What the US Election Could Mean for ASX Small-Cap Stocks

With Trump and Harris fighting for every vote, we break down how their different visions could reshape ASX commodity markets

BEFORE WE DIVE IN: Keep an eye out Monday-we're adding a new stock to the portfolio

We're now just 12 days away from the US election and you'd be forgiven for feeling like it can't come quick enough.

In the four months since Joe Biden shuffled onto the debate stage to face Donald Trump and argue about golf handicaps, we've endured a democratic decathlon that's made four months feel like four years.

Events have included a 'hot-swap' of Joe for Kamala, two assassination attempts, arguments over eating cats and dogs, a Kennedy joining the Republicans, a Cheney switching to the Democrats, and – in a scene that felt like it was taken from a Coen brothers film – A video of RFK Jr in his kitchen earnestly explaining to 90s sitcom star Roseanne why he once hid a dead bear in Central Park.

Just another election cycle in the US.

Who will win?

Your guess is as good as ours. The election is predicted to be the closest since Bush and Gore battled it out in the courts to decide a winner. Traders on Polymarket, where more than US $2 billion is riding on the outcome, have pushed Trump to a 64% chance over Harris' 36% after a big swing behind Trump in the past week. In racing terms, the late money is coming for Trump.

However, election oracle and polling pundit Nate Silver can't split them. Since July, Harris has won 49.4% of his highly regarded simulations to Trump's 50.2%—a virtual dead heat. This one will be won in a handful of toss-up states.

In 2016, Silver was the only outlier among pollsters. Giving Trump a one-in-three shot when others had him at 16% or lower.

Why should Aussie Investors Care About the US Election?

Simple. Trump and Harris have wildly different views on everything from green energy to trade wars. The winner will send shockwaves through global markets – including our ASX.

Energy and Environment

The Trump Card

“We will drill, baby, drill."

That was one of the first things Trump said when he accepted the Republican nomination in June. It left no doubt that he's a friend of the oil & gas industry. For ASX small-cap miners in coal, oil, and gas, this could mean a resurgence in demand.

Interestingly, Trump's previous term saw unexpected growth in renewable energy installations, particularly in wind. This was mainly due to projects already in the pipeline when he took office and favourable interest rates. Suppose Trump wins and interest rates fall as some predict. In that case, we might see a short-term boost in already-approved renewable projects, benefiting miners in critical minerals for green tech.

Trump's pro-business stance, including potential corporate tax cuts, could stimulate the US economy and drive demand for Australian resources.

Harris' Renewable Vision

As a presidential candidate in 2019, Harris released a US$10 trillion climate plan that pushed renewable energy investment, and a Harris presidency would almost certainly expand Biden's renewable energy agenda.

For ASX small-cap miners, this could translate to consistent demand for critical minerals used in renewable technologies and battery storage, like lithium, cobalt, nickel, rare earths and copper. These are essential for electric vehicle batteries, wind turbines, solar panels, and energy storage systems. Companies involved in rare earths could also see an extra bounce as the US seeks to diversify its supply chains away from China.

Harris is likely to continue Biden's approach to industry policy, particularly the Inflation Reduction Act, which provides US$370 billion in subsidies and tax incentives, primarily for renewable energy. This means sustained demand for critical minerals.

Harris' plans for infrastructure development and housing construction could also boost demand for copper and other construction materials, offering opportunities for ASX-listed miners in these sectors.

Trade and Tariffs

Trump is reportedly considering a 10% tariff on all imports, with China potentially facing a whopping 60% levy. For ASX small-cap miners, this presents opportunities and challenges.

Trump's hardline stance on China could escalate a trade war, potentially increasing demand for Australian exports of rare earths, iron ore, and other critical minerals as the US seeks to decouple more aggressively from Chinese supply chains.

However, those tariffs could complicate matters for companies with significant US exposure and potentially raise tensions between Australia and China (more on that later).

While Harris has been less specific about her trade policies, it's worth noting that many of Trump's tariff policies were continued or extended under Biden, including a 100% tariff on Chinese electric vehicles introduced in May 2024. This suggests protectionist trade measures may persist regardless of the election outcome.

The China Factor

Trump: Trade War 2.0?

If Trump reclaims the presidency, his proposed 60% tariff on Chinese goods could be the most significant way his re-election affects the ASX. If China gets slammed with such a tariff – effectively a nuclear option for a trade war – then it's possible the ASX would fall if headlines pile up about China's economic suffering.

