Weekly Wrap: Elon's Robot Army, Silver's Record Run and Trump Goes Nuclear

Silver hit triple digits, Musk says humanoids available next year, and the banks keep lifting gold targets

The ASX 200 barely moved this week. The small end of the market had other ideas. Commodities ripped across the board and the juniors with exposure caught a serious bid.

Gold got within spitting distance of US$5,000. Silver punched through US$100 for the first time ever. Uranium jumped on Trump talking up nuclear at Davos. Copper kept grinding higher even with Goldman waving caution flags. And Elon Musk told the world to prepare for billions of humanoid robots, which might sound like science fiction until you start thinking about what those robots need to be built from.

Plenty happened. Let's get into it.

Before we get started… our 2026 small-cap picks

If you missed our Top 10 Small-Caps to Watch of 2026, click here. Last week’s article was our most read ever, and many of the stocks mentioned had a great week too.

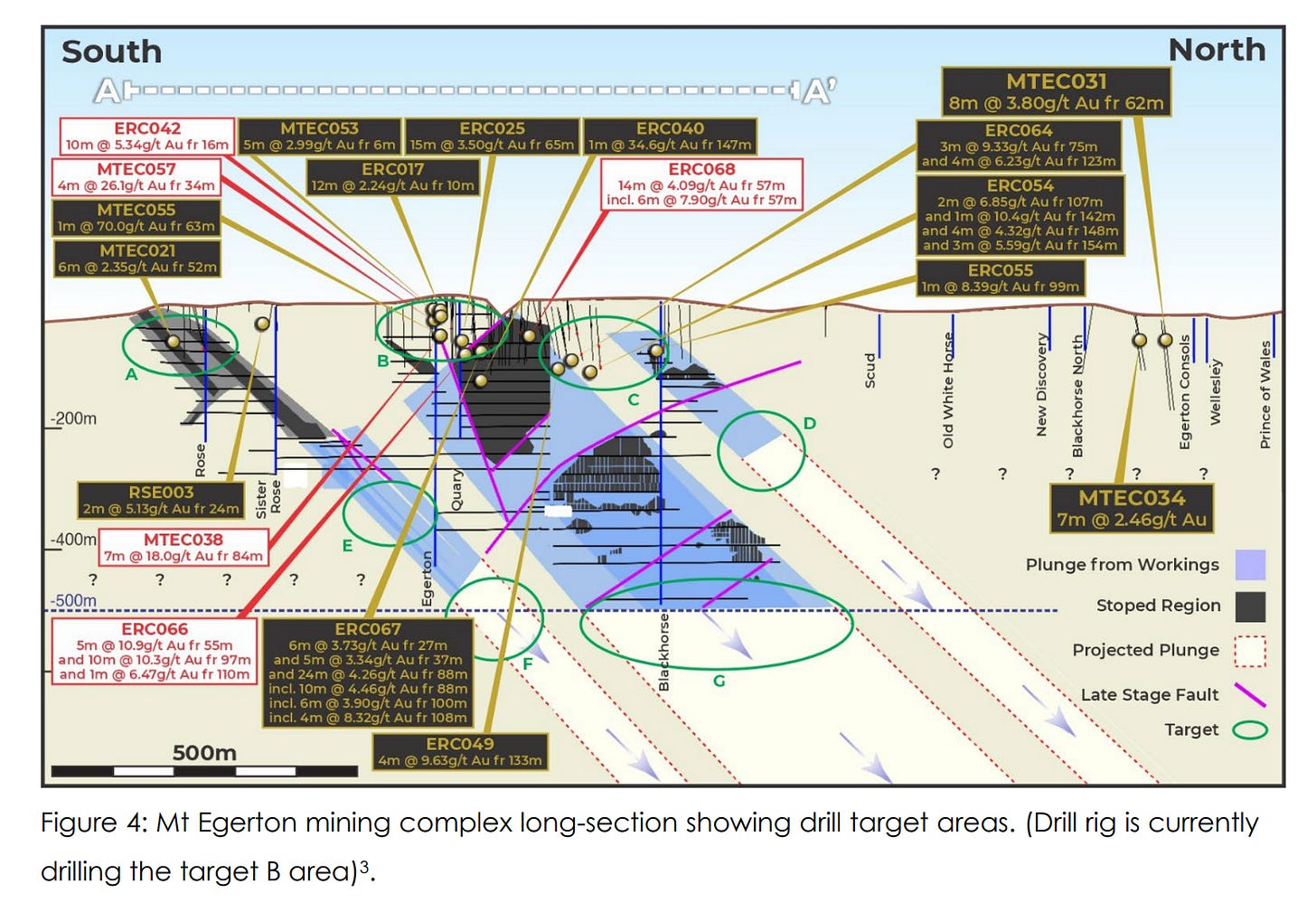

Black Horse keeps the drill turning

Our 2025 small-cap pick of the year, Black Horse Mining (ASX: BHL). kept the drill turning through the holidays while everyone else was at the beach, and their update this week shows why that matters.

The roadside channel sampling is done, and the geophysics has been folded into a 3D model that's now guiding drill targeting in real time. And diamond drilling is underway with close to 500 metres in the ground so far.

It’s a solid reminder that real progress in historic gold systems tends to look methodical rather than flashy, and BHL is going about things the right way.

What caught our attention is how BHL has been adjusting hole angles and targeting as new data comes in. Mt Egerton hasn't produced in over 100 years, and the combination of historic stopes and structural complexity can easily throw off a rigid drill plan. Being able to adapt on the fly is important when you're testing ground like this.

BHL slowed where necessary and adapted as the data came in while drilling through the holidays. Soil sampling kicks off shortly, which should help define extensions beyond the historic workings.

We called BHL our pick of the year when it listed at 20 cents. It now trades at 52 cents as the market positions ahead of first assays, expected from late February.

At current gold prices, a hit here won’t go unnoticed. We’re watching late February closely.

Gold closes in on US$5,000 as banks lift forecasts…again

