The battle for power in Australia, what commodities will be the winners?

How the renewables vs nuclear showdown could reshape the ASX (and the stocks set to win)

Renewables vs nuclear: it's the energy showdown that will keep Aussie politicians bickering right up to the election.

Never before have we seen such a stark contrast in the vision for Australia’s energy future between the two major parties, and the implications for investors are enormous.

With Labor backing renewables and the Liberals championing nuclear, the battle lines are drawn.

Globally, billions of dollars are pouring into renewables and nuclear energy, each with distinct advantages and hurdles. Australia stands at a crossroads. With abundant natural resources and ample space, we have the unique advantage of being able to choose our energy path.

While politicians trade blows over policy and ideology, savvy investors should take advantage. Whether it's sun, wind, or splitting atoms, there’s enormous opportunity for ASX-listed companies—especially nimble small caps that can capitalise on this seismic shift.

The team at Equities Club has broken down both sides of the argument for you, highlighting the commodities that stand to benefit and, more importantly, the small-cap companies poised to make the most of this energy transition.

Renewables - The Labor Party

The Australian Labor Party's renewable energy policy focuses on transitioning to a sustainable, low-carbon economy by investing heavily in renewable energy sources such as solar, wind, and hydroelectric power.

The policy aims to create jobs, reduce energy costs, and cut greenhouse gas emissions by 43% by 2030, aligning with global climate commitments.

Australia has an abundance of natural resources, making it an ideal location for large-scale renewable energy projects. Solar and wind energy, in particular, can leverage Australia's vast open spaces and high solar insolation levels.

Aussie miners are poised to reap the rewards of the renewable energy boom. The transition to a greener grid isn't just about solar panels and wind turbines; it's a massive undertaking that demands a whole lot of raw materials. And Australia, with its rich reserves of lithium, rare earth elements, and copper, is sitting pretty.

These materials are the building blocks of renewable energy technologies, and demand is only going to skyrocket as the world goes green. For ASX-listed companies with diverse mining portfolios, this means a chance to diversify revenue streams, and increase resilience to market fluctuations.

Renewables - Commodities & companies set to benefit

Lithium - A critical component in the production of batteries essential for renewable energy storage solutions like solar and wind power. These batteries store energy when production exceeds demand and release it when production is low, ensuring a stable and reliable energy supply.

A global leader in the exploration and production of lithium, Australia is a tier-one jurisdiction for companies to explore. Key ASX-listed explorers include:

Lanthanein Resources (ASX: LNR): With a low valuation and a prime location right next door to a massive lithium mine, LNR could be in for a serious share price surge if their upcoming drilling program hits the mark.

Rare earth elements - Vital for the production of high-efficiency magnets used in wind turbines and electric motors for electric vehicles. These elements, including neodymium and dysprosium, are critical for enhancing the performance and efficiency of renewable energy technologies.

Australia has significant rare earth deposits, yet only one operational mine. This could change significantly with several ASX-listed companies involved in rare earth exploration:

Lycaon Resources (ASX: LYN): This West Arunta explorer has near-term drilling coming up. If LYN can replicate the similar success of WA1 and ENR, this could see the share price multiple many times over.

Bubalus Resources (ASX: BUS): With a tiny valuation and located next door to Australia’s next rare earth mine in ARU, Bubalus has the potential to re-rate on drilling alone. Any success could see the share price head north quickly.

Copper - Essential for renewable energy infrastructure, including solar panels, wind turbines, and electric vehicles. It is used extensively in electrical wiring, transformers, inverters and EVs due to its excellent electrical conductivity and durability.

Copper is becoming harder to find and more expensive to produce, here are a few Australian copper explorers that have caught our eye.

FMR Resources (ASX: FMR): Keep an eye on this tiny copper explorer, which will be re-listing to the ASX today. With land in a proven copper belt, and the demand for copper continually increasing, FMR provides that high-risk high-reward style play.

Renewables, but at what cost?

Labor's ambitious initiative for a renewable-powered Australia, dubbed, Powering Australia, comes with a $76 billion price tag over the next decade.