This scenario presents both risks and opportunities for ASX small-cap miners. As the US increasingly decouples from Chinese supply chains, demand for Australian resources could skyrocket. Small-cap miners specialising in rare earths, lithium, and other critical minerals might find themselves in the geopolitical spotlight.

However, escalating tensions could also put Australia in a tight spot. The US is our key military ally, while China remains our largest trading partner, and Beijing has shown it's not afraid to use economic leverage. Small-cap miners with significant exposure to Chinese markets might need to brace for turbulence.

Harris: Strategic Competition

Detail from Harris on China has been light, with the vague statement "I'm determined that the US must win the economic competition with China for the 21st century" about the most offered.

Last year, Harris also underlined that US policy towards China was "not about decoupling, it is about de-risking". How Harris plans to do that has yet to be outlined, but her language seems less hawkish on China than Trump’s.

Despite the lack of specifics, there are indications that a Harris administration would continue the Biden administration's China policies:

Tariff continuity: Many of Trump's tariff policies were continued or extended under Biden. This suggests that protectionist trade measures may persist regardless of the election outcome.

CHIPS Act support: The Harris campaign has indicated strong support for the CHIPS and Science Act, which provides over US$280 billion for domestic semiconductor production and restricts China's access to cutting-edge chips. This could benefit ASX-listed companies involved in the semiconductor supply chain, particularly those mining critical minerals used in chip production, such as silicon, gallium, germanium, indium and rare earths.

The AUKUS Factor

While the general public might be yawning at the mention of AUKUS, savvy investors should be wide awake. This pact represents the most significant shift in Australian defence policy in decades, with unprecedented levels of technology transfer and intelligence sharing.

AUKUS, the trilateral security pact between Australia, the UK, and the US, aims to counter China's growing influence in the Indo-Pacific. Its two pillars focus on:

Equipping Australia with nuclear submarines

Collaborating on advanced technologies like AI, quantum computing, and cybersecurity

For ASX small-cap miners, this presents a golden opportunity. These advanced technologies require an array of critical minerals:

Rare earths: Essential for everything from missile guidance systems to night-vision goggles.

Lithium: This will power the next generation of military equipment.

Cobalt and Nickel: Key ingredients in military-grade alloys.

Graphite: Crucial for advanced electronics and heat-resistant materials.

Tungsten: Used in armour-piercing rounds and other military hardware.

Uranium: For nuclear submarine reactors.

With China dominating many of these supply chains, AUKUS could be a catalyst for Australian miners to fill the gap. The US and UK are likely to view Australia as a trusted source for these critical minerals, potentially fast-tracking approvals and investments.

But it's not all smooth sailing. The pact has ruffled some feathers:

France is still sulking over losing a $90 billion submarine deal to AUKUS.

Southeast Asian countries are worried about an arms race in the region.

Some Aussie officials are concerned about the cost and timeline of the submarine program.

China is quite miffed at Australia effectively becoming US-lite in its defence strategy. This is a delicate position for Australia to be in with its largest trading partner.

For ASX small-cap miners, these geopolitical waves could create a rising tide. Under either a Trump or Harris presidency, expect an intensified focus on securing supply chains away from China. Trump has been clear on his desire to reduce reliance on China. At the same time, Harris would likely maintain the push for diversified supply chains through a more multilateral approach.

ASX small-cap miners in critical mineral sectors could be on the cusp of a major boom, riding the waves of geopolitical realignment and technological advancement. However, they'll need to navigate the complex interplay of international relations, domestic politics, and resource allocation as Australia grapples with its new role in the Indo-Pacific security landscape.

