:

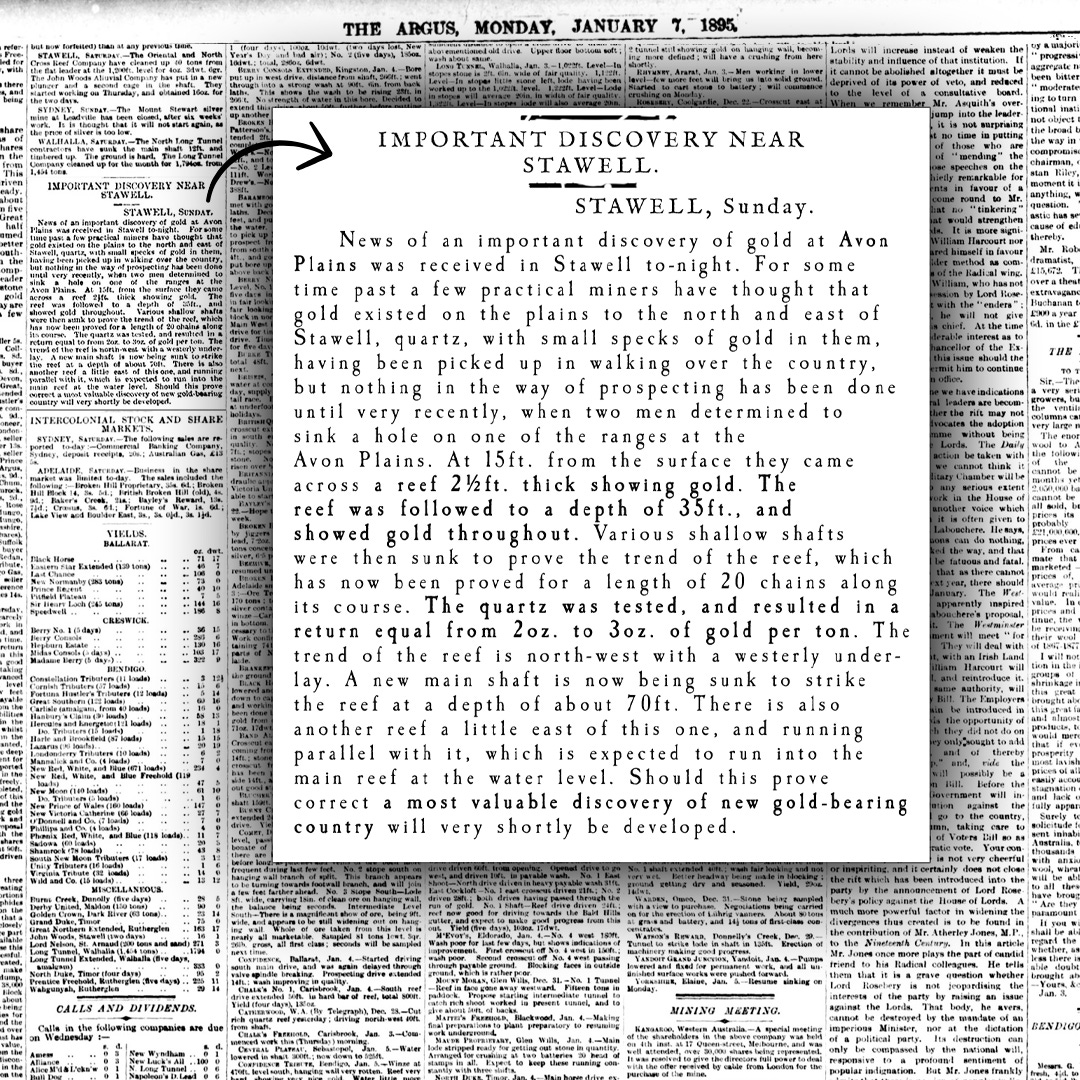

1895 - The Argus: "Quartz was tested and resulted in a return equal to 2oz. to 3oz. of gold per ton."

1901 - The Argus: "A parcel sent to the Ballarat School of Mines gave half an ounce to the ton.".

1902 - The Argus: "10 tons of stone for the Avon Plains Company yielded 3oz. 18dwt.”

1902 - The Riverine Herald: "Ten tons yielded 8dwt per ton from 36 feet."

1903 - The Age: "10 tons yielded 3oz. 18dwt. of smelted gold."

1903 - The Worker: "8dwt to the ton… the future of this mine will be assured."

1903 - The Argus: "6 tons from new surface find yielded 9dwt. 13gr. per ton."

1905 - The Argus: "Lode 3ft. wide, showing gold in dish prospects."

1905 - The Argus: "Preparing to start at 100ft. level lode 2ft. wide, strong underfoot."

1905 - The Argus: "Shaft to be sunk to 300ft, confident it will open up well at depth."

1906 - The Argus: "Undeveloped quartz field in the Pyrenees Belt."

1906- The Age: "Stone 2½ft. to 3ft. wide, prospects well."

1925 - George Walker: "Gold appeared at every stroke of the pick… crushing returned 9–10 dwt. per ton."

Now, we’re not saying every old newspaper report should be taken as gospel, but that's decades of scattered yet remarkably consistent reports pointing to high-grade quartz veins, untested depth, and a system abandoned due to water, not geology.

Combine this with a regional location that already has gold operations nearby, and Avon Plains begins to look less like a gamble and more like a sleeper opportunity.

Top End Energy: New CEO and a Show Of Faith

Top End Energy (ASX: TEE) appointed Luke Velterop as CEO this week, bringing serious natural hydrogen expertise to the helm at a critical time for the company.

