Our Top 10 Small-Cap Stocks to Watch in 2026

Last year's ASX picks averaged 53%. Here's what we like for 2026.

Every year we sift through over 2,000 ASX-listed companies to find the ones worth watching. More than 500 of them trade under $20 million, and many will stay there. But a handful won't.

That's what this list is about. Finding the ASX small-caps that have a genuine shot at delivering big returns for shareholders in 2026.

In 2025, our Top 10 finished up an average of 53%. Given that the year threw tariffs, wars, an Australian federal election, and inflation uncertainty at us, we reckon that's a solid result.

This year we’ve looked across mining, biotech, defence, and everything else sitting under $20 million. We've analysed assets, commodities, clinical trials, management teams, cash positions (and much more) to land on what we believe are the 10 small-caps with the best growth potential for the year ahead.

As always, these picks follow a familiar pattern: a new asset, a rising commodity, a quality management team, or a strong balance sheet. We've covered every angle we think matters.

This year, we’re also mixing things up a bit. We’ve got our top 10, plus a roughy, and a not-so-small-cap that our readers insisted we include.

We’ll check back later in the year to see how we went, good or bad.

For now, here’s our Top 10 ASX small-cap stocks to watch for 2026. In no particular order…

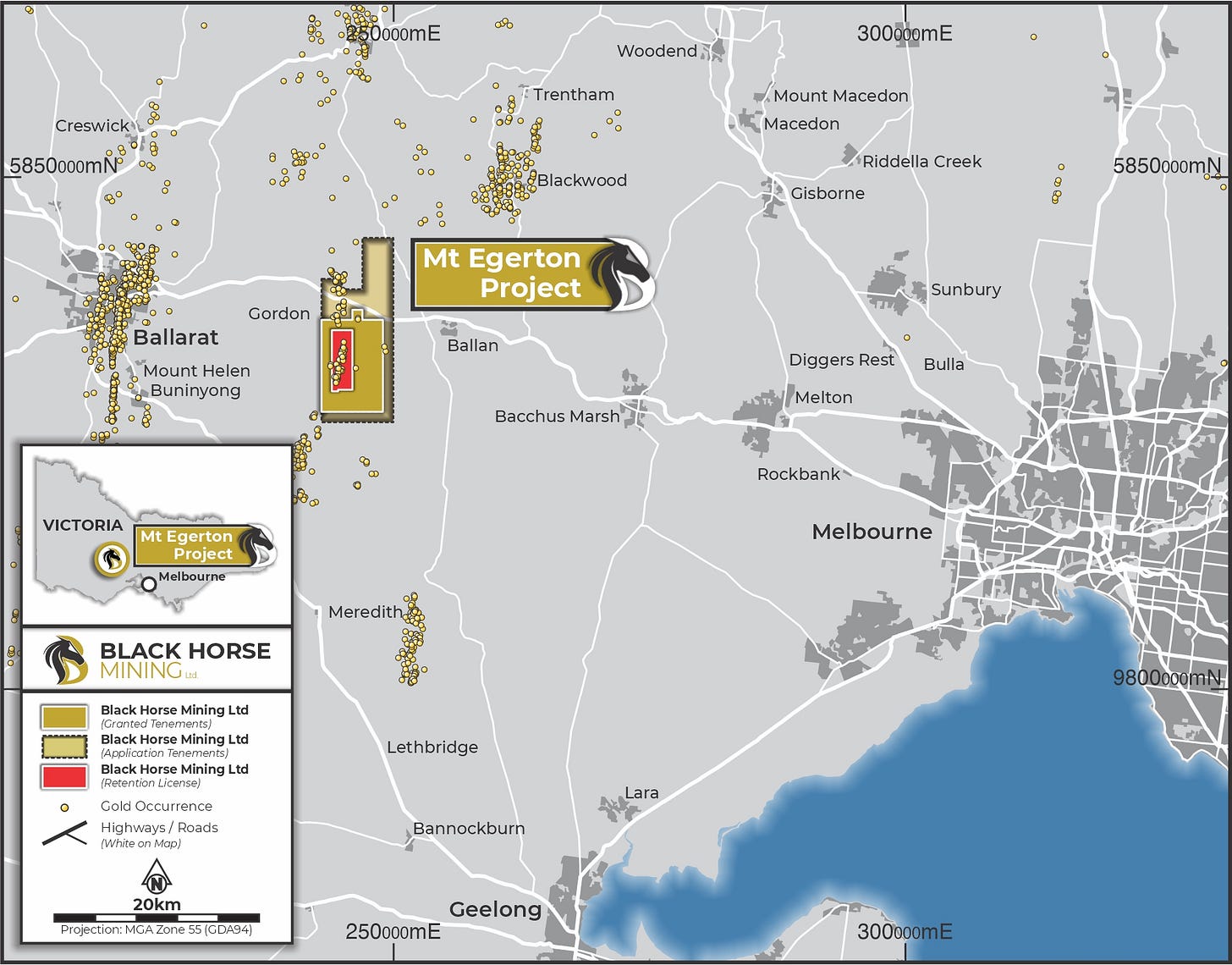

1. Black Horse Mining

ASX: BHL

Share price: 36.5c

Company valuation: $23 million

Sector: Mining

Commodities: Gold

Location of main asset: Australia

Development stage: Early-stage explorer

Website: blackhorsemining.com

Black Horse Mining listed in December 2025 and started drilling for gold on day one. The company is testing a historic gold mine that produced more than 1 million ounces before flooding forced it to shut in the early 1900s, not because the gold ran out. If results come back anywhere near what the old mine delivered, BHL's current valuation won't last long.

Reasons we like BHL for 2026

Drilling now: BHL had rigs turning on the same day it listed, which is rare for a fresh IPO. The company is testing historic areas that produced high-grade gold, with results expected to flow throughout 2026.

Untested depth: The old workings only went so deep before water became a problem. Everything below that level has sat untouched for over a century. BHL can now test ground the old-timers never reached.

Drill cores in the labs: The first cores are already at the lab, with results due in Q1. Shareholders can expect a steady stream of news through the year.

Strong cash position: The IPO raised $8 million, enough to keep drills turning through 2026 without needing to tap shareholders again. Not many small-caps have that runway while also sitting on a historic gold mine.

Tight register: The top 20 shareholders own more than 80% of BHL. These are typically long-term holders chasing multiples, not quick trades. With less than 20% of shares freely traded, any serious drill result could see demand far outstrip supply. When buyers come looking and there's nothing on the market, prices move fast.

The risk factor for BHL

BHL has a lot going for it with a historic high-grade mine, strong gold price and a cashed-up balance sheet. But the market’s already anticipating good news, and that cuts both ways. If the first couple of holes come up short, don’t be surprised if the share price takes a hit while everyone recalibrates. It wouldn’t kill the story or the long-term planning and vision of the board, but it’d test a few nerves.