A year ago, US$5,000 gold would have got you laughed out of most meetings in the commodities world. Now the investment banks are falling over themselves to call it.

Gold got within touching distance on Friday before pulling back slightly, but the tone from the big houses has shifted from cautious optimism to outright conviction heading into 2026.

Goldman Sachs lifted its end-of-2026 forecast to US$5,400 an ounce, pointing to central bank demand and a shift away from traditional financial assets.

Bank of America has gone further, flagging a potential move toward US$6,000 as rate cuts, tariffs, and economic uncertainty weigh on sentiment. UBS, JPMorgan, CommBank, and ANZ are all clustered around the US$5,000 to US$5,400 range.

A remarkable run considering gold was sitting just above US$2,000 an ounce in January 2024.

Every dollar higher makes the economics easier and the funding cheaper for small-cap gold explorers. The companies testing quality ground right now are drilling with the best macro tailwind at their back in more than a decade.

Elon’s robots, and what it means for raw materials

Elon Musk stood up at Davos this week and told the world to prepare for billions of humanoid robots, saying the first Tesla robots will be available for the public to buy by the end of next year.

It sounds like science fiction until you remember that a decade ago, so did reusable rockets and electric cars. Plus, at some point you have to stop betting against Tony Stark.

Elon’s argument is that birth rates are collapsing across the developed world and there won't be enough young workers to run the economy in 20 years. His solution is to manufacture the labour force by the billions. Build and train the workers (then ship them in crates).

Scaling robots at the magnitude Elon is predicting requires enormous volumes of raw materials, particularly titanium for strength and light weight.

Titanium is a critical input for robotic systems, and rutile is the natural feedstock for titanium.

Rutile is an unglamorous commodity, the kind of thing that shows up in pigment and welding rods. But when humanoid robots go from prototype to production line, rutile demand could shift from an industrial afterthought to a strategic chokepoint

Fortuna Metals (ASX: FUN) controls a high-grade rutile deposit in Malawi. At a market cap of around $33 million with results due through Q1, FUN is one of the few ways to get direct exposure to the theme on the ASX.