This may be updated in the coming week as the Labor party is said to be releasing revised pricing, with the Liberal party speculating that the cost could increase to more than $100 billion, underscoring the scale of the initiative.

A big chunk will go towards upgrading our ageing electricity grid, developing renewable energy projects, and pushing the adoption of electric vehicles and energy-efficient tech.

This investment in infrastructure is crucial for ensuring that renewable energy can be efficiently distributed and utilised across the country.

The plan also includes a sweetener for renewable companies in the form of subsidies and tax breaks – a move designed to kickstart innovation and accelerate the green transition.

Labor's also banking on renewables being a job-creation machine, promising over 600,000 jobs, many in regional areas where they're needed most.

While the upfront costs of the renewable energy transition are substantial, the Labor Party argues that these investments will lead to long-term economic benefits and cost savings.

Nuclear Energy - The Liberal Party

Nuclear power isn't a foreign concept to Australia.

It was floated in the 1980s during Bob Hawke's tenure as Prime Minister and in 2006 by then-Prime Minister John Howard, who established a Prime Ministerial Taskforce to review uranium mining, processing, and nuclear energy.

The Australian Liberal Party recently came out swinging in support of the implementation of nuclear energy as a means to enhance energy security, reduce carbon emissions, and provide a stable and reliable power source.

Party leader Peter Dutton believes nuclear energy is a necessary complement to renewable energy sources, providing reliable baseload power that complements the intermittent nature of solar and wind.