The company quote

“Black Horse has commenced drilling at the historic high-grade Mt Egerton gold project targeting extensions to known gold mineralisation within a proven goldfield. The program applies modern geological techniques to a site with a long history of production but very limited shallow modern exploration. Drilling coincides with a strong outlook for gold into 2026, supported by ongoing economic uncertainty and continued central bank demand.The Company believes the project offers significant exploration upside and is excited to get stuck in after a very successful IPO in late 2025.”

- Black Horse Mining Managing Director David Frances

The Equities Club insight

BHL was our small-cap pick of the year when it listed in late 2025. We backed it because you don’t often see a historic million-ounce gold mine sitting there undrilled with modern equipment, let alone when gold’s trading well above US$4,000/oz. Victorian gold explorers have gone from tiny IPOs to billion-dollar companies before, and we think BHL has a genuine crack at doing the same.

2. Fortuna Metals

ASX: FUN

Share price: 7.8c

Company valuation: $22 million

Sector: Mining

Commodities: Rutile

Location of main asset: Malawi

Development stage: Early-stage explorer

Website: fortunametals.limited

Fortuna Metals found high-grade rutile in Malawi in late 2025, and the market still hasn't caught on. The company sits on the same geological sequence as its neighbour Sovereign Metals, which trades at more than 10 times FUN's valuation despite comparable early grades. With rutile demand set to skyrocket due to AI robotics, FUN has the cash and the ground to enjoy a big 2026.

Reasons we like FUN for 2026

Geological risk is minimal: Most mining small-caps on this list are still drilling and hoping. FUN confirmed high-grade rutile in late 2025, with grades that stack up against some of the best rutile deposits globally. The geological guesswork is largely behind them. Each humanoid robot needs roughly 60kg of metals and materials to build, including rutile-derived titanium for the frame, and FUN has the ground to supply it.

Incoming demand: Demand for rutile is set to soar, as it’s a feedstock for titanium oxide, one of the main components of humanoid robots. It's light, strong, and doesn't fatigue like steel. Elon predicts humanoid robots will be ‘the biggest product in history by far’, calling 10 billion humanoids by 2040 ‘a low estimate.’ Barclays forecasts a $200 billion humanoid robot market by 2035. Morgan Stanley sees it hitting $5 trillion by 2050 - twice the size of the car industry. As the robotics market scales toward the trillion-dollar mark, rutile demand goes with it.

Strong cash position: FUN was smart and raised soon after its discovery at higher prices, meaning the company is cashed up to continue drilling without the need for a raise any time soon.

Continuous results due: Like with many small-caps, FUN has been busy drilling and has results due in the early part of 2026, with a potential resource due later in 2026. Very few small-caps are this advanced for such a cheap valuation.

Valuation comparison: FUN shares the same geological sequence as its neighbour, with early grades that are comparable, if not better. The only difference is that FUN trades at less than 7% of its neighbour’s valuation. There is obvious potential for FUN to close that gap in 2026.

The risk factor for FUN

Many would point to the jurisdictional risk of being located in Malawi. But Japan has committed $7 billion to infrastructure upgrades, the Chinese are building processing plants, and Rio Tinto is Sovereign's largest shareholder next door. The country needs mining for its own economic development, and governments tend not to burn the companies helping them get there. We see the jurisdictional risk as small.

The company quote

“We have made an exceptional high grade rutile discovery in Malawi. The rutile mineralisation remains open at depth. The rising demand for high quality natural rutile to be used in titanium metal for advanced manufacturing, robotics and humanoids is anticipated to be a key catalyst for high quality rutile going forward. Elon Musk's Optimus humanoid is projecting demand of 1,000,000 humanoids by 2027, which requires ~10kg of rutile per humanoid. With assays expected in the coming months, Fortuna is positioned for an exciting 2026 as we aim to delineate a major rutile and graphite resource."

- Fortuna Metals Managing Director Tom Langley

The Equities Club insight

FUN trades at a fraction of Sovereign's valuation despite sitting on the same geology with similar grades. If FUN gets to even 20% of where Sovereign trades, that's a 300% move from here. With continuous drilling, a resource later in 2026, and a market that doesn't quite understand the demand for robotics in the coming years, we see FUN as a high-conviction pick. The discovery is already in the ground and the cash is there to keep drilling. For us, it’s one of the cleaner setups on this list because most of the risk has already been drilled out.

3. Zinc of Ireland

ASX: ZMI

Share price: 1.3c

Company valuation: $7.5 million

Sector: Mining

Commodities: Zinc and Gold

Location of main asset: Australia

Development stage: Early-stage explorer

Website: zincofireland.com.au

Zinc of Ireland trades at just $7.5 million and has been quietly hunting for a new asset. ZMI's zinc, copper and gold projects offer some upside, but the board's focus is on landing an asset that could transform the company. With a valuation this low, even a modest acquisition could shift things quickly.

Reasons we like it ZMI for 2026

Tiny valuation: At just under $8 million, there aren’t many companies on the ASX that can rival this lowly valuation. Any hint of a new asset or a great drill result could easily see this valuation double, if not more.

Asset hunting: ZMI has been telling the market it is hunting a new asset for some time now. We think 2026 may be the time when this small-cap finally finds what it’s been looking for.

Proven board: Those on the board have proven experience in two critical areas that helped ZMI onto this list: value creation and asset acquisition. Together, they are a very appealing combination for small-cap investors.

Supportive large shareholders: The top 20 hold over 66% of shares on issue, which leaves about a third freely traded. When good news hits a register this tight, prices tend to move fast because there's not much stock to go around.

The Timing: ZMI has been patient while small-cap markets were tough. Now that sentiment has turned and deal flow has picked up, landing an asset in this environment would get a very different reception than it would have 12 months ago.

The risk factor for ZMI

Cash is the constraint. ZMI will need to raise if they want to buy anything worthwhile, and that means dilution. Other companies on this list are better funded and can move without tapping shareholders. The flipside is that ZMI’s lower valuation means that any dilution from a share raise would still keep its valuation reasonable compared with similar peers.

The company quote

“ZMI is excited for 2026, with a highly supportive shareholder base, a strong focus on M&A, as well as leveraging our existing asset base. ZMI has been methodically generating regional targets, refining drill programs, and working to understand the germanium potential within the Rathdowney Trend Project, in Ireland. Future regional exploration will be coupled with a substantial drill program at Kildare, which hosts a JORC resources of 11.3mt @ 9% Zn+Pb and is open in most directions. Zinc is the fourth most consumed metal on the planet but is a metal that hasn’t been muttered favourably by investors for nearly a decade, which excites me, as the prolonged under investment and rising geopolitical factors may set zinc up for a sustained bull market.”

- Zinc of Ireland Non-Executive director Thomas Corr

The Equities Club insight

ZMI is one every small-cap investor should be watching closely. A low cash burn, management looking for assets, and a board with proven experience suggest ZMI could be on the verge of something big. If the right deal lands in 2026, this one could move fast.