If there are going to be billions of robots, they’ll need to be built out of something. Rutile could be staring down one of the biggest demand shocks any commodity has ever seen.

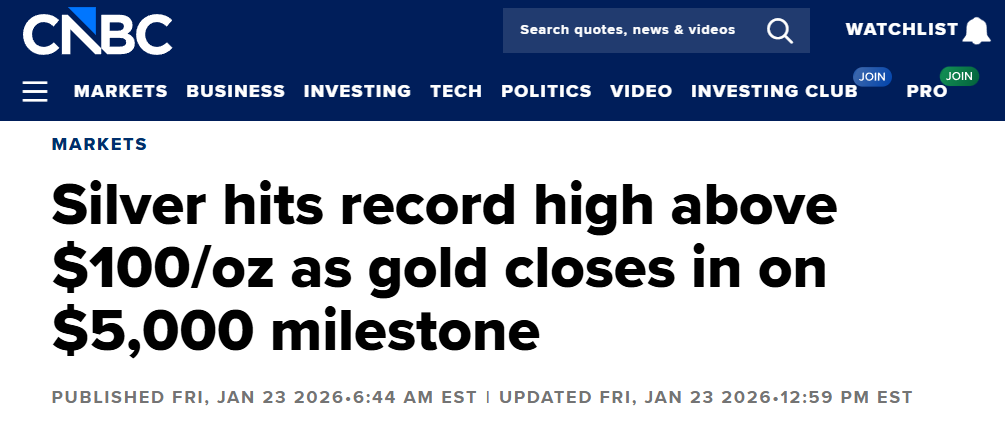

Silver punches through US$100 an ounce

Silver finally did it. After teasing the triple-digit mark for weeks, it punched through US$100 this week - one of the sharpest moves in commodities this cycle.

Over the past 12 months, silver is up more than 200%, driven by safe-haven demand and tightening physical supply.

Like gold, silver benefits when investors want protection from currency debasement and geopolitical risk. But it also has an industrial angle.

Mines are ageing and grades are falling while new supply has been painfully slow to come online. Meanwhile demand from solar panels and electrification keeps growing.

Historically, silver outperforms gold in the later stages of precious metals bull markets, particularly when enthusiasm tips from defensive positioning into momentum.

The gold-to-silver ratio is still elevated versus long-term averages, so some strategists reckon silver has further to run.

That said, silver at US$100 is pricing in a lot of optimism. This is another signal that the precious metals cycle is deeper and broader than many expected, but tread with caution.

Trump goes nuclear, uranium Rises

Uranium prices pushed about 5% higher this week after Trump used his Davos appearance to reiterate that the US intends to go “heavy” into nuclear as part of its energy strategy. The market, already dealing with tight supply, liked what it heard.

The uranium market has been undersupplied for years. Global production still falls short of reactor demand, and there’s limited new supply coming online in the near term.

Utilities are being forced to secure supply years in advance as inventories shrink.

Nuclear projects are capital-intensive and long-dated, but newer, safer technology combined with political backing is bullish for uranium.

With the US treating nuclear as a cornerstone of its energy mix, the investment case keeps building. And prices are starting to move.