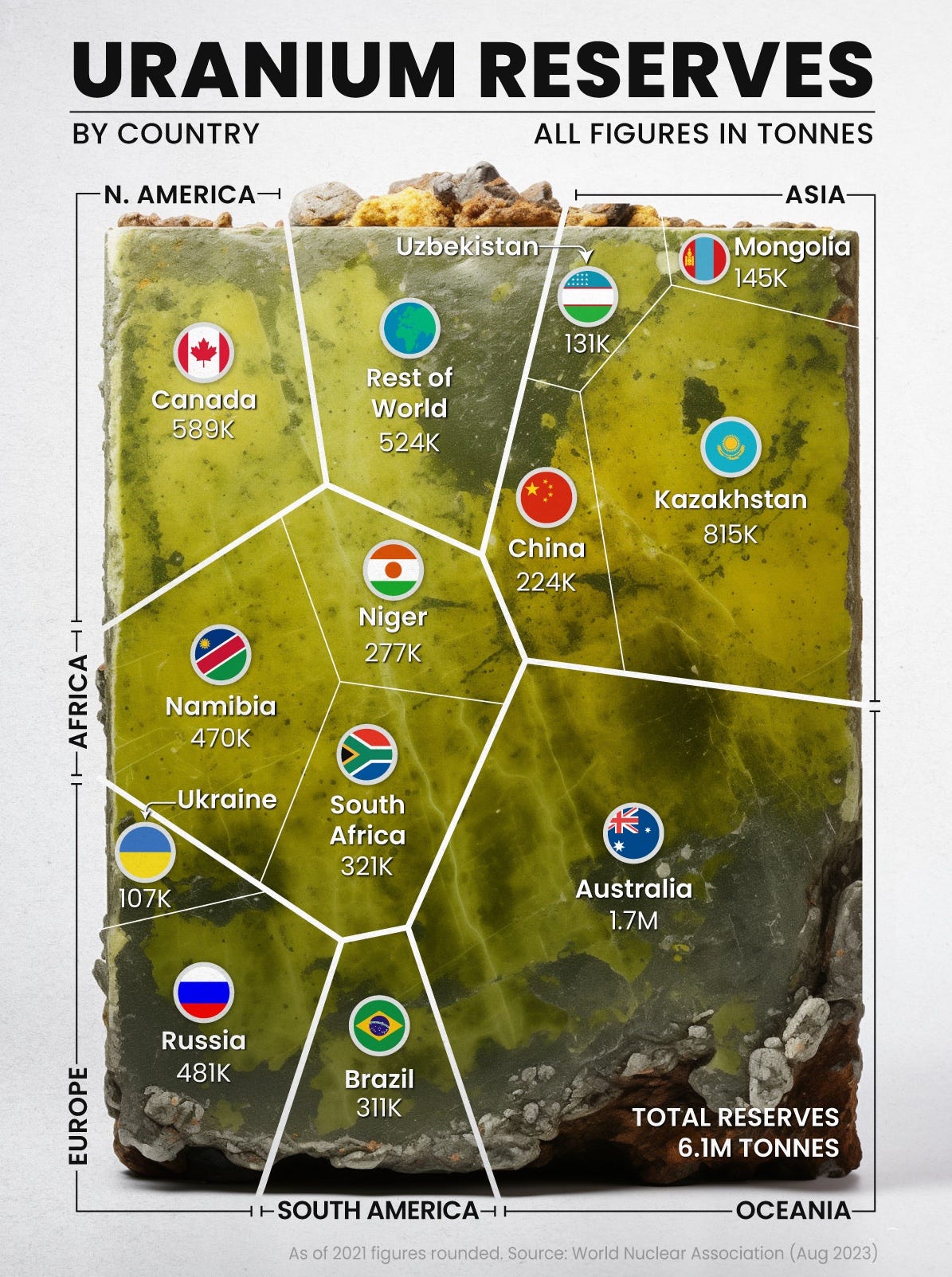

By leveraging Australia's significant uranium reserves, the Liberal Party argues the country can become a global leader in nuclear energy technology, contributing to both national energy independence and global carbon reduction efforts.

The plans for nuclear power plants focus on lifting the current prohibitions; uranium mining is banned in Western Australia, to enable the exploration and development of modern nuclear technologies.

This includes supporting the establishment of "new tech" Small Modular Reactors (SMRs), which offer a safer, more flexible, and cost-effective alternative to traditional large-scale nuclear reactors.

The party's proposal includes the construction of seven nuclear power plants at locations where existing coal-fired power stations have either closed or are scheduled to close.

The idea is to make the most of existing infrastructure – cooling systems, transmission networks, and a skilled workforce already familiar with power generation.

The billion dollar question is the cost. Nuclear power plants don't come cheap, and the Libs haven't put a price tag on their ambitious plan yet.

The Liberal Party's nuclear energy policy emphasises the need for a balanced approach to Australia's energy transition. It leverages both renewable and nuclear power to ensure a reliable, sustainable, and low-emission energy supply.

Nuclear - The commodities & companies set to benefit

Uranium - Nuclear reactors are hungry beasts, and it’s no secret their fuel of choice is uranium. if the Liberal Party's nuclear dreams become a reality, expect uranium demand to go through the roof.

More reactors mean more demand, more investment in mining and processing, and likely a healthy boost in uranium prices. Australia is already a major player in the global uranium market, and this could be our chance to stake our claim as a true uranium powerhouse.

Key explorers include:

Cauldron Energy (ASX:CXU): Focused on their Yarney uranium project in Western Australia, CXU would be big beneficiaries of changes to uranium mining in WA. Yarney is one of the biggest undeveloped deposits in Australia.

UVRE Limited (ASX:UVA): With the recent acquisition of uranium assets in South Australia, UVA provides extremely cheap exposure to a future drill program in Australia’s premier uranium state.

Zirconium - The metal of choice for encasing uranium fuel rods, thanks to its exceptional resistance to corrosion and its ability to let neutrons flow freely, ensuring the reactor operates efficiently and safely.

For investors, the appeal lies in the stable and growing demand for zirconium in the nuclear industry. Small-cap companies are few and far between, instead we’re highlighting:

Iluka Resources (ASX: ILU): This major player is a global producer of zircon, the primary source of zirconium. With established operations in Western Australia and South Australia, Iluka is well-positioned to capitalise on any increase in demand.

Graphite - Used as a moderator in some SMR designs, particularly in high-temperature gas-cooled reactors (HTGRs). It slows down the above-mentioned neutrons produced during the fission process, facilitating a more controlled and sustained nuclear reaction. Essentially increasing safety.