4. Bubalus Resources

ASX: BUS

Share price: 11c

Company valuation: $7.6 million

Sector: Mining

Commodities: Gold

Location of main asset: Australia

Development stage: Early-stage explorer

Website: bubalusresources.com.au

BUS has been drilling historic gold ground in Victoria while the gold price has been on a tear, and the market still hasn't paid much attention. With gold targets throughout Victoria and the drilling of a historical gold mine just completed, BUS could be the first company to rocket if gold is confirmed in the drill holes expected in Q1, 2026.

Reasons we like BUS for 2026

Four targets, not one: If there is one commodity that can get the pulse of a small-cap running quickly, it’s gold, and BUS has four separate gold targets across Victoria. That spreads the risk and gives them multiple chances to hit something through 2026. One decent result at this valuation could shift things quickly.

Historic grades on the ground: Two of those four targets have produced high-grade gold hits in the past. BUS is drilling to see if that mineralisation extends at depth, and confirmation of that would give the market something to get excited about.

Results due soon: Drilling wrapped up late last year at a historic high-grade mine, and assays should land in early 2026. The wait is almost over.

Cashed up: BUS raised late in 2025 and starts the year with over $3 million in the bank. Plenty of runway to keep drilling without going back to shareholders.

Experienced CEO: Brendan Borg took a lithium project from discovery through to production and sale. That kind of experience is rare at the ASX small-cap end, and it means BUS has someone running the show who actually knows what a successful exit looks like.

The risk factor for BUS

The biggest risk with BUS is that historical drill holes cannot be replicated, forcing the company to search for new assets. Given the records of high-grade historical results, it would be surprising, but this is an early-stage exploration. If the results miss, BUS has enough cash to keep working other targets or look for new ground without putting shareholders in a tough spot.

The company quote

“We delivered encouraging gold results from our Victorian portfolio in 2025 and look to build upon this in 2026, against a continuing backdrop of exceptional gold prices. We expect results from our maiden drilling program in early February, and will be back out on the ground with further work programs during Q1”

- Bubalus Resources Managing Director Brendan Borg

The Equities Club insight

BUS has everything a small-cap can hope for: a strong bank balance, an experienced board, and a drilling program at a historical high-grade gold mine in the best gold environment in history. We firmly believe the market is waiting for BUS to deliver results before shareholders are rewarded, and this could be as soon as Q1, 2026, meaning there isn’t much time to sit on the sidelines if you’re researching BUS.

5. Leeuwin Metals

ASX: LM1

Share price: 17.5c

Company valuation: $22.2 million

Sector: Mining

Commodities: Gold

Location of main asset: Australia

Development stage: Early-stage explorer

Website: leeuwinmetals.com

Leeuwin Metals is a quick mover in the small-cap space, having taken its Marda gold asset in Western Australia from acquisition to resource definition. In a booming gold market, LM1 management has done the groundwork, with a resource near existing infrastructure. Having just completed a large raise, LM1 will now get drilling. In a gold market like this one, LM1 has set itself up nicely heading into 2026.

Reasons we like LM1 for 2026

Fast maiden resource: LM1 took just nine months to deliver its maiden resource of 342,000 ounces of gold, which shows that management likes to move fast, and that there is a substantial amount of gold at Marda

Resource growth: 2026 will be the year LM1 looks to grow their maiden resource through aggressive drilling, funded by a recent large raise of nearly $6 million.

High-grade core within resource: Within the broader resource there’s a higher-grade portion at Evanston, 96,400 ounces at 1.52 g/t. If drilling can expand that zone, the project economics improve and the share price should follow.

Mining leases granted: Every ounce of gold in LM1’s current resource sits on granted mining leases, which cuts permitting and development risk, compared to exploration licences.

Modest valuation: At $22 million, LM1 trades at a low enterprise value per ounce (company valuation minus cash, then divided by ounces of gold) compared to ASX peers with similar or smaller resources. If they grow the resource through 2026 and the gold price holds, that valuation gap should start to close.

The risk factor for LM1

Even though LM1 has a decently sized gold resource, the risk is more about how large the resource could become. Management has delivered to date, but to attract further interest from bigger players, LM1 will need to grow this resource. However, it’s certainly possible given the fertile region in which they will be drilling.

The company quote

"There has never been a better time to be a Leeuwin shareholder with multiple exploration programs planned for 2026 at out Marda Gold Project in the Southern Cross region of WA . Marda already has gold resources of 342,000 ounces on Mining leases, 10,000m of drilling is underway at Evanston and 500km2 of highly prospective tenure in the southern cross belt with significant exploration potential across multiple underexplored prospects and historical workings."

- Leeuwin Metals Managing Director Christopher Piggott

The Equities Club insight

LM1 goes into 2026 well funded, in a tier-one location, with an existing resource, granted mining leases, and infrastructure nearby. Management has already shown they can move quickly, getting from acquisition to resource in under a year. The gold price is doing the heavy lifting on sentiment right now, and if LM1 can grow the ounces through drilling, the current $22 million valuation looks light. This could be the year the market catches on.

Before we continue, why invest in small-caps?

We’ve been at this for about 20 years. Through the GFC, through COVID, through all the wobbles in between.

We’ve backed companies that went from 15c pre-COVID to $15 within twelve months. We’ve been early on junior gold explorers that grew into some of the ASX’s largest producers. We’ve also had our share of duds that went nowhere (it comes with the territory).

The difference between small-caps and the big end of town is that you actually have to pay attention. You can’t park your money and forget about it for a few years. This part of the market moves quickly, and the investors who do well are the ones watching closely.

Not every pick on this list will come off, but it only takes one to shift a portfolio in a meaningful way. That’s the whole point of being here.