Commodity Spotlight

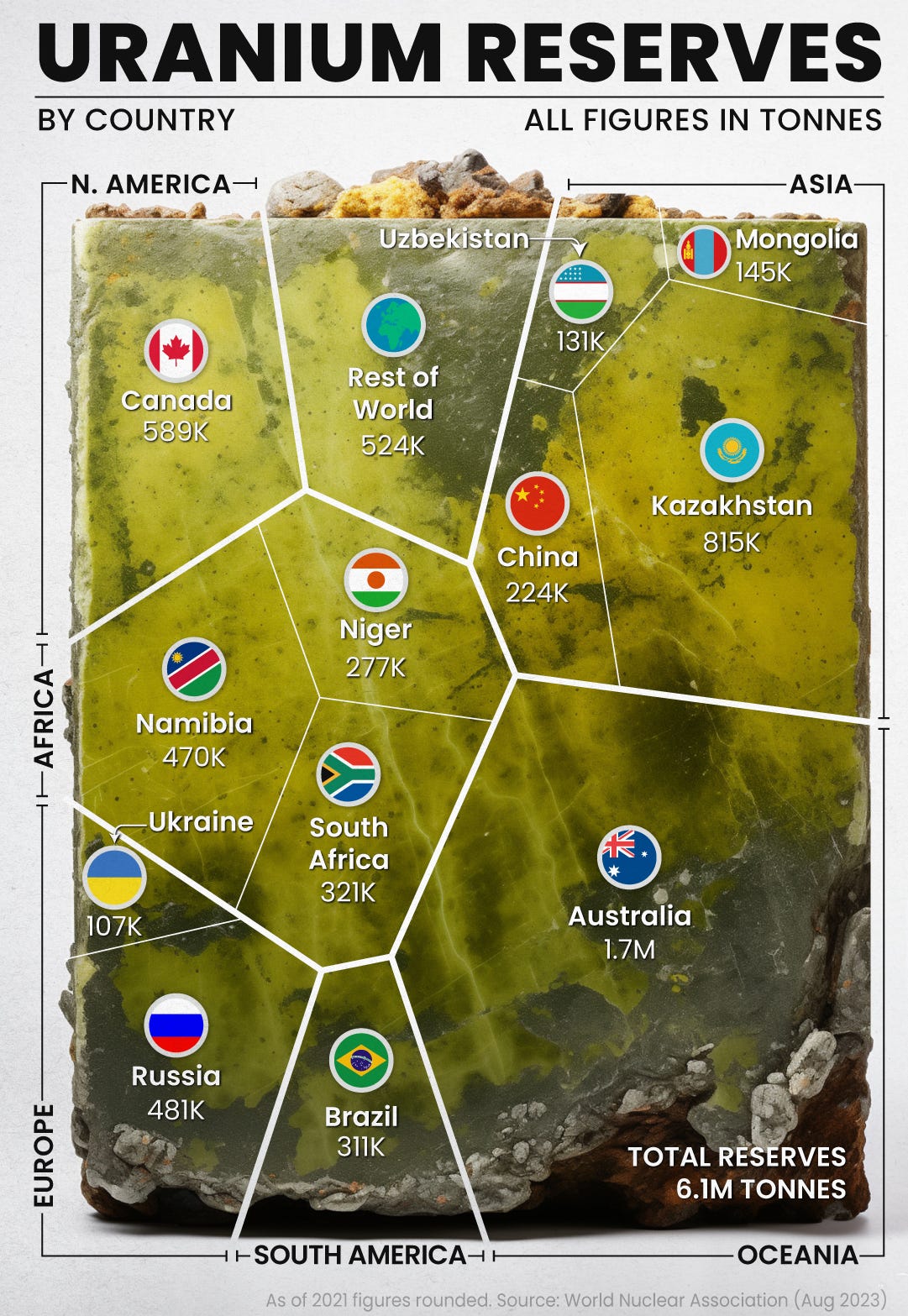

Uranium

Trump's presidency could see a push for Australia to develop nuclear fuel processing facilities, potentially as an alternative to Russian dominance. With almost a third of the world's known uranium reserves, Australia could become a key player in the global nuclear fuel supply chain. This could be a boon for ASX-listed uranium miners.

Harris, while less bullish on nuclear energy than Trump, might still include it as part of a diverse energy mix to meet climate goals. Earlier this month, Harris spoke of “advanced nuclear” among the next generation of breakthroughs she wanted to support. 1

The focus on reducing dependence on Russian energy could drive interest in Australian uranium under either administration.

The challenge lies in Australia's long-standing reluctance to invest in uranium mining and nuclear energy. Small-cap ASX uranium miners might face regulatory hurdles, but those who can navigate them could see significant opportunities.

Rare Earths

Both candidates are likely to prioritise securing rare earth supplies outside of China's control, but their approaches differ.

Trump would likely make bold moves to build non-Chinese supply chains, which could include direct investment in Australian miners. His proposed tariffs on Chinese goods could create immediate opportunities for Australian suppliers.

Harris would likely echo Biden’s approach but still focus on reducing dependence on China. This could result in long-term partnerships and investment in Australian rare earth processing capabilities.