Velterop brings the right mix of technical know-how and commercial experience. The founding director of Serpentine Energy and former COO at HyTerra has a geology background with more than a decade working across both traditional oil & gas and new energy projects.

He's spent years leading natural hydrogen initiatives in the United States - exactly the expertise TEE needs for its Kansas hydrogen play. And with approximately 10% of the company's shares already in his name, Velterop has plenty of skin in the game.

TEE chairman Patrick Burke clearly believes in the story. On the same day as Velterop's appointment, he bought 600,000 shares on-market for just over $48,000 - lifting his indirect holding to 1 million shares.

In a market where liquidity is thin and confidence is patchy, insider buying of this magnitude sends a signal. Both the new CEO and chairman now have meaningful personal capital at stake as TEE moves into its next growth phase.

The timing's interesting too. Natural hydrogen is starting to gather a bit of a following on the ASX. Gold Hydrogen (ASX: GHY) surged 36% this week amid hints at potential farm-out discussions, with the company's data room now open to partners. Natural hydrogen's still very early days, of course, but it's getting harder to ignore.

Gold Sets Records As Copper Surges Again

Another week, another record (for gold) with gold and copper both breaking key resistance levels.

Gold surged to new record highs, crossing USD $3,084/oz as its charge continued. Meanwhile, Goldman Sachs lifted its price target to USD $3,300/oz, suggesting we might be looking at a multi-year breakout if the Fed eases rates while all these geopolitical flare-ups continue simmering away.

Copper, meanwhile, continued its rally with fresh momentum. The red metal is predicted to touch $12,000/t this year, buoyed by tight inventories, ongoing strikes in South America, and growing optimism around Western-led electrification.

The gap between soaring metal prices and mining equities continues to widen. While commodity markets are running hot, many explorers and producers haven't yet caught the same bid. That disconnect rarely lasts - the money typically follows the metal.

Federal Election Called - First Take For Small-Caps

So Albo's finally called it - May 3rd it is. This sets up a five-week campaign where mining policy will factor heavily into both parties' pitches.

Most ordinary voters won't give mining policy a second thought, which is understandable when you're worried about grocery prices or mortgage repayments. But buried in the policy detail is plenty that'll matter to our corner of the market.

Albanese Government: The Budget

Labor's budget landed with a thud for some parts of the resources sector. The fine print reveals a mixed bag, but the resource sector got a few positive nods:

Critical minerals investment: A $4 billion fund will target midstream processing (such as lithium refineries) and value-add downstream industry to move Australia up the battery supply chain.

EPA expansion: Funding for environmental regulators is up again, with additional headcount to be deployed in high-impact areas. That could mean longer approval times and more stringent assessments.

Read between the lines, and Labor's vision becomes clear: a cleaner, more vertically integrated mining future that captures more value onshore. Noble goal, but that vision comes wrapped in enough red tape to decorate a Christmas tree. For junior explorers, the central challenge remains unchanged - getting timely approvals.

Dutton's Counter-Offer: Speed and Simplicity

Peter Dutton's budget reply painted a very different picture for miners. The opposition leader didn't hold back:

12-month approval guarantee: A commitment to fast-track mining and energy project approvals with a statutory 12-month cap. That could materially reduce pre-development timelines.

Critical minerals royalties cap: A promise to negotiate with states to cap royalties on new mineral projects to encourage investment and level the playing field.

The difference between the two parties is sharp. Labor's all about decarbonising and adding value at home (two worthy goals), while the Coalition wants to speed up approvals and unlock supply.

Small-cap explorers, particularly those bogged down in permitting purgatory, will be watching closely. A Coalition victory could dramatically shrink project timelines, making these stocks suddenly more attractive to impatient capital.

We’re not saying you should vote based on your portfolio (though plenty do), but it's definitely worth factoring into your investment thinking.

Those arcane policy details buried on page 94 of election manifestos can be what will determine which projects get funded, which sectors flourish, and which forgotten small-caps suddenly find themselves with institutional backing. And we’re keeping an eye on all of it.

Momentum Is Building

Bubalus' strategic grab in Victoria's gold country comes at the perfect moment. With both Avon Plains and Crosbie now in their portfolio, the company has multiple shots on goal in prime Victorian gold territory.

Historical newspaper reports pointing to grades up to 90 g/t at Avon Plains add another dimension to the story, while record gold prices provide an ideal backdrop for their upcoming April drilling campaign at Crosbie.

Brendan Borg's interview with us during the week at the bottom of this article gives a great overview of everything in the works at BUS and why their Victorian gold hunt is worth keeping an eye on.

Borg clearly knows his geology and laid out exactly why their approach deserves more attention.

Meanwhile, the commodity price surge continues unabated. Gold keeps pushing into record territory while copper charges toward levels not seen in years. That rubber band between metal prices and mining stocks can only stretch so far before it snaps back with a vengeance. When (not if) that happens, it'll be quite the show.

The upcoming election will have material implications for regulation, permitting, and funding. Staying attuned to these shifting political currents will be essential for identifying which companies stand to benefit most from policy changes.

All the ingredients for a cracking second quarter are in the mix. We'll be following these developments closely and keeping you updated as they unfold.

Talking about vertical integration which I 100% support, why doesn't Australia build out a Uranium Enriching industry? even if it captured 10% of the global market it would be of huge upside and benefit to the country. Before anyone asks, I have no industry knowledge or idea how to do it.