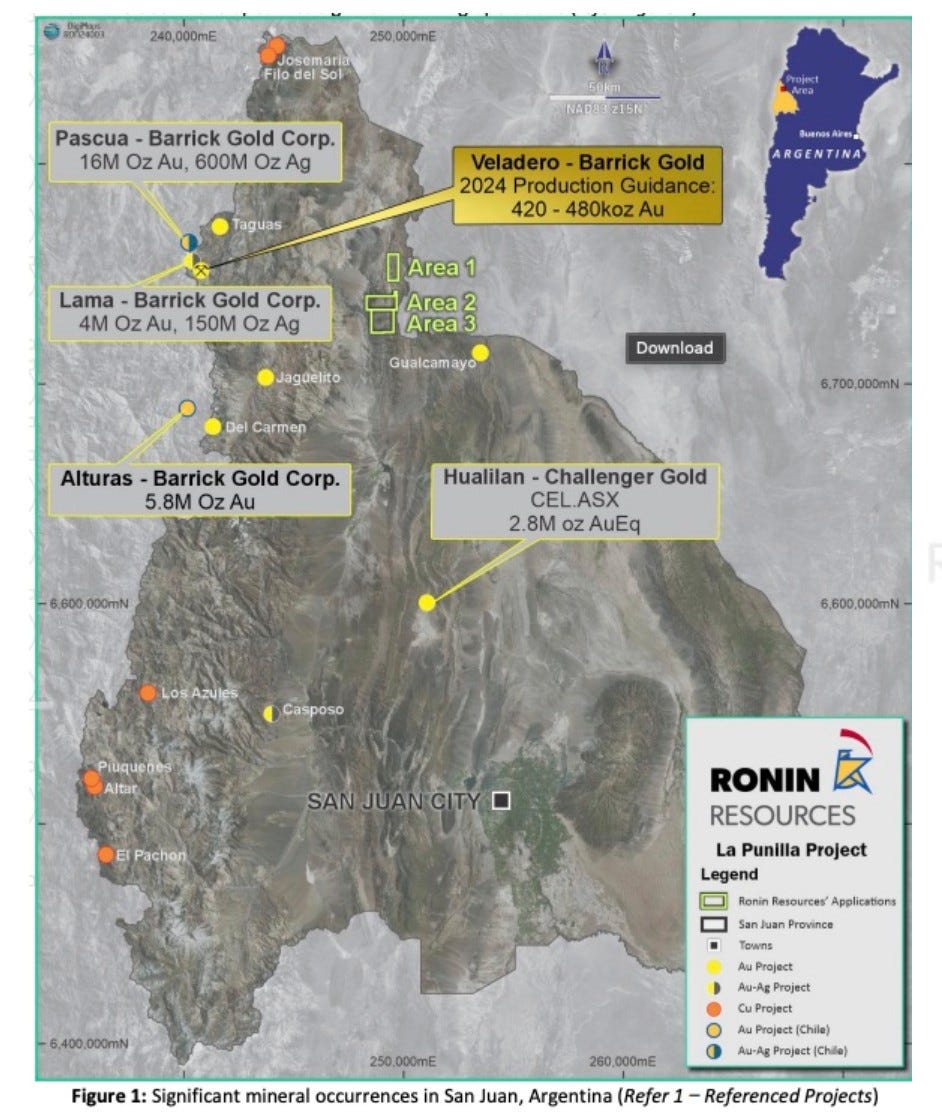

6. Ronin Resources

ASX: RON

Share price: 21.5c

Company valuation: $9 million

Sector: Mining

Commodities: Gold, silver and copper

Location of main asset: Argentina

Development stage: Early-stage explorer

Website: roninresources.com.au

RON has a gold-silver asset in Argentina and has been hunting for something bigger for a while now. The register reads like a who’s who of Australian small-cap mining, and with over $3 million in cash and a pro-mining government in Buenos Aires, RON has the backing and the runway to land a deal in 2026.

Reasons we like RON for 2026

Missed the 2025 run: A lot of small-caps shot up last year on sentiment alone. RON sat it out. That leaves it trading at a discount to peers who’ve run on far less substance.

The Argentina asset: RON’s existing gold-silver project in Argentina is barely being priced in by the market. With both metals trading well, that looks like an oversight. Any progress on that ground could add value even before a new deal lands.

The register: RON has a who’s who of large shareholders, including notable resource investor Tolga Kumova and high-profile small-cap brokers Tim Neesham and Faldi Ismail. When that crowd is on the register, they’re usually expecting something to happen.

Strong cash position: RON managed its cash well through 2025 while hunting for assets. The company still has over $3 million in the bank and a tiny quarterly burn rate. More money in the bank increases the likelihood of finding a high-quality asset.

The team behind it: Chairman Joseph van den Elsen is a proven operator and, in the past year, has taken Andina Copper from a $15 million market capitalisation company to $145 million. We’re hoping he’ll repeat the script for RON in 2026.

The risk factor for RON

The risk is exactly what happened in 2025 - the company doesn’t execute on a deal. This has been a long time coming for RON since IPO’ing in 2021, so we understand that pressure is building, but at the same time, rushing into a bad deal would be worse than waiting for the right one. The pressure is real, but so is the logic of holding out for quality.

The company quote

“The company looks forward to progressing the La Punilla Au-Ag project in San Juan, as well as advancing its broader corporate strategy of considering complementary, value accretive acquisition opportunities”

- Ronin Resources Technical Director Nicholas Young

The Equities Club insight

RON starts 2026 cheaper than most of its peers, with cash in the bank and a register full of people who’ve made serious money in small-caps before. If a deal lands, the re-rate could be quick. And even if it doesn’t, progress on the Argentina asset could still move the needle given where gold and silver are trading. Either way, there’s a path to value here.

