Weekly Wrap: Christmas Drills, Trading Halts, and One Very Happy Reader

A reader picks up $2,500 and a 659% return, drills turn at Avon Plains, and Fortuna enters a pivotal trading halt

The ASX 200 ground out a quiet 1% gain this week as December liquidity thinned out and investors started tidying their books.

Christmas is close, but the news flow hasn’t slowed down.

Gold pushed to US$4,300/oz, drills turned across the portfolio, and trading halts piled up. This is the time of year when stories can move fast and catch people off-guard.

What caught our eye this week:

Christmas comes early for one wise Equities Club reader.

Bubalus starts drilling beneath forgotten high-grade gold at Avon Plains.

Gold at US$4,300/oz sets the tone heading into a bullish 2026.

Fortuna Metals enters a pivotal trading halt ahead of rutile results.

Gina Rinehart weighs in on red tape and Australia’s mining future.

Silver’s breakout gathers momentum as analysts eye US$100.

Argentina reopens its doors as majors lead the way for juniors.

Next weekend’s wrap will be our last for the year (make sure you’re subscribed if someone forwarded you this). We’ll be rounding out 2025 and pulling apart what actually mattered, while starting to look ahead to what 2026 might have in store.

One reader’s Christmas comes early

One of our readers, Geoffrey L, just had the sort of year most investors dream about.

Back in July, he entered our stock-picking competition with his selection of Lumos Diagnostics (ASX: LDX), a diagnostics company we’d never covered and most people had never heard of.

The mechanics of the comp were simple: whoever picked the stock that gained the most between July and December took home the $2,500 prize.

Five months later, Geoffrey’s pick had returned 659%, climbing from 2.7c to 20.5c by competition close (and it’s kept running since).

LDX now trades around 28c, meaning Geoffrey’s sitting on roughly 1,000% gains in five months. We called Geoffrey on Friday to let him know he’d won, and he was absolutely rapt. Geoffrey’s also a retail investor in the company, so between the prize money and his position in LDX, he’s having a very merry Christmas indeed.

LDX rerated as its diagnostics platform gained traction in the US market, with regulatory milestones and distribution deals finally clicking into place, and the rest played out exactly how small-cap stories are supposed to when they work.

A 659% return in five months is genuinely life-changing, and it’s why we run these competitions.

Keep your eyes open because we’re launching the next competition early in the new year. And let’s just say it’s a golden opportunity.

Bubalus drills beneath high-grade forgotten gold

The rig is turning at Avon Plains and Bubalus Resources (ASX: BUS) is about to find out what’s been sitting beneath a historic high-grade gold mine for more than a century.

This is the first time anyone has tested the ground below 19th-century shafts that reported 2-3 ounces per tonne (roughly 60-90 grams per tonne) along with repeated 12-15 gram reefs, before the workings flooded.

Those grades put Avon Plains in rare territory for Victoria, particularly given the mine was abandoned due to water inflows rather than any decline in mineralisation.

We increased our own portfolio position in Bubalus by a third this week, and we like our chances here.

BUS has now kicked off at least 1,200 metres of RC drilling to get a proper read on the quartz reef behind those historic grades. The team has two weeks on the rig before assays are expected to start landing in early February.

The project sits in the Stawell Zone, a Victorian gold belt where many deposits strengthen with depth.

BUS sits at 15 cents and a market cap of $10 million, which is wild when you consider they’re drilling beneath reported 60-90 gram ground that nobody has ever put a modern rig into.

With gold at US$4,300/oz, even moderate hits would turn heads quickly.

