Weekly Wrap: TEE's Kansas Land Grab, AZ9's $4M War Chest & Copper's Perfect Storm

Energy and future electrification take prime position with natural hydrogen and copper dominating the headlines this week

There’s never a dull week in the commodities game.

Natural hydrogen projects continue to gain traction, and the copper price is making headlines for all the right reasons. Investors need to keep their ear to the ground as these shifts in demand and market dynamics present opportunities.

The big themes this week

TEE expands its hydrogen footprint in Kansas

Fleet Space and Koloma join forces

AZ9 now has funding to continue high-grade copper drilling.

We examine the copper price surge, what are BHP and China doing?

Now, let’s dive into the details.

TEE Expands in Kansas – What This Means for Hydrogen Exploration

This week, Top End Energy (ASX: TEE) snapped up more prime hydrogen real estate in Kansas, and investors should take note.

Kansas is fast becoming the hot spot for natural hydrogen thanks to its geological make-up and the land rush underway in the area. TEE knows this, and their expansion this week cements their growing footprint in the region.

TEE is betting big that Kansas will produce natural hydrogen for years to come. They've just increased their land holdings by 25% - going from 20,000 acres to 25,000 acres. That's a serious commitment to the region.

This aggressive land grab tells us something important - industry insiders believe Kansas could be among the first places where pulling natural hydrogen from the ground isn't just possible but makes commercial sense.

For investors watching the hydrogen space, TEE's moves matter. If their Kansas expansion hits pay dirt, it would validate what many are starting to believe - that natural hydrogen could be commercially extracted at scale.

TEE is clearly positioning itself ahead of the curve. In the resources game, getting in first often matters most, especially in what is shaping up as an exciting new energy frontier.

Fleet Space Joins Koloma in Natural Hydrogen Push

A significant development in the hydrogen sector came this week when Fleet Space partnered with Koloma, the Bill Gates billion-dollar-backed natural hydrogen startup.

Fleet Space brings serious tech to the table - their innovation in mineral exploration allows for rapid, high-resolution subsurface imaging that could dramatically speed up the hunt for natural hydrogen.

This deal leverages Fleet's satellite-based geophysical mapping technology to accelerate natural hydrogen discovery.

The timing is notable, given what we've seen with TEE. With TEE having secured 25,000 acres and looking to expand to 30,000 acres in prime Kansas territory, the land rush in this region is clearly heating up. With quality acreage being claimed quickly, Koloma and new entrants may have to pay up for remaining quality locations.

Koloma sits right next door to TEE's acreage in Kansas. This partnership shows that serious money is flowing into the region where Top End Energy has already established its position.

Investors should watch for initial exploration results in the coming months to gauge the results of this partnership. If the Fleetspace Koloma partnership is successful, it could open the floodgates for further land grabs across the USA.

AZ9 Gets Funds To Fuel Deeper Drilling

This week, Asian Battery Metals (ASX: AZ9) completed a $3.969 million heavily oversubscribed capital raise, indicating strong demand for this emerging copper play in Mongolia.

Previous drilling campaigns have already intercepted high-grade copper and nickel mineralisation. This fresh funding will allow them to drill deeper to locate the true source of these deposits.

With results like 8.8m at 6.08% copper and 3.19% nickel from 107m deep, we can understand the desire to drill to depth.

With AZ9 now fully funded for 2025, the deeper drilling campaign could unlock significant upside for investors if it confirms extensions of its existing high-grade hits.

If AZ9 can prove it has a large-scale copper-nickel system on its hands, it would attract the attention of major players in the industry. With copper prices on the rise, AZ9 is positioning itself at the right place, at the right time.

Copper Prices Surge – What’s Driving the Rally?

Copper had a strong run this week, with prices climbing over 5% at some points amid supply concerns and renewed demand optimism. With copper at $4.50+/lb and several factors helping its cause, we believe copper prices will rise through 2025.

The main drivers for this being:

BHP’s bullish stance – BHP reaffirmed its copper focus, highlighting a looming supply deficit and long-term demand growth from electrification.

China’s grip – The Chinese government has introduced new policies affecting copper smelting operations, leading to speculation about future supply constraints.

US tariff talk – Renewed discussion of Trump-era tariffs being reinstated, which could impact copper trade dynamics and drive price volatility.

Chilean supply disruption – A major power outage in Chile further squeezed supply.

What This Means for Investors:

The copper market is tightening, and major miners are preparing for a prolonged period of high prices. BHP, for example, has reaffirmed its commitment to expanding copper production, seeing strong demand ahead.

For junior explorers, this is positive. Projects with high-grade copper intercepts will likely attract more interest as supply constraints continue to bite.

The broader macro trends suggest that copper’s bull run is far from over. With China’s manufacturing sector rebounding, demand for copper is expected to strengthen further.

For companies like AZ9, which are actively drilling for high-grade copper, this environment is incredibly favourable. We say bring on that deeper drilling.