7. Exultant Mining

ASX: 10X

Share price: 18.5c

Company valuation: $6.8 million

Sector: Mining

Commodities: Gold, silver, and copper

Location of main asset: Australia

Development stage: Early-stage explorer

Website: exultantmining.com.au

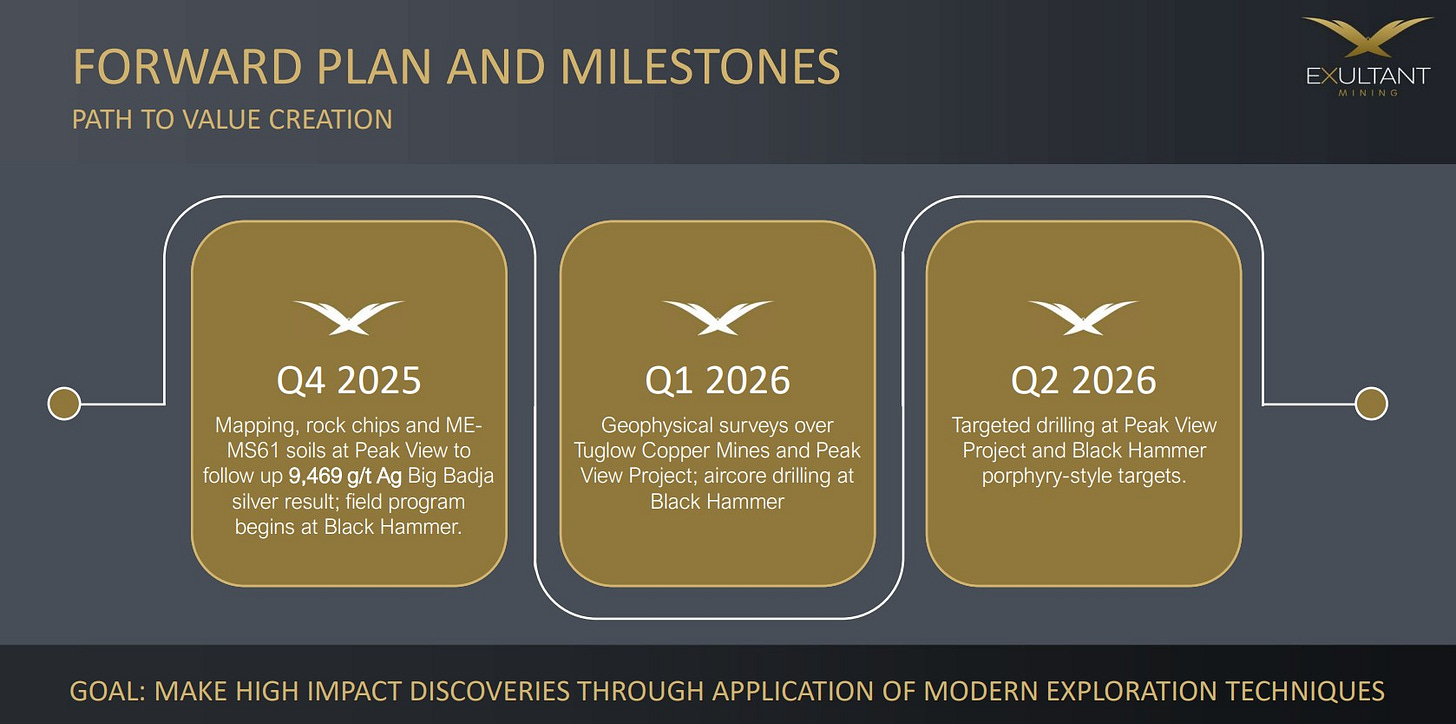

Exultant Mining was recently listed on the ASX in the latter stages of 2025 and is exploring for gold, silver and copper across several states in Australia. With a range of historic grades from underexplored assets, 10X has the potential to quickly add value to its small-company valuation, with drilling set to begin in 2026.

Reasons we like 10X for 2026

Trading below IPO: 10X is now trading under its listing price. For a company with historic high-grade results across multiple projects, a $6.8 million valuation feels like the market hasn't done its homework yet.

Australian ground: Everything 10X holds is in Australia, which matters when it comes to permitting, sovereign risk, and attracting capital. Gold, silver and copper are all trading well, and any confirmation of the historic grades on this ground would get attention quickly given the address.

Large landholding: A consistent theme across 10X’s portfolio is how little work has been done on its large landholdings. Previous high-grade gold, copper, and silver results warrant follow-up, and with modern technology, 10X could be sitting on something much more than previously reported.

Clear exploration pipeline: With the recent ASX listing, 10X has a well-thought-out process to begin exploration throughout 2026. With a strong bank balance and regular news catalysts throughout 2026, 10X won’t be short of news for investors.

Team with form: The people running 10X have been through the cycle before, from early exploration through to discovery and exit. That matters at this end of the market, where management quality often determines whether a cheap stock stays cheap or actually goes somewhere.

The risk factor for 10X

None of the projects have modern drilling or work done on them, which is the classic small-cap exploration risk. The limited prior exploration may have been for a reason, and we won't know until holes go in the ground. If any of the assets do come back with a good result, don't expect the cheap valuation to last.

The company quote

"10X is shaping up for a strong 2026 after listing in late 2025, with a tight capital structure of just 37.2 million shares and a high-quality asset base. Our Tier-1 assets are well placed for the application of Modern Exploration techniques as we build momentum in early 2026. Rock-chip results are expected in the coming weeks and geophysics is scheduled for mid-February. Our aim is to be ready to commence drilling by late March or early April on our Peak View and Black Hammer assets."

- Exultant Mining Chairman Brett Grosvenor

The Equities Club insight

It’s fresh to the ASX and has all the right ingredients, a tier-1 mining jurisdiction, and chasing the right commodities in gold, silver and copper. Now, it comes down purely to what the drill bit delivers. Nothing is a guarantee, especially in small-cap investing, but at its current valuation and with an experienced team behind it, 10X offers large upside potential and minimal downside.

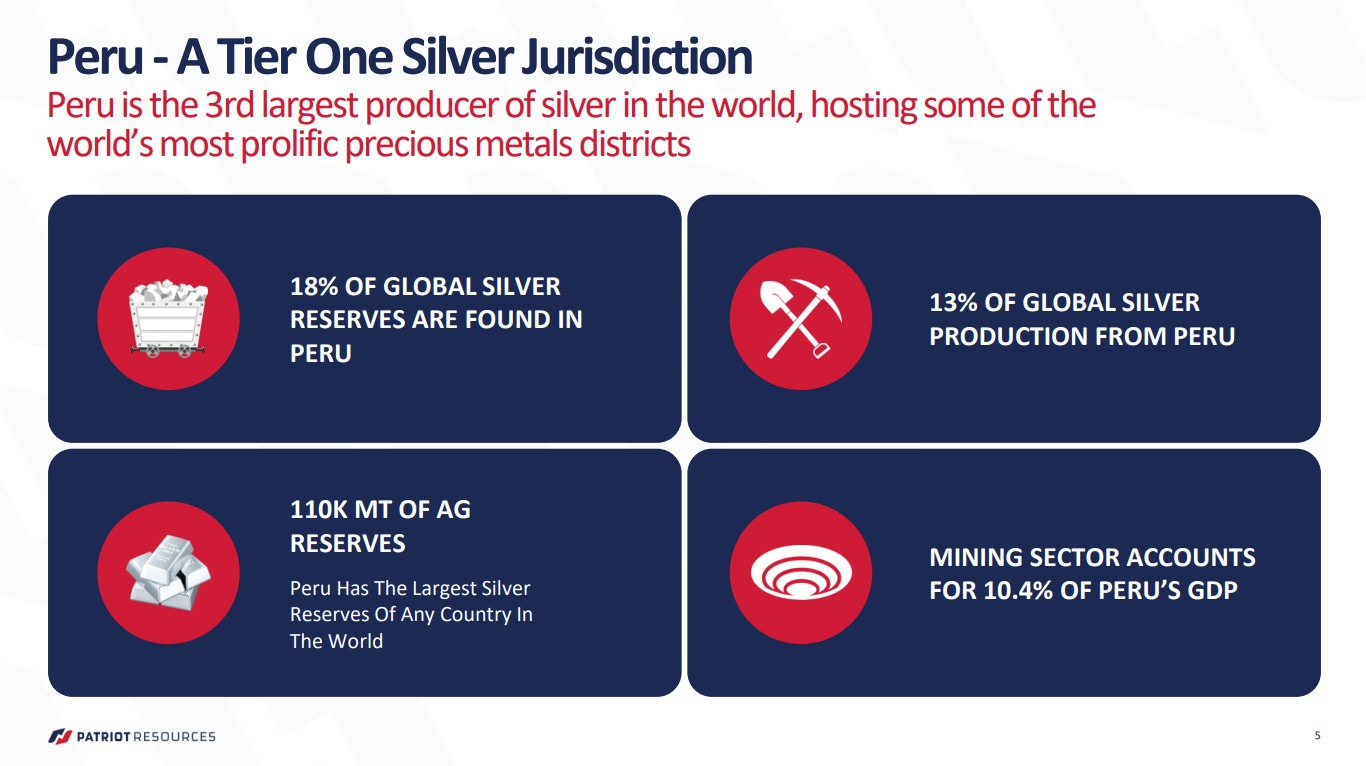

8. Patriot Resources

ASX: PAT

Share price: 6c

Company valuation: $12 million

Sector: Mining

Commodities: Gold, silver, and copper

Location of main asset: Peru

Development stage: Early-stage explorer

Website: patriotresources.com.au

Patriot Resources is chasing gold and silver in Peru, copper in Zambia and lithium in Canada. For a $12 million company with $4.25 million in cash, that’s a lot of ground to cover. But the Peruvian asset has 26 historical silver hits already drilled, and the Canadian lithium play gives them exposure if that market keeps recovering. PAT has multiple shots across commodities that are all moving the right way.