Lithium

Despite Trump's previous electric vehicle scepticism, Elon Musk's potential cabinet or advisory role to Trump could ensure pro-EV policies in a second Trump term. This comes despite Trump's proposal to gut pro-EV regulations and eliminate the US$7,500 EV tax credit introduced by the Inflation Reduction Act.

Interestingly, Musk says he's cool with the repeal of the EV tax credit, believing it “probably actually helps Tesla.”

Harris would likely accelerate EV adoption and renewable energy storage initiatives, further driving lithium demand. Under both candidates, the focus on energy independence could benefit lithium producers for grid storage applications.

Copper

Copper emerges as a potential winner regardless of the election outcome. Its crucial role in both traditional and green infrastructure positions it for strong demand under either presidency.

Trump's infrastructure plans and Harris' green energy push spells increased copper demand. The global shift towards EVs and renewable energy further supports this outlook. With supply constraints already evident, ASX-listed copper miners could be poised for significant growth.

Under both candidates, the focus on reducing dependence on China could benefit Australian copper producers further, potentially driving prices higher.

Coal

A Trump presidency might see a resurgence of coal mining, especially if environmental regulations are rolled back. However, market forces and cheaper alternatives might limit the upside.

Under Harris, expect an accelerated phase-out of coal power plants in the US. However, there's potential for increased exports to developing countries still reliant on coal.

Hydrogen

Harris would likely continue Biden's push for green hydrogen, maintaining tax credits and supporting the US$7 billion hydrogen hub initiative. Natural hydrogen believer Bill Gates was also revealed to have donated US$50m to Harris’ campaign this week, which could help his advocacy for the “global gold rush” inside the Harris administration.

Trump's stance could be clearer, but industry insiders suggest he might not fully repeal hydrogen tax credits, potentially favouring a more technology-neutral approach.

This could benefit ASX-listed companies involved in various hydrogen technologies, from green to blue and natural hydrogen production.

Crypto

This is outside our usual lane, but it bears mentioning given the growing single-issue voting and mega-donor blocs focused on crypto deregulation and the almost certain movements based on who wins.

Trump, once a vocal crypto sceptic, has pulled a 180. He's gone from denouncing cryptocurrencies as "based on thin air" to speaking at the Bitcoin 2024 Conference and vowing to make the US "the crypto capital of the planet." If he wins, we could see a surge in crypto-friendly policies that might send Bitcoin and other established digital assets like ETH and SOL to the moon (crypto-speak for "up" for the uninitiated).

Legendary investor Stanley Druckenmiller says the recent movement in crypto is one reason he has already priced in a Trump win.

On the flip side, a Harris victory would likely mean more of the same cautious approach we've seen under Biden. Think of it as the SEC continuing to play whack-a-mole with crypto companies. Not exactly a bull run catalyst.

And One for the Punters…

US election betting is an old vice of ours at Equities Club. A word of caution from a battle-scarred election punter: Timing is everything. We bet on Kamala Harris as the 2020 nominee back in 2017. It didn't pan out.

Fast forward to the lead-up to the 2024 cycle, and we were certain Biden wouldn't make it to election day. We went all-in from 2022 on long-shot bets for California governor Gavin Newsom. Then Biden dropped out, and a scramble to hedge what we could with a Kamala nomination began. Right idea, wrong candidate – again.

In betting, as in stocks, you can pick the right sector but the wrong player.

For those still keen to wager:

Watch Nate Silver's model closely as election day approaches. Look for value in state-by-state betting. Aussie bookies are often slow to adjust these markets.

Election day offers prime live-betting opportunities. Remember, mail-in ballots typically skew Democrat and are counted later. Keeping an eye on the head-to-head is your friend.

What’s Ahead

As we approach this pivotal election, ASX small-cap investors face a landscape ripe with opportunity and risk. Whether it's Trump's vocal stance on China and fossil fuels or Harris' push for renewables, the outcome will ripple through our markets.

Key takeaways for investors:

Critical minerals, especially those used in technology and defence, could see increased demand under either administration.

The AUKUS pact presents significant opportunities for Australian miners, regardless of who wins.

Copper and lithium appear well-positioned under both scenarios.

Coal and crypto markets could see dramatically different outcomes depending on the victor.

As always, diversification and careful research remain crucial. While geopolitical events like elections can create short-term volatility, long-term trends in technology and energy transition will likely continue to shape the market landscape.

Barack Obama said almost exactly the same in 2011, referencing "new… nuclear technologies" during a speech on energy policy at Georgetown University in 2011. In that speech, he highlighted the need for innovation in energy sources, including nuclear.