Beyond its role in nuclear power, graphite is also a key component in battery technology, making it a versatile commodity with a bright future. Australia has emerging graphite mining operations, with some ASX-listed companies focusing on this commodity:

Renascor Resources (ASX: RNU): Even with a larger market cap RNU catches our eye as they have an Australian graphite deposit that is well advanced. Any change or demand for locally sourced graphite will play into RNU’s Siviour project.

Nuclear power offers a level of stability that renewables can't match. Unlike solar and wind, which depend on the weather, nuclear plants generate power around the clock.

This consistent demand translates to long-term contracts and predictable revenue for miners of uranium, zirconium, and graphite – a stable foundation that governments and investors alike find appealing.

Nuclear, is it safe?

Chernobyl, Fukushima – these disasters are etched into our collective memory. But the big question is: have we learned anything? Has nuclear power become safer?

Well, nuclear energy technology has seen significant advancements over the past few decades, enhancing safety, efficiency, and environmental sustainability.

One of the most notable improvements is the development of new reactors (Generation III and III+), which offer superior safety features compared to their predecessors built in the 1970s.

New reactor designs boast enhanced safety features, like passive cooling systems that rely on natural forces (think gravity and convection) instead of pumps and valves that can fail. These reactors are designed to shut down automatically in emergencies.

This is a big tick for a government trying to sell the idea of nuclear to a skeptical public.

Moreover, the emergence of SMRs represents a transformative shift in nuclear energy technology. The Liberal Party is pitching this as its bait to lure voters.

SMRs are designed to be more flexible, cost-effective, and scalable than traditional large reactors. They can be constructed in a factory and transported to sites, significantly reducing construction times and costs.

And the Libs are dangling the prospect of manufacturing them right here in Australia, creating jobs and pumping up our manufacturing sector.

Pulling off this nuclear pivot won't be simple. It will require a hefty dose of legislative elbow grease, both in Canberra and the state capitals. These changes would need to streamline the regulatory process and provide incentives for the adoption of nuclear energy.

Environmental sustainability has also been a focal point of recent nuclear advancements. Modern reactors are designed to have lower environmental impacts, with reduced pollution and lower emissions.

Advances in nuclear energy technology over the past few decades have made it a more viable and attractive option for meeting future energy demands.

These advancements not only address safety and efficiency concerns but also bolster the economic and environmental sustainability of nuclear power, painting a promising and optimistic picture for the future.