Reasons we like PAT for 2026

High-grade silver: The Tassa asset in Peru came with historic high-grade silver hits. The upcoming drill program will test whether those grades extend, and if gold shows up alongside the silver, Tassa could end up being the asset that defines PAT.

Previous drilling isn’t luck: Many small-caps will boast of historical hits, maybe one or two high-grade hits. PAT is lucky enough to have 26 historical hits, meaning its pathway to a resource and adding valuation is much shorter than it is being given credit for.

Proximity to world-class assets: Tassa directly borders a high-grade gold asset set to start production in 2026, underscoring that the region PAT is exploring is highly fertile.

Funded to drill: PAT raised recently and has the cash to fund drill programs across their portfolio. Ground with 26 historic hits and the money to test it properly is a better starting position than many juniors have.

Management with form: Chairman Hugh Warner has built and sold lithium companies before. PAT has a lithium asset in Canada, and if he can replicate that same success, shareholders should do well.

The risk factor for PAT

The biggest risk for PAT in 2026 is jurisdictional risk. The Tassa asset is located in Peru, and although they have an established mining sector, things can change quickly in South America. We see this risk as minimal, similar to the risk in Zambia, where many of the majors are now chasing the red metal.

The company quote

“2026 is going to be Patriot’s breakout year. Our three core projects are focussed on some of the highest in-demand commodities. Our Tassa Silver Gold Deposit in Peru has drill confirmed grades of up to 383g/t silver. Only 26 holes drilled to date with conversion of 43-101 geological results to JORC is underway. A drill program to follow, with the expectation of significantly expanding the footprint of this discovery.”

- Patriot Resources Chairman Hugh Warner

The Equities Club insight

PAT is a story that is quickly going to come into the mainstream if the drilling of Tassa delivers what we believe it can. A $12 million valuation with more than $4 million in cash, 26 historic hits at Tassa, and a neighbour about to go into production. If the upcoming drill results confirm what the old data suggests, people will start paying attention. The commodities are all moving the right direction, and PAT has exposure to most of them.

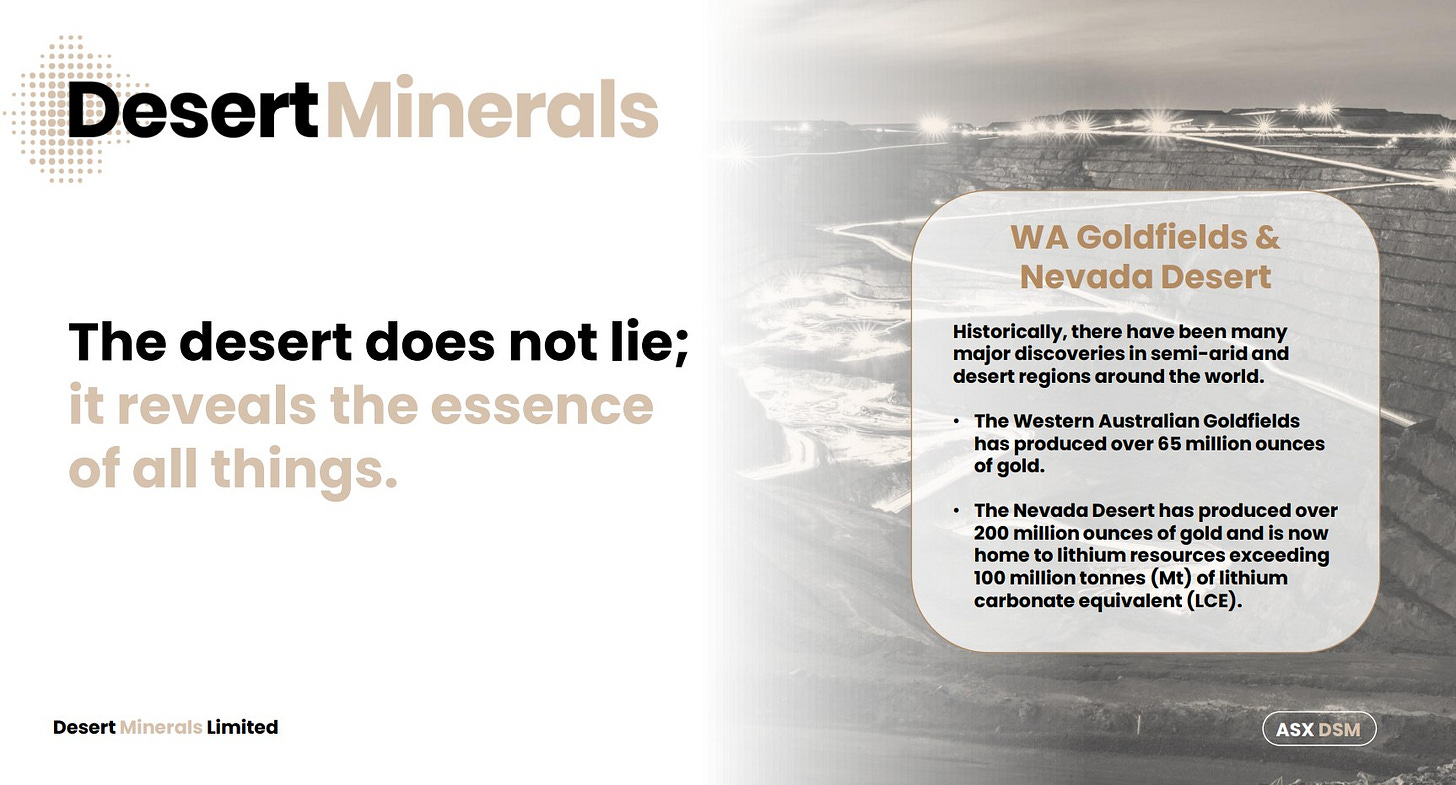

9. Desert Minerals

ASX: DSM

Share Price: 23.5c

Company valuation: $6million

Sector: Mining

Commodities: Gold and lithium

Location of main asset: Australia

Development stage: Early-stage explorer

Website: desertminerals.com.au

Desert Minerals listed on the ASX in the second half of 2025, chasing gold in WA and lithium in Nevada. Gold's been the story of the past two years and doesn't look like slowing down. Lithium's the opposite, absolutely copping it since the 2022 highs (but sentiment is shifting). A few of the major investment banks have started talking about a proper price recovery through 2026 for lithium, and DSM has timed their listing to catch it if it comes.