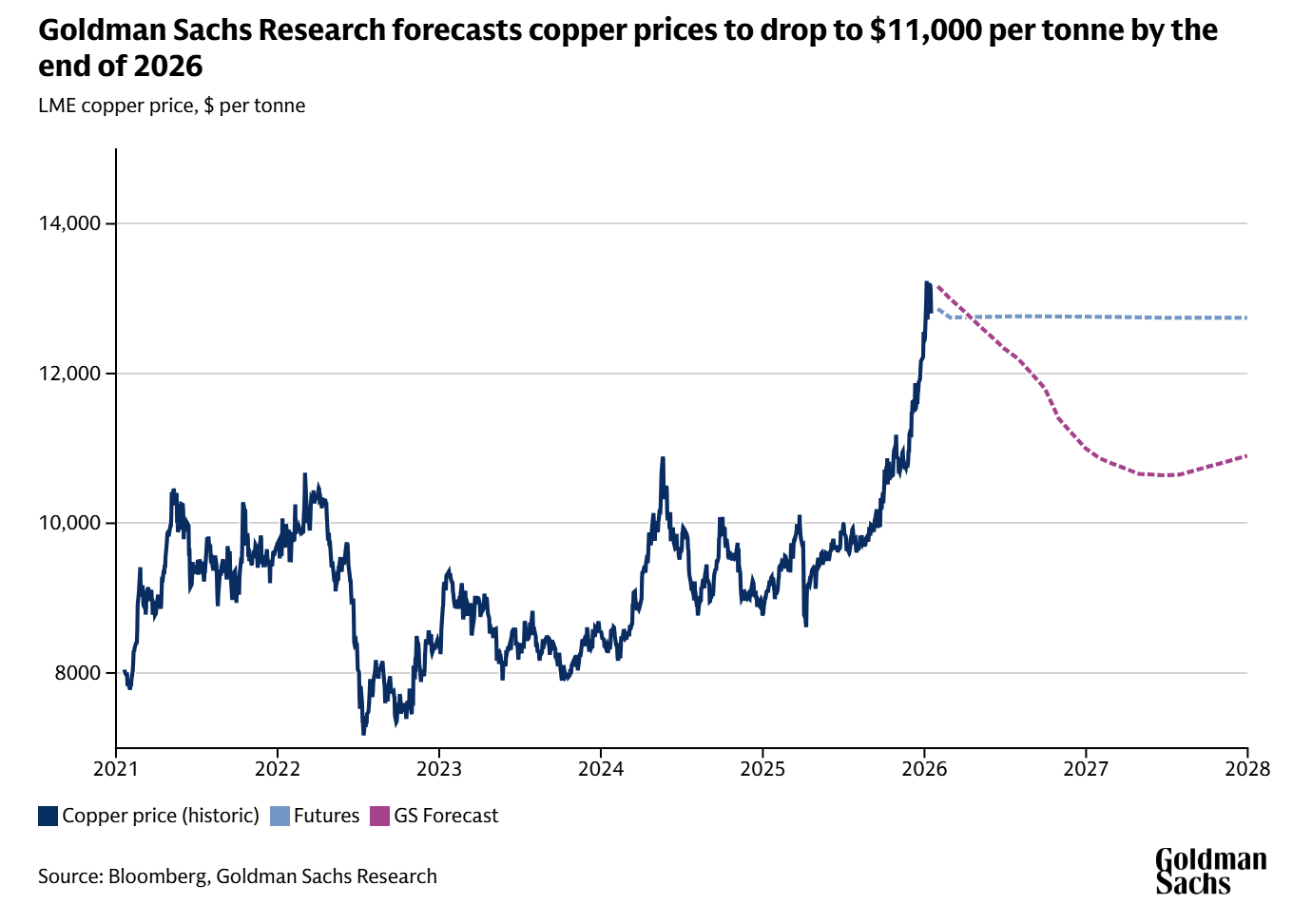

Copper keeps running, but Goldman stays cautious

Copper pushed above US$13,000 a tonne this week as the market grapples with tightening supply and growing concern over how quickly new production can come online.

Disruptions at key mines and falling grades have combined to keep supply tight, just as demand from electrification, grid buildout and data centres accelerates.

Not everyone is convinced this lasts. Goldman Sachs has cautioned that once tariff uncertainty eases and inventories rebuild, copper could soften back toward US$11,000 a tonne later in the year.

Copper is still a cyclical commodity, even when structural themes are working in its favour.

Even if prices pull back, the bigger shift is hard to ignore. Copper looks to be operating at a structurally higher base than at any point in history. The world needs more copper than it used to, and finding it isn’t getting any easier.

The Wrap

The ASX 200 went nowhere this week but the commodities underneath it went everywhere. Gold, silver, uranium, copper all moving. And behind them, a new industrial narrative around robotics that could reshape demand for materials most investors haven’t thought about yet.

We’re not calling a top or a bottom. But setups like this tend to reward the companies getting their hands dirty over the ones still polishing a PowerPoint.

Plenty still to play for as the year’s only getting started.

Till next week.