In Brief: Trump-Zelenskyy Minerals Deal Collapse

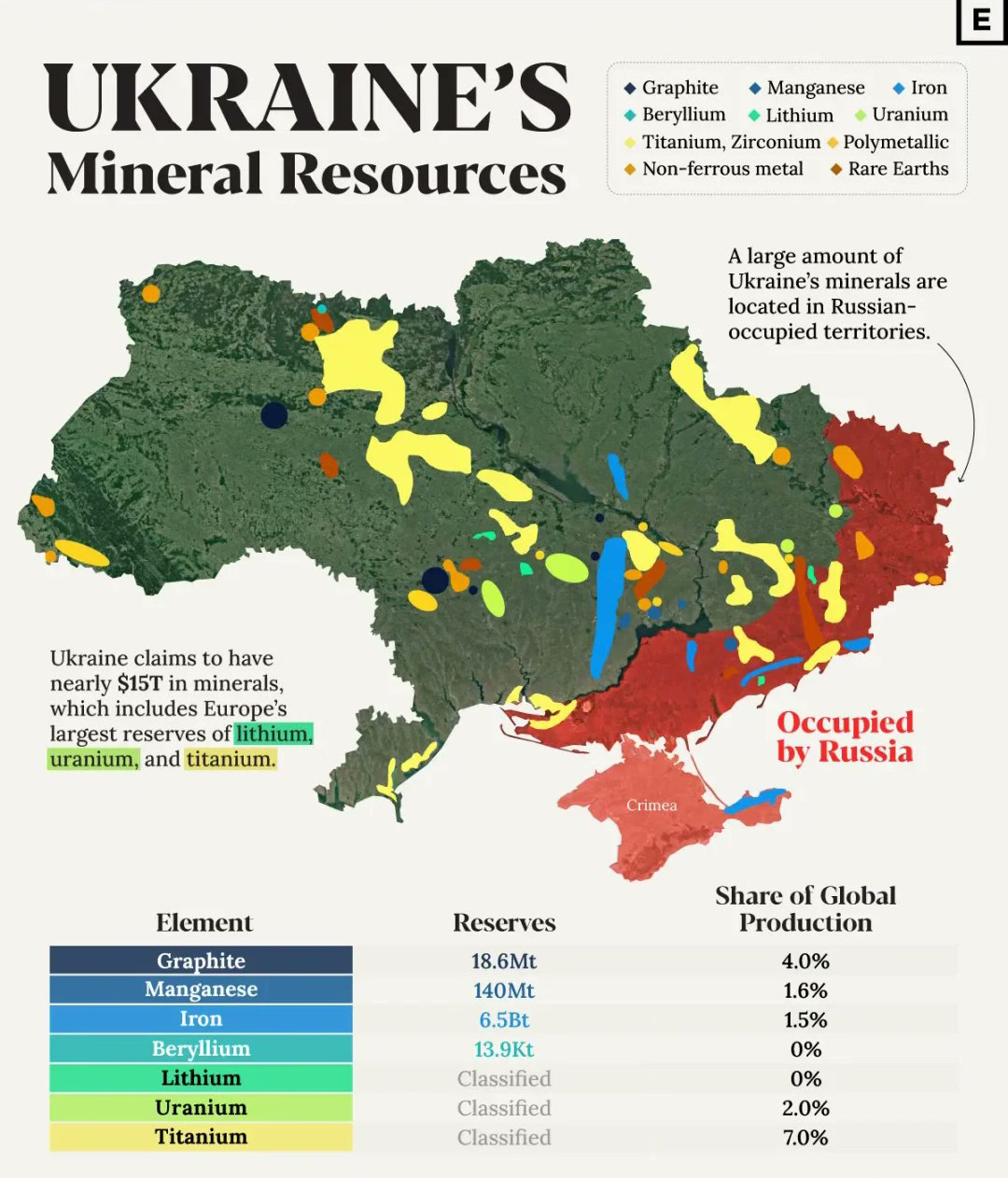

Talks in the Oval Office are usually a bit above our pay grade, but yesterday's dramatic clash between Donald Trump and Volodymyr Zelenskyy resulted in a scrapped critical minerals deal. The proposed agreement, which would have given the US access to Ukraine's estimated US$15 trillion in mineral wealth (including lithium, rare earths, and uranium) in exchange for security guarantees, fell apart during a heated exchange.

While these resources would have taken years to develop, and the deal may yet be revived, the very public fallout reinforces why politically stable mining jurisdictions like Australia remain attractive for critical minerals investment right now.

Final Thoughts

Our investments keep making noise for all the right reasons. It shows us that we’ve picked commodities that will be around for a long time to come.

Natural hydrogen might be the new kid on the block, but it's attracting serious attention - and serious money. While billionaires like Gates and Bezos pour cash into the sector, companies like TEE are quietly positioning themselves at ground zero. With global energy costs putting pressure on economies worldwide, natural hydrogen offers that rare combination of clean energy without the "green premium" price tag.

The copper story continues to gain momentum. As the world electrifies everything from cars to cooktops, we're facing a copper crunch few investors appreciate. We're simply not finding enough new deposits to meet demand. We firmly believe the market will reward those active in the copper space and making large discoveries.

The small-cap sector is warming up for 2025. Historically, March-to-April brings increased activity to ASX small-caps. Smart money is already positioning ahead of this seasonal uplift.

Make sure to subscribe as we continue to bring you the latest in the small-cap sector.

https://coloradosun.com/2024/04/01/colorado-hydrogen-geological-hunt-investment-gold-rush/

https://www.perplexity.ai/page/massive-gold-hydrogen-reserves-kRgxDixrTJCI1W17S2zcbw