Reasons we like DSM for 2026

Existing gold resource: Although small, the gold resource at the Mt Monger gold project is open at depth, and with drilling underway, DSM could be sitting on something much greater in a short period of time

Location of Mt Monger: There are operating mines right next door, meaning if DSM finds something worth mining, they might be able to truck ore to an existing plant rather than building their own. It keeps the costs down and the timeline short.

The lithium bounce: DSM listed with a lithium asset when most companies wouldn't touch the stuff. The Scotty project in Nevada already has drilling underway, and if the US keeps throwing money at critical minerals security, being on American soil with a drill program running is a decent place to be.

Strong balance sheet: DSM came out of the IPO with close to $5 million in the bank. That's enough to keep both drill programs turning without needing to rattle the tin again any time soon.

The people behind DSM: Last year, we backed BTM, a small-cap that finished the year up 103%. Many of the same team are behind DSM in 2026, including its executive chairman, Peretz Schapiro, who helped lead BTM through a very big 2025.

The risk factor for DSM

It's exploration, so there's no guarantee the gold extends at depth or that the lithium recovery sticks around. But DSM has enough cash to keep swinging if the first few holes don't land. That's more than a lot of juniors can say.

The company quote

“Desert Minerals is set for a big 2026. We are fully funded with an exceptionally attractive capital structure, which puts shareholders in a strong position to reap the rewards of any potential positive catalyst in the year ahead.”

- Desert Minerals Chairman Peretz Schapiro

The Equities Club insight

DSM flew under the radar when it listed. Being late in the year, and have a lithium asset and a small gold resource weren’t exactly headline grabbers. But look closer and there's a $6 million company with $5 million in cash, run by people who just delivered triple-digit returns at their last vehicle. Two drill programs are already turning. If either one hits, this won't stay quiet.

10. Entropy Neurodynamics

ASX: ENP

Share price: 3.7c

Company valuation: $58 million

Sector: Biotech

Main focus: Psychedelics

Stage of operation: Clinical trials

Website: entropyneurodynamics.com

Entropy Neurodynamics is the only biotech to make the list in 2026 and also carries the highest valuation. Don’t let that deter you. ENP is developing a psychedelic medicine delivered directly into the bloodstream to treat conditions that still lack decent treatment options: binge eating disorder, fibromyalgia and irritable bowel syndrome. The combined market for treatments across these three is huge, and with clinical trials progressing in 2026, even a small slice could shift ENP’s valuation considerably.

Reasons we like ENP for 2026

Precision delivery: The conventional way has always been oral, but ENP is developing an IV-infused delivery, giving doctors precise control over the onset, intensity, and duration. This addresses one of the biggest hurdles in psychedelic medicine, which is variability and long treatment times.

Data already rolling in: Like any biotech, they live and breathe data, and ENP has already cleared the first hurdle with Phase I results showing safe, consistent therapeutic blood levels within minutes.

More data in 2026: ENP is already delivering doses to patients for binge eating, with the first results expected early in 2026. If the data comes back positive, this is a major milestone for ENP ticked off.

Huge addressable market: ENP is targeting some very large markets in binge eating, fibromyalgia, and irritable bowel syndrome. Capture even a fraction of any of them, and the share price could be multiples of where it sits today.

Big pharma is circling: Recent billion-dollar acquisitions at early clinical stages in the psychedelic space show growing pharma interest. ENP’s approach aligns more closely with traditional drug development, which makes it a realistic takeover target down the track.

The risk factor for ENP

The biggest risk is that the clinical trials don’t stack up as hoped. ENP at a $58 million valuation already has elevated expectations, and going through each phase is no easy task. That said, the team running ENP has serious pedigree, which counts for a lot when navigating the clinical process.

The Equities Club insight

ENP is the only biotech on this list, and if the trials deliver, the upside is substantial. The market for these conditions runs into the tens of billions, and ENP only needs to carve out a fraction of it to justify a much higher valuation. Phase II data is due early in 2026, so we’ll know soon enough whether the science holds up. If it does, this one could move fast.