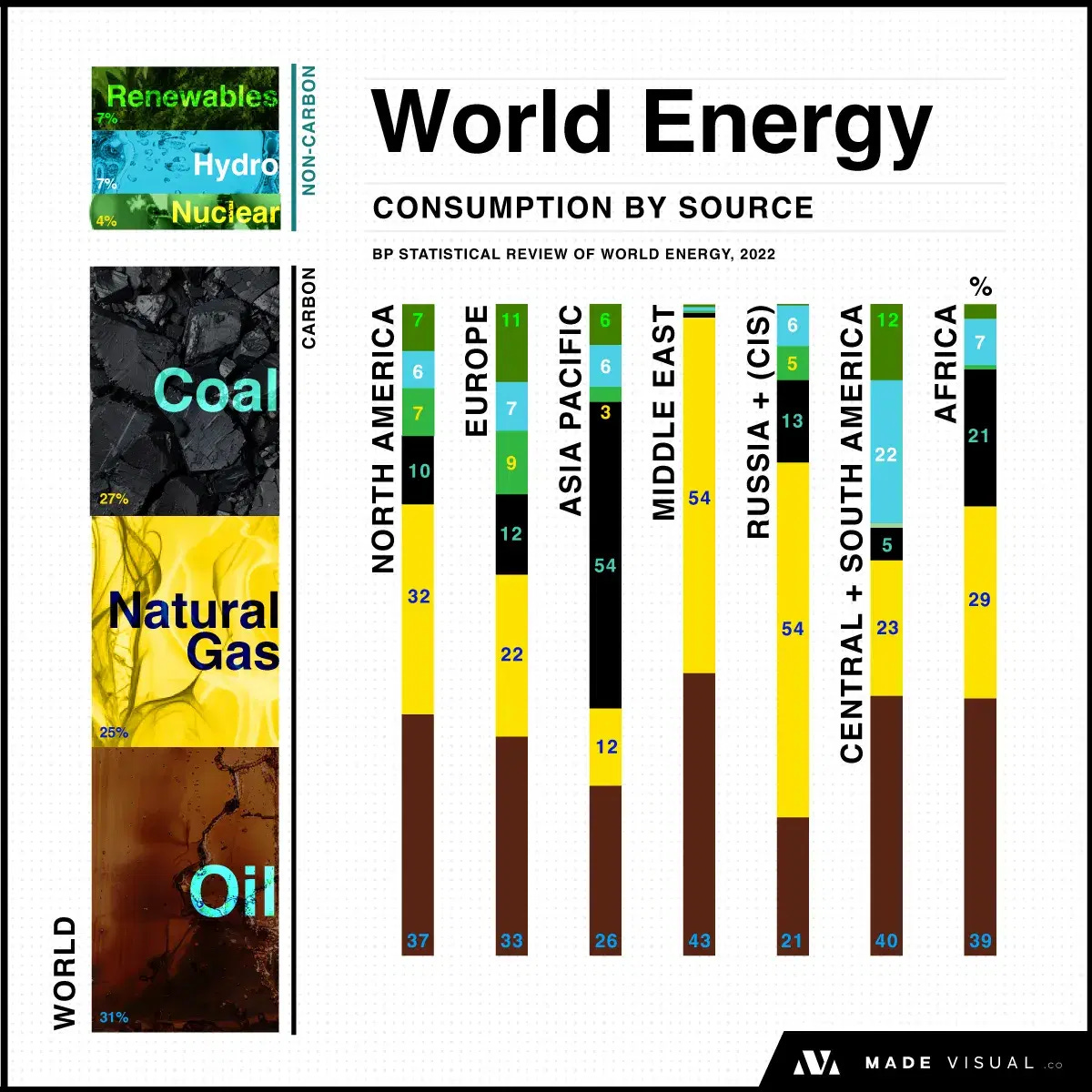

What’s the rest of the world doing?

While Aussie politicians duke it out over renewables vs nuclear, it's worth checking out what the rest of the world is up to. It turns out that it's a mixed bag, with big players betting on both sides.

The United States has made significant strides in renewable energy and nuclear power. The Inflation Reduction Act has been an essential driver of increased investment in renewables, particularly solar and wind energy.

The U.S. aims to have 50% of new car registrations be electric by 2030, supported by robust clean energy policies. However, nuclear energy remains a vital component of the energy mix, with continued support for extending the life of existing reactors and developing new nuclear technologies such as SMRs.

The European Union is heavily investing in renewable energy as part of its Green Deal, aiming to become climate-neutral by 2050. The EU plans to increase the share of renewables in its energy mix to 32% by 2030.

Countries like Germany have phased out nuclear power entirely in 2023, focusing instead on wind, solar, and hydroelectric power.

However, other EU members, such as France, continue to rely heavily on nuclear energy, which provides about 70% of France’s electricity. France is investing in extending the life of its current nuclear plants and developing new reactors to ensure energy security and low emissions.