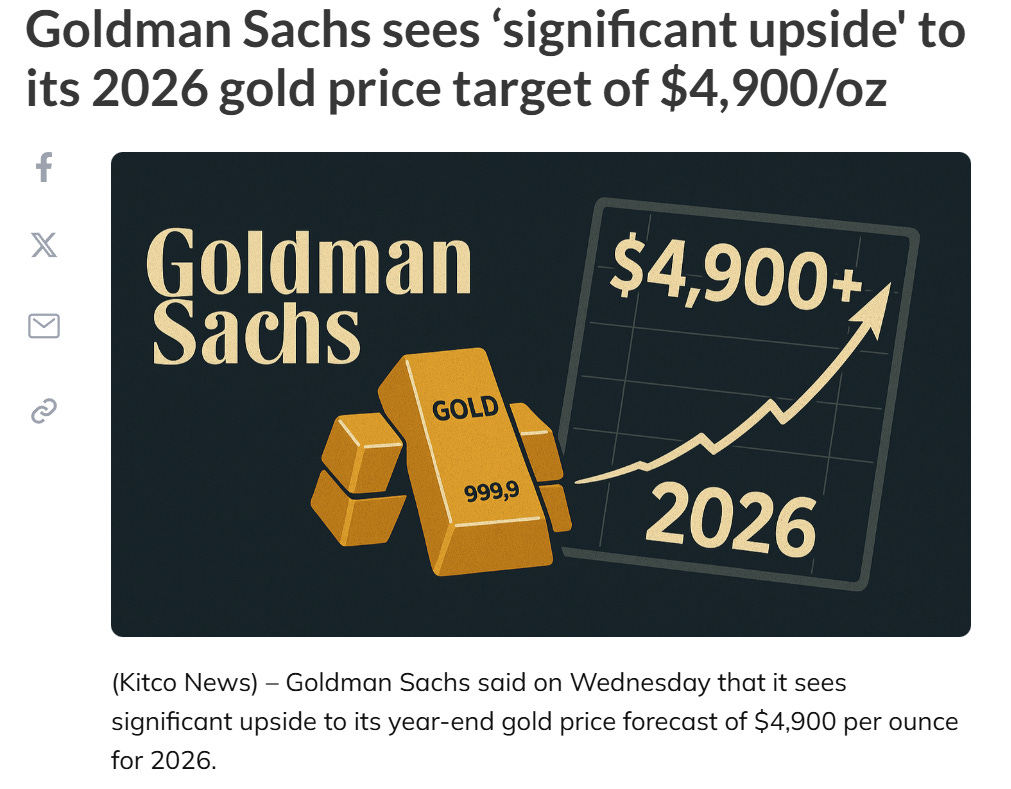

The banks are getting louder on gold

US$4,300/oz marks a seven-week high, and the analysts reckon there’s more to come.

Investment bank Goldman Sachs has been one of the most vocal, reiterating a US$4,900/oz target for late 2026 and flagging what it calls “significant upside” even beyond that level.

Their reasoning is that central bank buying remains strong, while emerging market banks continue to diversify reserves away from the US dollar and into gold.

It also coincides with a period when mine supply growth remains constrained.

There’s also the expectation of US Federal Reserve rate cuts coming soon, which historically funnels capital into gold via ETFs as real returns compress.

If prices do push toward US$4,900/oz, the leverage play sits with small-cap companies drilling high-impact targets. This is why we have backed Bubalus Resources and Black Horse Mining (ASX: BHL), which are both drilling former gold mines in Victoria.

BHL was our Equities Club small-cap pick of the year, and closed the week just off an all-time high at 36c per share, up 80% from its IPO price two weeks ago.

In strong gold markets, discoveries matter, capital flows faster, and re-ratings can be quick.

The ones drilling now are the ones who get the calls later.