And, the roughy…

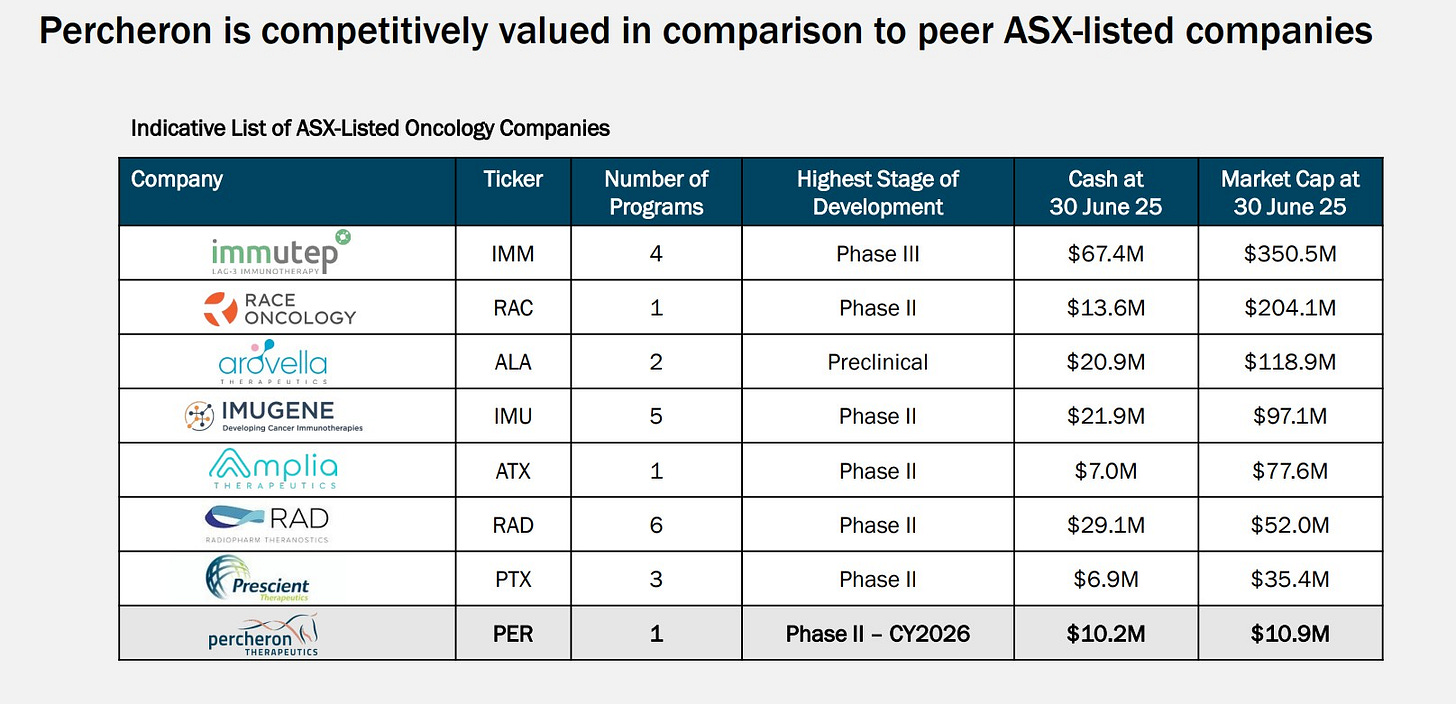

Percheron Therapeutics

ASX: PER

Share price: 0.8c

Company valuation: $9 million

Sector: Biotech

Main focus: Immuno-oncology (cancer treatment)

Stage of operations: Clinical trials

Website: percherontx.com

Percheron is working on a new type of cancer treatment that helps the immune system recognise and attack cancer by targeting a specific control switch called VISTA. Its lead asset has completed a Phase I clinical trial in patients with advanced cancer, demonstrating a favourable safety profile and early signals of disease stabilisation. At $9 million, the company trades at a fraction of what similar biotechs are worth at the same stage.

Reasons we like PER for 2026

First-in-class VISTA opportunity: PER is trying to crack a new immune system lock that cancer uses when older immunotherapies stop working. If they succeed, they’ll be the first to market in that space. That's a lucrative place to be if they pull it off.

Phase I trial done, with favourable safety: PER got through Phase I without serious adverse effects. In cancer drug development, proving your treatment won't harm patients is the first hurdle. Clearing that puts PER ahead of biotechs still waiting to dose their first human.

Testing across multiple cancers: PER isn't putting all their eggs in one basket for Phase II. They're running trials across several cancer types, which gives them more chances for something to land. If one indication works better than others, they can focus there and move faster.

Ultra-lean cost structure: Unlike many biotechs, PER runs a tight operation and spends most of its money on drug development rather than on large teams. With about $5.7 million in cash, it has enough funding to keep going for most of 2026, a big upside in this market segment.

Cheap compared to peers: PER has a drug that's been through human testing and trades at $9 million. ASX biotechs at the same stage often sit at multiples of that. Phase II trials are starting soon, and if the data looks good, that gap could close quickly.

The risk factor for PER

Phase I looked good, but Phase II is where things get real. The trials need to show the drug actually works against cancer, not just that it's safe. If the data disappoints, the momentum dies.

The Equities Club insight

PER is the roughy because the risk is real, but so is the upside. Phase I success doesn't guarantee anything in Phase II, and plenty of biotechs have stumbled at this exact point. But if the trials deliver, PER is chasing a market worth billions while trading at $9 million. This is a coin toss, but if PER lands the right side up the payoff could be substantial.

Our Readers’ Tip

We asked readers at the end of 2025 which stock they wanted to see in this year’s picks. West Wits Mining (ASX: WWI) came up more than anything else.

At $354 million, WWI doesn’t fit our usual small-cap criteria. But it kept getting mentioned, so we had a proper look.

West Wits Mining

ASX: WWI

Share price: 9.1c

Company valuation: $354 million

Sector: Mining

Commodities: Gold

Location of main asset: South Africa

Development stage: Developer to producer

Website: westwitsmining.com

West Wits is about to become a gold producer. The Qala underground mine in South Africa is built, funded, and set to pour first gold in Q1 2026. With gold sitting near record highs and many analysts expecting it to keep climbing, WWI's timing looks pretty good.

Reasons our readers (and us) like WWI for 2026

High-grade gold: Gold's at record prices, so owning a decent resource right now is valuable (to put it mildly). WWI has more than a decent resource. By global standards, it's large and high-grade, and every dollar gold moves higher flows straight to the margin.

Production is imminent: Unlike the other small-caps on this list, WWI will actually be producing gold in Q1 2026. Cash coming in the door changes the entire investment case. No more waiting on drill results or feasibility studies. This one's about execution now.

Economics keep improving: The DFS valued the asset at $983 million when gold was US$2,850 an ounce. Gold now trades around US$4,450 and WWI's current market cap sits at $354 million. The gap between what the study says it's worth and what the market is paying for it is hard to ignore.

Tier-one geology: The geology at the Witwatersrand Basin, where the WWI asset is located, is well understood, and the processing methods are simple and straightforward, leaving little to question if the study figures can be replicated in real life.

Experienced management: The management team at WWI has experience in underground mining, which is crucial given that the mine will be underground. The blend of mining and capital markets experience sets WWI up well as it moves from developer to producer.

The risk factor for WWI

South Africa carries jurisdictional risk, and going from developer to producer is where a lot of mining companies trip up. WWI has management with extensive in-country experience, which helps on the first point. On the second, the geology is well understood and the processing route is proven. They've got a better chance than most of making this transition smoothly.

The Equities Club insight

WWI is bigger than our usual picks, but the readers spoke and we listened. A strong gold price environment, which many think will go higher, only increases the margin WWI will make per ounce of gold produced. A high-grade resource coupled with scalability is something that very few other developers can genuinely state. If South Africa stays stable and the ramp-up goes to plan, WWI should generate serious cash flow through 2026. We can see why so many of you wanted this one on the list.

Let’s see how big a year 2026 can be

That’s our ten for 2026, plus a roughy and one the readers wouldn’t let us leave out.

We sifted through more than 500 ASX small-caps to get here. Most didn’t make it past the first look. The ones that did have management we trust, catalysts we can see coming, and valuations that leave room to run. Whether they deliver is another matter, but we’ve done the work and we like what we’ve found.

Mining and biotech should have strong years. Gold’s at record highs with the banks calling for more, and the biotechs we’ve picked are sitting on data readouts that could move things quickly. Defence had a belter in 2025, but we think most of that upside has already been captured, which is why you won’t find any here.

Last year our picks averaged 53%. We’d be happy to match that. Happier still to beat it.

We’ll be back at the end of the year to tally the score. Until then, good luck out there.

- Equities Club

Solid methodology behind the stock picks. The spread across gold, rutile and biotech actually makes sense given how different those risk profiles are. One thing I've seen work in small-cap screening is not just filtering by valuation but also watching managment track records like you did with BHL and FUN. The rutile-humanoid robot thesis for FUN is particularly well-timed if Elon's 10 billion humanoids forecast plays out even partly.