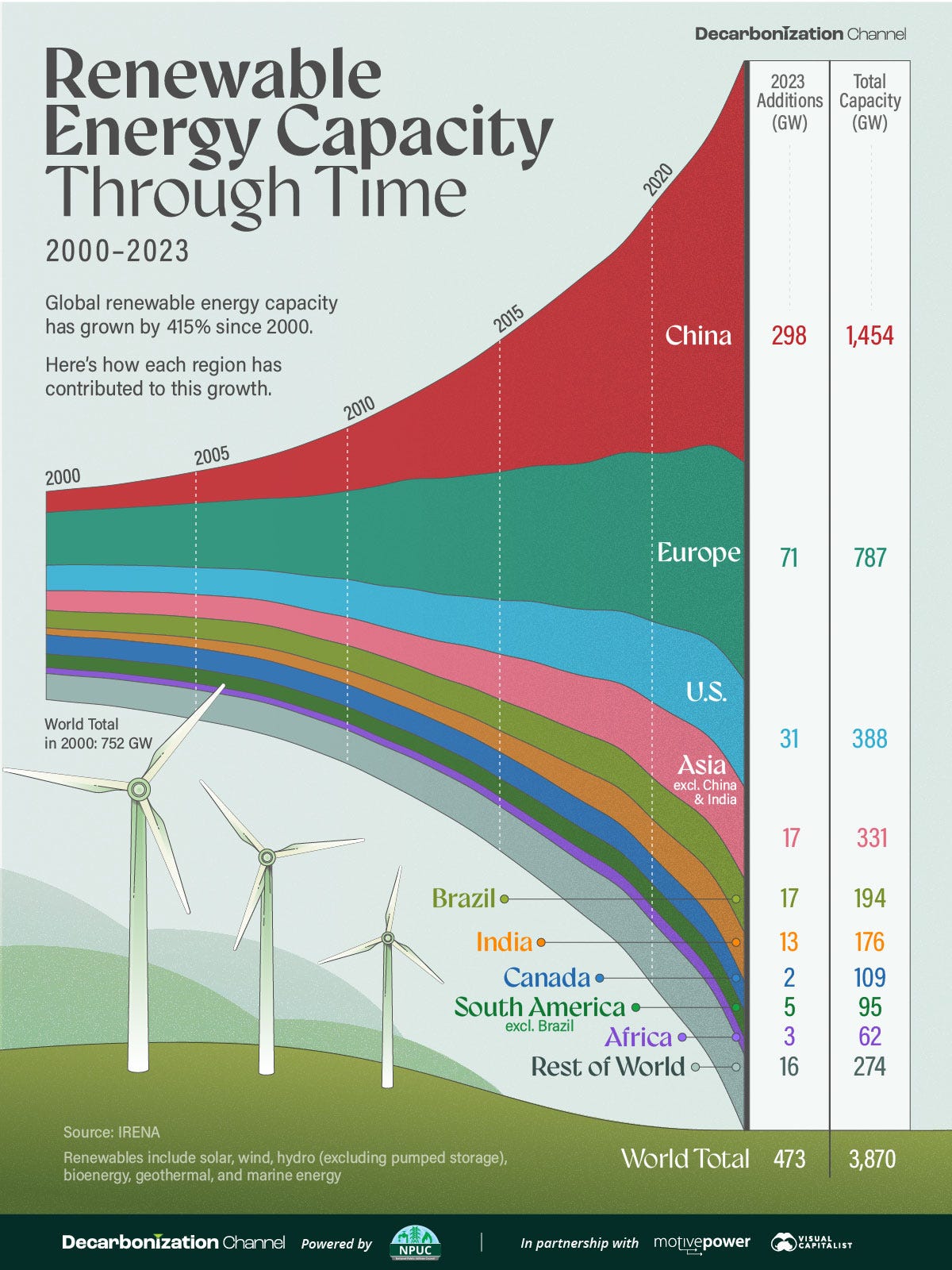

China is aggressively expanding its renewable energy capacity, aiming to become a global leader in solar and wind power.

In 2023, China added significant solar PV capacity, equal to the total global additions from the previous year. China is also investing heavily in nuclear power, recognising that it's a reliable workhorse that can help meet the energy demands of its massive population.

While there is a global trend towards increasing renewable energy capacity, many countries also recognise the role of nuclear power in providing a stable and low-emission energy source.

This trend has significant implications for the mining sector and investors, as it opens up new opportunities for small-cap companies that can pivot quickly.

The balance between these two energy strategies varies significantly based on regional needs, resources, and policy frameworks.

The key takeaway here is that diversification is king. A well-rounded energy portfolio that includes both renewable and nuclear plays could be the ticket to weathering the ups and downs of the ever-evolving energy market.

In any case, the mining sector stands to gain as we continue to meet the world's energy needs.