Fortuna Metals: The week we’ve been waiting for

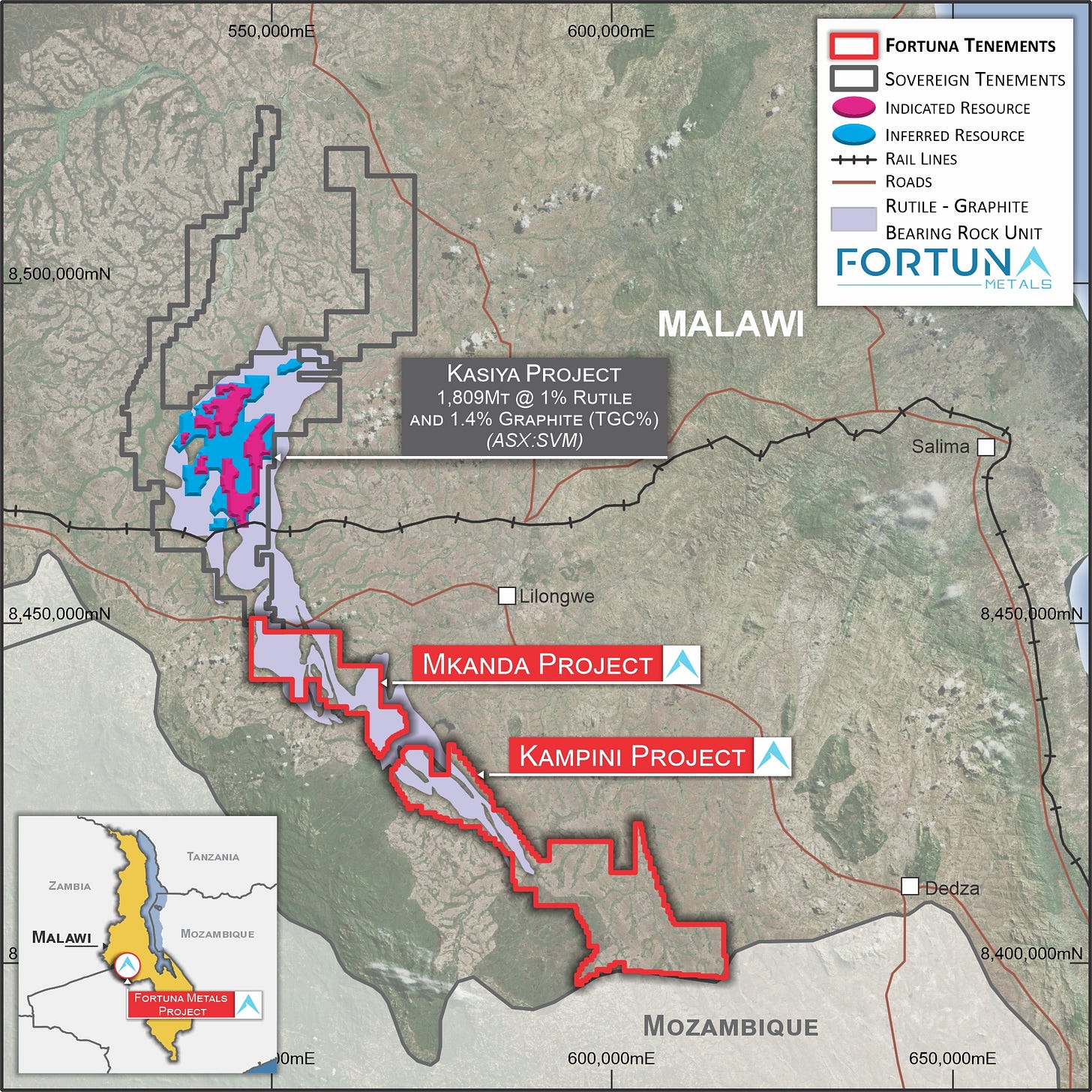

Fortuna Metals (ASX: FUN) went into a trading halt on Friday, with assay results from its Mkanda rutile project in Malawi due any day now.

We’ve backed FUN in our portfolio this year, and this is the week that could define the story.

For those coming to the story fresh, Fortuna Metals is a rutile explorer sitting on ground that looks a lot like its neighbour, Sovereign Metals (ASX: SVM). Rutile is the cleanest feedstock for titanium, and SVM trades at roughly ten times FUN’s valuation despite operating in the same emerging rutile province.

FUN trades at around $28 million with roughly $7 million in cash. If the grades from Mkanda stack up against what SVM has found to the north, that gap starts to look very wide.

The market will get its first real chance to compare the two when results land this week.

If grades stack up, this could mark the early stages of a genuine discovery and a potential re-rating event for the company.

We’ll know soon enough.

Gina Rinehart takes aim at red tape

“Excessive regulation is putting Australia’s global competitiveness at risk.”

That was Gina Rinehart’s blunt assessment this week, and it didn’t cause much of an uproar because it reflects what many in the industry have been saying quietly for years.

Speaking at the 10-year anniversary of Hancock’s first iron ore shipments, Australia’s richest person pointed to a system where projects are delayed, watered down, or abandoned altogether, despite Australia sitting on world-class geology.

The Minerals Council estimates around 80% of potential mining projects never make it through the approvals maze, with policy settings copping the blame rather than geology or capital.

Rinehart’s own experience at Roy Hill says it all, with thousands of permits, years of delays, and more than $100 million spent before the project was even assured.

That same project has since returned $12 billion in taxes and royalties and paid over $15 billion to local contractors.

And it’s not just iron ore feeling the pinch. Regis Resources’ McPhillamys gold project, one of Australia’s largest undeveloped open-pit gold resources, was effectively scrapped on indigenous heritage grounds despite having cleared all major state and federal approvals.

How many future projects won’t get that far? And what’s the cost to the industry and the broader economy when they don’t?

Silver’s up 115% and still running

Silver has woken up in a big way this year. The price surged through US$60 an ounce and recently traded around US$62–63, setting a fresh record and leaving the metal up more than 115% year to date.

Silver is being pulled higher by two powerful forces at the same time:

As a monetary metal, it is benefiting from persistent fiscal deficits, elevated debt levels, and growing geopolitical risk.

Industrial demand keeps expanding too, with silver playing a critical role in solar generation, electrification, EV infrastructure, and the data centres driving AI adoption.

Years of underinvestment have tightened the market, inventories are thin and there’s not much flexibility on the supply side to absorb sustained demand growth. That imbalance is now showing up in the price.

Some analysts are starting to talk about US$100 silver over the next 12 to 18 months if conditions hold. Whether it gets there or not, the direction is clear, and small-cap explorers and developers tend to do well when the metal runs like this.

Milei’s argentina gets tick from the majors

Argentina’s mining revival has been building for a while now, but this week it got another stamp of approval. Both BHP and Rio Tinto pushed projects forward in-country, adding to the growing list of majors betting that Milei’s reforms are here to stay.

We’ve covered Milei’s big push into cutting mining red tape in Argentina here, and if you want insight into mining in South America, be sure to check out Jordan 🇦🇺 Webster’s blog here.

When the majors step in, the juniors usually aren’t far behind. Large miners have the balance sheets to absorb early jurisdictional risk, and their presence tends to de-risk a country quickly.

If infrastructure improves then deal flow picks up, and what starts as a trickle of confidence from locals turns into a flood across the exploration end of the market.

As Argentina’s credibility rebuilds, the number of small-cap explorers moving into the country is likely to rise sharply. For juniors, early exposure to a jurisdiction on the way up can be transformative.

The smart money’s already circling.

Almost time to down tools

There’s only one wrap left before we pack it in for Christmas, but it’s shaping up to be a good one.

A few final results are still to come, metals prices remain supportive, and you can already see investors starting to shift their focus from what worked in 2025 to what might matter most in 2026.

Next weekend we’ll close out the year properly. We’ll pull apart what actually mattered over the past twelve months, the calls that worked, the surprises that caught everyone off guard, and where the real money was made.

We’ll also start laying out how we’re thinking about the year ahead, because while the market slows down over the break, we’ll still be looking for opportunities.

Till next week.